Discuss your challenges with our solutions experts

Green steel – will Sweden be the trailblazer?

Proactive initiatives and abundant renewables could see Sweden take the lead in the race to decarbonise steel

1 minute read

By Sohaib Malik, Principal Analyst, Energy Transition Practice, Mingming Zhang, Senior Research Manager, Metals and Mining, Bridget van Dorsten, Research Analyst, Energy Transition Practice, Flor Lucia de la Cruz, Senior Analyst, Energy Transition Practice

The global steel industry is responsible for between 7% and 9% of annual carbon dioxide (CO2) emissions. That alone is enough for the sector to embark on a decarbonisation drive. Add to the mix the primary role that steel will play in the global energy transition and the need for greener solutions only intensifies.

Put simply, renewables need fossil-free steel to achieve carbon neutrality. Right now, for instance, steel contributes 65% and 94% of raw material emissions of onshore and offshore wind turbines, respectively. At the same time, renewables are the key enabler for the European steel industry to reach its emissions reduction target of 80-95% by 2050.

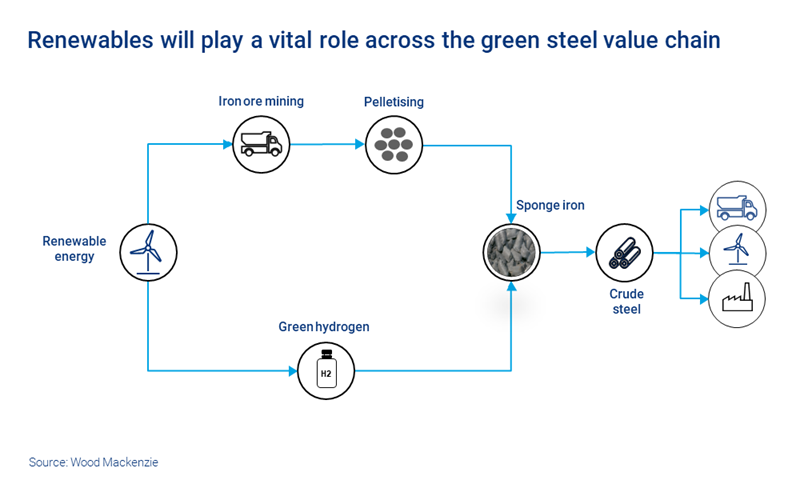

The race to decarbonise steel is on – and Sweden looks like a likely contender to take the lead. About 80% of the 28 ‘green’ steel ventures currently active across the continent aim to utilise hydrogen produced from renewable energy as an alternative fuel for steel production, replacing coal-intensive coking. Swedish initiatives stand out for their ambition to decarbonise the value chain from iron ore mining to crude steel.

At Wood Mackenzie, we brought together our cross-sectoral expertise in power and renewables, hydrogen and metals and mining to analyse Swedish green steel ventures and their potential to blaze a trail for the industry.

Visit the store to read our case study in full. Or read on for an introduction.

The Swedish ecosystem for green steel

Sweden boasts an abundance of renewable energy resources and adequate iron ore reserves. This has enabled the steel industry to align itself with the country’s 2045 carbon neutrality target.

Our levelised cost of electricity (LCOE) underlines the cost competitiveness of Sweden’s vast wind energy resources. At US$30/MWh, onshore wind is among the lowest cost sources of power generation, enabled by developers’ ruthless drive to create value in an unsubsidised environment. Offshore wind has a limited track record in the country, but the government’s willingness to fund part of the interconnection capex will improve the economics. Traditional financiers’ openness to funding future growth and turbine tech advancements will fuel LCOE reductions in a maturing merchant and corporate PPA market.

Low-cost wind power allows developers to produce green hydrogen at competitive rates. Our levelised cost of hydrogen (LCOH) modelling shows green hydrogen costs falling as low as US$1/kg by 2030. Cost drivers differ for different electrolyser types, and we see alkaline electrolysis (ALK) as a strong contender for preferred adoption in the 2020s and 2030s. – As the proton exchange membrane (PEM) has a 25% higher capex, ALK will benefit from economies of scale faster.

