Sign up today to get the best of our expert insight in your inbox.

The coming geothermal age

Next-generation technology aiming to transform the sector

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

India’s energy challenge

-

The Edge

Is there still life in decarbonising hard-to-abate sectors?

-

The Edge

A wild week for gas markets

-

The Edge

How Venezuela complicates the oil market’s delicate rebalancing

-

The Edge

Is Greenland Venezuela 2.0?

-

The Edge

Five themes shaping the energy world in 2026

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A wild week for gas markets

-

The Edge

How Venezuela complicates the oil market’s delicate rebalancing

-

The Edge

Is Greenland Venezuela 2.0?

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

-

The Edge

Five key takeaways from COP30

-

The Edge

Can copper supply keep up with surging demand?

Annick Adjei

Senior Research Analyst, Subsurface (New Energies)

Annick Adjei

Senior Research Analyst, Subsurface (New Energies)

Annick is instrumental in advancing Wood Mackenzie’s geothermal solution.

Latest articles by Annick

-

Opinion

Hot rocks: geothermal momentum continues to build

-

Opinion

Rock solid: geothermal’s upward trajectory

-

Opinion

Geothermal: the next North American goldrush?

-

The Edge

The coming geothermal age

-

Opinion

Heating up: 2024 showcased the promise of geothermal energy

-

Featured

Subsurface 2025 outlook

Kate Adie

Research Analyst, Subsurface

Kate Adie

Research Analyst, Subsurface

Kate is a key contributor to our global research on established and developing geoenergy technologies.

Latest articles by Kate

-

Opinion

Hot rocks: geothermal momentum continues to build

-

Opinion

Rock solid: geothermal’s upward trajectory

-

The Edge

The coming geothermal age

-

Opinion

Heating up: 2024 showcased the promise of geothermal energy

-

Featured

Subsurface 2025 outlook

-

Opinion

Subsurface: 5 things to look for in 2025

Zoé Sulmont

Research Analyst, Energy Transition

Zoé Sulmont

Research Analyst, Energy Transition

Latest articles by Zoé

-

Featured

Nuclear 2026 outlook

-

Opinion

Energy evolution: navigating the path to a sustainable future

-

Opinion

Hot rocks: geothermal momentum continues to build

-

Opinion

Rock solid: geothermal’s upward trajectory

-

The Edge

The coming geothermal age

-

Opinion

Heating up: 2024 showcased the promise of geothermal energy

A proven low-carbon energy source offering abundant, 24/7 heat and power, geothermal sounds like manna from heaven.

There’s always a catch, however and with geothermal it’s the rocks. Conventional geothermal energy production requires both high-temperature and high-permeability rocks, making commercial projects rarer than hen’s teeth. This could change, though as next-generation technologies open the prospect of geothermal energy production virtually anywhere.

Can next-gen geothermal unlock far more of the earth’s clean energy? Gavin Thompson spoke to Annick Adjei, Kate Adie and Zoé Sulmont from our subsurface and energy transition teams.

Why is interest in geothermal hotting up?

