Wind industry faces a perfect storm of profit pressures

The upstream wind supply chain feels the tightest squeeze from rising costs and aggressive power pricing tenders

3 minute read

Endri Lico

Principal Analyst, Global Wind Supply Chain and Technology

Endri Lico

Principal Analyst, Global Wind Supply Chain and Technology

Latest articles by Endri

-

Opinion

Liberation Day tariffs threaten to disrupt US wind and solar industries

-

Opinion

New frontiers: order intake by Chinese wind turbine OEMs advanced beyond domestic dominance in H1 2024

-

Opinion

Wind from the east gathering strength: the outlook for OEMs

-

Opinion

Wind turbine technology evolution is diverging quickly between China and the rest of the world

-

Opinion

Western wind turbine manufacturers are prioritising profit over volume, opening the door for Chinese market share growth

-

Opinion

Goldwind captures the top spot for global wind turbine supply

Aaron Barr

Global Head, Onshore Wind Energy Research

Aaron Barr

Global Head, Onshore Wind Energy Research

Latest articles by Aaron

-

Opinion

Supply shortages and an inflexible market give rise to high power transformer lead times

-

Opinion

EU wind pledges: a little overblown?

-

Featured

Wind 2024 outlook

-

Opinion

Onshore wind energy: what to look for in 2024

-

Opinion

IRA set to increase cumulative US wind energy installations by over 50% in the next five years

-

Opinion

The Inflation Reduction Act and its impact so far

The wind energy market is growing fast, doubling in size in the last five years. Nonetheless, many turbine and component suppliers face negative profits in the face of serious supply chain challenges.

Our new Global wind supply chain trends series – drawing on insight from the Global Wind Markets Service – explores this topic in depth. Fill in the form for a complimentary extract, and read on for an introduction.

Profit margins in the wind industry have tightened

As global markets grapple with both post-Covid recovery and geopolitical tensions, supply chains have been fundamentally restructured. The availability and cost of raw materials and parts have been significantly affected and flexibility has been drastically reduced.

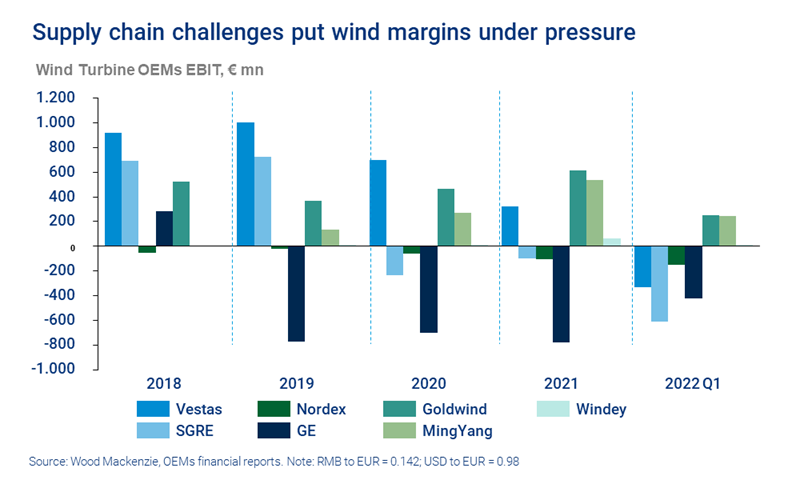

It is, in many ways, a perfect storm for profit margins. Energy price inflation, skyrocketing costs for specialised logistics, rising skilled labour rates and lingering Covid-related delays now combine with downstream cost pressure from aggressive power pricing tenders. As a result, western original equipment manufacturers (OEMs) have recorded over €3.4 billion losses in the last two years, including nearly €1.5 billion in the first quarter of 2022 alone.

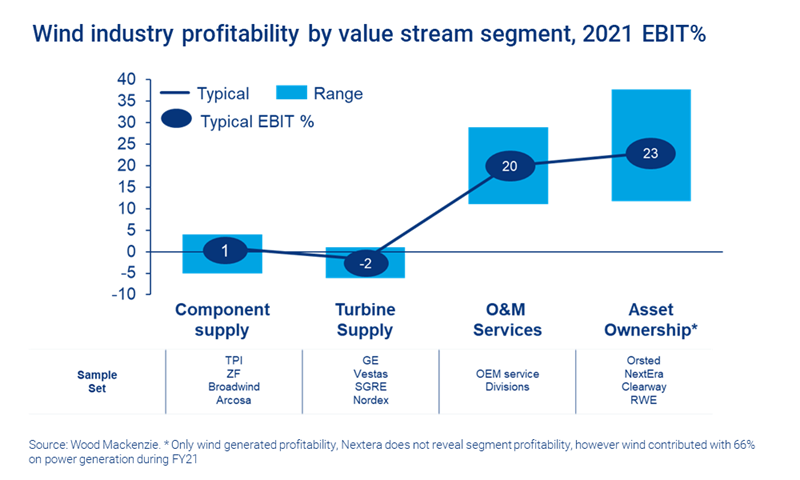

Profit pressures are the most intense upstream within the supply chain; asset owners and O&M providers enjoy higher margins

