Global upstream: four current key themes

Current hot topics include efficiency challenges in the US Lower 48, changing corporate landscape in Nigeria and Russia’s energy alignment with China

3 minute read

Fraser McKay

Head of Upstream Analysis

Fraser McKay

Head of Upstream Analysis

As head of upstream research, Fraser maximises the quality and impact of our analysis of key global upstream themes.

Latest articles by Fraser

-

Opinion

What's new in global upstream

-

Opinion

Is upstream oil and gas delivering on decarbonisation?

-

Opinion

The biggest topics in global upstream

-

The Edge

Is consolidation changing upstream’s appetite for investment?

-

Featured

Upstream oil & gas: region-by-region predictions for 2024

-

Opinion

Global upstream: four current key themes

A range of themes are occupying the minds of global upstream stakeholders as we transition into 2024. From pursuing efficiency and meeting more serious emissions regulations to dealing with geopolitical instability and changing regional investment priorities, market participants have plenty to think about.

Wood Mackenzie’s global upstream update is an Insight produced for subscribers to our global Upstream Service. In it, we dissect some of the hottest topics in upstream oil and gas over the previous six weeks. Fill in the form for your complimentary extract from the latest update, or read on for a quick introduction to four of the key themes explored.

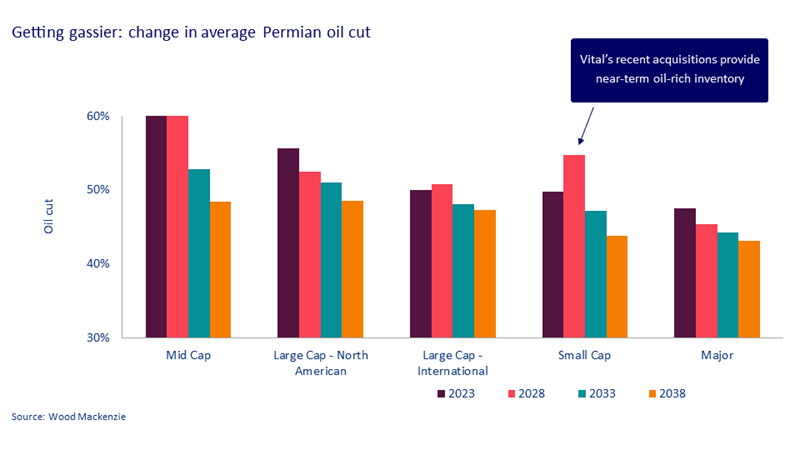

1. US Lower 48: rethinking inventory

Capital efficiency in the US Lower 48 will decline as production shifts to tier two and three acreage over the coming years. Gassier, less oil-rich wells will result in almost all producers suffering an erosion of capital efficiency by the end of the decade. In the second half of next decade, the average Permian oil cut will fall below 50% for all producers (see chart below).

Operators can attempt to counter this trend by acquiring additional high-quality locations. However, the scarcity of viable acquisition targets is a growing issue. With demand for quality inventory making M&A increasingly expensive, many exploration and production (E&P) firms may be considering potential deals long before they have a need for more well locations.

2. Sub-Saharan Africa: Nigeria’s changing corporate landscape

In Nigeria, planned divestments from a range of joint ventures by international oil companies (IOCs) are set to significantly shift the upstream corporate landscape towards indigenous companies (see chart below). Assuming the Nigerian government approves these deals, capex by indigenous and Africa-focused E&P firms will rise from 17% to 27% between 2024 and 2030. Meanwhile, their share of production will increase by 8% to 33%

3. Russia: energy alignment with China

While China has demonstrated its enthusiasm for Russian oil, gas and LNG supply, Chinese investors are less keen on taking stakes in Russian upstream. Russia was China’s largest supplier of oil in the first eight months of 2023, ahead of Saudi Arabia.

Gas and LNG exports from Russia to China are also healthy and likely to have exceeded 30 billion cubic metres (bcm) in 2023. In terms of investment, the China Investment Corporation has a 45% stake in the Nobel Oil fields, while various Chinese firms have stakes of up to 25% in other fields. However, Chinese investors have not signed up to Vostok Oil and are unlikely to replace the IOCs which have exited Russia’s upstream sector.

4. North Sea: UK electrification – a reality check

We believe ambitious proposals from the North Sea Transition Authority (NTSA) to mandate electrification of the UK’s North Sea fields need a reality check. Norway is often cited as the model, but emissions there have been driven down gradually over a 30-year period. Mandating the rapid electrification of what are now mature fields is a very different prospect.

Full electrification should only be required if there is a reasonable chance of success and the gains are meaningful. For UK North Sea assets, contracting power and connecting into the UK national grid are significant stumbling blocks.

Reasonable alternatives that could be more effective include:

- For larger players: a focus on supporting longer-term solutions such as carbon capture and storage (CCS).

- For smaller players: contributions to a UK decarbonisation fund that could, for example, pay for home insulation on a national scale.

The complimentary extract from our latest Global Upstream Update covers these themes in more depth, as well as providing a summary of the key themes in the full report, and analysis of:

- Canadian corporate guidance for 2024

- Capital discipline within the upstream supply chain

Don’t forget to fill out the form at the top of the page for your copy. You can also check out our 'Things to Look For in 2024' series, when published. This is our annual global tour of what to expect in terms of critical themes and events for global upstream over the coming year.