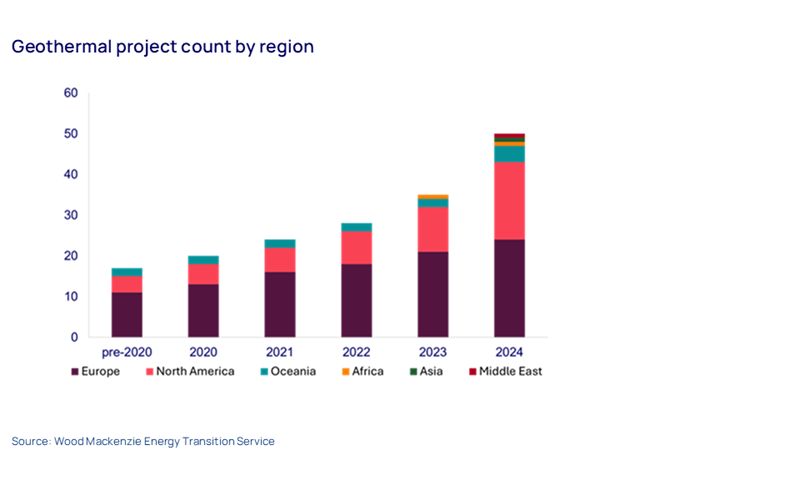

As numerous nascent clean energy technologies struggle for take-off, next-gen geothermal is the new energy transition cool kid that could break through at scale. Last year saw significant growth in announced projects and progress in financing and regulation, helping to push up next-gen geothermal by five places on our technology leaderboard.

Looking forward, we expect confidence in the sector to keep rising, with the ever-increasing call on clean power from the booming datacentre sector the latest kicker.

What can next-gen technology offer?

Four technologies with the potential to broaden the scope of geothermal energy extraction way beyond the narrow geographic and geological limitations of conventional projects are making progress.

The two most advanced are Enhanced Geothermal Systems (EGS) and Advanced Geothermal Systems (AGS). EGS fractures hot, dry rocks to increase permeability while AGS is a closed loop system ideal to repurpose end-of-life oil and gas wells for heat and power production. By targeting lower permeability rocks, both these technologies could be applied far more widely and double output per well compared to conventional geothermal to create the potential for almost limitless baseload low-carbon energy.

Two others are bubbling under. Superhot Rocks (SHR) targeting high temperature rocks with a single well aims to produce ten times the energy of a conventional geothermal well; and Geopressured Geothermal Systems (GGS) which is focused on over-pressured sedimentary basins.

What are the obstacles?

Costs. Next-gen geothermal capex needs to fall by up to 60% to compete with nuclear in the baseload clean power market. Drilling wells is a significant part of capital spend but there has been considerable progress - in the US, Fervo Energy has already halved drilling times across its horizontal development wells at its Project Red pilot site and commercial-scale Cape Station.

Co-locating geothermal plants alongside other low-carbon technologies such as green hydrogen or carbon capture can support the economics. Additional revenue by extracting critical minerals from geothermal fluids could also improve the financial viability of projects. It is still early days, but pilot lithium extraction plants are already established in Germany, New Zealand, North America and the UK.

Are governments stepping up?

Unproven low-carbon tech cries out for help and governments are slowly recognising the opportunity with geothermal. Financial support is increasing, with governments allocating more than US$2 billion to geothermal energy initiatives in 2024 – though so far, the majority has gone to conventional projects.

Less costly, but still valuable, favourable policy and regulatory environments are emerging for geothermal. Four countries passed new legislation last year, notably Germany which passed a major legislative package in September to facilitate the approval of geothermal projects and the expansion of heat systems.

The Biden administration in the US introduced twelve bills to support the geothermal industry, and notwithstanding President Trump’s open antipathy to clean energy, the new Administration’s National Energy Emergency declaration includes geothermal as a key domestic energy source. US energy secretary Chris Wright has been public in his support.

Do Big Tech and Big Oil share the love?

The lure of clean, 24/7 power is attracting the world’s biggest technology companies to geothermal, with three standout partnerships. In 2024, Sage Geosystems signed a 150MW PPA with Meta to supply power to its energy-hungry US data centres. In the same year, Microsoft partnered with KenGen and G42 for a US$1 billion digital investment in Kenya, including a geothermal-powered data centre. Just last month, Google signed PPAs in Taiwan for geothermal power from projects operated by Baseload Capital, its first geothermal deal in Asia Pacific and touted by the tech giant as a catalyst for further project development on the island.

For the oil and gas industry, strategic partnerships signed by BP, Equinor and Chevron with project developers indicate interest, though the Majors will want to see more progress on project competitiveness. The opportunity to leverage skill sets in subsurface and drilling is an attraction, though the demotion of low carbon in capital allocation may slow progress down.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.