Metalmorphosis:

How decarbonisation is transforming the iron and steel industry

October 2023

Authors

Decarbonisation will support the emergence of new production, processing and trading hubs for low-carbon iron and steel. Driven by rising demand for green steel, the industry’s push for net zero is set to transform the value chain of a commodity essential to the industrialised world.

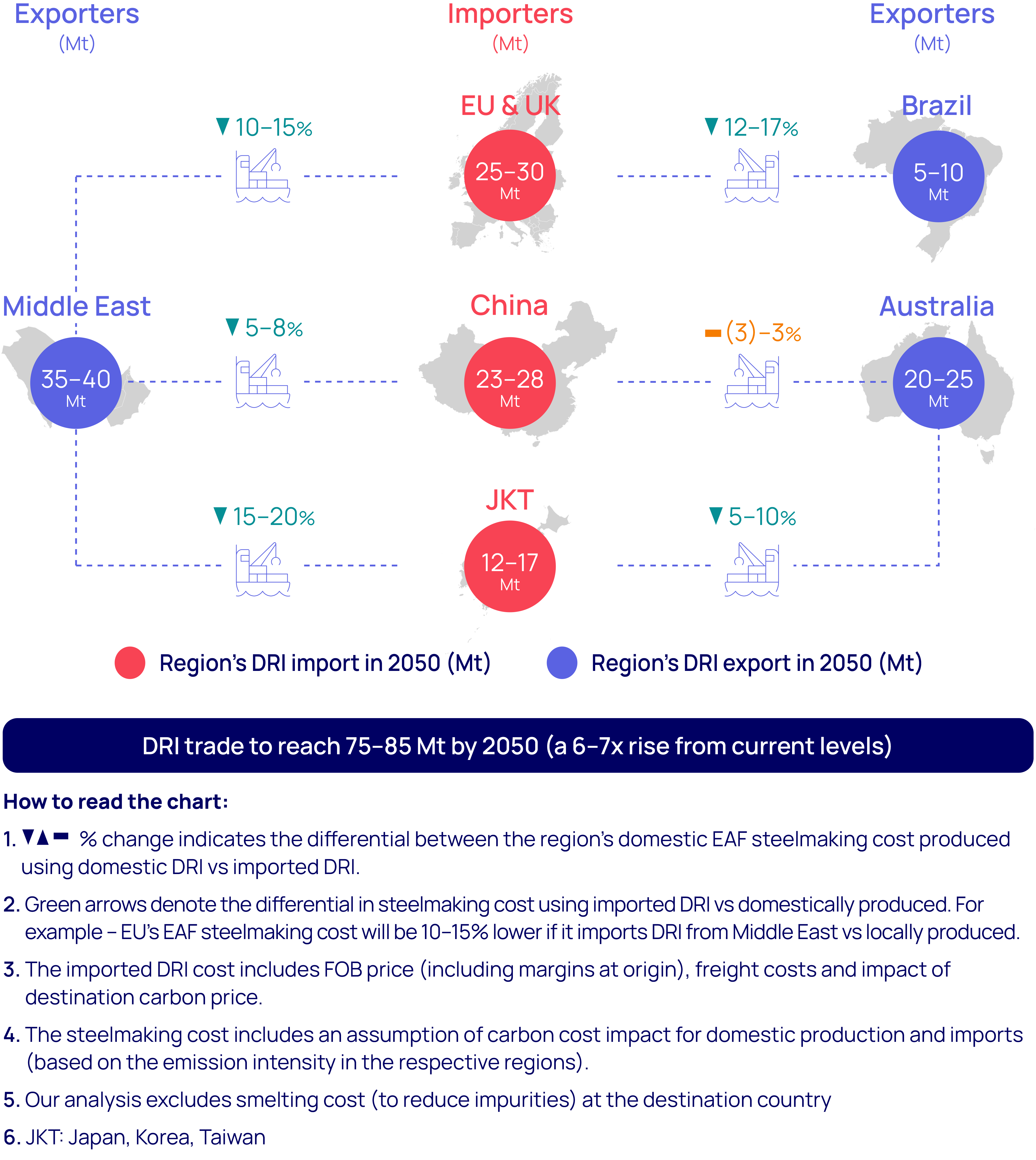

These new hubs will centre on abundant, low-cost renewable electricity and competitive green hydrogen supply, both key to the production of green direct reduced iron (DRI), used as feedstock in steelmaking. Lack of high-quality iron ore resources seems to be less of an impediment now as seaborne DRI trade from the Middle East and Australia becomes a reality.

