Discuss your challenges with our solutions experts

How long can nickel prices defy market fundamentals?

Nickel prices have been rising since April, but dysfunctional dynamics won’t last

1 minute read

Adrian Gardner

Principal Analyst, Nickel Markets

Adrian Gardner

Principal Analyst, Nickel Markets

Adrian is a principal research analyst with our Nickel Metal Service, providing a global view of the industry.

Latest articles by Adrian

-

Opinion

Nickel: 5 things to look for in 2024

-

Opinion

How long can nickel prices defy market fundamentals?

Nickel has ignored western market fundamentals, where demand has dried up due to the global pandemic, and prices have soared 30% since April. What lies behind these market dynamics and what can we expect to see in the next five years?

Our latest long term outlook explores the drivers of nickel prices before turning the focus on the likelihood of structural oversupply for most of the 2020s. Read on for a summary of some of the main themes, or visit the store to access the full report.

Prices won’t stay elevated for long

Nickel prices have continued to rise since April – in line with other metals. The rise appears to have been fuelled more by optimism of industrial recovery as China’s lockdown eased than based on traditional fundamentals of supply and demand elsewhere. But given that China now accounts for over 50% of the global market, this should no longer come as a surprise.

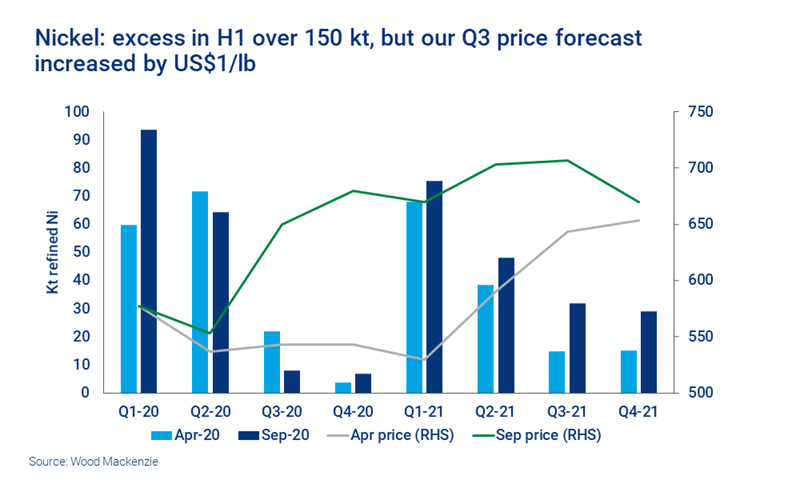

Coronavirus has moved the nickel market into greater surplus, exacerbated by a ramp-up in production of nickel pig iron (NPI) in Indonesia. Overall, we forecast cumulative excess of over one million tonnes between 2020 and 2025.

Elevated prices can only last so long. We expect fundamentals to reassert themselves by late 2021 as the surge in NPI production exceeds the ability of Indonesian and Chinese stainless-steel melters to take it.

China and Indonesia are ramping up production

China and Indonesia are by far the largest sources of nickel production. Since the first quarter there has been a rapid recovery in stainless melt production in China, with output already surpassing what we considered were bold forecasts in our Q2 outlook. We predict this expansion will continue into 2021.

Meanwhile, Indonesia has become a stainless steel powerhouse, and a major supplier of Class II nickel pig iron to China. And there’s more on the way, with new NPI projects coming on stream between now and 2025.

What options are available to China and Indonesia for reducing the excess nickel? And what’s the likelihood of oversupply easing? Find out more in our long term outlook.

For the West, the electric vehicle revolution can’t come soon enough

It’s a different story outside China and Indonesia. The rest of the world has seen very low growth in demand for more than decade. High prices in 2006/2007 led to manufacturers substituting nickel with cheaper alternatives. With the shocks of the financial crisis – and now Covid-19 – along the way, demand has never recovered.

Electric vehicle (EV) adoption and increasing requirements for sustainable energy storage could change this. As the EV revolution gathers speed, demand for Class 1 nickel will accelerate along with a surge in demand for nickel sulphate. However, the really transformative effects of electrification won’t take effect until after 2025.

Tesla CEO Elon Musk has warned of nickel shortages. More correctly, he is referring to a shortage of the specific nickel product types that are most cost-effective and environmentally acceptable to go into battery feeds. We’re not seeing a shortage right now in those specific products, and it is an unlikely scenario in the next four to five years, if a ramp-up in high-pressure acid leach (HPAL) projects comes into play.

Do the long-term fundamentals stack up?

The near to mid-term outlook for nickel may appear to paint a fairly bleak picture. But, with the growing industries in China and Indonesia – together with the global shift to electrification towards the end of the next decade – the long-term view beyond 2030 is a more promising one.

Where and when will those signs of optimism first appear? To find out more, visit the store to access our latest quarterly nickel outlook.