How will oil and gas companies get to Scope 3 net zero?

Only ten major oil and gas companies have set Scope 3 net zero ambitions – so far three broad business models for dealing with this complex challenge are emerging

3 minute read

Tom Ellacott

Senior Vice President, Corporate Research

Tom Ellacott

Senior Vice President, Corporate Research

Tom leads our corporate thought leadership, drawing on more than 20 years' industry knowledge.

Latest articles by Tom

-

The Edge

Majors' capital allocation in a stuttering energy transition

-

Featured

Corporate oil & gas 2025 outlook

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

Can ExxonMobil make attractive returns from its US CCUS portfolio?

-

Opinion

How do integrated companies position themselves in the changing downstream landscape?

Decarbonisation has become a strategic imperative for oil and gas companies. And there is growing scrutiny of the progress that is being made towards net zero goals: investors are increasingly benchmarking decarbonisation progress against peers, and new frameworks are edging the sector closer to standardised disclosure, measurement and mandatory climate reporting.

Net zero targets for Scope 1 (direct) and Scope 2 (indirect from electricity supply to operations) emissions are now an industry standard. Around 65% of the companies we cover in our Corporate Service have set net zero targets.

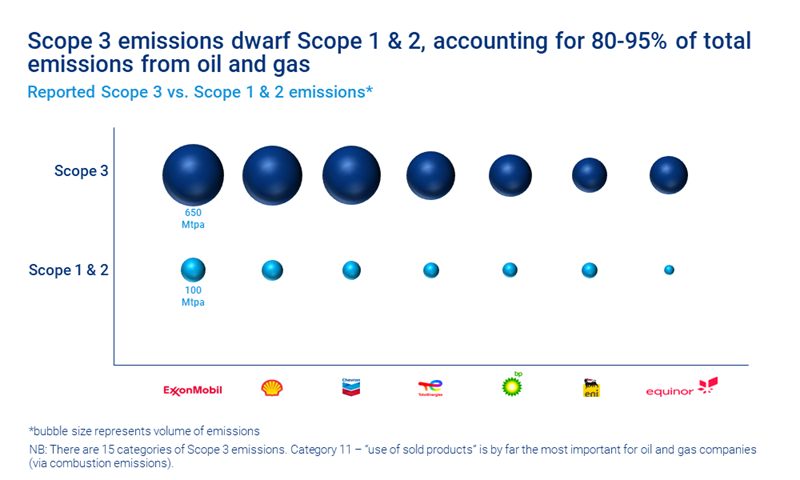

But it’s a very different story for Scope 3 emissions (indirect emissions in the supply or services chains and mainly due to the combustion of oil and gas products). To date, only ten oil and gas companies in our Corporate Service universe have made net zero commitments. While those emissions are often outside the direct control of oil and gas companies, they are also responsible for 80-95% of the total emissions along the value chain.

Why have so few players set net zero Scope 3 ambitions? We explore the challenges in getting to net zero Scope 3 and how oil and gas companies plan to get there in a new report. Fill in the form on this page for a complimentary extract – or read on for an introduction to the three main emerging strategies.

The limited commitment reflects the scale of the challenge

Deep structural change will be needed if the oil & gas sector is to reach Scope 3 net zero. The scale of the challenge is enormous – mainly because it requires dramatic shrinkage of oil and gas. Without a strategy to build new low-carbon profit centres that’s a fundamental threat to sustainability.

Of the ten companies that have made commitments on Scope 3 emissions – the Euro Majors, Repsol, OMV, Oxy, Denbury and CRC – there are three broad strategies emerging.

1. Big energy

The Euro Majors are largely following this strategy. They will need to expand into new low carbon profit centres in a big way if they are to sustain operating cash flow as legacy production and refining shrink out to 2050.

This will result in a huge structural change by 2050. Oil and gas production will dwindle by as much as 60% to 70%, which will be offset by investment in renewables, low carbon fuels and electric vehicle charging infrastructure. Oil and gas portfolios will also get much gassier out to 2050.

2. Carbon as a Service

This strategy involves aggressive expansion into carbon capture and storage (CCS) and direct air capture (DAC) technology to offset Scope 3 emissions. Other carbon removals and even nature based solutions are also part of these removal portfolios. Companies offering carbon as a service may deliver net zero earlier or trade this service on the carbon market, and the strategy allows for a slower decline in oil and gas production. Potentially, an e-fuels offering linked to DAC could be developed.

3. Sustainable fuels

OMV is the only company planning to cease oil and gas production in 2050 as it repositions to be a European leader in sustainable fuels.

It plans to focus on diversifying into low-carbon fuels and the circular economy in order to offset falling oil and gas production and crude processing. The advantage of this strategy is the exposure that OMV will have to a buoyant chemicals markets; however, there is a risk of value erosion in being an early mover in this space.

Scope 3 net zero will require a huge reduction in oil and gas production and crude processing. How quickly will companies wind down their legacy portfolios, and at what pace will they invest in new low-carbon profit centres? The full insight includes a deep dive into the strategies of the ten companies that have committed to net zero and the moves other players are making to manage Scope 3 risk.

To learn more, fill in the form at the top of the page to receive a complimentary extract from How will oil and gas companies get to Scope 3 net zero?