We identify three key drivers:

1) steel producers moving to phase out highly polluting blast furnaces and replace these with electric arc furnaces (EAFs), powered by renewables;

2) growing demand for less carbon-intensive feedstocks; and

3) the steel industry’s increased use of high-grade scrap through recycling.

Mature markets with higher carbon prices will move from importing finished steel from more emissions-intensive producers, such as China and India, to importing green DRI to manufacture green steel using EAFs. Carbon policies such as the European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM), designed to punish high-emitting producers, will further rebalance the steel trade.

This does not mean that steel producers in China and India will fall behind. Many are already beginning to invest in EAF capacity to retain their positions, while the greater use of higher-quality scrap through recycling will also benefit most existing producers, as it is sourced from demand centres.

In this month’s Horizons, we consider how the iron and steel industry will decarbonise and what impact its success will have on global supply and trade. As pressure to address its carbon emissions mounts, the metamorphosis of the iron and steel industry is underway.

Overcoming the challenges of decarbonising iron and steel

Accounting for around 8% of global carbon emissions, iron and steel production sits squarely on the list of hard-to-abate sectors.

Despite this, the industry is exploring a range of production-based opportunities to reduce both its carbon intensity and net emissions. Blast-furnace efficiency programmes will help, reducing emissions by up to 15%. But the greater impact will come from replacing coal-powered blast furnaces with EAFs run on renewables. Cleaner feedstocks and the increasing use of scrap must also play a part.

All face challenges: EAFs remain small scale to date, hydrogen-based DRI is unproven and far from commercialisation, and quality issues with scrap continue to limit its use in high-grade steel production. These issues are not insurmountable, however. With the right levels of investment and policy support, decarbonising steel is a realisable goal, bringing with it the potential to transform the industry outlook.

Going electric: EAFs as a segue to steel’s decarbonisation goals

EAFs fed with low-carbon metallics will be the most impactful step towards greener steel, offering a near-term pathway ahead of newer low-carbon technologies that have yet to be commercialised.

EAFs face technical challenges in three key areas ‒ current small furnace size, high energy intensity and quality restrictions ‒ but progress is being made. The right mix of low-carbon feedstocks ‒ such as DRI produced using hydrogen (H-DRI) and low-impurity scrap, along with the rising availability of renewable power ‒ is already fuelling EAF growth. Companies including Nippon Steel have announced plans to develop super-sized EAFs to help address scalability issues.

