Last dance for UK upstream exploration?

Investment allowances and a new licensing round could boost activity – if willing explorers can be found. Embracing the UK’s potential as an energy super basin is crucial

2 minute read

Neivan Boroujerdi

Research Director, Upstream Oil and Gas

Neivan Boroujerdi

Research Director, Upstream Oil and Gas

Neivan is a research director with particular expertise in North Sea development costs, exploration and M&A.

Latest articles by Neivan

-

Opinion

ADNOC acquires 10.1% stake in CCUS player Storegga

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

The future of European upstream oil and gas

-

Opinion

Global upstream update: a review of key industry themes

-

Opinion

Harbour and Talos in merger discussions – what are the drivers?

Glenn Morrall

Research Analyst, North Sea Upstream

Glenn Morrall

Research Analyst, North Sea Upstream

Glenn's research focuses particularly on the UK upstream sector.

Latest articles by Glenn

-

Opinion

Last dance for UK upstream exploration?

-

Opinion

A tantalising year for North Sea exploration

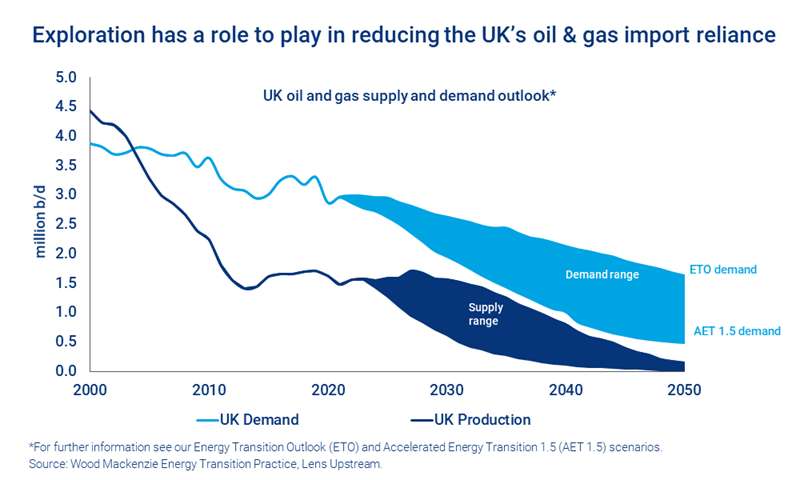

High commodity prices and Russia's invasion of Ukraine have thrown energy security into the spotlight. In response, the UK government launched an energy security strategy, introduced investment allowances and announced a new oil and gas licensing round. We think exploration could deliver another 2 billion boe – but are there any willing explorers?

We drew on data from Lens Upstream to explore the future of UK exploration in a new report. Fill in the form for a complimentary extract from UK exploration’s last dance: can allowances and a new licensing round boost activity? And read on for an introduction.

Opportunity exists: there are strong fundamentals for more UK exploration

The UK is a net importer of oil and gas. That won’t change – particularly in the case of gas – in any energy transition scenario.

What’s more, UK exploration performance has improved. Abundant infrastructure and relatively quick lead times have supported recent returns while a favourable fiscal environment and high prices could boost value creation even further.

A barrel discovered in the UK, under the current fiscal regime, has one of the highest values globally.

New investment allowances offering 85% tax relief should stimulate activity …

The fiscals are broadly favourable. In May 2022, the UK Government introduced the Energy Profits Levy (EPL), a 25% tax – applying until the end of 2025 (for now) – that brings the total marginal rate to 65%. To sweeten the move, new allowances have been introduced to incentivise further investment. E&Ps could receive 85% relief on exploration and appraisal spend and potentially pay only 40% tax on new field profits.

This will make exploration attractive to taxpayers, though non-taxpayers are still hindered.

Download the complimentary extract to see charts on global versus UK exploration returns, and value creation.

… but there’s little sign of a resurgence so far

Willing explorers are thin on the ground. Most companies that could take full advantage of the EPL allowances have shown little appetite to explore. IOCs have retreated, hastened by high political risk as new projects come under increased scrutiny. Drilling activity is at historic lows.

UK discovered resources have improved in recent years, but 2022 could be the first year without any discovered volumes since 1965.

Neivan Boroujerdi

Research Director, Upstream Oil and Gas

Neivan is a research director with particular expertise in North Sea development costs, exploration and M&A.

Latest articles by Neivan

-

Opinion

ADNOC acquires 10.1% stake in CCUS player Storegga

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

The future of European upstream oil and gas

-

Opinion

Global upstream update: a review of key industry themes

-

Opinion

Harbour and Talos in merger discussions – what are the drivers?

Is a new licensing round likely to deliver material volumes? If past performance is a precedent, no. The number of applicants and licence awards in mature rounds has stayed relatively flat in recent years. Drilling commitments have fallen sharply and the 27th round in 2012 was the last to deliver commercial volumes.

The UK needs to embrace its energy super basin status

The world’s need for sustainable energy is changing the upstream oil and gas industry. New projects can – and indeed must – reduce emissions intensity.

The UK has to embrace its energy super basin potential with developments intertwined with renewables. Advantaged resources – both low cost and low carbon – are the future of upstream.

How clear is the UK’s energy super basis potential? Which are the basins and hotspots to watch? The full report explores the future of UK exploration in more detail.

Fill in the form at the top of the page for a complimentary extract, including charts on:

- UK exploration ranked within a global context for value creation and prospective resources

- UK basin-by-basin creaming curve analysis

- Potential farm-in opportunities

- And more.

Wood Mackenzie Lens Upstream

Build resilient and sustainable portfolios with Lens Upstream

Learn more