Navigating Nigeria’s changing oil and gas landscape

Divestment by the majors creates an opportunity for domestic producers to increase market share

3 minute read

Ian Thom

Research Director, Upstream

Ian Thom

Research Director, Upstream

Ian brings 18 years of experience to his role as head of regional analysis for Europe, Russian, Caspian and Africa

Latest articles by Ian

-

Opinion

Video | Lens Emissions: Africa’s oil – legacy fields vs low-carbon future

-

Opinion

Namibia faces setback as Shell downgrades oil discoveries

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

ADNOC acquires stake in Rovuma LNG from Galp

-

Opinion

Global upstream: the biggest topics

-

Opinion

Africa’s Energy Hotspots – three trends that will shape the next decade of African energy

Mansur Mohammed

Africa Upstream & Carbon Management New Business Development

Mansur Mohammed

Africa Upstream & Carbon Management New Business Development

Mansur is the Head of West Africa Upstream Content, Sub-Saharan Africa Oil & Gas.

Latest articles by Mansur

-

The Edge

Nigeria’s bold strategy to double oil production

-

Opinion

Navigating Nigeria’s changing oil and gas landscape

-

The Edge

Financing the next phase of Africa’s oil and gas development

-

Opinion

The key factors shaping investment in Africa’s upstream industry

-

Opinion

Three critical factors to developing Africa’s oil and gas resources

Upstream oil and gas investment in Africa has fallen significantly in the last decade, but as the majors increasingly focus on advantaged resources, opportunities are emerging for domestic producers. In Nigeria, four major divestments have been announced as of Q1 2024, provoking a fundamental shift in asset ownership in the country’s oil and gas sector. So, what do global, regional and domestic market changes mean for Nigeria’s independent producers?

Upstream capex is stabilising but deepwater and LNG will be the priorities

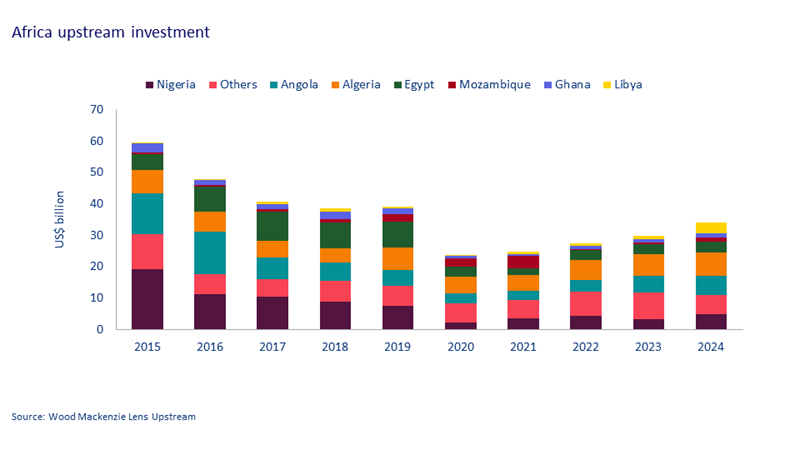

From an investment perspective, upstream oil and gas capex has been declining over the last decade, Africa is not an exception. We estimate investment in the region has halved in that time, while Nigeria’s share of that already-reduced capex has dropped from a third to around one sixth of the total.

On the upside, global upstream investment has stabilised at a steady figure of around US$500 billion. This should underpin continued supply growth over the next decade. However, reinvestment rates are below 50%, with operators instead focusing on cost efficiency and shareholder returns. What’s more, in Africa much of the investment focus will be on deepwater and LNG.

The global shift towards advantaged resources has implications for Nigeria

Meanwhile, as the global energy transition progresses, international oil and gas companies face an investment ‘trilemma’: the need to increasingly focus on advantaged resources that offer strong economics, lower emissions and reduced risk. Their response is to gravitate towards what we call ‘energy super basins’, which offer a combination of abundant oil and gas resources, plentiful low-carbon electricity and hub-scale carbon capture and storage (CCS). As a result, the majors are increasingly withdrawing from less favoured fields and more problematic areas like onshore Nigeria.

The current downward trend in Nigerian liquids production must be reversed

Taking liquids production as an example, security improvements last year mean Nigerian oil and condensate production should be steady in the short term. However, even if the improved security situation continues, overall production is trending downwards. We expect total liquids production in 2024 to be just above 1.6 million barrels per day (b/d); if Nigeria is to meet its production target for liquids of 3 million b/d, production will have to increase significantly.

With theft and terminal downtime ongoing issues, many indigenous operators have resorted to alternative export solutions. Barging is still being used, but only limited volumes can be transported in this way and the high cost makes this method unsustainable in the long term. Instead, new export pipelines and terminals are being developed to divert volumes away from security hot spots. This is perhaps where the biggest opportunities exist for sustained production growth from onshore fields.

Divestments create a golden opportunity for Nigerian companies to increase their share of production

The majors have announced four large transactions selling their onshore and shallow water joint ventures to Nigerian operators: ExxonMobil’s asset sale to Seplat Energy, Equinor’s divestment to Chappal Energies, Oando’s acquisition of the Eni-owned NAOC company and the sale of Shell’s SPDC subsidiary to the Renaissance consortium.

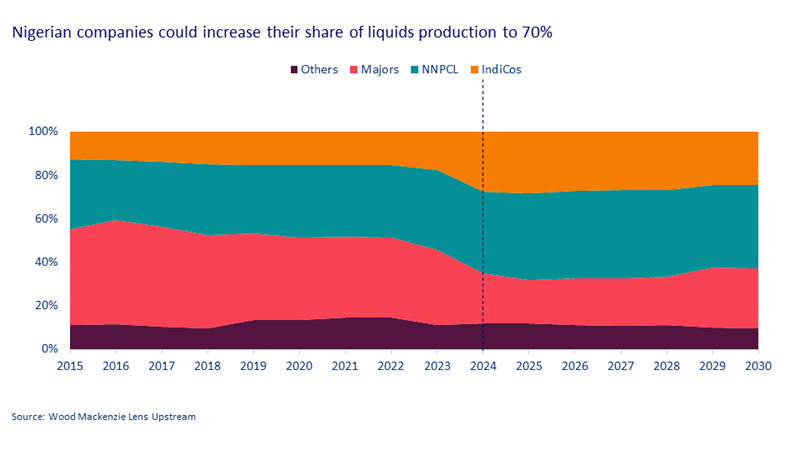

The chart below shows historical and projected Nigerian oil and gas production from 2015 to 2030, dividing this into production by majors, the Nigerian National Petroleum Company Ltd (NNPCL), Nigerian Independent Companies and Others. As you can see, the role of indigenous companies will become significantly more important once the announced divestments are concluded (note that the chart does not include other ongoing and future divestments). These operators will have a bigger role in the onshore sector, which is larger than both deepwater and shallow water by production volumes.

Our base case view is that indigenous companies will account for a quarter of overall liquids production, or an average of 400,000 b/d annually on completion of the deals. This excludes any upside, a change in strategy from new operators or the potential for changing investment priorities. When added to NNPCL’s share of production, that means domestic companies will control close to 70% of total liquids production, easily outstripping the majors. We think more deals are likely as the majors continue to re-evaluate their global portfolios.