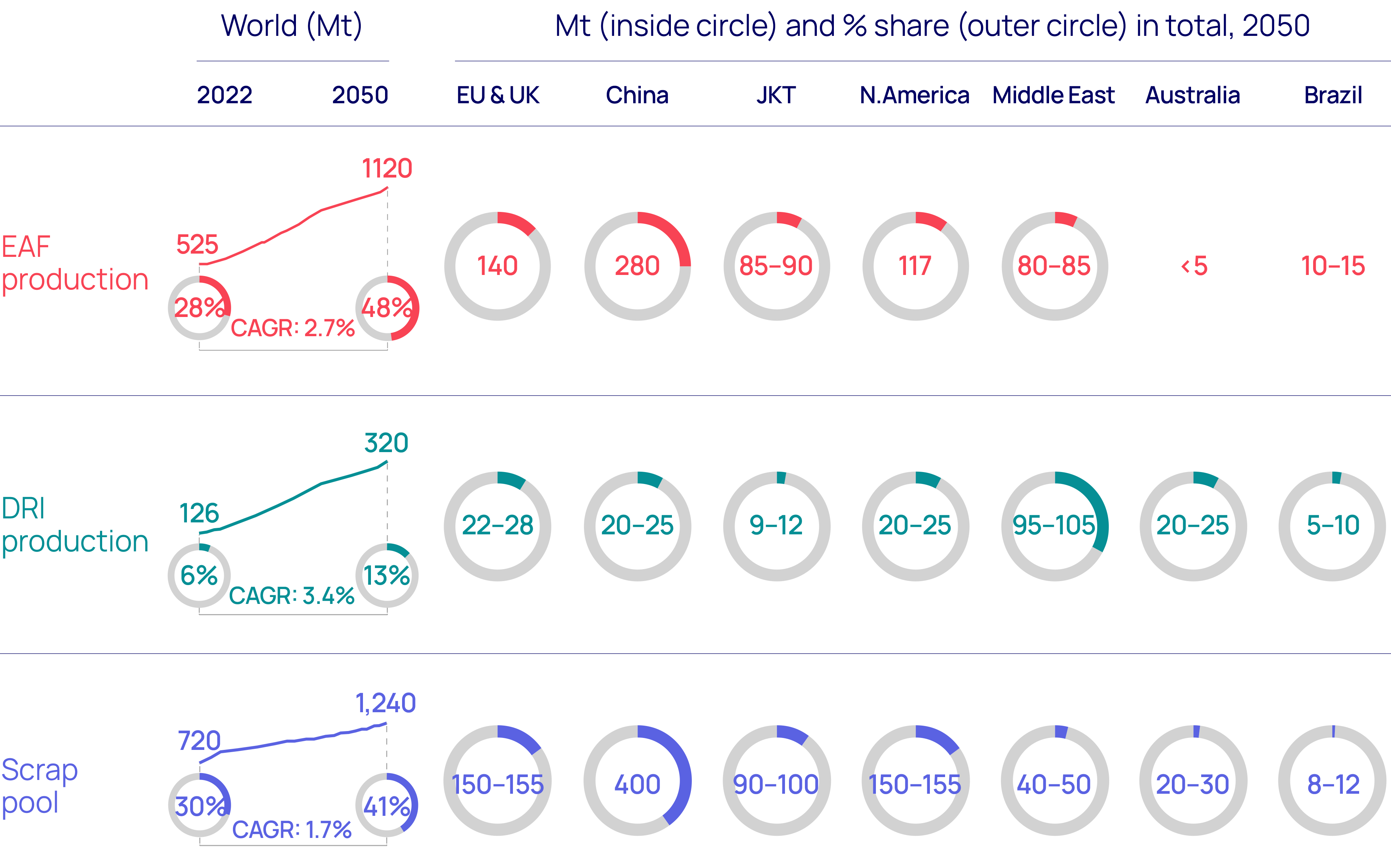

As a result, the EAF share of global steel production will increase from the current 28% to almost 50% by 2050, according to our base-case scenario, requiring at least 550 million tonnes of new EAF capacity. This will not come cheap. At a typical capital cost of US$200-250 per tonne, the required investment will be as much as US$130 billion. In our net zero 2050 scenario, broadly aligned with the goals of the Paris Agreement, this figure climbs to US$250 billion.

Steelmakers in Europe, Japan, China and the US are the first responders in EAF adoption. But while this will help cement their position as major steel producers, growth in demand for green DRI as a feedstock for EAF will open the door for new steel manufacturing. Future green DRI producers in regions such as the Middle East may seek to go further down the value chain and produce their own green metallics for export.

Figure 1: Green metallics demand growth and production hubs (2050)

Not just any old iron: the rise of green DRI

DRI – and specifically demand for green DRI ‒ will be the primary beneficiary of steel's decarbonisation journey. In our base case, DRI's share of total metallics demand will rise from 6% currently to 13% by 2050, with production growing nearly five times faster than total metallics demand, to 320 Mt.

Critically, we expect almost half of all DRI produced by 2050 to be hydrogen-based. As new processing hubs emerge, by 2050, almost 25% of DRI supply will be traded, compared with just 7% now.

Europe, China, Japan and South Korea will be the epicentres of green DRI demand as they move to decarbonise. To achieve this, however, steelmakers in these markets will need to decide whether to make DRI domestically rather than import hot briquette iron from emerging supply hubs. The availability and cost of green hydrogen and renewable power, proximity to raw materials (DR pellets/high-grade iron ore), and carbon policies will dictate the outcome.

