Get Ed Crooks' Energy Pulse in your inbox every week

AI helps support demand for US gas

Utilities plan to add gas-fired plants as power consumption grows

11 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Making low-carbon hydrogen a reality

-

Opinion

Rising electricity demand in Texas: the canary in the coalmine for the rest of the US?

-

Opinion

Deals show the enduring appeal of US gas

-

Opinion

2024 is a year of elections. What will they mean for clean energy?

-

Opinion

Home energy storage booms in the US

-

Opinion

China’s solar growth sends module prices plummeting

US greenhouse gas emissions have been on a downward trend since 2007, and the main reason has been the replacement of coal by gas and renewables for power generation. In 2014, the Obama administration set a goal of cutting US emissions by 26% to 28% by 2025, from a 2005 baseline. Barring some enormous shock to the economy, that goal will not be achieved. But by 2022, there had been an 18% reduction, with the electricity sector the principal contributor.

From now on, however, continued reductions in emissions will be more difficult. The emissions from power generation are lower with gas than with coal, but they are not zero. And the US is adding significant additional gas-fired generation capacity. Abundant reserves of natural gas, which can be produced at very low cost, make it a highly competitive option for power generation that will be difficult to displace.

The Biden administration has set goals of reducing US greenhouse gas emissions by 50% to 52% by 2030, also from that 2005 baseline, and of having a 100% zero-carbon electricity sector by 2035. Despite the rapid build-out of renewable generation in the US, it is not on course to meet either of those goals.

Increased demand for electricity, created by new data centres for artificial intelligence applications and new manufacturing plants for semiconductors and batteries, threatens to make achieving those objectives even harder.

Speaking at the Distributech conference earlier this month, Harry Sideris, Duke Energy’s executive vice-president for customer experience, solutions and services, said the company expected to meet growing demand through a combination of renewables and gas, with the addition of more nuclear power “eventually”.

A starring role for renewables, with a smaller but vital supporting part played by gas, is a common theme for utility investment in the US, as reflected in the integrated resource plans (IRPs) monitored by Wood Mackenzie analysts.

Dominion Energy South Carolina, for example, last year published an IRP including its “preferred plan” for investment to meet demand and replace two aging coal-fired plants. That plan projects that by 2050, the utility would add about 8.3 GW of new generation capacity, including about 5 GW of solar, 1.6 GW of battery storage and 1.7 GW of gas-fired power.

Under that plan, far from being 100% zero-carbon by 2035, Dominion Energy South Carolina would be generating only about 46% of its power from emissions-free sources in 2050. There are similar projections from other utilities across the country.

Forecasts from Wood Mackenzie’s North America Power & Renewables Tool show that over the next 10 years, US utility-scale solar capacity is expected to triple from 110 gigawatts to about 359 GW, while onshore wind capacity rises from 161 GW to 288 GW. But over the same period, combined cycle gas turbine generating capacity is also expected to grow, going from about 271 GW to 338 GW.

The capacity factors for those gas-fired plants are likely to fall, as they will increasingly be used to back up variable renewables. But they will support demand for gas even so. Wood Mackenzie’s forecasts suggest gas demand for power generation in the US Lower 48 states may have peaked last year, but it is expected to decline only slowly through the 2020s and 2030s.

We are currently updating our forecasts with the latest information on new loads being added to the grid, and there is a good chance that projections for both power and gas demand will be revised to be even higher.

These trends have caught the attention of the natural gas industry. Toby Rice, chief executive of EQT, said this week: “There is a lot of excitement in the natural gas markets. We’ve talked a lot about LNG, but one market that’s emerging that we are equally as excited about is the AI boom that is taking place.”

He was speaking as EQT announced its US$5.5 billion deal to buy pipeline company Equitrans Midstream, which it had owned until a spin-off in 2018. Buying Equitrans back again will give EQT gas gathering and interstate pipeline assets in Appalachia, and a stake of about 49% in the Mountain Valley Pipeline, which will carry gas from West Virginia to Virginia, the world’s largest data centre market.

Alan Armstrong, chief executive of Williams, one of the largest US gas pipeline companies, made similar observations recently. “Electricity demand is experiencing three times faster growth per year this decade than what we’ve seen in previous decades, driven by the increase in electric vehicles and emergence of new, large-load data centers,” he told analysts this month.

