Permian basin GOR: recalibrating US gas production models

Could we expect even more Permian gas production than what's currently modelled?

1 minute read

Eugene Kim

Research Director, Americas Gas

Eugene Kim

Research Director, Americas Gas

Eugene Kim is a Research Director on Wood Mackenzie’s Americas Gas Research team.

View Eugene Kim's full profileHow is GOR calculated?

The GOR, or gas-to-oil ratio, is the ratio of the volumetric flow of gas that comes out of solution to the volume of oil at standard temperature and pressure conditions. As individual wells mature, so do GORs. Once reservoir pressure drops through production, GORs rise.

In liquid reservoirs with ultra-low permeability, solution gas separates from the rock when the reservoir's pressure drops lower than the bubble point. After bubble point is reached, pressure declines slow and GORs increase significantly.

Higher GORs are typically accompanied by falling oil production, but estimating the future GOR trend can be challenging in a liquids-rich reservoir. Subsurface characteristics like source rock maturity, organic matter and the geothermal gradient can all influence GOR.

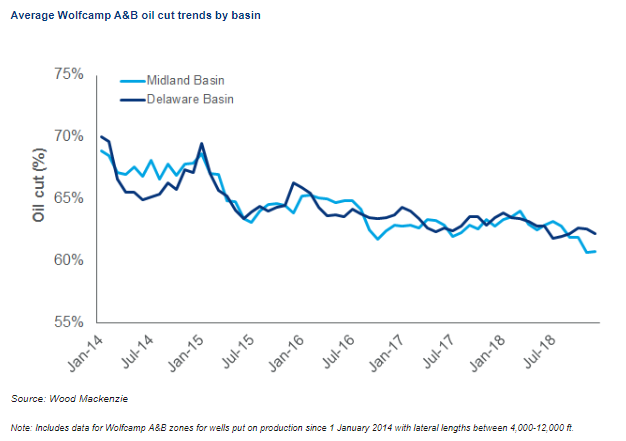

Declining Permian oil cuts

Indeed, in the Permian's Wolfcamp A & B bench drilling, oil cuts have started to decline. Average Midland and Delaware basin oil cuts have fallen nearly 10% over the last five years, with more dramatic cuts seen in sub-plays like the Northern Reeves in the Delaware and the Midland basin's Southern Fairway. Average Wolfcamp A&B oil cuts have dropped below 65%, driven by aging tight-oil wells hitting their bubble points.

Natural gas price implications

In the Permian, accelerating GORs cause ripple effects throughout the natural gas marketplace. The most visible impact spurs from a mismatch between surging gas production and constrained takeaway pipelines. Waha gas prices have tumbled to record lows, hovering in extreme negative territory and forcing well shut-ins from producers like Apache and Chevron.

Permian gas production is poised to grow by up to 4 bcf/d between May and December 2020, heightening price pressure and further impacting modelling adjustments necessary as GOR rises.

How can producers and midstream companies monetize growing Permian Basin supply, particularly the price-disadvantaged gas and NGL markets?

Join me on July 24 at 11am for "Monetizing Growing Permian Basin Supply: A Holistic Midstream Approach To Understanding Potential Bottlenecks" Session 336-12A – Overcoming Gridlock: Unlocking the Midstream Bottleneck at URTeC 2019 in Denver.

I'll demonstrate our holistic analysis using proprietary midstream data that encompasses oil, gas, and NGL takeaway pipelines, gas processing plants, NGL fractionators, and export terminals.