Green DRI hubs emerging near clean energy sources

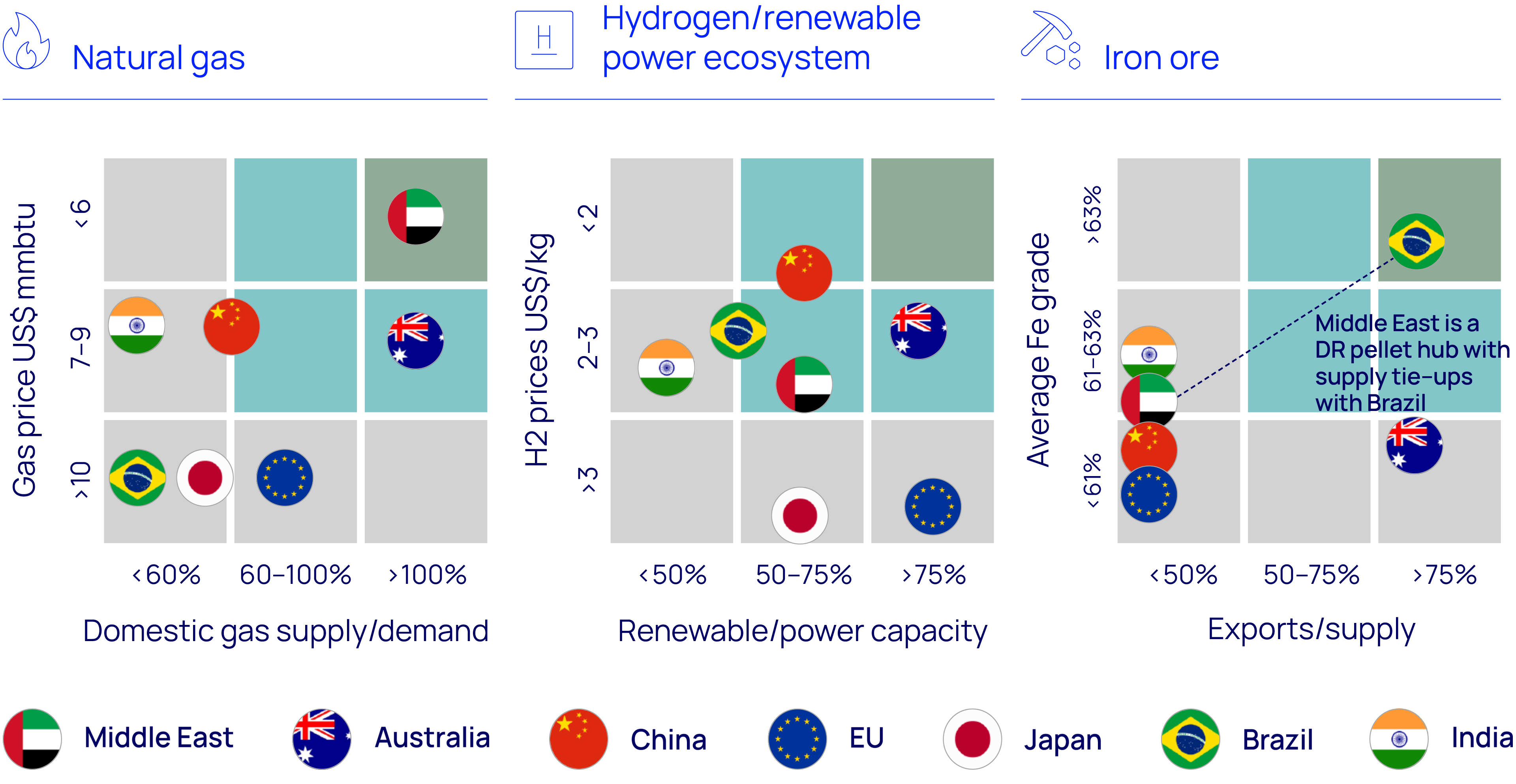

Competitive green hydrogen will be a game changer in steel's decarbonisation. Future green DRI hubs will be determined by how close they are to low-carbon hydrogen production, particularly given the uncertainties around how traded hydrogen will be transported and stored. The availability of low-carbon, low-cost natural gas will also provide an additional advantage for intermittent blending with green hydrogen until 100% H-DRI becomes widely available.

The Middle East and Australia are well positioned to capitalise on this opportunity and the project pipeline in both regions is growing fast. Some 25 Mt has been announced in the Middle East over the past two years. Australia has also seen large Japanese and South Korean steelmakers planning investments in green DRI/hot briquetted iron for export.

Global steelmakers, energy companies, miners and trading houses are leading the race to produce green DRI by taking advantage of multiple catalysts in both the Middle East and Australia:

- Renewable power and green hydrogen potential: the Middle East and Australia sit in the top echelon for solar irradiance and will see the share of renewables in their power mix exceed 50% and 75%, respectively, by 2050. The availability of land and attractive renewable power costs should support globally competitive delivered hydrogen prices of US$ 2-3/kg by 2050.

- Natural gas: the Middle East boasts ample low-cost gas supply through to 2050, supporting gas use for blending with green hydrogen. Australia has significant undeveloped gas resources, but will require supportive policies for its development.

