Sign up today to get the best of our expert insight in your inbox.

How AI can unlock an extra trillion barrels of oil

And deliver the volumes needed to meet resilient demand

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

View Simon Flowers's full profileAndrew Latham

Senior Vice President, Energy Research

Andrew Latham

Senior Vice President, Energy Research

With his extensive exploration expertise Andrew shapes portfolio development for international oil and gas companies.

Latest articles by Andrew

-

The Edge

How AI can unlock an extra trillion barrels of oil

-

Opinion

Q&A: Fields of dreams

-

Opinion

SEC 2025: Why the SEAPEX region still needs high-impact exploration

-

The Edge

How ultra-deepwater is revitalising oil and gas exploration

-

Opinion

Geothermal energy: the hottest low-carbon solution?

-

The Edge

Low-carbon tech: is geothermal close to a breakthrough?

Orla Marnell

Principal Data Scientist, Upstream

Orla Marnell

Principal Data Scientist, Upstream

Latest articles by Orla

View Orla Marnell's full profileJosh Dixon

Senior Research Analyst, Upstream

Josh Dixon

Senior Research Analyst, Upstream

Josh co-leads the Wood Mackenzie Plays Centre of Excellence.

Latest articles by Josh

-

The Edge

How AI can unlock an extra trillion barrels of oil

-

Opinion

Q&A: Fields of dreams

-

Opinion

Introducing Analogues

-

Opinion

More running room in Lower 48 efficiencies?

Stronger-for-longer oil demand will heap pressure on the upstream industry to deliver new supply. I asked our subsurface experts, Dr Andrew Latham, Orla Marnell and Josh Dixon how artificial intelligence can identify opportunities to meet the challenge.

Why do we need to unlock new supply?

The slow pace of the energy transition means that oil demand is likely to be far more resilient than some thought just a few years ago. Wood Mackenzie forecasts annual consumption won’t peak until the early to mid-2030s, and cumulative demand will be almost 1,000 billion barrels through 2050.

Firm demand throws the spotlight onto where new supply can be sourced. Production from assets already onstream or justified for development will gradually decline under current investment plans from just over 100 million b/d today to 50 million b/d 2050, cumulatively 650 billion barrels. That leaves a huge supply gap of 300 million barrels.

Traditional exploration will play its part but can’t get anywhere near bridging a gap of this scale. Even the 21st century’s biggest new play, Guyana, with 15 billion barrels of oil, barely makes a dent.

What can AI bring to the party?

By helping to identify where operators can wring substantially more oil out of producing reservoirs. Wood Mackenzie’s new AI-powered Analogues benchmarks best-in-class recovery factors to quantify the remaining potential in existing fields.

Analogues uses a machine learning method known as clustering to identify each field’s closest matches across 60 different attributes spanning rock properties, fluid characteristics, and commercial factors. The system eliminates the human bias inherent in traditional filtering approaches which find only exact matches to just a few screening criteria.

Wood Mackenzie models every field in the world. For each one, the AI identifies the top 100 most similar assets globally. Statistical analysis then benchmarks performance across different groupings by country, operator and resource type.

The AI approach has three advantages over conventional subsurface methods. First, it considers holistic reservoir characteristics rather than single parameters like porosity. Second, it high-grades results, ranking similarity levels. Third, it uses sophisticated gap-filling techniques to create complete datasets for analysis.

How much upside does Analogues identify?

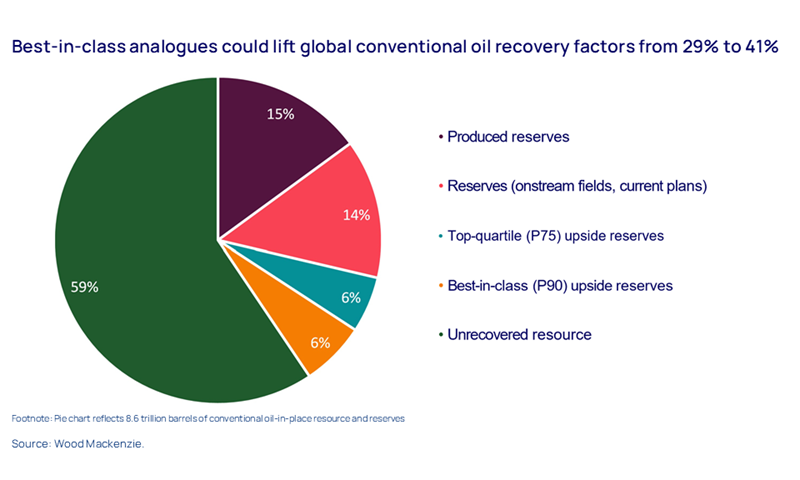

We examined recovery factors across the world's largest oil fields, comparing actual performance against analogous assets. The industry’s current plans will recover an average 29% of oil in place from major fields, of which 15% has already been produced.

However, benchmarking against best-performing analogues suggests 6-12% additional recovery potential using production technologies and practices that are already widely deployed elsewhere. While a seemingly modest improvement, that would translate to approximately one trillion additional barrels, almost doubling remaining recovery potential from existing assets. In short, just getting industry best practice deployed much more widely can unlock almost as much again in recovery potential within the world's oil fields.

AI analysis reveals stark performance differences across regions and operators

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

View Simon Flowers's full profileWhich countries and operators have most upside potential?

The AI analysis reveals stark performance differences across regions and operators. Mature basins like Norway and the UK already have superior recovery factors, a result of sustained investment and technological advancement over decades. These assets serve as global benchmarks for newer developments globally.

On the other hand, assets in regions with less established infrastructure or different fiscal regimes have substantial upside potential. National oil companies operating in challenging environments often lag international counterparts in recovery performance. These plays and fields offer great opportunities for collaboration and technology transfer.

There’s brutal honesty in the analysis about portfolio quality and operational effectiveness that we think will be of immense help to operators. Companies can benchmark both their asset base quality and operational performance against global standards, identifying specific improvement opportunities.

Will AI make subsurface teams redundant?

Not in our opinion. AI excels at automating routine tasks, identifying unexpected analogues that human analysts might overlook, and handles pattern recognition across vast datasets. However, regional geological understanding and exploration creativity require human insight, and geoscientists provide the essential contextual interpretation and strategic thinking. Despite AI's analytical power, subsurface expertise is irreplaceable – the two are complementary.

What about upstream investment?

Realising the potential in higher recovery rates requires sustained investment – additional wells, enhanced recovery techniques, and advanced technologies. Not all such investment will offer attractive returns at current prices.

But our analysis suggests the industry possesses more choices than previously recognised and strengthens operators' negotiating positions with host governments. Resource holders will have to offer fiscal terms and stable regulatory environments attractive to operators if they are to secure the necessary investment.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.