Mission invisible: Tackling the oil and gas industry's methane challenge

November 2023

Authors

Methane is responsible for almost a third of the emissions-induced increase in global temperatures since the start of the industrial era, second only to carbon dioxide (CO2) in its impact on climate change.

The oil and gas industry is estimated to account for up to a quarter of human-caused (anthropogenic) methane emissions. This includes large-scale flaring and venting, where operators have no access to gas infrastructure and markets, but also routine methane losses from innumerable small, undetected or unreported leaks across the oil and gas value chain.

For the oil and gas sector to take effective action against this invisible challenge, emissions must first be measured. And there is the rub: there is currently no feasible technology that can track all methane losses. Oil and gas producers often lack accurate data on their own emissions. Satellite technology has been heralded as one great solution, but current offerings are not yet providing the accuracy that would support meaningful enforcement.

At the same time, regulation and penalties for emitters are set to increase. While commitments on tackling methane to date have been largely voluntary or tied to more general action on greenhouse gases (GHGs), the goals of the upcoming COP28 climate conference are likely to be less forgiving. We expect more ambitious binding country commitments on methane reduction.

Fortunately, existing methane reduction technologies are relatively simple, can be cost-effective and bring environmental benefits over a relatively brief time horizon, thanks to methane’s shorter duration in the atmosphere than, for example, CO2. For oil and gas producers, the incentives can also be financial: reducing methane losses can increase gas sales and, in turn, revenues.

In this month’s Horizons, we look at the scale of the oil and gas industry’s methane challenge, how technological improvements can help and what companies and governments must do to resolve it.

The scale of the oil and gas industry’s methane challenge

Methane is produced by virtually every oil and gas project worldwide, either as a by-product of oil production or directly from gas or gas condensate reservoirs.

The vast majority of methane produced globally is sold as natural gas. The industry’s challenge lies in its emissions of the gas, intentionally or not, directly into the atmosphere. We class these emissions into two broad categories: snowballers, which are minor but innumerable, and super-emitters, which are few by comparison but of very large scale. Both can be intentional or accidental, but while super-emitters catch the headlines, snowballers add up to a large cumulative impact.