- Iron ore and DR pellets: Australia is the world’s biggest iron ore exporter, though its ore is largely unsuited to DRI making (except for a few projects), so will require smelter technology. Brazil, however, is well positioned to produce high-grade ore, though it faces operational challenges at mine sites. The Middle East is well placed to expand as a pellet hub, as it imports more high-grade iron ore from Brazil and upcoming high-grade ore projects in Africa. Brazil’s Vale is also setting up mega-hubs in Saudi Arabia, the United Arab Emirates and Oman to feed DRI furnaces.

- Technology and tie-ups: the Middle East already accounts for 40% of global DRI production, giving the region the technological edge.

The iron and steel sector has long been aware of a shortage of high-quality iron ore to feed DRI demand and has finally stepped up its response. Over the past year, leading iron -ore miners and steelmakers have switched gears to explore smelter technology (to reduce and melt low-grade DRI), the electric refinement of any grade of ore, investments in high-grade ore mining projects and forward integration into value-added products.

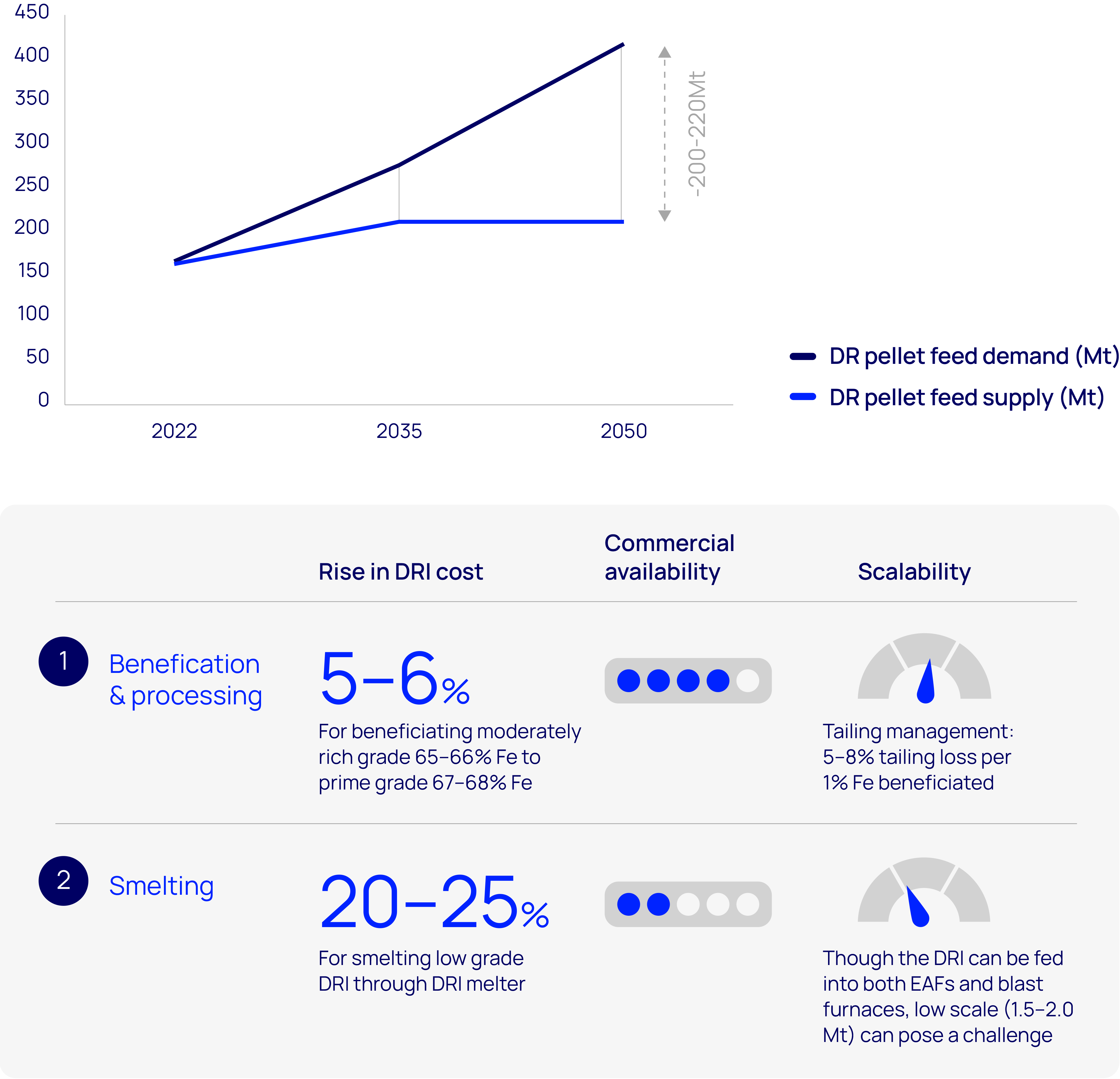

In our base case, we expect the industry to face a gap of around 200 Mt of high-grade ore by 2050. With iron ore accounting for around half the total production cost of DRI, access to the necessary grade of feedstock is becoming more pressing. There are solutions, though they vary by region and type of ore and come at a cost:

