Tight oil news: Majors go bullish as Independents rein in

Putting numbers on the industrialisation of the Permian

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Is net zero by 2050 at risk?

-

The Edge

Can emissions taxes decarbonise the LNG industry?

-

The Edge

Why the transition needs smart upstream taxes

-

The Edge

Can carbon offsets deliver for oil and gas companies?

-

Featured

Wood Mackenzie 2023 Research Excellence Awards

-

The Edge

Nuclear’s massive net zero growth opportunity

The Permian basin is being industrialised. Anyone who doubted that the arrival of Big Oil would accelerate realising the potential of Permian tight oil might pause for thought after this week’s upgrades. The implications will resonate way beyond the confines of the US L48.

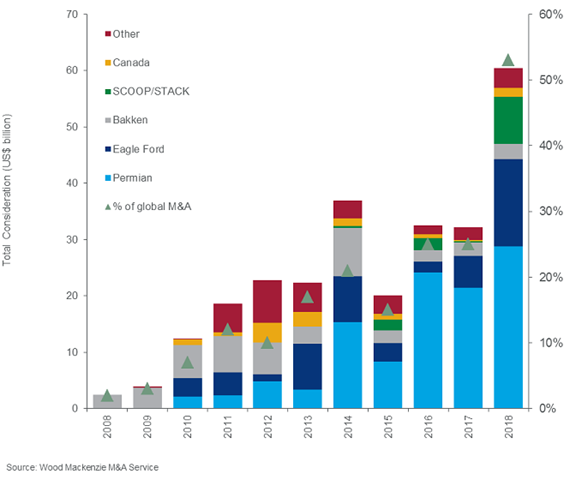

Consolidation in US tight oil has been underway for some time, propping up the M&A market in 2018. The value of deals reached an all-time high of US$60 billion, twice as much as each of the two prior years, accounting for 53% of global M&A activity. The Permian itself set a new record of US$29 billion. Much of the value was down to corporate takeovers rather than asset transactions as the big got bigger.

Investors shape the way the basin is being exploited

BP last year joined Chevron, ExxonMobil and Shell as the fourth Major to establish a sizeable tight oil platform. The acquisition of BHP’s L48 assets included a prize Permian position. These four are among the biggest investors shaping the way the basin is being exploited.

Scale is a means of creating value – access to a bigger inventory of pre-drill wells, especially in contiguous acreage. High-grading inventory, selecting well sites, and drilling faster and longer wells are key to converting acreage into production and money.

Chevron and ExxonMobil have put hard numbers on industrialisation. Both companies announced big upward revisions to Permian targets that envisage oil production of at least 0.6 million b/d in five or six years’ time. Chevron also increased tight oil resource by 5 billion boe – the increase in production isn’t just about getting the oil out quicker.

WoodMac is a tight oil bull, but the new targets together add 0.4 million b/d to our current forecasts of Permian supply in 2023/24. That’s material to global supply and would absorb a big chunk of annual demand growth. And this just from two companies that account for only one-tenth of the basin’s present total.

Volumes for the basin as a whole continue on their merry upward path. Despite a temporary blip caused by weak prices and constrained exit capacity, oil production in 2019 will have doubled compared to 2016. We expect an average of nearly 4 million b/d this year, 2 million b/d more over the next five years, and an eventual peak at 6.4 million b/d in 2034.

Do ExxonMobil and Chevron’s upgrades mean we need to revise these forecasts upwards?

The short answer is yes, but not necessarily proportionally for the entire basin. More than 80% of Permian production is in the hands of Independents which, in the main, operate under very different rules.

These are the entrepreneurs whose risk-raking and nimbleness opened up tight oil plays. Today, most Permian-focused Independents are capital-constrained, dancing to the tune of investors who prioritise dividends and buy backs over growth. ‘Tight oil unconstrained’ was a black hole that consumed capital. The new game imposes discipline on spend and focuses minds on value creation and shareholder returns.

Pioneer, one of the biggest Permian producers, once also set a production target of 1 million boe/d, among the most aggressive in its peer group. Last month, it backed away from its targets and switched emphasis to free cash flow as a key metric. The timing is sweet as Chevron and ExxonMobil go in the opposite direction – Majors, too, will be held to account on targets. But it does highlight the longer-term perspective a Major with access to capital can take compared with an Independent.

Another factor that could limit production growth is productivity. The data we collect and analyse suggest the industry’s main value-driving metric is showing signs of fatigue. Our latest work on the Midland basin showed year-over-year productivity gains at 1%, compared to 35% from 2015 to 2016. Eight of the top 10 most productive areas in the Permian showed flat or declining productivity in 2018. Future growth may be more a function of capital rather than productivity.

The Majors’ appetite for Permian assets is as yet unsatiated. Permian oil will contribute around 15% and 20%, respectively, of ExxonMobil and Chevron’s global oil and gas production by the early 2020s. That’s more than double BP and Shell, while Total, Eni and Statoil have little or no exposure. So expect more consolidation – industrialisation is only just getting going.