Sign up today to get the best of our expert insight in your inbox.

Can China’s recovery turn the oil market around?

Government starts pulling the levers to bolster the economy

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

What comes after the Permian for IOCs?

Peter Martin

Head of Economics, Macroeconomics

Peter Martin

Head of Economics, Macroeconomics

Peter is responsible for producing our macroeconomic outlook to 2050.

Latest articles by Peter

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

Opinion

Global economic outlook: trade tensions bite

-

Opinion

Global economy: can momentum trump uncertainty?

-

Opinion

What the Middle East conflict means for oil, LNG and the global economy

-

Opinion

Trump’s tariff plan: implications for the future of global liquids trade

Yanting Zhou

Principal Economist, Asia Pacific

Yanting Zhou

Principal Economist, Asia Pacific

Yanting leads our in-house macroeconomic research for Asian economies.

Latest articles by Yanting

-

The Edge

Getting China back on track

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

The Edge

Can China’s recovery turn the oil market around?

-

Opinion

China juggles four major economic changes in 2023

Ann-Louise Hittle

Vice President, Oil Markets

Ann-Louise Hittle

Vice President, Oil Markets

Ann-Louise directs our Macro Oils Service and is a frequent contributor to numerous industry publications.

Latest articles by Ann-Louise

-

Opinion

Price swings ripple through North American oil markets

-

Opinion

Oil and refining market implications of Israel’s strike on Iran

-

Opinion

What is the impact of US tariffs on oil and refining?

-

Opinion

What the Middle East conflict means for oil, LNG and the global economy

-

The Edge

What the Middle East conflict means for oil and LNG

-

Opinion

Trump’s tariff plan: implications for the future of global liquids trade

Douglas Thyne

Research Director, Oil Supply

Douglas Thyne

Research Director, Oil Supply

Douglas manages our global oil supply research and forecasts.

Latest articles by Douglas

-

Opinion

Trump’s tariff plan: implications for the future of global liquids trade

-

The Edge

Can China’s recovery turn the oil market around?

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

Oil and refining market implications of Israel’s strike on Iran

-

Opinion

What is the impact of US tariffs on oil and refining?

-

Opinion

Oil and refined products in 2025: a commodity trader’s guide

-

Opinion

Global refinery closure outlook to 2035

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

The much-anticipated rise in crude oil prices spurred by China’s post-Covid economic boom is yet to materialise. Even successive OPEC+ supply cuts aimed at keeping the market in balance have failed to stop Brent drifting back to the low end of the US$70/bbl to US$80/bbl range this quarter. Is the bull run just a matter of timing or has the economy-led story petered out?

I asked our economists Peter Martin and Yanting Zhou about China’s economy, and the Macro Oils team – Ann-Louise Hittle, Alan Gelder and Douglas Thyne – about the read-through for the oil market.

How is China’s economic recovery going?

After fully reopening in January, China's GDP outperformed expectations by growing 4.5% year-on-year in Q1. But rather than gain momentum, the recovery has since lost steam.

Pent-up demand for services is still supporting growth, but industrial production and construction are underperforming. The industrial sector is running down inventories, slowing the recovery in new production. And export demand for manufacturing goods is weak due to the global economic slowdown.

More than anything, though, sluggish economic activity stems from low consumer confidence across businesses and households. That’s what is causing concern about the sustainability of China’s rebound. Consumer confidence is still well below 2021 levels, manifesting in weak demand for durable goods and caution over property purchases.

What‘s the outlook for the rest of 2023?

We don’t believe the government target of 5% GDP growth this year is at risk. But the weaker-than-expected consumer confidence and demand for goods does challenge our 5.7% forecast. We have assumed an acceleration of growth through the year – driven initially by services before a pick-up in the property sector and construction starts in the second half.

Restoring consumer confidence and unleashing excess savings are the keys to accelerating China’s recovery in H2. We estimate that Chinese households accumulated USD1.1 trillion (6.2% of GDP) of excess savings over the past three years, ample enough to fuel ‘revenge’ consumption for eight to twelve months.