- Brazil and Africa can produce moderately rich iron -ore grades that can be beneficiated and processed by steelmakers to make them suitable for DRI; processing will add around 6% to DRI-making costs.

- Australian ore largely produces low-grade DRI, which can be smelted to high-grade DRI through electric melters, but this will involve a cost increase of 20‒25%.

DRI decision time for steelmakers: produce or import?

Incumbent steelmakers face an obvious decision. Do they acquire the green hydrogen and raw materials needed to produce DRI at home using renewable power or import green DRI from countries abundant in clean energy and suitable iron ore resources? How steelmakers respond will shift trade patterns across the supply chain.

- In the EU, producing EAF steel using imported Middle Eastern DRI will be up to 15% cheaper than making steel using locally manufactured DRI. We expect the EU to be the largest importer of DRI globally, accounting for over a third of total trade by 2050.

- The world’s biggest steel producer, China, is likely to look to a mix of imported and locally produced DRI. While imports from the Middle East will be more competitive, China is also likely to invest at home to support its massive domestic steel sector. Low-grade DRI imports from Australia will be on a par with domestic production costs. Several Pilbara miners have already announced technical collaborations with Chinese steel producers.

- Japan and South Korea will largely import DRI from both the Middle East and Australia, as domestic costs sit at the higher end of the cost curve due to higher energy and raw-material costs. Steelmakers from the region have already announced DRI collaboration projects with Middle Eastern and Australian producers, to be shipped home for processing.

The rise in DRI production and trade will create new investment and revenue generation opportunities for companies across the value chain. We expect DRI capacity to double over the next three decades, requiring up to US$80 billion of capital investment, excluding the need for additional investment in green hydrogen, smelters for low-grade DRI, pellet hubs and shipping.

