1 minute read

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Latest articles by Julian

-

Opinion

Metals investment: the darkest hour is just before the dawn

-

Opinion

Ebook | How can the Super Region enable the energy transition?

-

The Edge

Can battery innovation accelerate the energy transition?

-

Featured

Have miners missed the boat to invest and get ahead of the energy transition?

-

Featured

Why the energy transition will be powered by metals

-

Featured

Could Big Energy and miners join forces to deliver a faster transition?

James Whiteside

Head of Corporate, Metals & Mining

James Whiteside

Head of Corporate, Metals & Mining

With 15 years of experience in the metals and mining industry, James leads our corperate coverage.

View James Whiteside's full profileRobin Griffin

Vice President, Metals and Mining Research

Robin Griffin

Vice President, Metals and Mining Research

An integral part of the research team since 2007, Robin leads our analysis across metals and mining markets.

Latest articles by Robin

-

Opinion

Future Facing Commodities Forum 2024: your questions answered

-

Opinion

Ebook | Navigating the cross-commodity metals and mining landscape in 2024

-

Featured

Metals and mining 2024 outlook

-

The Edge

COP28 key takeaways

-

Opinion

COP28: a metals and mining stocktake

-

Opinion

Our top takeaways from the Coal Forum 2023

What are the key trends to watch in the metals and mining industry in 2022?

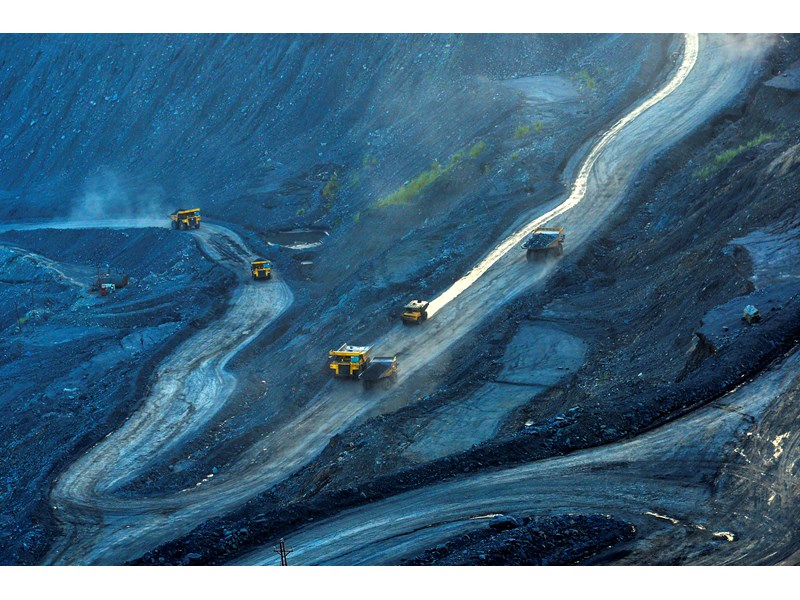

Last year presented a unique challenge to metals and mining players: how to make sense of disorientating price volatility and a dizzying array of market signals. We expect 2022 to provide some respite from the frenetic pace of 2021 – but of course things won't change overnight.

From an economic perspective, it looks set to be a year of narrowing extremes but widening uncertainty for the metals and mining sector. If last year was all about rebound, then 2022 could well be characterised by rebalance. Much of the evidence points to a year of lower demand growth. Look for stimulus to wane, fiscal and monetary policy to tighten, and supply chains to refill. In this environment, commodity prices could settle from the extraordinary highs of 2021.

Metals and mining corporates: decisions, decarbonisation and discipline

For the diversified miners this will be a pivotal year. In the wake of COP26, mining companies are even more acutely aware of the outside perception of the sector, and the challenge that represents.

Yet the world needs mining companies to shift more material than ever before in 2022. Miners can unlock a faster decarbonisation pathway by accelerating production of the very building blocks of low-carbon technology. Will they position themselves as agents of change?

Read Metals and mining corporate: five things to look for in 2022 for our view on:

- Decision time for coal assets

- M&A – expect a measured approach

- Miners look for new domains

- Tightening decarbonisation targets, not budgets

- Cost inflation and lower prices to limit dividend growth

Fill in the form at the top of the page for your complimentary copy.

Plus, find out how key themes play out for different metals and mined commodities:

|

|

|

Aluminium

Uday Patel, Senior Research Manager, Global Aluminium Markets

Battery raw materials

Booming demand tested supply chains last year, with spot prices for all key battery inputs rising over the course of the year. On the technology front, the lithium iron phosphate – LFP – renaissance strengthened further. What does 2022 hold in store?

Read our view in Battery raw materials: 5 things to look for in 2022.

Gavin Montgomery, Research Director, Battery Raw Materials

Bulk alloys

Jack Anderson, Principal Analyst, Metals Smelting & Refining

Cathode and precursor

Cobalt

2021 saw a dramatic shift in fundamentals in the cobalt market, leading to a technical deficit for the first time since 2016. 2022 will be another eventful year, from supply chain regionalisation to the battery boom and the quest for cleaner cobalt.

Find out more in Cobalt: 5 things to look for in 2022.

Ying Lu, Senior Research Analyst, Energy Transition & Battery Materials Markets

Copper

Eleni Joannides, Principal Analyst, Copper

Gold

Graphite

Suzanne Shaw, Principal Analyst

Iron ore

Paul Gray, Research Director, Iron Ore Markets

Lead

Lithium

Allan Pederson, Principal Analyst

Metallurgical coal

Anthony Knutson, Principal Analyst, Coal

Nickel

Sean Mulshaw, Research Director, Nickel Markets

Noble alloys

Dale Hazleton, Head of Steel Alloys and Nickel Markets

Rare earths

For the rare earths industry, 2021 was a critical year with prices for some elements sustained well above historical averages. In 2022, we’ll be tracking Chinese consolidation and quotas, international trade in feedstock, ESG concerns and more.

Find out more in Rare earths: 5 things to look for in 2022.

Steel

Malan Wu, Head of Steel and Raw Materials Markets

Thermal coal

Natalie Biggs, Global Head of Thermal Coal Markets

Zinc

Jonathon Leng, Principal Analyst, Zinc Markets

Sustainable smelting

Sustainable smelting operations continue to grow. The development of green technology retrofits and the use of hydrogen and carbon capture continues at pace – but existing processes can't be replaced overnight.

Find out about this and more in 5 things to look out for in sustainable smelting during 2022.