Get this complimentary article series in your inbox

1 minute read

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Latest articles by Julian

-

Opinion

Metals investment: the darkest hour is just before the dawn

-

Opinion

Ebook | How can the Super Region enable the energy transition?

-

The Edge

Can battery innovation accelerate the energy transition?

-

Featured

Have miners missed the boat to invest and get ahead of the energy transition?

-

Featured

Why the energy transition will be powered by metals

-

Featured

Could Big Energy and miners join forces to deliver a faster transition?

To quote Elon Musk, “We are running the most dangerous experiment in history right now, which is to see how much carbon dioxide the atmosphere can handle before there is an environmental catastrophe.” What was once a heated debate about whether climate change was occurring or not has tipped over into a discussion about how to deal with its consequences. Specifically, what is society going to do to limit the impact of change driven primarily by carbon dioxide emissions generated by the burning of fossil fuels?

Various governments have reacted to the climate challenge with net zero commitments, albeit often with deadlines decades hence. Meanwhile, for those advocating much faster change, the recent court ruling forcing Shell to accelerate its emissions reductions offer hope that the pace of change is picking up.

Carbon taxes: much talk, little action

It’s not just court rulings that will provoke the necessary transition to healthier consumption patterns and lower emissions. The introduction of universal carbon taxes will play a vital role in forcing change and preventing ‘carbon leakage’ – where decarbonising countries transfer the production of goods to countries with less stringent climate regulations then import them in.

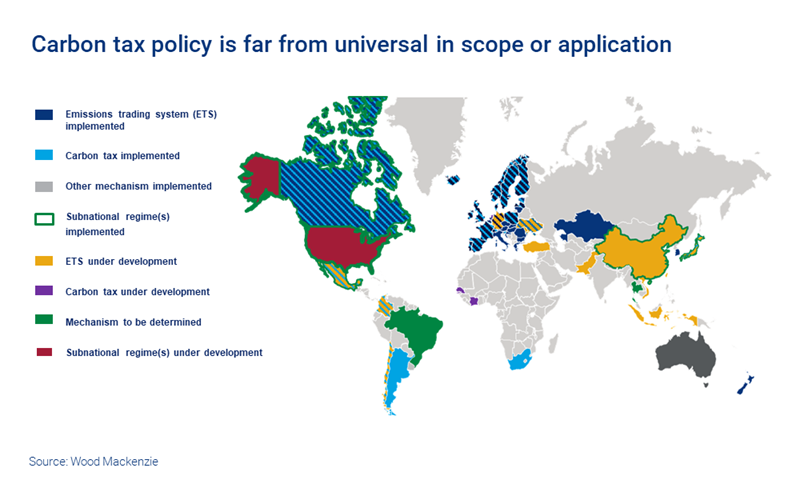

Assuming carbon taxes are universally applied (by no means a given), the question then becomes how fast will they be imposed and at what level? While there is some momentum behind the introduction of carbon tax policy, very few countries have actually introduced a levy, and even then levels are not yet punitive. To date, Western Europe and Canada stand alone as having implemented either a carbon tax regime or pathway to one alongside an emissions trading scheme. For the two largest emitters, the US and China, as well as for India, no policy is in place.

We are therefore still a long way from implementing a universal tax regime, let alone a punitive one.

How high do carbon taxes need to be?