From quantity to quality: the rise of scrap

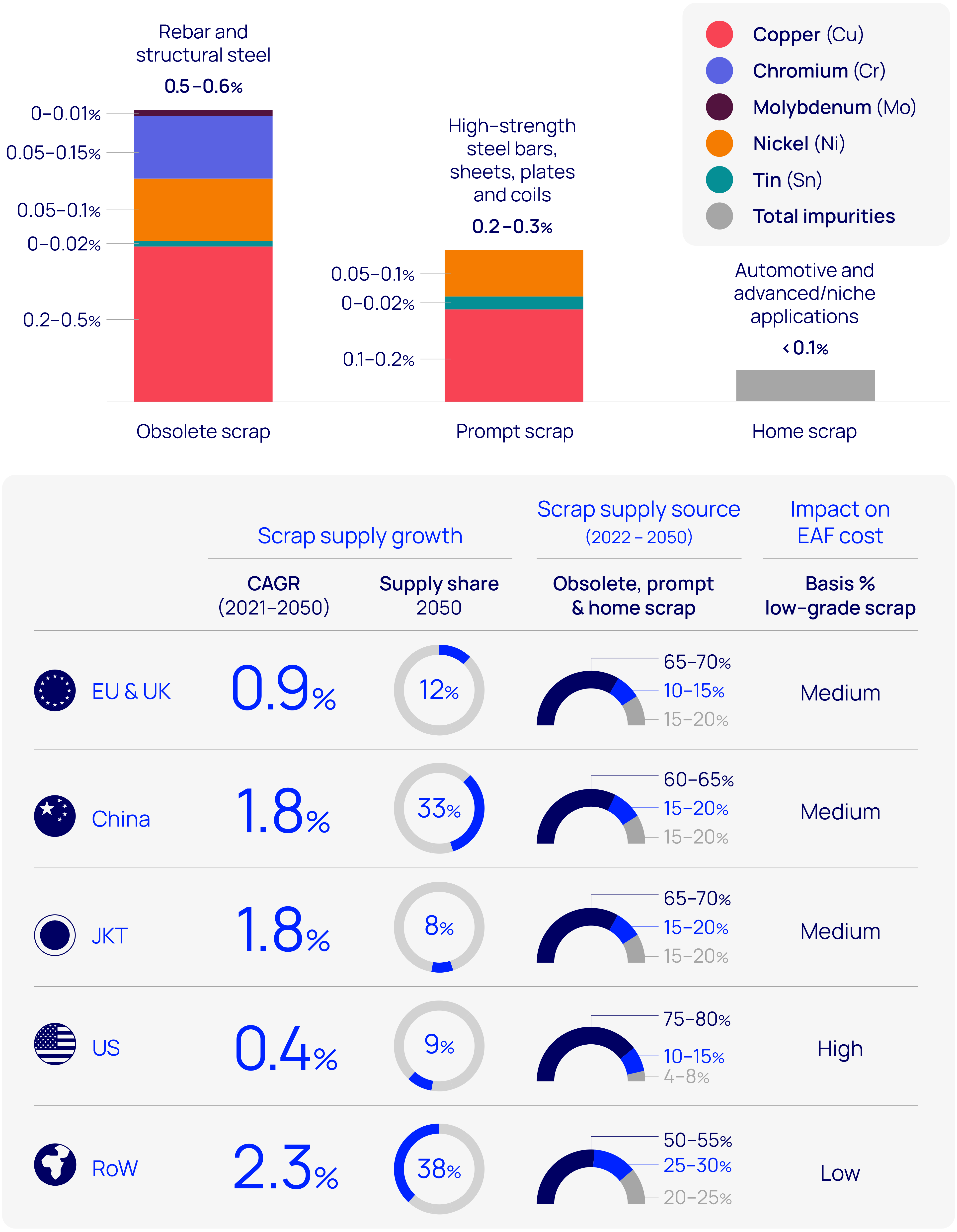

The increased use of scrap through recycling is the final part of steel’s decarbonisation jigsaw. Through recycling, steel mills can reduce their carbon footprint by up to 60% and save 1.5 tonnes of iron ore, 0.9 tonnes of metallurgical coal and 0.3 tonnes of other additives.

The major issue with scrap has long been unremovable tramp elements (impurities) that restrict high-grade steel production. Strict quality specifications determine the limit on tramp elements in the final output. As the cost of greener steel rises, quality will take precedence over quantity.

Here, technology can help. Streamlining the scrap supply chain and limiting impurities can be addressed in several ways:

- Foster greater collaboration between the steel industry and governments to ensure supportive regulations to reduce scrap contamination and improve availability.

- Improve standards to ensure end-use product design incorporates easy dismantling.

- Incentivise small and fragmented scrap hubs to maintain records of source, contamination and type.

- Ensure processing centres are set up near collection hubs.

- Incentivise the use of low-impurity scrap by offering tax rebates or incentives

- Scrap hubs: improve supply growth, generation source and impurity content.

We expect mature economies with the most ambitious net-zero targets to emerge as future scrap hubs and key markets for DRI imports, as both incentivise the switch to EAF steel production.

For China, the world’s biggest steel producer, things are more uncertain. Recycling offers a huge potential advantage for local steelmakers. But scrap availability will only gather pace in the latter half of the forecast period, as the majority of China’s construction boom ‒ a major source of scrap as buildings are demolished ‒ has taken place since the 2000s and has a lifespan of 30 to 50 years.

This growing role for scrap in green steel will also support DRI demand, as blending will be required to reduce impurities, a further boon to green DRI producers.