“This is a major shift for our country, and it’s a major shift for the natural gas market to be able to keep up with this.”

The prospect of continued long-term reliance on gas in the US power system is crucial context for the power plant emissions regulations currently being worked on by the administration. Draft rules were published last year. Michael Regan, the administrator of the Environmental Protection Agency, said last month that the final standards for coal-fired and new gas-fired plants would soon be sent to the White House Office of Management and Budget, while “a new, comprehensive approach” would be launched to cover existing gas-fired plants. The rules for those existing gas-fired plants are not expected to be published until after the elections in November.

The draft rules proposed mandating that new gas-fired plants either begin co-firing with low-carbon hydrogen by 2032, ramping up to 96% by 2038, or start using carbon capture for 90% of their emissions by 2035. Existing coal and gas plants would have to have 90% carbon capture to keep operating beyond the end of 2039. These routes seem demanding, given that both the CCUS and low-carbon hydrogen sectors are still nascent.

In its comments on the proposed rules, the Edison Electric Institute, the industry group, said electricity companies were not confident that the hydrogen and CCUS technologies could “satisfy performance and cost requirements on the timelines that EPA projects.”

The group added: “This will impact electric companies’ efforts to deliver affordable and reliable electricity to customers.”

Legal action against the new rules is expected, and the regulations are also likely to be a political issue. The first Trump administration proposed much less restrictive emissions standards for power plants. A second Trump administration would be expected to abandon the current plans and reintroduce something much closer to those 2019 regulations, known as the Affordable Clean Energy rule.

The EPA projected in its regulatory impact assessment that its proposed rules would accelerate the phase-out of coal in the US, while actually increasing demand for gas through the 2020s. It forecast that US coal consumption for power generation was on course to drop by 68% over 2028 to 2035 but would fall 75% over that period if its proposals were implemented.

However, given all the signs of stronger demand growth, it is possible that more utilities will want to keep coal-fired plants running for longer, raising the stakes in the debate over the EPA’s plans.

“Coal emissions are so much higher per megawatt hour than gas,” says Sam Berman, Wood Mackenzie’s principal analyst for power and renewables. “Delayed coal retirements would be the biggest problem for emissions reductions in the power sector.”

If you worry that the replacement of coal by gas is a mixed blessing for US climate policy, consider the consequences if coal stops being replaced by gas.

In brief

Ukraine has hit at least three Russian oil refineries with drone strikes, after stepping up its attacks this week. A Ukrainian official told the Financial Times that the country was “systematically implementing a detailed strategy...to deprive the enemy of resources and reduce the flow of oil money and fuel”. Russia’s energy ministry said output of oil products would be lower, but crude exports would be higher, as a result of unplanned maintenance at some refineries.

The US government has made a conditional commitment of a US$2.26 billion loan to help finance the construction of a lithium carbonate processing plant in Nevada. The plant, which will be built next to a mine that contains the largest proven lithium reserves in North America, is expected to produce enough carbonate to make batteries for up to 800,000 electric vehicles a year. The site, known as Thacker Pass, is being developed by a subsidiary of Vancouver-based Lithium Americas, which is listed on the New York and Toronto stock exchanges. General Motors has made an equity investment into Lithium Americas to support the Thacker Pass project, and is expected to be a long-term primary buyer for lithium carbonate from the plant.

Volkswagen has announced a plan to launch an electric car selling for just €20,000 (about US$21,700) in 2027. The company said the new ID.1 EV would offer “affordable electric mobility for everyone”.

After Amazon’s acquisition of a nuclear-powered data centre earlier this month, Google this week agreed an eight-year deal for wind, solar and battery storage to power a new data centre in Mesa, Arizona. The power will come from three facilities operated by NextEra Energy Resources that will add about 430 megawatts on carbon-free capacity to the Salt River Project’s grid in Arizona.

Amanda Peterson Corio, Google’s global head of data centre energy, wrote in a blog post that the company expected the agreement would help its operations in Arizona reach at least 80% carbon-free energy on an hourly basis by 2026. Google’s goal is to run its entire business on 24/7 carbon-free energy by 2030. Corio added: “We are not just offsetting our energy use, but also actively working to add carbon-free energy capacity directly to Arizona's grid when and where it's needed.”

