Battery raw materials: tracking key market dynamics

The forces shaping nickel, cobalt and lithium markets – from the supply growth challenge to carbon costs and the rise of recycling

5 minute read

Robin Griffin

Vice President, Metals and Mining Research

Robin Griffin

Vice President, Metals and Mining Research

An integral part of the research team since 2007, Robin leads our analysis across metals and mining markets.

Latest articles by Robin

-

Opinion

Metals and mining tariff scenarios: potential impacts of new US tariffs on metals markets

-

Opinion

Where next for metals markets in 2025?

-

Opinion

eBook | Understanding the metals and mining landscape in 2025

-

Featured

Metals & mining 2025 outlook

-

Opinion

Challenges and opportunities for the steel value chain

-

Opinion

The future of coal in the global energy sector

Allan Pedersen

Research Director, Lithium

Allan Pedersen

Research Director, Lithium

Latest articles by Allan

-

Opinion

The strategic planning outlook for lithium | Video

-

Opinion

The strategic planning outlook for lithium | Video

-

Opinion

The strategic planning outlook for lithium | Video

-

Opinion

How will the lithium market rebalance?

-

Opinion

Direct lithium extraction: is the hype justified by the reality?

-

Opinion

Five options to address the looming lithium surplus

Anthony Knutson

Global Head, Thermal Coal Markets

Anthony Knutson

Global Head, Thermal Coal Markets

Anthony is the global head of our thermal coal markets research for the Metals and Mining group.

Latest articles by Anthony

-

Opinion

Harris v Trump: A fork in the road for US energy

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

Decarbonising metals and mining: three key strategies to win the emissions battle

-

The Edge

Resource nationalism and energy transition metals

-

Opinion

Golden opportunities to drive down mining and metals carbon emissions

-

Opinion

Battery raw materials: tracking key market dynamics

Suzanne Shaw

Head of Energy Transition & Battery Raw Materials

Suzanne Shaw

Head of Energy Transition & Battery Raw Materials

Suzanne specialises in commodities including cathode and precursor, lithium, cobalt, graphite, rare earths and lead.

Latest articles by Suzanne

-

Opinion

How will the new US Republican government reshape the global electric vehicle supply chain?

-

Opinion

Four key takeaways from LME 2024

-

Opinion

Three challenges to overseas expansion for the Chinese cathode sector

-

Opinion

What’s next for the EV and battery value chains?

-

Opinion

Battery raw materials: tracking key market dynamics

-

Opinion

Energy transition metals: the ESG dilemma

The past year has seen major paradigm shifts with significant implications for energy transition metals. The war in Ukraine, the energy trilemma and China’s changing growth dynamics have all contributed to ongoing uncertainty about how the market for vital commodities like nickel, cobalt and lithium will develop.

Our recent Future Facing Commodities Forum focused on the short and long-term outlook for mined materials key to building our electrified future. Missed the event, or want a recap? Fill out the form to watch a replay of our panel session on supply and market developments, and read on for a brief overview of six factors that will be key to the future of the lithium, cobalt and nickel markets.

-

Battery raw material supply growth challenges

The energy transition is creating a huge need for key commodities – rechargeable batteries now account for 85% of lithium demand, for example. However, the rapid increase in demand for battery raw materials has so far not been matched by a big enough increase in supply.

Recent rapid expansion of nickel supply in Indonesia demonstrates that the necessary growth is possible. However, building mines and refineries takes a significant commitment in terms of both time and money. That makes short-term market volatility an issue as uncertainty makes investing in new supply less attractive.

Project delays are also a big problem in building out supply at the scale needed. Labour shortages are causing delays in some regions, particularly a lack of experienced plant operators. Delays in the delivery of critical equipment are also an issue.

-

Complex metal market dynamics

A key aspect to keep in mind when looking at supply and demand dynamics is that the market in a commodity such as nickel actually consists of multiple product types.

For example, Class 1 nickel refers to London Metal Exchange (LME) grade products containing 99.9% nickel. LME prices are based on this type of nickel and represent around 15% of current global production. Class 2 nickel covers everything else, including ferronickel and nickel pig iron.

