Sign up today to get the best of our expert insight in your inbox.

The complexity of capital allocation for oil and gas companies

How to balance upstream, new energy and shareholder demands

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

What comes after the Permian for IOCs?

Tom Ellacott

Senior Vice President, Corporate Research

Tom Ellacott

Senior Vice President, Corporate Research

Tom leads our corporate thought leadership, drawing on more than 20 years' industry knowledge.

Latest articles by Tom

-

The Edge

Majors' capital allocation in a stuttering energy transition

-

Featured

Corporate oil & gas 2025 outlook

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

Can ExxonMobil make attractive returns from its US CCUS portfolio?

-

Opinion

How do integrated companies position themselves in the changing downstream landscape?

Neivan Boroujerdi

Director, Corporate Research

Neivan Boroujerdi

Director, Corporate Research

Neivan leads Wood Mackenzie's global corporate NOC coverage.

Latest articles by Neivan

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

ADNOC doubles net hydrogen production through stake in ExxonMobil’s Baytown project

-

Opinion

ADNOC acquires stake in Rovuma LNG from Galp

-

Opinion

Benchmarking the Middle East NOCs against the supermajors

-

The Edge

How and why big oil is strengthening its oil and gas exposure

Alex Beeker

Research Director, Corporate Research

Alex Beeker

Research Director, Corporate Research

Alex is a research director on our Corporate Research team, focused on the Majors and US Independents.

Latest articles by Alex

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

Chesapeake-Southwestern Energy deal: ten key takeaways

-

Opinion

What does the Chevron-Hess deal mean for oil and gas?

-

The Edge

Big Oil: upstream M&A gets serious

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael focuses on Latin America and its national oil companies as a senior analyst on our Corporate Research team.

Latest articles by Raphael

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

What does Milei mean for oil and gas in Argentina?

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

Unwrapping key players in Colombia's upstream sector

-

Opinion

Are NOCs rising to the energy transition challenge?

Oil and gas investment strategy started getting trickier after the Paris Agreement almost a decade ago. In recent years, the uncertain pace of the energy transition has added another layer of complexity, making annual planning decisions a bit like three-dimensional chess. How much capital to allocate to oil and gas versus building a sustainable business in low carbon for the longer term – all the while meeting the financial expectations of stakeholders? This year, the implications for oil and gas markets of the grave escalation of conflict in the Middle East compound the challenge.

Our Corporate Strategic Planner is a new addition from our Corporate Strategy and Analytics Service. It’s designed to help oil and gas companies, advisors and shareholders anticipate and navigate the key themes in their annual planning and capital allocation cycle.

I asked Tom Ellacott, Neivan Boroujerdi, Alex Beeker and Rapha Portela from our Corporate Analysis team how they see 2025 shaping up for the 32 companies they’ve analysed spread across US Majors, EuroMajors, Emerging Majors and NOCs.

Are companies planning to spend more in 2025?

Yes, we’re about to enter the fifth year of an upcycle. By the end of this year, annual investment for these 32 companies will have risen more than 60% from the 2020 low during the pandemic. But we expect growth to slow to about 5% in 2025, assuming Brent at US$75/bbl. This reflects the industry’s disciplined approach to investment balanced with providing adequate returns for shareholders.

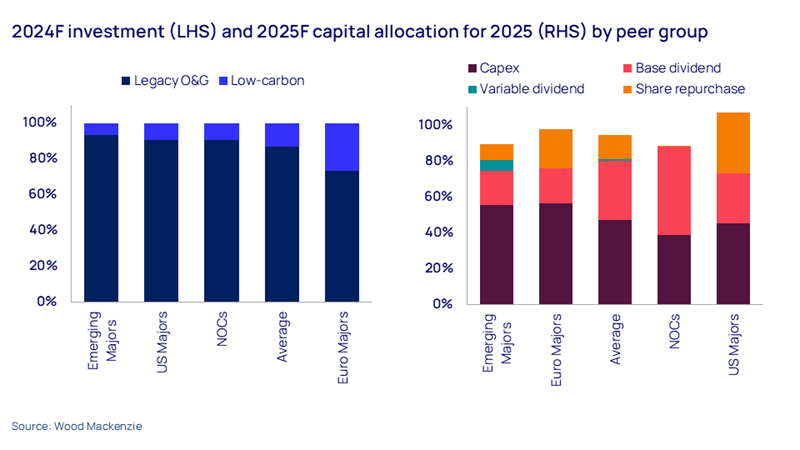

Companies are coalescing around an average re-investment rate of 50%, again assuming US$75/bbl Brent – Majors a little higher, NOCs lower. Returns to shareholders average between 35% and 60% by peer group, either in the form of dividends or buy-backs. There are outliers, of course – one or two companies with big development projects will invest up to 80% of cash flow and may require asset sales to support distributions. For IOCs, capital allocation fits within a conservative overall financial framework that includes target balance sheet gearing at or below 20% (the Majors’ average was 16% in Q2 2024, half the end-2020 peak).

Is upstream spend increasing?

Upstream still dominates across all four peer groups, in 2024 ranging from 60% of total investment for the EuroMajors to almost 90% for Emerging Majors. Organic spend in upstream is already at its highest level since 2015 in absolute terms – and we expect it to go higher still in 2025, albeit marginally.

The main driver has been the dawning realisation that the transition is unfolding more slowly than expected, implying that oil and gas demand may be stronger for longer. EuroMajors are looking to plug production and cash flow gaps by investing more in upstream. US Majors and some Emerging Majors have already used M&A to expand and extend upstream exposure. We expect more sector consolidation to come in 2025.

Exploration spend, though, is still subdued, tracking at around half the levels of a decade ago – only a few NOCs are stepping up investment. The Majors will need to consider increasing budgets for high-impact exploration as one means of replenishing portfolios for the next decade.

Is interest in low-carbon investment waning?

Far from it. From minimal levels in 2020, spend in low carbon will hit a record US$50 billion across the peer group this year. Renewable power is the big growth area. It will absorb almost half of low-carbon budgets and is expected to increase steadily from current levels through the decade.

The Euro Majors and NOCs account for almost 80% of investment in low carbon. The biggest company spenders are Shell, TotalEnergies, Saudi Aramco, BP and ADNOC. Each is investing around US$5 billion a year, more than double the next tier of companies, which includes the two US Majors. Proportionately, Repsol is the leader, committing 40%.

NOCs are emerging as the biggest spenders on low carbon. While some IOCs may soften longer term low-carbon targets, the scale of the NOCs’ cash generation and overarching country targets suggests they are less likely to dial back. ADNOC is a case in point. It’s charged with helping to deliver the UAE’s national decarbonisation strategy as well as the longer-term goal of diversifying the country’s economic dependence on oil and gas revenue.

What are the main risks to investment next year?

The implications for oil (and LNG) prices of of heightened geopolitical tension in the Middle East as well as the current structural oversupply of oil. Our Corporate Strategic Planner projections for 2025 are premised on US$75/bbl Brent, which we believe is broadly aligned with companies’ planning assumptions. Any additional cash flow from higher prices is likely to be returned to shareholders or used to pay down debt. If prices are materially lower, we’d expect buybacks and/or dividends – rather than investment – to be adjusted down.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.