Global upstream update: a review of key industry themes

The upstream oil and gas industry continues the push to decarbonise production but faces increasing regulatory uncertainty. Find out how global trends are playing out in your region

1 minute read

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

Global upstream update: diverging development strategies in Latin America, investment at risk in Africa, and Kazakhstan supply tensions explained

-

Opinion

Is oil price volatility a threat to upstream production, investment and supply chains?

-

Opinion

Global upstream update: UK fiscal changes and an Asia-Pacific licence bonanza

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

Opinion

Global upstream update: the global sanctions slump, grappling with gas and potential US tailwinds

-

The Edge

Why upstream companies might break their capital discipline rules

Adam Pollard

Principal Analyst, Upstream Emissions

Adam Pollard

Principal Analyst, Upstream Emissions

Adam is a principal research analyst leading Wood Mackenzie’s upstream emissions initiative.

Latest articles by Adam

-

Opinion

Video | Lens Upstream: Leveraging emissions and commercial data for decarbonisation

-

Opinion

Is upstream oil and gas delivering on decarbonisation?

-

Opinion

Global upstream update: a review of key industry themes

Neivan Boroujerdi

Director, Corporate Research

Neivan Boroujerdi

Director, Corporate Research

Neivan leads Wood Mackenzie's global corporate NOC coverage.

Latest articles by Neivan

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

ADNOC doubles net hydrogen production through stake in ExxonMobil’s Baytown project

-

Opinion

ADNOC acquires stake in Rovuma LNG from Galp

-

Opinion

Benchmarking the Middle East NOCs against the supermajors

-

The Edge

How and why big oil is strengthening its oil and gas exposure

Michael Moynihan

Research Director, Russia Upstream Oil and Gas

Michael Moynihan

Research Director, Russia Upstream Oil and Gas

As a research director in our upstream team, Michael analyses developments in the upstream industry in Russia.

Latest articles by Michael

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

-

Opinion

Russian Federation upstream: 4 things to look for in 2024

-

Opinion

Global upstream update: a review of key industry themes

The global upstream update is an insight produced for subscribers to our Upstream Service. In it, we dissect some of the biggest topics and themes in upstream oil and gas from the last six weeks.

Fill in the form for your complimentary copy or read on for a quick introduction to four of the key themes explored in the insight.

1. Majors upstream emissions benchmarking

The Majors are ahead of the pack when it comes to decarbonisation to date, having been among the first movers. But some obvious areas still need addressed if flaring and net-zero targets are to be met. Progress towards upstream 2.0* requires a continued roll out of decarbonisation technology needed to offset growing production volumes.

Download the abridged insight for more.

*We define upstream 2.0 as a scenario where emissions metrics are as influential as economic, and all reasonable actions have been taken in terms of emissions abatement.

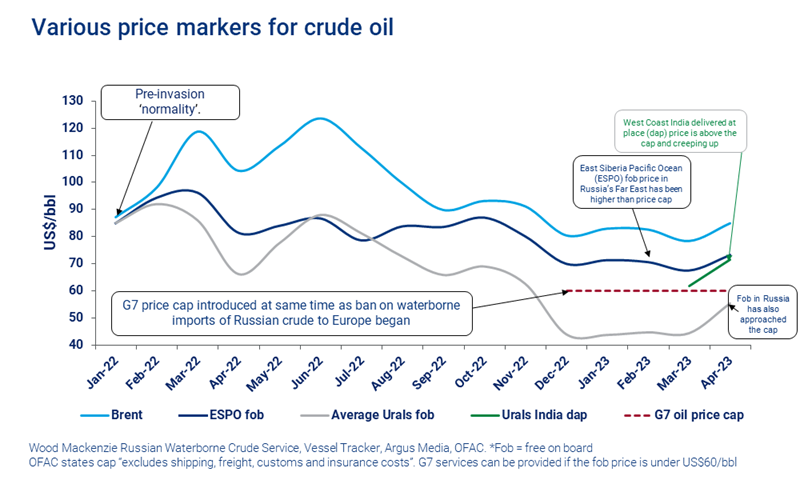

2. Russia: the price of keeping crude oil flowing

With OPEC+ acting to support prices, the G7 will need to review, revamp or reverse its crude oil price cap if realised Russian prices exceed US$60/bbl.

The contradictory goals of restricting Russia’s oil revenues, while maintaining supply of oil could soon be laid bare.

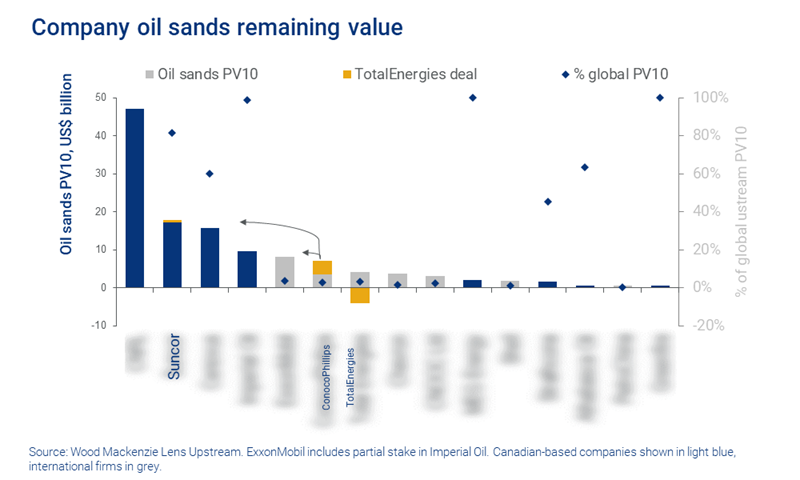

3. Canada: another chapter ends in oil sands consolidation

Over the past ten years, 10+ international companies have divested oil sands interests, and Canadian companies have taken advantage to consolidate 100% ownership of key assets. TotalEnergies signalled plans to spin-out its oil sands position last year. Instead, the company accepted a US$5.5 billion offer from Suncor. ConocoPhillips later exercised pre-empt rights on surmont.

4. North sea: is fiscal and political uncertainty set to shut down the sector?

There are over 40 projects, which represent over 1.5 billion in barrel of oil equivalent (boe) in the UK project pipeline. However, under Labour’s windfall scenario, just over 10 projects clear a 20% internal rate of return (IRR), putting most other volumes at risk.

The insight from our global upstream update also includes analysis of:

- Sub-Saharan Africa: Namibia’s investment ripple effect

- Latin America: Brazil’s frontier exploration woes

- And more.