Permian consolidation heats up and there's more to come

Anadarko bids echo the big M&A themes of the downturn

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

View Simon Flowers's full profilePermian consolidation was already the big focus of global M&A. A bidding war for Anadarko, one of the leading independents, takes things to a whole new level. Chevron’s and Occidental’s bids for Anadarko are more ambitious than any other acquisition globally in the downturn, bar Shell/BG. The logic though is consistent with the big themes that have shaped M&A through the downturn. Corporate analysts Kris Nicol and Zoe Sutherland identify four.

1. Consolidation around advantaged assets

The Majors have set about strengthening core portfolio positions, chief among them Total (North Sea, Brazil, Uganda, PNG LNG, Libya, Arctic LNG), ExxonMobil (PNG LNG, US tight oil, Mozambique LNG), Shell (BG’s Brazil and LNG assets) and BP (US L48, Mauritania, UK).

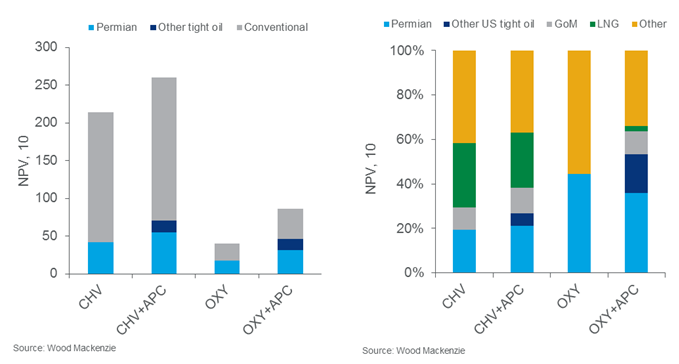

The Permian is central to both bids for Anadarko. But for Occidental, it’s really all about the Permian, which would double its exposure in NPV terms. Anadarko’s conventional assets, about one-third of the total valuation, could all be sold pronto. For Chevron, the fit is broader. Anadarko bolsters its leading Permian exposure; ditto deepwater Gulf of Mexico, while Mozambique injects a sizeable (and needed) growth engine to its LNG portfolio.

2. Scale

Undaunted by the threat of peak oil demand or the energy transition, Big Oil has bigged up. Through business development and exploration, the Majors have managed to layer on 5 million boe/d, or 20%, to 2025 production compared with our 2014 forecasts. The focus has been on low-cost, long-life assets to make portfolios more resilient. It’s a more defensive countercyclical approach to repositioning than in past downturns, yet still an expression of bullishness about the future.

Anadarko is an opportunity for the bidders to scale up and build resilience. Chevron would become the third-biggest Supermajor, producing more than Shell next decade, behind only ExxonMobil and BP. Occidental would leapfrog ConocoPhillips by a small margin, becoming a Super-Independent.

3. Capital discipline versus investment

The industry has re-invented itself for lower oil prices in the last few years. Cash flow breakevens now average US$50 to US$55/bbl compared with US$95/bbl in 2014. That’s been achieved by cutting costs and reducing spend. As finances have recovered, free cash flow has been directed to dividends and buy backs rather than investment as companies seek to rebuild confidence among investors.

Until now, the bidders have largely abstained from significant business development, both being staunch adherents to capital discipline. When prices fell, Chevron was exiting a heavy period of growth investment. A new CEO focused on delivering those projects, then tightening the belt to generate cash flow and boost returns. Occidental set itself up pretty well ahead of the downturn, shedding higher cost assets and deleveraging with the spin-off of Californian Resources. It has effectively been a dividend machine since.

We don’t expect a winning bid to change that commitment to capital discipline. Combining Permian positions will bring high grading and investment profiling opportunities. Mozambique will need US$1 billion a year of growth investment through the early 2020s. But Chevron and Occidental will accelerate portfolio rationalisation in the aftermath of success to release cash and strengthen the balance sheet.

4. Deal value

The bids were well timed after a period of share price underperformance. We estimate the implied long-term oil price (ILTOP) in Chevron’s offer is US$55/bbl (Brent); Occidental’s US$61/bbl – at the lower end of the US$60 to US$70/bbl average ILTOP for deals done over the last two years. This suggests bids could go higher still, but there’s a limit beyond which value becomes harder to justify.

What will the loser do?

There are plenty more fish in the sea, but few other Permian-focused independents with Anadarko’s compelling fit. And there will be competition. Fellow tight oil ‘haves’ – like Shell, BP and other independents – will look to strengthen Permian positions. The ‘have nots’ are still weighing up how to gain a foothold in oil’s biggest growth theme.

The bidding war for Anadarko is merely the latest episode in the Permian M&A saga. Operationally, the basin is being industrialised. The logical next step from industrialisation is concentration. There are lots more deals to come.