How Colombia could lead Latin America through the energy transition

As investment into zero carbon technology ramps up around the world, Colombia has a range of opportunities to diversify

3 minute read

David Brown

Director, Energy Transition Practice

David Brown

Director, Energy Transition Practice

David is a key author of our Energy Transition Outlook and Accelerated Energy Transition Scenarios.

Latest articles by David

-

Opinion

Energy priorities of House Republicans come out in full force

-

Opinion

The new landscape for gas-fired power: turbocharged or turbo lag?

-

The Edge

The narrowing trans-Atlantic divide on the energy transition

-

Opinion

Energy transition outlook: Americas

-

Opinion

The federal government steps up support for nuclear power

-

Opinion

The impact of Republican control on US energy policy and the IRA

Oil and gas exploration has been at the heart of Colombia’s national energy strategy and that of its National Oil Company, Ecopetrol. But as the world decarbonises and Colombia focuses on its own net zero target, the winds of change are blowing. How can the country now become a regional leader in a sustainable approach to energy?

We recently conducted research into Colombia’s potential to lead Latin America through the energy transition, drawing on unique insight from our Energy Transition Service and Wood Mackenzie Lens. Fill out the form to access a complimentary extract from the report into our findings, and read on for an introduction.

Repositioning Colombia for a lower carbon future

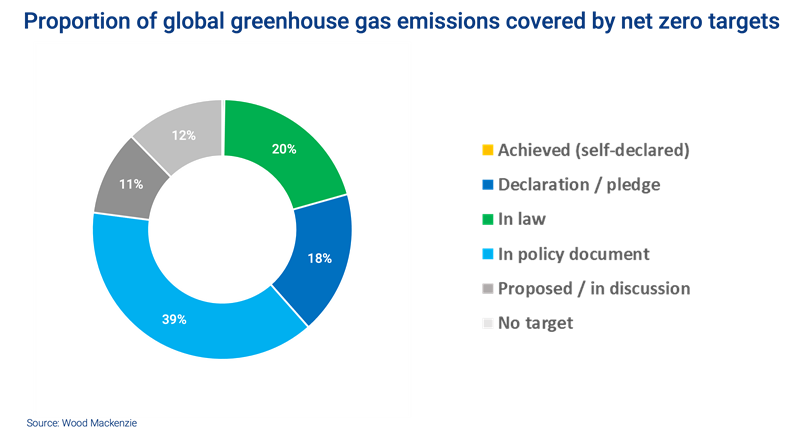

While the fallout from the energy crisis has boosted oil and gas investment in the short term, decarbonisation is a structural trend driven by economics and policy. For example, costs for electric vehicles (EVs) are already at parity with internal combustion engine (ICE) stock in major markets. Net zero targets cover 88% of global emissions, and associated policy will incentivise investment into zero carbon technology and away from fossil fuels. Unsurprisingly, forward-looking announcements by companies around the world show that spending on new energies is set to accelerate.

Colombia produced around one million barrels a day (mb/d) of oil in 2022 and has valuable product exports to the United States. But US efforts under the Inflation Reduction Act (IRA) are designed to propel decarbonisation towards a 1.5 degree pathway. On this pathway – which we explore in our AET-1.5 scenario – oil demand in the US transport sector could fall to less than 1 mb/d by 2050. That would put Colombia’s liquids exports at significant risk.

As governments and markets globally focus on how to achieve net zero, the sources of value creation in the energy market will shift dramatically.

So, how can Colombia maximise its positive exposure to this trend?

Colombia could diversify into metals exports

Colombia is already a small nickel producer and could shift its ferronickel production to nickel sulphate, used in electric vehicle (EV) batteries. Colombia is also one of 20 governments that has a Free Trade Agreement (FTA) with the US. This is a critical piece of trade policy in place that could support expanded trade with the United States following the IRA.

Colombia also has material reserves of copper, another metal essential to the energy transition. More exploration and permitting clarity are required to ramp up production.

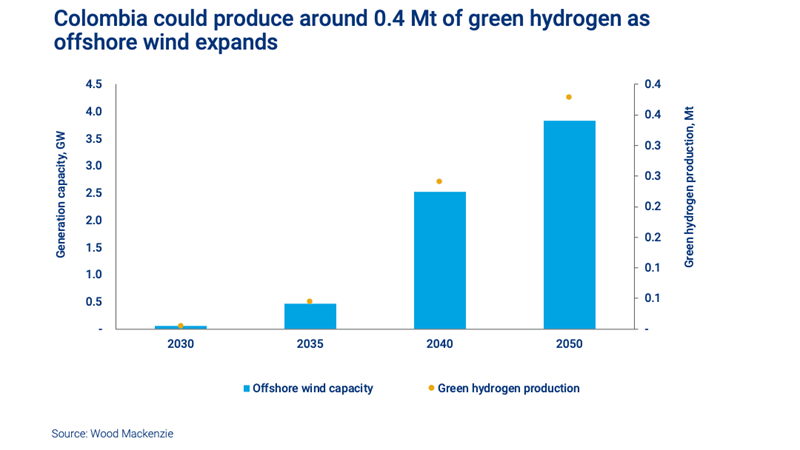

Giving the green light to low-carbon hydrogen

As wind and solar expand, we expect resulting lower power costs to help green hydrogen produced in Colombia become economically competitive with current forms of hydrogen production and some fossil fuel sources by the 2030s.

Hydrogen-to-power strategies are key to decarbonisation pathways in Europe and Asia, making these key potential export markets for hydrogen produced in Colombia. We estimate the levelised cost of hydrogen (LCOH) in Colombia could be similar to Chile’s. Potential export volumes from Colombia would be globally competitive, especially into Europe.

For a look at Colombia’s e-fuels strategy and the implications for upstream and refining, read our latest Americas Energy Transition Update.

Colombia can expand its position in the global carbon offset market

Our outlook for carbon offsets suggests that in a net zero scenario overall demand could expand to around five billion tonnes by 2050. Colombia has strong potential to increase its investment in offsets, particularly from forestry and land use markets. Projects that can provide high-quality offsets will be able to realise a premium in the market.

For Colombian energy giant Ecopetrol, the carbon credit agreement between the Government of Guyana and Hess Corporation is a valid case study. Ecopetrol has a similar total emissions profile to Hess, and the deal is considered a gold standard in the industry for its structure, potential scale and the implications for Hess’s overall emissions.

Capturing the CCUS opportunity

Given the costs of the technologies involved, some level of government support will be required for carbon capture, utilisation and storage (CCUS) to see a return on capital. Colombia has yet to announce any CCUS projects, even though it has a net zero target in place and CCUS storage potential. Colombia’s government has indicated policy support for low-carbon hydrogen – to meet its net zero pathway, CCUS has to be part of the equation in Colombia too.

Get further insight into Colombia’s potential to lead the Latin American energy transition

The full report offers more detailed analysis of Colombia’s potential role as Latin America’s energy transition leader. The slides include a wide range of data presented in easily digestible charts and graphics, including our net zero pathway for Colombia.

Fill in the form at the top of the page for a complimentary extract.