Discuss your challenges with our solutions experts

Can the North Sea oil and gas industry survive the downturn?

In the short term, yes. But longer term, investment is required. if the industry goes into harvest mode, a premature end is inevitable.

1 minute read

Neivan Boroujerdi

Research Director, Upstream Oil and Gas

Neivan Boroujerdi

Research Director, Upstream Oil and Gas

Neivan is a research director with particular expertise in North Sea development costs, exploration and M&A.

Latest articles by Neivan

-

Opinion

ADNOC acquires 10.1% stake in CCUS player Storegga

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

The future of European upstream oil and gas

-

Opinion

Global upstream update: a review of key industry themes

-

Opinion

Harbour and Talos in merger discussions – what are the drivers?

The North Sea oil and gas industry has weathered several storms in its 50-year existence. But the events of the past few weeks mean the sector is entering uncharted waters. The coronavirus pandemic and collapse in OPEC+ production restraint has seen Brent reach its lowest point since 2003.

This article is based on the report, Oil price crash: can the North Sea survive at US$30/bbl? Purchase the report in store here.

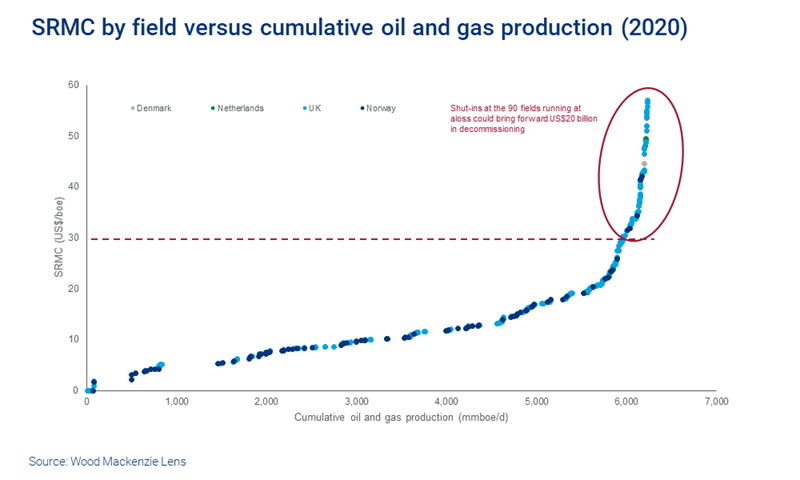

In the short term, the North Sea can survive; 95% of onstream production is ‘in the money’ at US$30/bbl. But close to a quarter of fields will run at a loss in this price environment. The major concern here is not volumes. Early shut-ins would accelerate US$20 billion in decommissioning spend.

What levers can the industry pull to ensure a sustainable future?

The quickest win is to reduce opex. But longer term, investment is required to increase production and reduce unit costs. If the industry goes into harvest mode, a premature end is inevitable.

Most FIDs for 2020 are off the table. A sustained US$30/bbl environment could see two-thirds of development spend wiped from our forecast over the next five years. Annual investment in the UK could fall below US$1 billion as early as 2024. The threat of stranded assets is real – nearly six billion barrels of economically viable resources could be left in the ground.

All is not lost

Short-cycle, strategic tie-backs are still likely to go ahead. Three of the six billion barrels of economically viable resources breakeven below US$50/bbl (NPV15). Further cost reductions or a price recovery could quickly make them attractive again.

Who will come to the rescue?

The traditional North Sea players may not be willing investors. The Majors will defer capital elsewhere and the sector's independents will struggle financially, particularly if banks look to decarbonise their portfolios.

Could private equity come to the rescue again? With several unmonetized vehicles already on the shelf, a new wave of money is not certain.

The picture isn’t quite as bleak in Norway. But recent FIDs mean that due to capex commitments in 2020, Norway plc needs a Brent price of US$40/bbl to avoid negative cashflow for the first time in over a decade.

At a time when there is public pressure to move towards more a 'greener' energy mix, it’s hard to see governments easing the fiscal terms. Long term, the energy transition needs to accelerate but there’s a risk of short-term stagnation.

For the companies that survive, they will need to adapt to a greener future.