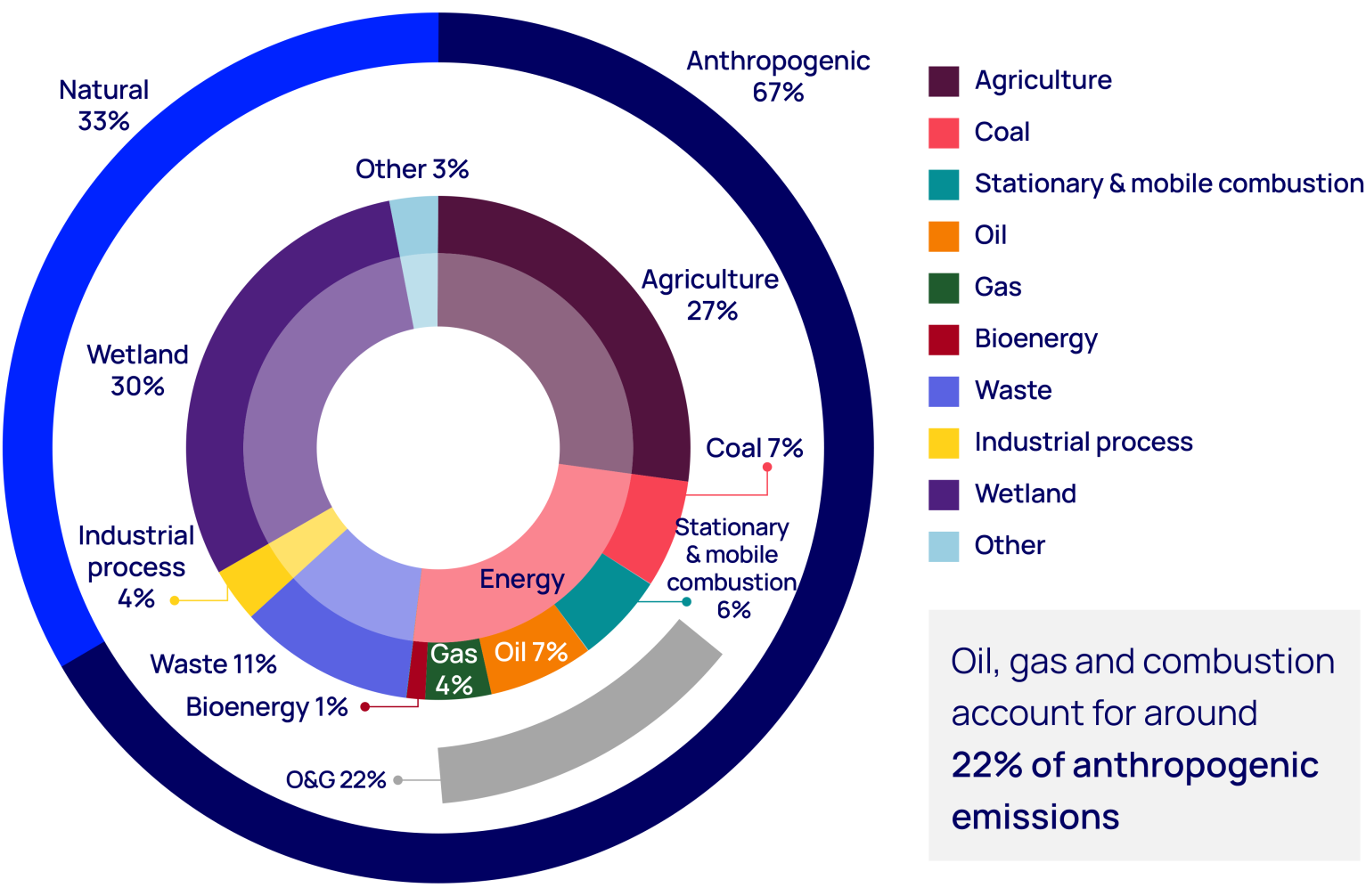

Figure 1: Methane emissions by source

Estimates of total annual methane emissions have been consistently revised upwards in recent years, mostly due to improvements in estimation methodologies. Even so, the currently accepted figure of around 370 Mtpa of anthropogenic methane is probably still underestimated. One recent Royal Society of Chemistry study shows that actual methane emissions from the UK oil and gas sector could be five times current estimates.

Super-emitter events: soft solutions for hard challenges

Super-emitter events take place when emissions exceed 10,000 kg/hour. Accidental examples include pipeline or storage tank ruptures, while intentional operational events include direct venting (effectively unlit flares) or incomplete combustion. Stopping the more easily identifiable super-emitter events is at the sharp end of efforts to curb methane emissions.

Large-scale flaring or venting of methane often occurs at oilfields where there is no market for the gas and it cannot be monetised. Methane’s climate potency makes venting the gas far less desirable than flaring (where methane is combusted and CO2 is emitted instead) but because of flaring's higher visibility, some operators and governments turn to venting to downplay the problem.

Snowballers: operational emissions that quickly add up

Small-scale operational emissions come from innumerable sources that have a huge cumulative effect. These sources include leaking valves, pneumatic devices, venting from tanks and wellheads, and incomplete combustion in generators and flare stacks.