The squeeze is not being felt evenly across the industry. Cost pressure originates within the competitive power markets and long-standing expectations for sustained levelised cost of energy (LCOE) reduction for wind energy. These CAPEX reduction expectations are then passed upstream to the supply chain, including wind turbine manufacturers and their component vendors.

OEMs have limited options to pass inflation-related costs off to customers, due to the long timeline between order placement and equipment delivery. They have therefore begun to increase average selling price and implement cost-based indexing on new supply contracts. In addition, many OEMs are performing comprehensive product portfolio reviews, while re-valuating their existing order portfolio to prioritise profitability and long-term policy certainty over market share in many global markets.

The lone bright spot for OEMs’ profitability is in the aftermarket, as the services business regularly delivers double-digit EBIT margins. The global installed capacity of wind energy has now eclipsed 800 GW, with the next decade expected to add nearly another 100 GW per year, on average. This massive fleet – and potential for repeatable high-margin revenue – provides the primary source of profit growth for wind turbine OEMs.

Asset owners experience the highest average EBIT margins across the value chain, driven by the sale of electricity and project investment. Many of the largest global asset owners are also focusing on margin expansion within the O&M segment, as they vertically integrate the servicing of their growing fleets.

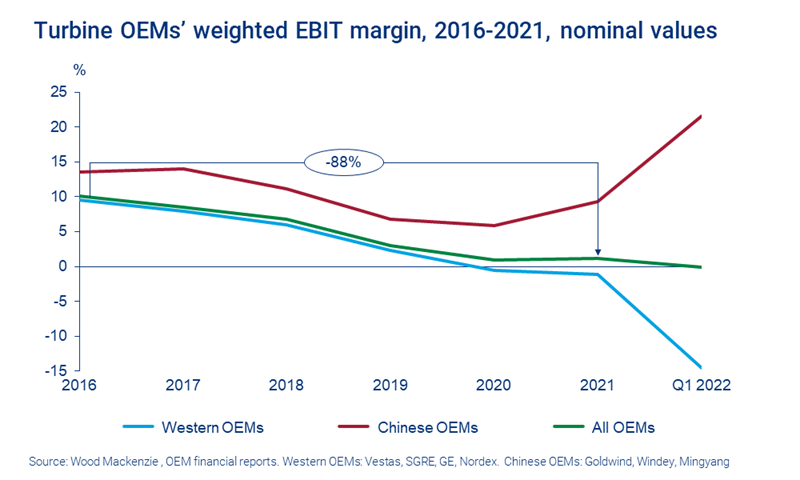

Chinese wind turbine OEMs have been shielded from profit pressures, driven by a massive domestic market and localised supply chain

While western turbine OEMs are facing negative profitability and increasing prices, Chinese OEMs achieved significantly better results and continue to reduce turbine pricing. This is driven by the economies of scale within the massive Chinese wind energy market, which represents over 50% of 2021 installations and over 48% of our 10-year cumulative forecast. This dominance is driven by the long-term renewable energy policy roadmap defined by the Chinese government.

Chinese wind turbine and component supply is highly localised, as China has positioned itself as the global supply hub for the lowest cost specialised wind turbine components. This localised supply chain presents low logistics costs, as many manufacturing factories are located in close proximity to the major wind bases in-country. In addition, Chinese OEM scope of supply does not include the wind turbine tower, which has been subject to significant steel material price escalation and high specialised shipping costs.

However, despite Chinese OEMs’ advantaged financial performance, they have also seen profit erosion in the past five years, with 2021 EBIT margins 32% lower than in 2016.

Risks remain for future profit erosion of even the Chinese OEMs. Intense competition among local OEMs and oversupply of critical components has driven down turbine pricing by more than 30%, and the Chinese supply chain is not wholly isolated from material escalations that are affecting global markets.

Additionally, trade tension and new geopolitical reality may limit the potential to fully utilise Chinese factories for export to western markets, and limits the options for overseas expansion for Chinese OEMs.

Our new Global wind supply chain trends series explores wind industry opportunities and challenges in depth. Fill in the form for a complimentary extract.