The dawn of CBAM: transforming Europe’s steel trade

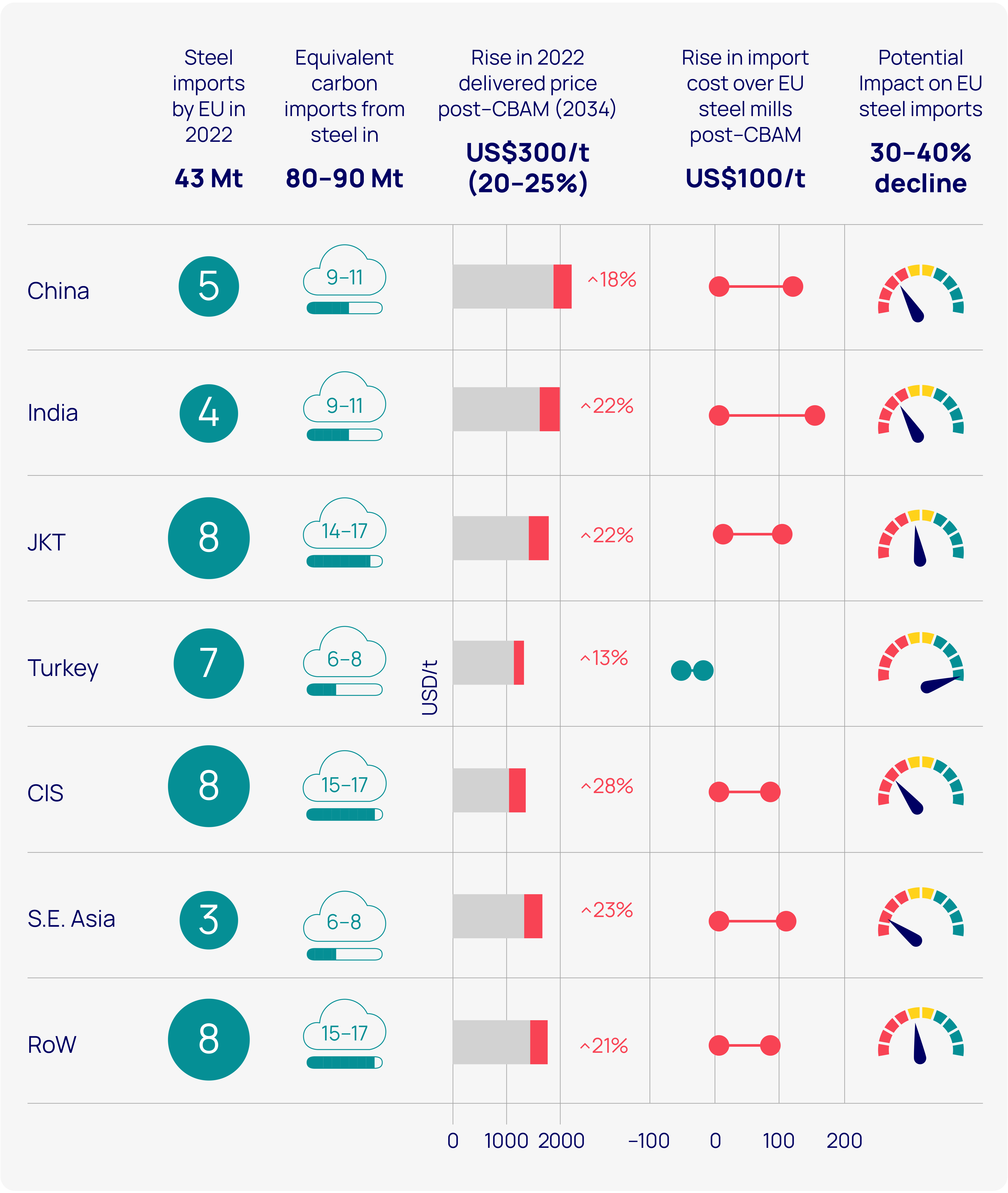

A further driver of the transformation of iron and steel and the emergence of new hubs is policy. The most obvious example is the EU’s CBAM.

The implications of the CBAM are clear. The EU imported 23% of its finished steel in 2022 but imported 34% (equal to around 90 Mt) of its carbon emissions from finished and semi-finished steel. From 2026, an increasing share of these emissions must be paid for under the CBAM. Within nine years, 100% of the carbon content of steel imported into the EU will be taxed.

As a result, the delivered price of steel in the EU is expected to increase by a quarter by 2034, equal to an additional US$300/tonne. When benchmarked to EU steel mills, this will equate to an average cost burden of US$100/t because of the higher emissions intensity of imports.

The impact of the CBAM on EU steel imports and domestic production will be felt around the globe, as European countries weigh up whether to import finished steel, green DRI to produce steel or additional scrap. The implications for exporters vary by region:

- Emissions-intensive Chinese and Indian flat steel will be hit hardest. Coastal mills using greener raw materials with optimum cost structures will still make the cut.

- Japan and South Korean mills targeting the EU will benefit, as both nations are at the forefront of decarbonisation. Their greater share of high-grade steel production will also cushion the impact.

- Low-emission Turkish steel will benefit, but will still face constraints as scrap-based EAFs are more suited to long steel products. However, the upside is limited, as EU steel imports are dominated by flat steel.

- Commonwealth of Independent States (CIS) nations will be further penalised through sanctions.

Explore our latest thinking in Horizons

Loading...

Sign up now to get insights like this in your inbox weekly.

Our unique point of view on the latest news, tailored to your industry and interests.