Will international shipping be net zero by 2050?

Upgraded decarbonisation targets present a huge challenge for marine fuels

3 minute read

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

Oil and refining market implications of Israel’s strike on Iran

-

Opinion

What is the impact of US tariffs on oil and refining?

-

Opinion

Oil and refined products in 2025: a commodity trader’s guide

-

Opinion

Global refinery closure outlook to 2035

Iain Mowat

Principal Analyst, EMEARC Refining and Oil Product Markets

Iain Mowat

Principal Analyst, EMEARC Refining and Oil Product Markets

Iain brings extensive knowledge of global energy markets to his analysis of energy and petroleum demand.

Latest articles by Iain

-

Opinion

Trump’s tariff plan: implications for the future of global liquids trade

-

Opinion

Full steam ahead: the changing outlook for global marine fuels to 2050

-

Opinion

Will international shipping be net zero by 2050?

-

Opinion

Decarbonising global shipping

-

Opinion

Could alternative marine fuels decarbonise shipping?

Gordon McManus

Research Director, EMEARC Oils and Refining

Gordon McManus

Research Director, EMEARC Oils and Refining

Gordon is responsible for leading our global coverage of the long term oil products markets.

View Gordon McManus's full profileIn the wake of COP26, the international shipping sector felt the pressure to reduce its greenhouse gas (GHG) emissions more rapidly. The recent adoption of the 2023 International Maritime Organisation (IMO) Strategy on Reduction of GHG Emissions confirms ambitious plans to achieve net zero for the sector by 2050. But is that goal achievable, and what will need to change for it to happen?

In our latest report IMO2050: Sailing towards decarbonisation we explore the implications of tough new emissions reduction targets for the marine fuels segment globally. Fill out the form to download a complimentary extract from the report, or read on for an introduction to the topic.

What was the situation?

The existing IMO strategy (agreed at MEPC 72 in April 2018) already presented a significant challenge for the sector. Key targets were to halve total greenhouse gas emissions from international shipping by 2050, and to pursue efforts to reduce carbon intensity by 70% by the same date (both versus a 2008 baseline). An intermediate target to reduce carbon intensity by at least 40% by 2030 was also agreed.

At MEPC 76 in June 2021 the IMO adopted an Energy Efficiency Existing Ship Index (EEXI). This came into effect at the beginning of this year, alongside an operational carbon intensity indicator (CII) which links carbon emissions to the amount of cargo carried over distance travelled. In conjunction with an Energy Efficiency Design Index (EEDI) for newly built vessels, improving these measures put the sector on course to achieve both 2030 and 2050 carbon intensity targets.

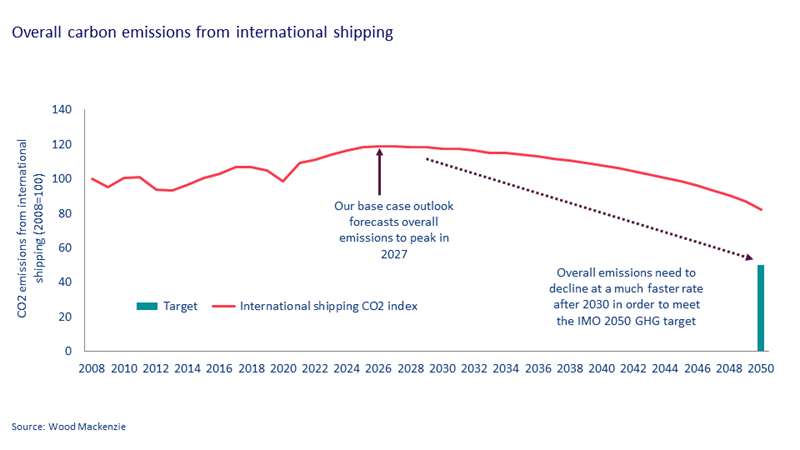

However, with global maritime trade expected to increase by 17% between now and 2030 (and to continue growing), reducing overall emissions is a much bigger challenge. Our current base case outlook forecasts overall emissions to continue to rise until 2027, and to fall only gently through the following two decades (see chart below).

What’s changed?

The existing decarbonisation target already presented a real challenge. However, at MEPC 77, which took place immediately after the COP26 climate conference in November 2021, the IMO recognised the need to go even further. The result is a new strategy requiring the sector to achieve net-zero emissions by 2050, which was adopted at the recent MEPC 80 session in July 2023.

What are the implications for global shipping?

A range of technologies can be used in the design of new ships or retroactively fitted to existing vessels to make them more fuel efficient and reduce emissions. Some of these, including hull shape optimisation and fitting smaller engines, result in an overall cost saving. Others, such as wind power, contra-rotating propulsion, waste heat recovery and air cushions, are relatively low-cost solutions. However, for such an ambitious climate goal to be achieved, much more costly technologies such as low- and zero-carbon fuels and even solar power will need to be a significant part of the mix. The development of mid and long-term greenhouse gas reduction measures will be crucial to making this happen.

What does it mean for marine fuels?

Currently, we expect global marine fuel sales to grow by just 4% between now and 2030 before starting to decline, as the energy efficiency measures reduce fuel consumption. Global oil marine bunkers should peak in 2025, with marine LNG becoming the main source of growth through to 2040. After that, synthetic e-fuels should become more widespread, supported by the increasing availability and lower cost of green hydrogen.

However, to achieve the IMO’s 2050 targets, a much more rapid shift to low- and zero-carbon fuels will be needed. Biofuels including fatty acid methyl ester (FAME) and hydrotreated vegetable oil (HVO) could play a role in decarbonising shipping. Yet even as the use of biofuels for road transport declines as the sector increasingly electrifies, aviation is likely to take up the available supply. Second generation cellulosic biofuels derived from waste biomass could provide a new source of supply in the longer term, but the current investment outlook is limited.

Other alternative fuels include e-methanol and e-ammonia. As with e-diesel, these are synthesised from green hydrogen produced through the electrolysis of water using renewable energy sources. Of the three, e-methanol is the most market ready.

Don’t forget to fill in the form at the top of the page to download your complimentary extract from the report. This includes a more in-depth exploration of the potential of different low-carbon fuels, along with a range of charts forecasting global marine bunker volumes by fuel type and marine fuel sales through to 2050.