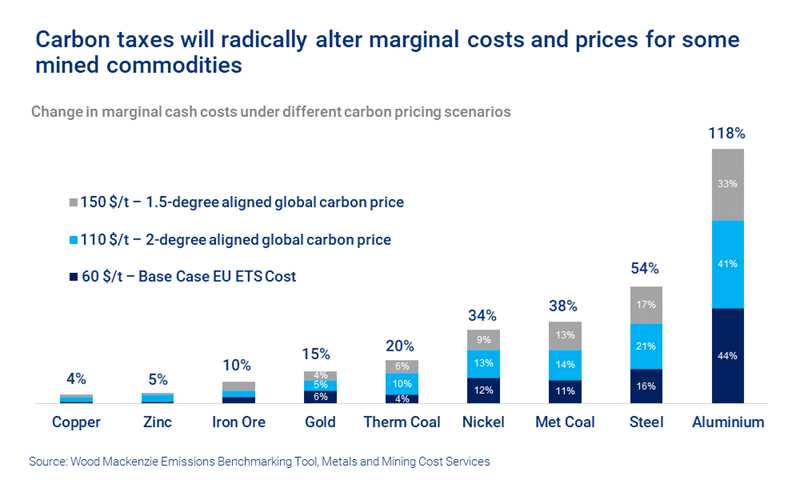

Our AET-2 scenario reflects an integrated analysis of one potential pathway to limit the average global temperature rise to a maximum of two degrees above pre-industrial levels. Under AET-2, a global carbon tax of US$110 per tonne is required by 2030. If a 1.5-degree pathway is to be achieved (our AET-1.5 scenario) carbon taxes become even more onerous, at US$150 per tonne.

Carbon taxes at the AET-2 and AET-1.5 level will, if applied, drive out carbon from the supply side of the metals and mining industry. However, the pace of reduction for the largest volume emitter, steel, will be determined by the development of hydrogen-based green steel processes. The speed of introduction of these processes will in turn be driven by the availability of economic green hydrogen, which will be limited by the availability of green energy. This green energy itself requires green metals, creating what we at Wood Mackenzie call the ‘energy transition circularity’. In the case of aluminium, the second largest and most intense emitter of CO2e gases among metals, decarbonisation will primarily be driven by the speed at which power supply decarbonises, reinforcing the energy transition circularity.

The impact of carbon taxes on marginal costs

The carbon intensity of the production of mined commodities varies significantly both within each metal and between metals, which is also true of cash costs. As such, applying carbon taxes to the cost curve, allowing for the relative carbon intensity of operations, leads to a significant distortion. Specifically, marginal costs rise significantly more for those commodities with high carbon intensity and/or a relatively low cash cost structure compared to the combination of high carbon taxes and high carbon intensity.

This distortion is particularly pronounced for primary aluminium, steel, metallurgical and thermal coal and nickel. The contributing factors vary. For aluminium it’s primarily caused by the use of hydrocarbon power supply in China. In the case of steel, it’s a result of the metallurgical coal used in the reduction process (hence the focus on the development of hydrogen-based iron ore reduction and a greater use of scrap processing). For metallurgical and thermal coal, fugitive emissions are the major contributors to their respective carbon footprints and drive the high impact of carbon taxes at the margin. Meanwhile, for nickel, coal-based power, along with the use of coal in the conversion process itself in countries like Indonesia and China, boosts marginal carbon intensity.

Copper, zinc, iron ore and indeed gold see relatively little change in their marginal costs. So, one could argue that these metals are somewhat immune to carbon costs – or at least will be well positioned to compete with metals with high marginal carbon intensity and a low cost structure. An example of this is copper, which competes with aluminium in power transmission applications.

Implications for prices: the good, the bad and the indifferent

Prices trend to the marginal cost of supply unless stocks are well below or above ‘normal levels’, which we define as the long-term average which transcends at least two business cycles. While there is some debate about the exact cost level at which prices intersect the cash cost curve, it is typically at around the 90th percentile.

Absent full decarbonisation of the metals supply chain, the application of carbon taxes will be inflationary for prices. For some commodities this uplift in prices will be transformative. A sharp rise in marginal prices will ultimately drive decarbonisation of the supply chain, so that marginal costs will ultimately fall accordingly. However, given the scale of investment required and the inertia in the system, this may take a decade or more. In the interim prices will remain elevated, which will help incentivise the development of projects to seed the energy transition.

Elevated marginal prices represent significant opportunities for assets and companies positioned at the low end of the carbon intensity curve. Not only will they benefit from margin expansion, there will be greater demand for the equity given the desire by investors to green their portfolio. What’s more, lenders have mandates for decarbonisation lending, so low-carbon entities benefit from lower financing costs.

Just as there is a race to the bottom of the curve for business costs to maximise returns, the same can be expected for carbon intensity. The starting gun has been fired, so let the race begin.

Get unique views on metals and mining

This article is part of a regular series exploring opportunities and challenges in the world of metals and mining. To make sure you don't miss out, fill in the form at the top of the page to get this complimentary series in your inbox.