Sign up today to get the best of our expert insight in your inbox.

Hydrogen: how carbon intensity rules can muddy the waters

Choosing between green and blue won’t be straightforward

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Flor Lucia De la Cruz

Principal Analyst, Hydrogen and Derivatives

Flor Lucia De la Cruz

Principal Analyst, Hydrogen and Derivatives

Flor is a subject matter expert in hydrogen and emerging technologies, working for our Energy Transition Practice.

Latest articles by Flor Lucia

-

The Edge

Hydrogen: how carbon intensity rules can muddy the waters

-

Opinion

Australia’s energy revolution: the promise of battery storage and hydrogen

-

Opinion

Tracking the hydrogen market: from policy to project pipeline

-

Opinion

Decoding the hydrogen rainbow

-

Opinion

Hydrogen: the US$600 billion investment opportunity

-

Featured

Will CCUS and hydrogen live up to the hype in 2022? | 2022 Outlook

Green hydrogen looks to be the winner. Manufactured from water using electrolysers powered by renewables, green hydrogen offers the potential for zero-emissions hydrogen. It’s expensive today but innovation and scaling up should make it a competitive energy source by the early 2030s. With brown hydrogen made from coal and both grey and blue hydrogen from natural gas with released CO2 captured, the common perception is that green will dominate the future hydrogen supply colour map, wiping the floor on costs and carbon intensity.

But is it cut and dried? Flor de la Cruz, Principal Analyst, Hydrogen and Derivatives, identified four factors in our latest Horizons that complicate the rise of green hydrogen that both developers and potential buyers need to be aware of.

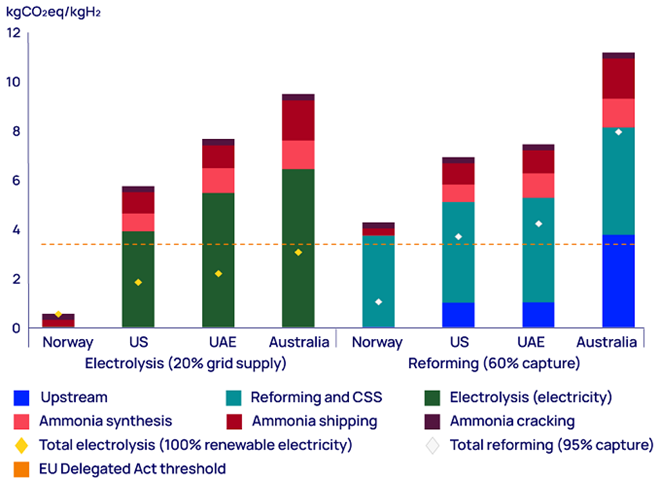

First, genuinely green hydrogen has a very low carbon intensity, typically between zero and 0.5 kgCO2eq/kgH2. That’s 20 times lower than blue, 50 times lower than grey and 100 times lower than brown. But that’s only if green hydrogen is produced using renewable power – and solar and wind’s variability sharply reduces electrolyser utilisation, driving costs up.

The 24/7 solution is to plug the electrolyser into the local grid during renewables downtime to maximise electrolyser utilisation. Therein lies the problem. Most grids are a long way from zero emissions so using grid-power will increase the carbon intensity of the produced green hydrogen. On our calculations, electrolytic hydrogen produced from 100% grid power can have even higher carbon intensity than brown hydrogen.

Electrolyser technology also matters. China dominates global manufacturing capacity, but its favoured alkaline electrolysers need a continual electrical load to remain within safety limits, inevitably resulting in higher emissions. PEM technology, favoured by western OEMs, allows developers to mirror hydrogen production to renewable generation. The concern is that we end up with a two-tier global market as Chinese OEMs push low-cost alkaline electrolysers to carve out market share in countries with less stringent rules on emissions.

Second, policymakers are trying to establish rules – and incentives – to certify that a green hydrogen molecule coming onto the market does what it says. The EU has set strict limits on the use of grid-connected electrolysers. In the US, the rules around the use of grid power and renewables for electrolysers, which determine tax credit eligibility, are based on carbon intensity. Other markets – including Japan, Canada and India – are lagging. The obvious option in any market is for the developer to buy 100% green power through PPAs. However, developers find that PPAs at the scale and duration required just aren’t available today in most power markets.

Third, emissions from green hydrogen aren’t confined to the production process. Future hydrogen supply traded globally will be produced in renewables-rich countries such as Saudi Arabia and Australia, then exported to the big demand centres of Europe and North Asia. Once converting, compressing, transporting and reconverting hydrogen are factored into the equation, emissions intensity becomes a whole new ball game.

To ship hydrogen, which has a low density, by sea, it must be compressed or liquefied, or converted into derivatives such as ammonia or methanol, which are already common cargoes in sea trade. Our analysis suggests ammonia synthesis, shipping and cracking will add another 20% to 25% to the emissions intensity of most green and blue hydrogen for export.

Fourth, the rules around the carbon intensity of grids and the transportation value chain muddy the waters as to what constitutes the lowest carbon-intensive hydrogen. The surefire bet is 100% renewables-powered green hydrogen, which clocks in below the EU-intensity ceiling of 4kgCO2eq/kgH2. That benchmark, though, is beyond most developers and only hydro-rich Norway can guarantee 100% renewables at scale.

Most green hydrogen projects in the Middle East, US or Australia will likely have to use the local grid for at least some power. Taking ammonia and shipping into account, these green hydrogen projects will not only exceed the EU threshold but potentially may even have a carbon intensity similar or higher than blue hydrogen projects in the same country.

Electrolytic hydrogen offers the potential for truly green energy supply. But the road to zero emissions will be long and bumpy for the burgeoning green hydrogen industry, with efforts to minimise carbon intensity through the value chain impacting both costs and eligibility for subsidies. Increasing access to renewable power via green PPAs has to be the starting point.

Emissions from assumed ammonia imports into the Netherlands, 2023

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.