Discuss your challenges with our solutions experts

A timeline of major events in Ukraine-Russia gas relations

1 minute read

Kateryna Filippenko

Research Director, Global Gas Markets

Kateryna Filippenko

Research Director, Global Gas Markets

Principal Analyst with a focus on the European gas market and the development of alternative scenarios.

Latest articles by Kateryna

-

Opinion

Global gas industry in the 2050 net zero world

-

The Edge

WoodMac’s Gas, LNG & Future of Energy conference – five key takeaways

-

Opinion

What will the gas market look like in a net zero world?

-

Opinion

Could a return to shale exploration be part of the solution to Europe’s gas supply problem?

-

Opinion

Can Europe get through winter?

-

Opinion

Europe pivots away from Russian gas: how will the global market rebalance?

The gas transit and supply contracts between Russia and Ukraine expire at 10 am on 1 January 2020 (Moscow time) – the future of Ukraine transit remains the largest uncertainty for global gas markets in 2020. Crunch talks are underway as the contract expiry looms.

Get the latest on this developing story: Ukraine transit deal close but sanctions halt Nord Stream 2

We take this opportunity to reflect on 20 years of Russia-Ukraine gas relations.

Note: This timeline is not exhaustive, and excludes a number of smaller disputes involving price and volumes of gas supply and transit, ownership of Ukrainian pipelines, and a range of political stumbling blocks.

Continue reading below...

Latest research into Ukraine gas-transit risk

Can Europe cope if Russia shuts off Ukraine gas transit?

Visit store to buy this report2005-06

Winter 2005/06: Disruption to direct sales

The 2004 pro-western ’Orange Revolution’ resulted in a pro-European Ukraine president and worsened Russia-Ukraine relationships. A dispute on supply and transit followed. With the parties unable to reach agreement on pricing terms, Russia cut off supplies on 1 January 2006. Ukraine allegedly continued to offtake gas from transit supplies for its own needs in the first few days of 2006. After only a few days, a new deal was reached involving an intermediary company (RosUkrEnergo) and supplies to Ukraine were restored.

2008-09

February/March 2008 – Reduction in direct sales

Disagreements over the amount of accumulated debt by Ukraine led to Gazprom briefly halving direct supplies to Ukraine in early March.

Winter 2008/09 – Disruption to direct sales and transit

1 January 2009

Following prolonged negotiations over price and Ukraine’s outstanding debt, Russia cut off direct supplies to Ukraine. The transit continued, although the sides clashed over the offtake of gas by Ukraine with conflicting claims made by both sides. Naftogaz claimed the offtake was for the purposes of fuel for the transit, while Gazprom insisted that the volumes were taken illegally for domestic use.

7 January 2009

Russia cut off supplies completely, including transit volumes.

19 January 2009

Following pressure from the EU, the new 10-year gas sales and transit contracts were signed and flows were restored. The contracts were later disputed in the Stockholm Court of Arbitration (see details below).

2014

June 2014 – Disruption to direct sales

The 2013/14 anti-corruption pro-western rallies in Ukraine led to the ousting of a pro-Russian then-president Viktor Yanukovych and the creation of a new pro-western government. Tensions between the countries heightened as Russia annexed the Ukrainian region of Crimea and began a military involvement in the east of Ukraine. Throughout this time, Gazprom unilaterally removed a number of discounts. As a result, the price charged by Gazprom changed by 80% – from US$269 per thousand cubic metres in December 2013 to US$486 per thousand cubic metres in April 2014.

During this time, supplies to Ukraine continued, but the sides could not agree on a price. On 16 June 2014, both Gazprom and Naftogaz filed lawsuits at the Stockholm Court of Arbitration regarding the supply agreement. These were later followed by lawsuits regarding the transit agreement. Also on 16 June 2014, Gazprom requested to switch to supplies based on prepayment. But as Naftogaz disagreed with the price charged, and amid heightened political tensions, supplies to Ukraine eventually stopped.

31 October 2014 – Restoration of direct supplies, first "winter package"

The first "winter package" was agreed with the support of the European Commission. The package enabled direct gas supplies from Russia to Ukraine on a pre-payment basis without the ToP clause until March 2015. Prices were set up in line with the neighbouring EU countries. The Ukrainian side committed to ensuring uninterrupted transit to Europe. The package was later extended until July 2015.

2015

25 September 2015 – Second "winter package"

The second "winter package" was agreed covering the period between 1 October 2015 and 31 March 2016. The terms were similar to the first "winter package".

