Nigeria’s marginal field bid round – opportunities for investors?

Nigeria’s government, through the Department of Petroleum Resources (DPR), recently launched its first marginal field bid round in almost 20 years

1 minute read

Simon Anderson

Vice President, Strategy & Transformation Advisory, Africa

Simon Anderson

Vice President, Strategy & Transformation Advisory, Africa

Simon works with energy and natural resources companies to improve financial, commercial and operational performance.

View Simon Anderson's full profileNigeria’s government, through the Department of Petroleum Resources (DPR), recently launched its first marginal field bid round in almost 20 years. A total of 57 fields, spread across onshore, swamp and shallow water, are on offer. DPR defines a marginal field as a discovered resource that has been left unattended for more than 10 years. These fields remain undeveloped and only a few have been appraised.

The majority of the fields were previously held by Shell, ExxonMobil, Chevron and Total. We estimate total resources on offer of around 800 mmbbl oil and 4.5 tcf gas. The 25 largest oilfields have the potential to unlock $9.4bn of investment over the first five years and generate over $38bn in revenue over the life of the fields.

Unsurprisingly, the 2020 bid round has attracted significant attention with over 600 companies registering to participate. Investors want to know:

- How commercially viable are the marginal fields?

- Where are the best opportunities?

To answer these – and other – questions, Wood Mackenzie assembled a team of regional upstream experts and valuation analysts to carry out an in-depth economic assessment of the marginal fields on offer. We used our judgement, based on over 20 years of experience covering upstream projects in Nigeria, to identify the most likely scenarios for field development and hydrocarbon evacuation. We took the following into consideration

- Field and reservoir characteristics

- Field location and proximity to existing infrastructure

- Capital investment requirements

- Operating costs, fees and tariffs

- Marginal field fiscal terms

- The potential production profile

We estimate that 42 fields have positive post-tax NPVs, with the highest valuation of over $150m and an average valuation of $31.5m (using a 10% discount rate). However, post-tax NPV is not the only investment criteria.

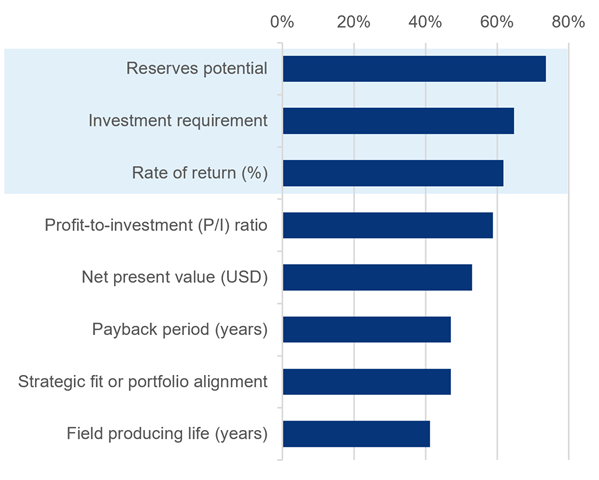

Wood Mackenzie recently carried out a survey on the industry’s perspectives of the 2020 bid round. We asked E&Ps and other investors which criteria are being used to support their investment decisions on Nigeria’s marginal fields. The most important criteria, as shown in Figure 1, are: reserves upside, investment requirements, and rate of return.

With these criteria in mind, where are the best opportunities?

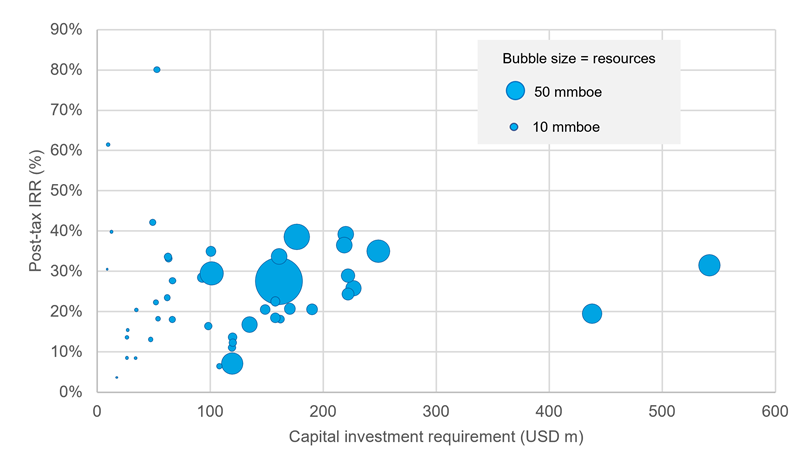

Figure 2 plots the marginal fields using the three most important investment criteria: post-tax investment returns on the vertical; capital investment requirements to first oil and gas on the horizonal; and remaining resources as the bubble size. (The sweet spot for most investors, based on our survey, is the top-left.)

Over two-thirds of respondents revealed that their organisation expects a rate of return of over 15%; our analysis shows that 37 fields fit the bill. Furthermore, almost a third of respondents expect returns above 20%; only 29 fields exceed these higher expectations. Taking into consideration the initial capital investment, there are 22 fields with +20% returns that will require up to $200m before first oil and gas. Of these, 12 fields have remaining resources of more than 10 mmboe.

Opportunities clearly exist in Nigeria’s 2020 marginal field bid round. However, investors will need to carry out an in-depth screening process to assess the commercial viability of the fields on offer and identify high potential targets. Our commercial review gives investors the data and insights to screen opportunities using their own priorities. In addition, the ability to design robust field development plans will be key to optimising the initial capital investment, time to first oil, subsequent developments opportunities, and cashflows.

To find out more about Wood Mackenzie’s marginal fields study and how we can support your business during the bid round, please visit our Marginal Field Bid Round page.