How Big Oil is set to transform the offshore wind sector

The Euro Majors’ huge renewables ambitions mean the winds of change are blowing

1 minute read

By Søren Lassen, Head of Offshore Wind Research, Norman Valentine, Director, Corporate Research and Valentina Kretzschmar, VP, Corporate Research.

Having done little more than dip their toe into the sector for decades, a number of oil companies took the plunge into offshore wind in 2020. The Euro Majors accounted for nearly a third of offshore wind project final investment decisions (FIDs) in 2020, while also being responsible for around 30% of M&A transactions in the sector. And this is just the start.

In a recent article, Wood Mackenzie Chairman Simon Flowers highlighted that Big Oil’s offshore wind journey is only just beginning. Here, we explore further what the Euro Majors’ considerable ambitions mean for the sector. Who’s getting involved? What strategies are emerging? And what does this mean for the future of the sector?

This article is based on a webinar presentation from our Corporate New Energy Series. Read on for a summary — and fill in the form for a complimentary selection of the accompanying slides.

Why offshore wind, and why now?

Offshore wind forms part of a radical shift in future strategic direction for Big Oil. The Euro Majors’ huge growth ambitions in renewables require a sector with massive growth potential, and offshore aligns well with that need. Some companies, like Shell and Equinor, have been committed to the transition from Big Oil to Big Energy for several years but others, like Total, BP and Eni, are starting to get in on the act.

At less than 5% of current operational capacity, Big Oil’s involvement in offshore wind may seem insignificant, but that’s about to change. In terms of FIDs, 2020 was a pivotal year for the Majors: securing around 30% of confirmed new capacity is remarkable and is a clear signal of intent. And it’s at a scale that could shift the dynamics of the sector.

Are they too late to the game? Probably not. We foresee more than 200 GW of capacity being deployed in the next decade. That represents almost a sevenfold increase compared to today — and two-thirds of that capacity won’t be connected until the second half of the 2020s.

How big will Big Oil go with offshore wind?

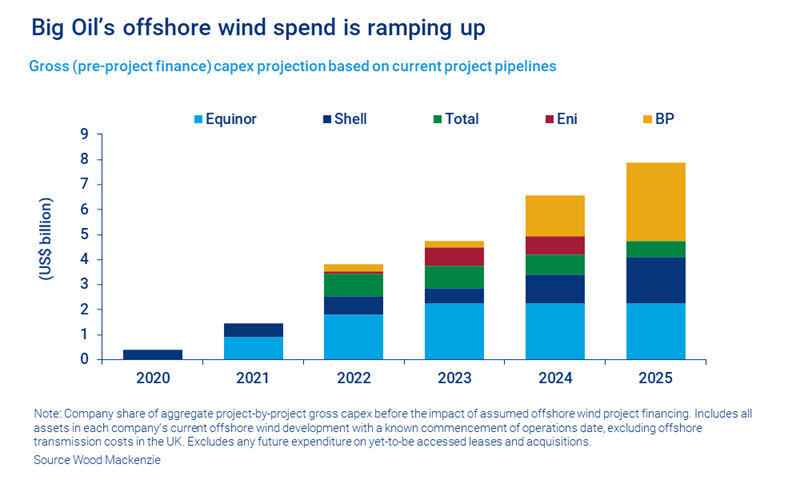

The impact of Big Oil’s burgeoning love affair with the sector is hard to downplay — around half of the ex-China offshore wind tenders awarded between the start of 2019 and March 2021 were won by the Majors. And their development spend on the offshore wind project pipeline is set to ramp up significantly.

We estimate annual spending on offshore wind by the Euro Majors before project financing will increase to around US$8 billion a year in 2025 — more than 18 times 2020 spending levels. That’s a game-changer for the development of offshore wind.

Big Oil’s ambitions to grow in renewables means there will be even more to come. With the exception of Shell (which doesn’t have a stated target), the Euro Majors have renewables capacity targets of at least 125 GW before 2030, with growth ambitions growing almost by the week.

Most recently, Total has upgraded its renewables capacity target to over 100 GW on a gross basis, including all its subsidiaries. The Majors’ portfolios in offshore wind, and in solar, will need to get much bigger than they are today if those targets are to be met.

How are the Euro Majors going about their move into offshore wind?

Joint ventures and partnerships are already growing popular in the industry and are an arena in which the Majors are set to play a key role. As well as enabling access to new and emerging markets, this will help mitigate initial spend and enable ambitious buildout plans.

Another element of the Euro Majors’ approach is the development of power off-take agreements. Equinor and Shell stand out as being power purchasers as well as offshore wind developers, typically committing to purchase power from the development projects in which they are partners. Over time, we expect many of the other Euro Majors to leverage their energy trading and marketing experience to extend their presence through the low-carbon power value chain. This makes sense for a company like Shell in particular, with its strategic focus on marketing and the end consumer.

To enhance returns and generate early cashflow, the Euro Majors are also using the M&A market to sell down stakes in some of their offshore wind projects. Equinor has generated over US$1.9 billion from asset sales over the last couple of years, representing a very healthy return on its investment in the sector to date.

The Euro Majors already hold some of the most diversified offshore wind portfolios in the sector.

Where are the opportunities?

Big Oil’s global presence makes it better placed than regionally-focused incumbents to pursue opportunities on a worldwide scale. The Euro Majors already hold some of the most diversified offshore wind portfolios in the sector. As well as established wind markets like the UK, Germany and the Netherlands, they’re entering committed markets like the US where projects have won government support but aren't yet operational. Equinor and Shell have also established positions in emerging and pre-emerging markets, with other Majors likely to follow.

Within Europe, the Black Sea is generating a lot of interest, while further afield China is a huge potential market which remains hard to access but is increasingly hard to ignore. Equinor has signed a partnership to try and get through the door, and this could be a viable route for other Euro Majors, since Chinese players also want to break out. In the long term, some of the most important markets for the Majors are probably not even on the map yet.

To see a map of the Euro Majors’ offshore wind presence by market development status, fill in the form on this page for a copy of the presentation slides.

Will they make money?

Oil companies are paying record-breaking auction fees for projects with lead times of up to ten years. However, initial government support will reduce risk and wind farms will be operational for decades, giving plenty of time to recoup upfront costs and generate profit.

Companies are quoting internal rates of return (IRR) of 8-12% for offshore wind, although our own base case is slightly lower. Proprietary analysis of pre-FID oil and gas projects globally using our Lens platform shows returns of around 16-17% at an oil price of US$50 a barrel. Yet at US$30 a barrel, which is not an unlikely price under a two-degree climate change scenario, IRR drops to 6-7% (and that’s without including likely carbon taxes and increased cost of capital).

Overall, longer project life and lower risk mean returns for offshore wind can compete with conventional energy sources.

What’s next?

Big Oil’s interest in offshore wind does mean competition is heating up. But while demand could put huge competitive pressure on the race to access projects in the near-term, the sector is dynamic and growth potential enormous.

One aspect to look out for in the future is the Euro Majors' positioning in the development of offshore floating wind. Equinor has been active in floating wind for over 20 years, with Equinor, Shell, and Total also getting involved in projects looking to scale up the potential of advances in the technology. This could become an important source of growth for them in the 2030s.

Find out more

Our presentation extract features details of the Corporate New Energy Series, plus a selection of charts, including:

- Capacity targets of selected renewables players versus offshore wind sector growth outlook

- Awarded offshore wind tenders

- Map: Euro Majors’ presence by market development status