And finally: one of the most ambitious new ideas in energy for a while. The biggest – and most obvious – drawback of solar power is that it doesn’t work during the hours of darkness. A company called Reflect Orbital has come up with what they say is a viable solution: a network of satellites that could “precisely [reflect] sunlight that is endlessly available in space to specific targets on the ground”.

Critics have suggested that batteries, other storage technologies and demand response, to name but a few, are likely to be more cost-effective, and safer, solutions than a network of orbiting reflectors.

Other views

Nuclear’s massive net zero growth opportunity – Simon Flowers and David Brown

Navigating changing supply chain dynamics: the challenges and opportunities facing utilities

Distributed solar and storage competitive landscapes shift in 2023 – Max Issokson

Ancillary services market redesign to drive grid-scale battery uptake – Kashish Shah

Carbon management frequently asked questions part 2: offsets – Elena Belletti

Assessing the refineries at risk of closure – Alan Gelder and others

As project economics rebound, upstream FIDs to increase in 2024, with focus on deepwater resources

A new surge in power use is threatening US climate goals – Brad Plumer and Nadja Popovich

The obscene energy demands of AI – Elizabeth Kolbert

Climate policy reform options in 2025 – John Bistline and others

How the world’s biggest plane would supersize wind energy – Jennifer Hiller and Brian McGill

Quote of the week

“The whole topic of tariffs to me is so simple. Number one, it’s great economically for us and it brings our companies back. Because if you charge tariffs to China, they’re going to build their car plants here and they’re going to employ our people. They’re right now building big plants – because of Biden – they’re building big plants in Mexico. So they build big [Chinese] plants in Mexico then they sell it across the border with very little tax. It’s ridiculous. We want them to build their plants in the United States. We don’t want to get cars from China. We want to get cars made by China in the United States, using our workers.”

Former President Donald Trump, now officially selected as the Republican party’s presidential candidate for the elections on 5 November, defended his proposals for increased tariffs on imports in an interview on CNBC. Trump has proposed a “universal baseline tariff” of 10% on all imports, with potentially much higher rates for some countries.

The former president’s support for Chinese manufacturers building plants in the US contrasts with the position of some other Republican politicians, who have opposed China-linked investments on national security grounds.

Chart of the week

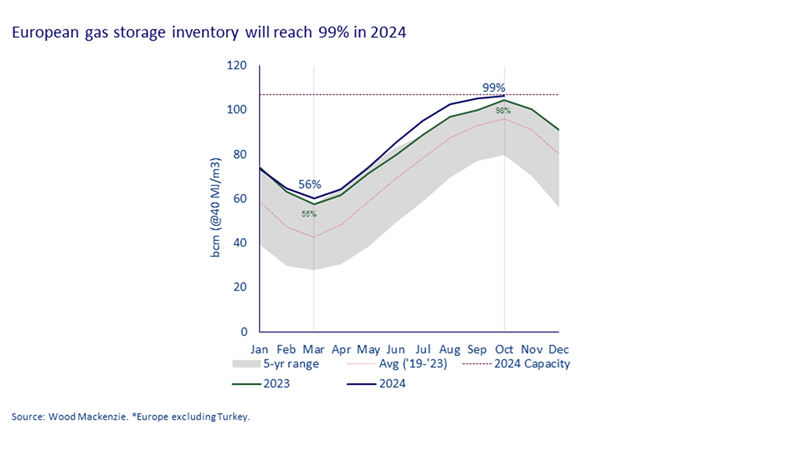

This comes from a new note by Mauro Chavez, Wood Mackenzie’s head of European gas and LNG markets, titled: ‘Three key takeaways from our Europe gas markets short-term outlook Q1 2024’. There are several excellent charts in the note, explaining why European gas prices are now back to their levels before the Russian invasion of Ukraine, and highlighting the key factors that will influence where we go from here. But this one particularly stood out to me.

It shows actual and projected levels of gas inventories in Europe, this year and compared to the recent past. You can see how two consecutive warm winters, weak Asian LNG demand growth and structural demand destruction have meant that European gas storage levels are currently above 56% full. We think European storage could be 89% full by the end of July, and reaching full capacity by the end of October, despite a rebound in the region’s industrial demand and lower imported supply of both piped gas and LNG.

High storage levels create downside risk to prices as the summer progresses, and we expect benchmark European TTF prices will have to drop to below US$7 per million British Thermal Units (mmbtu) in August and September.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today to ensure you don’t miss a thing.