25 November 2015 – Cessation of direct sales

Having established sufficient reverse flows from the EU, Ukraine stopped buying gas from Gazprom directly, and has not bought it since (as of December 2019).

2017/18

May, December 2017/ February 2018 – Arbitration ruling on supply and transit

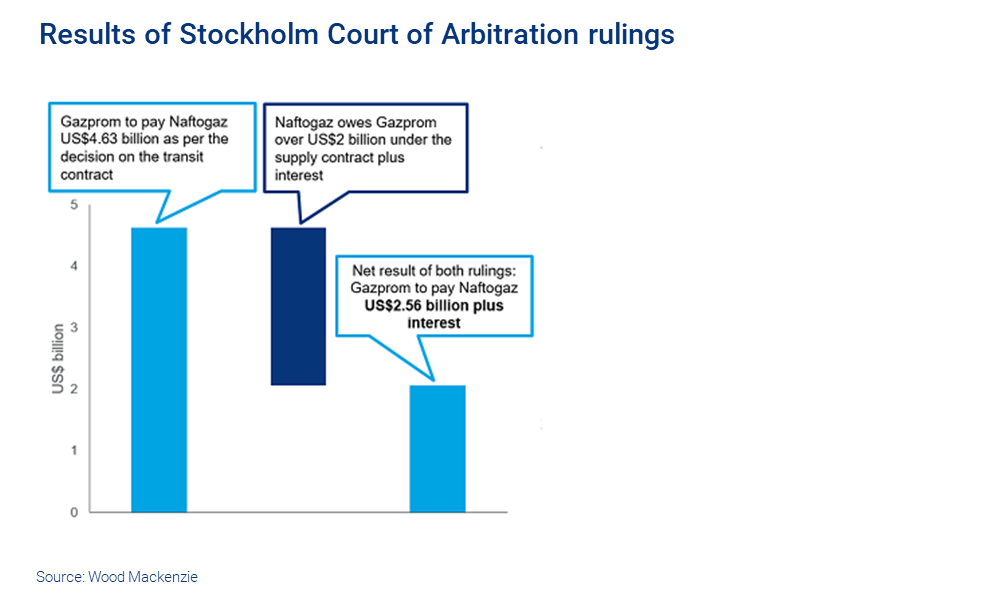

The Stockholm Court of Arbitration issued rulings on the 2009 supply and transit contracts (see details in the infographic below). Gazprom did not recognise the outcome of the rulings and attempted to appeal.

2 March 2018 – Request for termination of supply and transit contracts

Gazprom announced that it would seek to end its contracts with Naftogaz, as the Russian side did not recognise the Stockholm Court of Arbitration rulings on the contracts. However, the termination process is likely to take a few years, while the contracts expire on 31 December 2019.

2019

November 2019 – Naftogaz filed another lawsuit at the Stockholm Court of Arbitration

Naftogaz filed another lawsuit at the Stockholm Court of Arbitration aimed at revising transport tariffs under the existing transit contract for the period between 13 March 2018 (date when Naftogaz notified Gazprom about the lawsuit) and end-2019 (expiration of the contract). Naftogaz claims that a revision needs to bring the tariff in line with the European principles of tariff formation. The decision is scheduled for 2021, and the overall claim amounts to over US$12 billion consisting of the US$11.8 billion main tariff revision claim, additional compensations and interest.

Ukraine remains the major transit route for Russian gas into Europe – over 76 billion cubic metres will be transported via Ukraine this year. The implications of a disruption are significant.

Murray Douglas

Vice President, Hydrogen and Ammonia Research

Murray is responsible for Wood Mackenzie’s Global coverage across the hydrogen value chain.

Latest articles by Murray

-

Opinion

Big ambitions but slow progress: global hydrogen market developments in Q4 2023

-

Featured

Hydrogen 2024 outlook

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

-

Opinion

Exploring the long-term outlook for hydrogen and ammonia

-

The Edge

What's on CEOs' minds

-

Opinion

Our top takeaways from the Hydrogen Conference 2023

What does this mean for Naftogaz and Gazprom as they enter the final rounds of talks?

Gas transit and supply contracts expire in the morning of 1 January 2020, and negotiations over the future of the transit continue. Our team of gas experts has analysed each side's negotiating positions as they enter the final rounds of talks. Contact us for an in-depth discussion of negotiating positions and likely outcomes.

Kateryna Filippenko, Principal Analyst, Global Gas Supply