But government action is needed to get things going, and pronto. A 10-basis-point cut in the medium-term lending facility (MLF) policy rate to 2.65% on 15 June sends the right signal but may not tempt ultra-cautious consumers to spend more. More effective in the short run might be government-funded vouchers and discounts to subsidise purchases. Improving employment prospects, especially for the younger cohorts with high unemployment rates, would be a more lasting measure.

China could yet turn to its old trick of debt-fueled infrastructure stimulus as a last resort to support an ailing economy. This is, however, unlikely given the government’s growth target is still within reach and the local government debt burden is becoming problematic. There would be no clearer signal that growth is slipping below the modest expectations of the government than announcing a big stimulus to infrastructure.

What are the implications for oil demand?

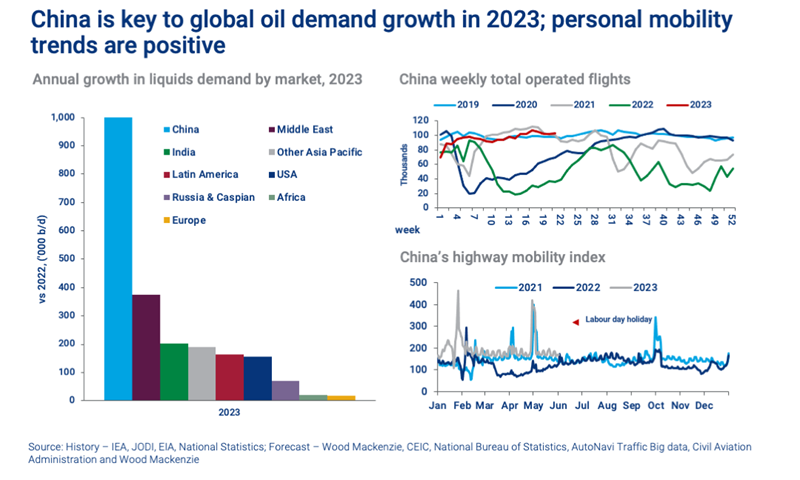

With much of the developed world on the verge of recession, China’s recovery is pivotal if the strong growth in global oil demand of the last two years is to continue into 2023 and 2024. We forecast China’s demand growth at just over 1 million b/d this year, the second highest annual increase ever, and contributing almost half of global demand growth.

While our overall forecast for China isn’t much changed over the last six months, the mix has. Personal mobility has pushed demand for transport fuels higher, offsetting downward revisions in the petrochemicals sector where new capacity has been slow to come onstream. Even so, a strong second half is required to meet our forecast and lift China’s oil demand to a new annual high of just under 16 million b/d.

Why does OPEC+ keep cutting supply?

Its strategic and collective goal is to balance the market and protect price. That’s proved quite a challenge in 2023 with a two-paced global economy hampering demand. The resilience of Russia’s export volumes has been a supply-side factor.

However, the June decision to extend existing cuts to the end of 2024 and for Saudi Arabia to offer an additional one million b/d cut for July is the latest signal that OPEC+ remains committed to its strategic goals.

On our forecasts, global demand exceeds global supply in Q3 and Q4 2023, leading to a significant implied drawdown of inventory.

What are the options for OPEC+ now?

It’s really all about demand. If growth comes through as we expect, there will be ample room for OPEC+ to progressively lift production later in the year and into 2024 while supporting Brent in the US$80/bbl to US$90/bbl range. Saudi Arabia, having taken the biggest cuts, would be able to restore some of its forgone market share.

In contrast, weak demand growth would pose fresh challenges for OPEC+ in managing the market and price. Saudi Arabia, having shouldered the biggest production cuts, would find it takes longer to regain lost market share without undermining price recovery.

In a recovering global economy, China holds the key. We will be closely monitoring the economic signals in the coming months.