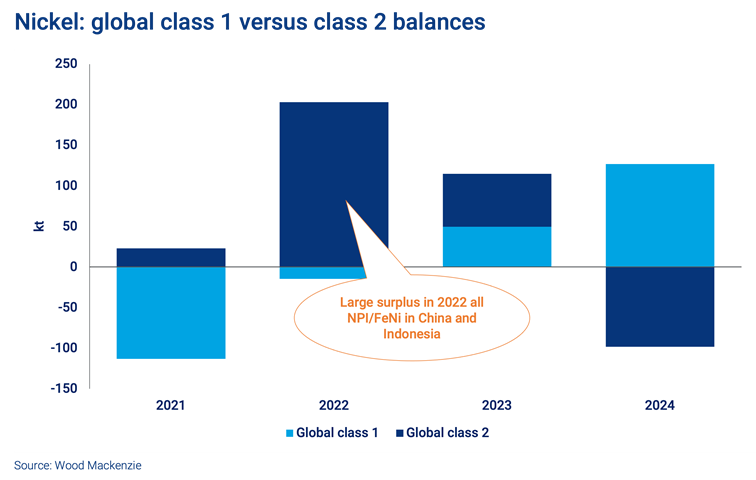

Although there was a global surplus of 190 kilotonnes of nickel in 2022, this was predominantly a surplus of class 2 nickel, mainly in China and Indonesia. The rest of the world was short of Class 1 nickel and this is what has kept prices relatively high.

Understanding the complex dynamics within markets is key to accurately forecasting demand, supply and pricing. For more on this, fill in the form to watch the webinar replay.

-

Changing battery chemistry

Developments in battery chemistry are having a growing impact on the demand for different battery raw materials. Traditional ternary lithium-ion batteries use nickel in their cathodes; in contrast, lithium iron phosphate (LFP) cathode chemistries contain no nickel or cobalt, and use around half the lithium of ternary batteries.

The move towards LFP batteries for some applications is, therefore, significant for future nickel demand. LFP uptake also has implications within the lithium market, where it will drive increased demand for lithium carbonate, at the expense of the lithium hydroxide used in high nickel cathode chemistries.

-

Varying emissions profiles and emerging carbon costs

Despite their critical role in the coming energy transition, emissions from the mining and processing of battery raw material commodities is currently unavoidable. Within this space, nickel production alone will generate around 0.3% of total global emissions in 2023 with lithium carbonate equivalent emitting less, but still significant at 0.02%. While absolute emissions are an important factor, by comparing emissions intensities across commodity and by process, we begin to see clear trends amongst producers, countries, ore types and processes.

Carbon prices are a significant likelihood for many producers. Burgeoning carbon markets have the potential to accelerate not only cost increases but expectations of rising prices as well. As the direction and scale of the global carbon pricing environment become more evident, there will likely be some clear winners. Existing low carbon emitters and decarbonisation early movers will reap higher margins in growing energy transition commodity markets.

Emissions data and analysis were derived from Wood Mackenzie’s Metals and Mining emissions benchmarking tool (EBT). This web-based tool provides you with independent commodity emissions data by year, asset, company and location. Drill down further into the data by scope and emissions source. Visualise your assets and your competition on a detailed carbon emissions curve, map or download the data to investigate trends and opportunities yourself.

For a closer look at how lower carbon emissions opportunities can impact margins, fill in the form to watch the full replay.

-

Mined commodity process innovation

The potential impact of emissions and carbon pricing is leading to the development and implementation of new solutions to sourcing future-facing commodities.

In the US and elsewhere, firms are looking to treat mining waste to recover unextracted material. Some companies claim to have the technology to treat these waste streams cost-effectively; for example, mine tailings from past laterite mining can be treated to extract nickel and cobalt. Other businesses are developing the use of hydrometallurgy techniques to recover and reuse battery raw materials from black mass (waste comprising crushed and shredded end-of-life battery cells).

This more flexible approach to supply should reduce reliance on specific countries and regions (China and Indonesia account for almost 70% of global finished nickel supply) and the vulnerability of global commodity markets to resource nationalism. But a lot of work needs to be done.

-

Risk from broader ESG factors

Most cobalt production came from the Democratic Republic of Congo (DRC) in 2022. Conflict in the region has long been a concern and, while the situation has improved, upheaval and disruption to production and logistics is not uncommon. With elections imminent in the DRC, instability in the supply of cobalt hydroxide in particular could be an issue.

With demand for cobalt rising steadily, this and other ESG factors represent a significant risk. One outcome of this is likely to be that recycling will take a much larger part of the market for cobalt in the future, reducing demand for newly mined product.

Get this insight in full

Don’t forget to fill out the form to access the full panel session replay. This includes forecasting of demand, supply and pricing for nickel, lithium and cobalt, as well as deeper analysis of how carbon pricing will impact a range of commodities.