Sign up today to get the best of our expert insight in your inbox.

Securing offtake for green hydrogen

Could Europe’s beleaguered refiners hold the key?

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

The big themes on Big Oil’s mind

-

The Edge

India’s energy challenge

-

The Edge

Is there still life in decarbonising hard-to-abate sectors?

-

The Edge

A wild week for gas markets

-

The Edge

How Venezuela complicates the oil market’s delicate rebalancing

-

The Edge

Is Greenland Venezuela 2.0?

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

The big themes on Big Oil’s mind

-

Opinion

European gas: 6 Q&As on prices, supply, and regulatory impact

-

The Edge

A wild week for gas markets

-

The Edge

How Venezuela complicates the oil market’s delicate rebalancing

-

The Edge

Is Greenland Venezuela 2.0?

-

Opinion

Five key takeaways from our Gastech 2025 Leadership Roundtables

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray is responsible for Wood Mackenzie’s global coverage across the hydrogen value chain.

Latest articles by Murray

-

Featured

Hydrogen: 5 things to look for in 2026

-

Opinion

eBook | Overcoming the challenges around hydrogen deployment

-

The Edge

Securing offtake for green hydrogen

-

Opinion

Hydrogen: the outlook to 2050

-

Opinion

Our top takeaways from the World Hydrogen Summit

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what utilities and developers need to know

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

The Edge

How Venezuela complicates the oil market’s delicate rebalancing

-

Opinion

Venezuela regime change: what it means for oil production, crude and product markets

-

The Edge

Oil’s resilience in the energy system

-

Opinion

5 key ways to decarbonise downstream

-

Opinion

How can European refiners thrive in an uncertain world?

-

Opinion

Flight path to net zero: aviation’s fuel outlook to 2050

The ability to deliver almost carbon-free hydrogen through renewables put electrolytic green hydrogen at the heart of net-zero ambition at the turn of the decade. But the sector is struggling to reduce costs, and project development is only now gathering some momentum. And offtakers, wary of buyer’s remorse, remain reluctant to sign expensive long-term supply agreements.

Ironically, salvation could lie with one of the energy world’s most maligned sectors – European oil refining. Even as electric vehicles erode road transport fuel demand across the continent, EU regulations are forcing its refiners to decarbonise faster than anywhere else.

Can European refiners unlock green hydrogen demand? Murray Douglas and Alan Gelder, authors of our recent Horizons report on scaling up the sector, share their views.

Why are Europe’s refiners turning to green hydrogen?

Refineries need hydrogen. Refining, ammonia and methanol combined account for 98% of global hydrogen demand, essential for chemical conversion and upgrading crude oil into transport fuels and petrochemical feedstocks. But conventional hydrogen production from natural gas releases large amounts of CO2, putting it in the crosshairs of EU efforts to decarbonise transportation. With EU CO2 emissions free allowances gradually being eliminated, refiners face rising costs under the bloc’s Emissions Trading Scheme.

Help is at hand. Among the EU’s alphabet soup of policy mandates, the Renewable Energy Directive (RED) aims to cut energy sector carbon emissions by increasing the contribution of renewable sources. The latest iteration, RED III, provides support for ‘renewable fuels of non-biological origin’ (RFNBOs), including green hydrogen that meets sustainability and traceability criteria along with e-fuels in the transport sector and green hydrogen use in fuel-cell vehicles.

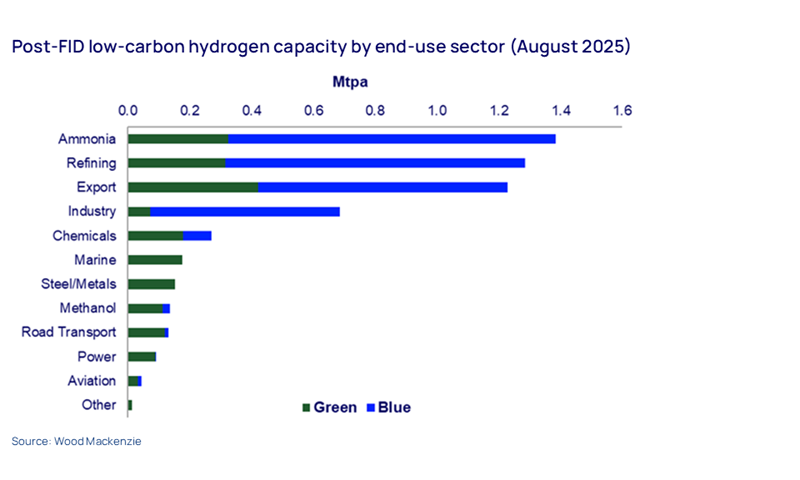

Facing rising costs for their emissions and given the high cost of e-fuels and limited uptake of fuel-cell vehicles, European refiners are turning to onsite green hydrogen production. Of the 6 Mtpa of low-carbon hydrogen capacity that has taken a final investment decision (FID), European refiners have already committed more than US$5 billion of capital.

What’s needed to strengthen the value proposition?

Green hydrogen production costs for European refiners remain significantly above those of traditional hydrogen production units. The high cost of clean power is the major component, so our forecast drop in the levelised cost of renewable electricity in Europe by the end of this decade offers promise.

RED III provides the policy juice for green hydrogen’s near-term growth in the European refining sector. But it needs to be adopted quickly into national legislation by all member states, and with sufficient incentives. RED III’s mandate that RFNBOs account for a minimum of 1% of the energy used by the transport sector by 2030 is low by any measure and an acknowledgement of the challenges in expanding RFNBO supply. Once met, national governments will issue certificates for RFNBO compliance of a sufficient value to allow for a reasonable rate of return on a refinery electrolyser investment.

Could the maritime sector help scale up demand?

Green hydrogen can also deliver lower-carbon fuels to other transport sectors, with the marine sector already starting to make progress. The International Maritime Organization’s net-zero framework – which will come into force in early 2027 if adopted this October – will introduce an emissions pricing system based on vessels’ greenhouse gas fuel intensity, with a two-tier mechanism penalising emissions above set targets. The framework has the potential to unlock more than 80 Mtpa of hydrogen-derived fuels – equivalent to around 15% of the current marine fuel market – in the long term. But it will take time for hydrogen-based fuels to increase their competitiveness, and further action will be required to displace fuel oil at pace.

Do other markets offer hope for green hydrogen?

Europe isn’t the only player. China is building out its green hydrogen value chain, though adoption is largely driven by government mandate and, in some cases, often lacks full green credentials. Domestically produced alkaline electrolysers offer the benefit of upfront capital cost savings over Western technologies. Meanwhile, low renewable generation costs and wholesale power prices are helping Chinese projects close the gap on conventional hydrogen production.

Elsewhere, India has set a production of 5 Mtpa by 2030 with over 50% allocated for exports, including into Europe. Competitive renewable power prices and a flurry of government initiatives are attracting both local and foreign investors.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.