Further capex reductions in both techs will improve the commercial attractiveness of green hydrogen for the steel industry.

When can green steel compete with conventional steel on cost?

Fairly soon. Our research shows a strong case for green steel to reach cost parity with conventional steel this decade, under the right conditions.

We compare the baselines of natural gas- and green hydrogen-based direct reduction (DR) and electric arc furnace (EAF) processes in Sweden. Notably, Sweden has shielded its steel industry from the high carbon tax of US$130/tonne. Expanding the carbon tax net to the industry will shoot the cost of conventional steel by 20-30% at the stroke of a pen.

Our analysis signals substantial cost reduction potential for green steel, driven chiefly by two factors: higher carbon prices and lower LCOH. The criticality of the former is evident from the fact that a CO2 price of US$100/tonne benefits green steel producers by US$85/tonne through carbon credits. For the latter, a combination of onshore wind and ALK may yield an LCOH enabling green steel to have superior economics in the 2020s across carbon price scenarios of US$50, US$100 and US$150/tonne.

High CO2 prices and a sustained reduction in the cost of offshore wind and electrolysers will improve the case for offshore wind in the 2030s.

Are the economics enough to secure the future of green steel?

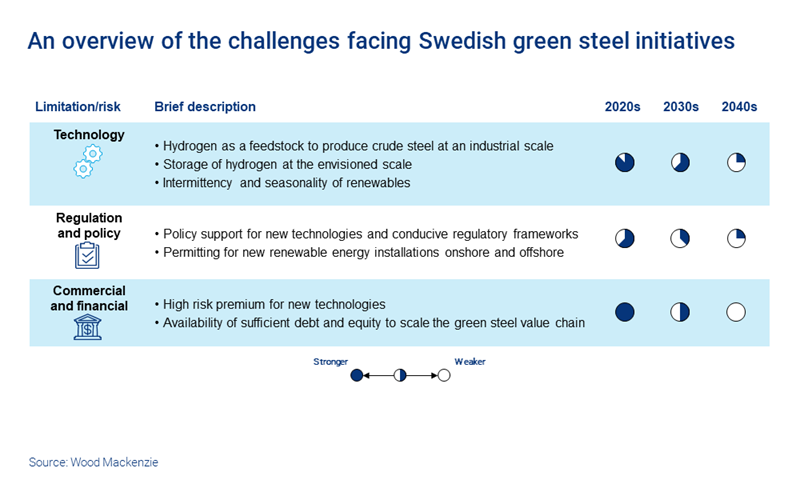

No. Given the novelty of the proposed technologies, developers have to overcome a host of technical, regulatory and commercial challenges for hydrogen to play the desired role. They have yet to demonstrate the viability of storing hydrogen securely and economically at the envisaged level. And the usage of hydrogen as a feedstock for fossil-free steel has yet to be tested at an industrial scale.

Similarly, the intermittency and seasonality of renewables demand a diverse set of power sources for optimum utilisation of hydrogen electrolysers.

So, does steel have a bright green future?

The nature and expanse of technological innovation required for green steel ventures to succeed is not unique. The decarbonisation of heavy industry has several moving parts that must prove their reliability individually and as a synchronised sum. However, there are several reasons to argue that green steel has a brighter future than conventional steel.

First, various steel companies have produced fossil-free steel already. The challenge of deploying these solutions at an industrial scale is sizable, but we expect it to lessen in the 2030s through an iterative process.

Second, the policy and regulatory frameworks will become conducive in the coming years, given the government’s pledge to carbon neutrality. Nonetheless, local opposition towards new renewable energy plants will test the resolve of developers for years to come.

Finally, public funds are available to lower the financial risk of green steel developments. Sweden’s HYBRIT is among seven projects selected by the EU for a Euro 1.1 billion investment. More importantly, the superior economics of green steel will stimulate the flow of low-cost capital. That in turn will aid developers to expand production and maximise economies of scale through the 2030s and 2040s.