Sign up today to get the best of our expert insight in your inbox.

How higher interest rates could hold up energy transition investment

What can policymakers do about it?

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

What comes after the Permian for IOCs?

Peter Martin

Head of Economics, Macroeconomics

Peter Martin

Head of Economics, Macroeconomics

Peter is responsible for producing our macroeconomic outlook to 2050.

Latest articles by Peter

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

Opinion

Global economic outlook: trade tensions bite

-

Opinion

Global economy: can momentum trump uncertainty?

-

Opinion

What the Middle East conflict means for oil, LNG and the global economy

-

Opinion

Trump’s tariff plan: implications for the future of global liquids trade

James Whiteside

Head of Corporate, Metals & Mining

James Whiteside

Head of Corporate, Metals & Mining

With 15 years of experience in the metals and mining industry, James leads our corperate coverage.

Latest articles by James

-

Opinion

The end of capital discipline in mining?

-

The Edge

Big Mining pivots to copper for growth

-

Featured

Metals & mining 2025 outlook

-

Opinion

Battery power play: countercyclical opportunities in raw materials

-

Opinion

Copper rush: A strategic analysis

-

Opinion

PPAs: transforming miners’ decarbonisation strategies

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

Global upstream update: diverging development strategies in Latin America, investment at risk in Africa, and Kazakhstan supply tensions explained

-

Opinion

Is oil price volatility a threat to upstream production, investment and supply chains?

-

Opinion

Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

The Edge

Why upstream companies might break their capital discipline rules

Srinivasan Santhakumar

Principal Research Analyst, Offshore Wind

Srinivasan Santhakumar

Principal Research Analyst, Offshore Wind

Srinivasan is a principal analyst with a particular focus on asset valuation, LCOE forecasts and market research.

Latest articles by Srinivasan

-

The Edge

How higher interest rates could hold up energy transition investment

-

Opinion

Elevated subsidies enable offshore wind to end 2023 on a high note

-

Opinion

Offshore wind: policy frameworks decide who wins – but not when

The energy transition won’t come cheap. Most of the investment in the transformation to a low-carbon energy system will be debt-financed, whether the US$52 trillion we project in our base case over the next three decades or the US$75 trillion to deliver net zero. So how will higher interest rates affect investment across the energy and metals and mining sectors? I asked the authors of last month’s Horizons insight on the topic, Peter Martin, James Whiteside, Fraser McKay, and Srinivasan Santhakumar.

Will interest rates be higher in future than investors have been used to?

Most likely. Interest rates may come down from the current highs in the next few quarters, as inflation falls towards central banks’ targets of around 2%. But structural inflationary trends are intensifying – global trade realignment, deglobalisation and production onshoring. That points to a period of tighter monetary policy in the coming years. We think the ultra-low rates of the decade after the Great Financial Crisis were the anomaly, and interest rates will normalise again through this decade at a higher level.

How do higher rates affect different sectors?

Most projects across the energy and mining sectors are capital-intensive but between sectors, there are differences in balance sheet exposure to debt. Wind and solar projects and nuclear power are typically financed by debt secured against long-term power purchasing agreements (PPAs). As a result, corporate gearing (net debt/equity) is relatively high, averaging 50% to 60% for the renewables companies in Wood Mackenzie’s Corporate Strategy and Analytics Service. The bankability of these project revenue streams can reduce the cost of debt, but the high leverage leaves renewables companies sensitive to interest rate rises.

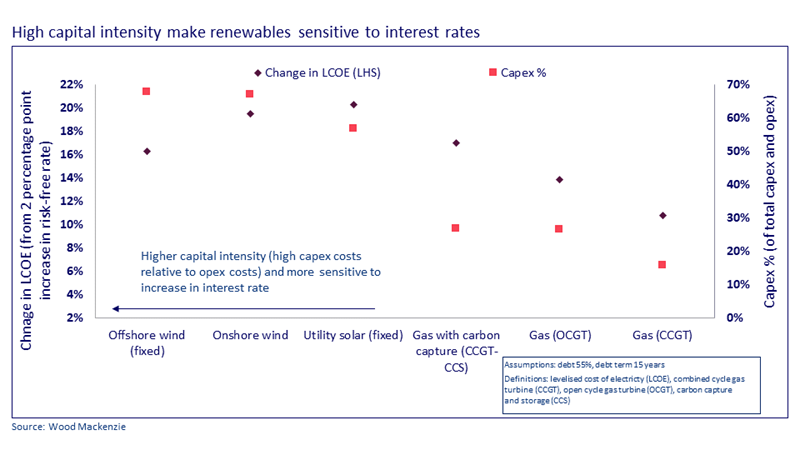

Higher rates will reduce renewables’ competitiveness in power markets. Our analysis shows that a 2% increase in the risk-free interest rate pushes up the levelised cost of electricity for a renewables project by 20% compared with only 11% for a combined cycle gas plant.

Oil and gas and metals and mining companies are less exposed to higher rates. After a period of assiduous capital discipline that has strengthened balance sheets, gearing now averages around 20% in both sectors. Also, project financing is less common for developments exposed to volatile oil and gas or mining commodities. Among the exceptions in the oil and gas value chain are LNG and midstream projects, which have comparatively stable revenue streams.

Are higher rates bad news for emerging green technologies?

Nascent technologies that are essential for the transition to net zero are also capital-intensive and will require high levels of investment to scale up. So higher rates will pose another challenge for many projects to get off the ground, whether low-carbon hydrogen, carbon capture, utilisation and storage and direct air capture (DAC).

The lack of economic incentives for both carbon capture and a hydrogen market are the most significant obstacles to investment in these sectors. But for projects that could progress, higher interest rates hurt the economics. Developers will either have to take lower returns on the chin or demand higher prices.

Can governments step in to compensate for high rates?

Ideally, governments would boost incentives to ensure investment in low-carbon technologies doesn’t stall but gains momentum. However, many governments’ own debt and debt service costs are increasing. Some may be forced to reduce supportive subsidies and tax incentives or cut direct public capital investment in a low-carbon economy. China has already reached the limits of its available funding capacity to subsidise new renewables projects.

What other levers can policy makers pull?

We think there are three main ones. First, ensure that subsidies have the maximum impact on global decarbonisation. The most efficient are targeted and non-discriminatory. Second, a fully functional, tradeable global carbon market is critical if countries are to meet their emissions targets. Ratifying Article 6.4 of the Paris Agreement at COP29 in Azerbaijan in November is a must.

Third, drumming up climate finance, be it from the private or the public sector or both, is critical to supporting green investment in climate change mitigation and adaptation in developed and developing economies. In addition to improving the availability of finance, so-called ‘green rates’ could offer preferential interest rates to finance low-carbon projects and offset the higher rate environment.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.