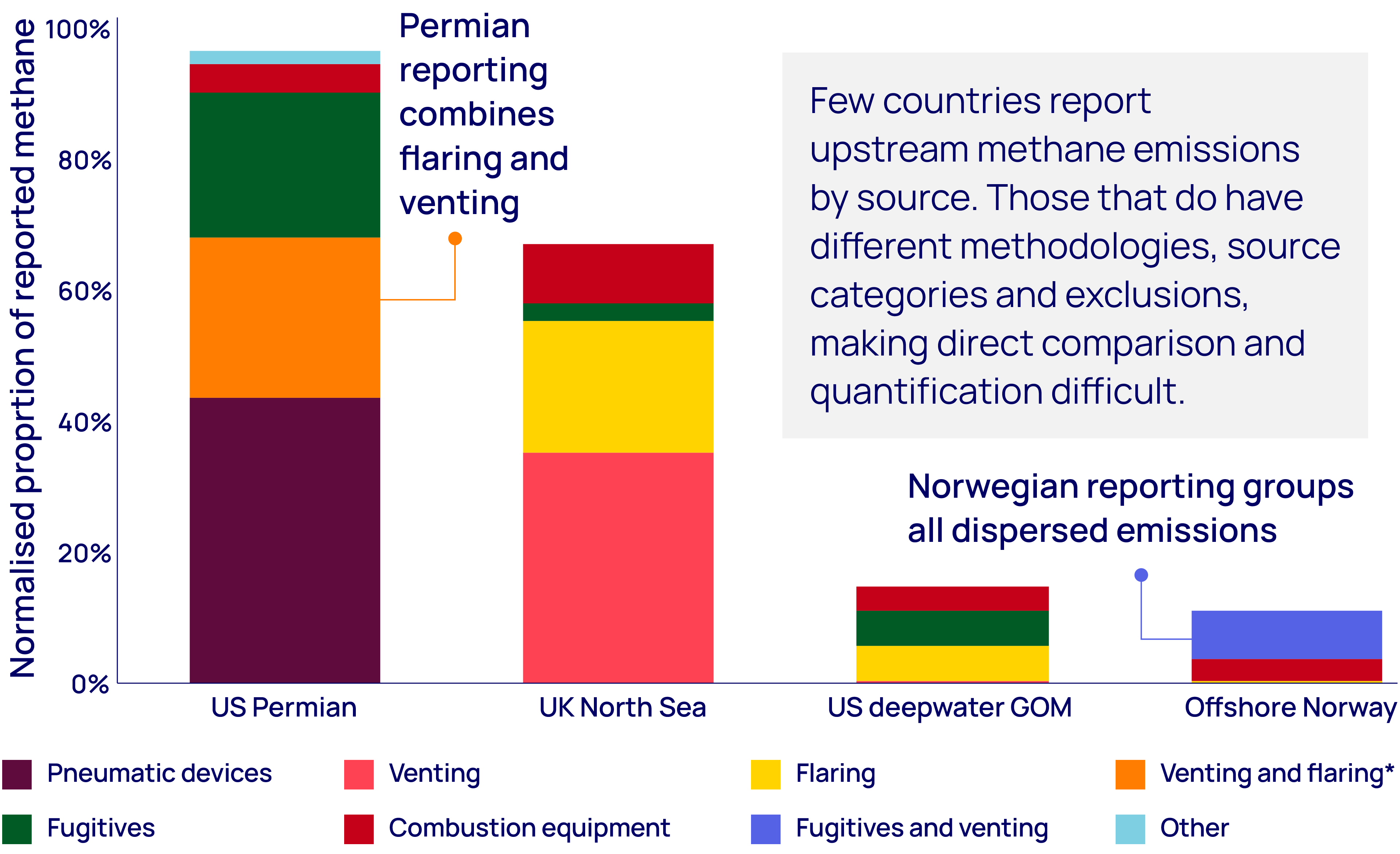

Estimates of the scale of absolute emissions and the contribution of each source vary widely. Few jurisdictions report emissions in detail and those that do often exclude key sources. Data from the from the U.S. Environmental Protection Agency (US EPA) excludes facilities emitting less than 25,000 t/year, for example. Identifying and quantifying losses consistently is a serious challenge.

Figure 2: Operational methane emission sources and intensity vary widely by region and asset type

The emissions measurement challenge

Existing technology is unable to provide complete coverage or granularity on methane losses. Even the most proactive oil and gas companies probably still underestimate the true extent of avoidable methane losses, making better emissions measurement options to support mitigation even more urgent.

For super-emitters, this is less of a problem, as existing satellite technology is sufficient to detect and measure large methane releases. The challenge is how to stop them. Greater political will is needed to end strategic, wilful venting through rigorous regulation and penalties.

Improved detection and data accuracy are key to addressing smaller leaks. Upstream operators currently use six main monitoring approaches to record emissions: satellites, aircraft, drones, regional sensors, point sensors and, most commonly, optical gas imaging (OGI) cameras. Remote locations and the scale of operations can make this difficult. For example, full coverage of the Permian Basin would require a distributed network of small, precise meters across thousands of wells and kilometres of pipeline – with prohibitive costs.

The role of satellites in the measurement of methane

As emissions regulations tighten, there is an increasing focus on satellite technology to support more accurate and timely measurement of methane. There remains a significant gap between the spatial, spectral and temporal resolution of today's satellites and what is required.

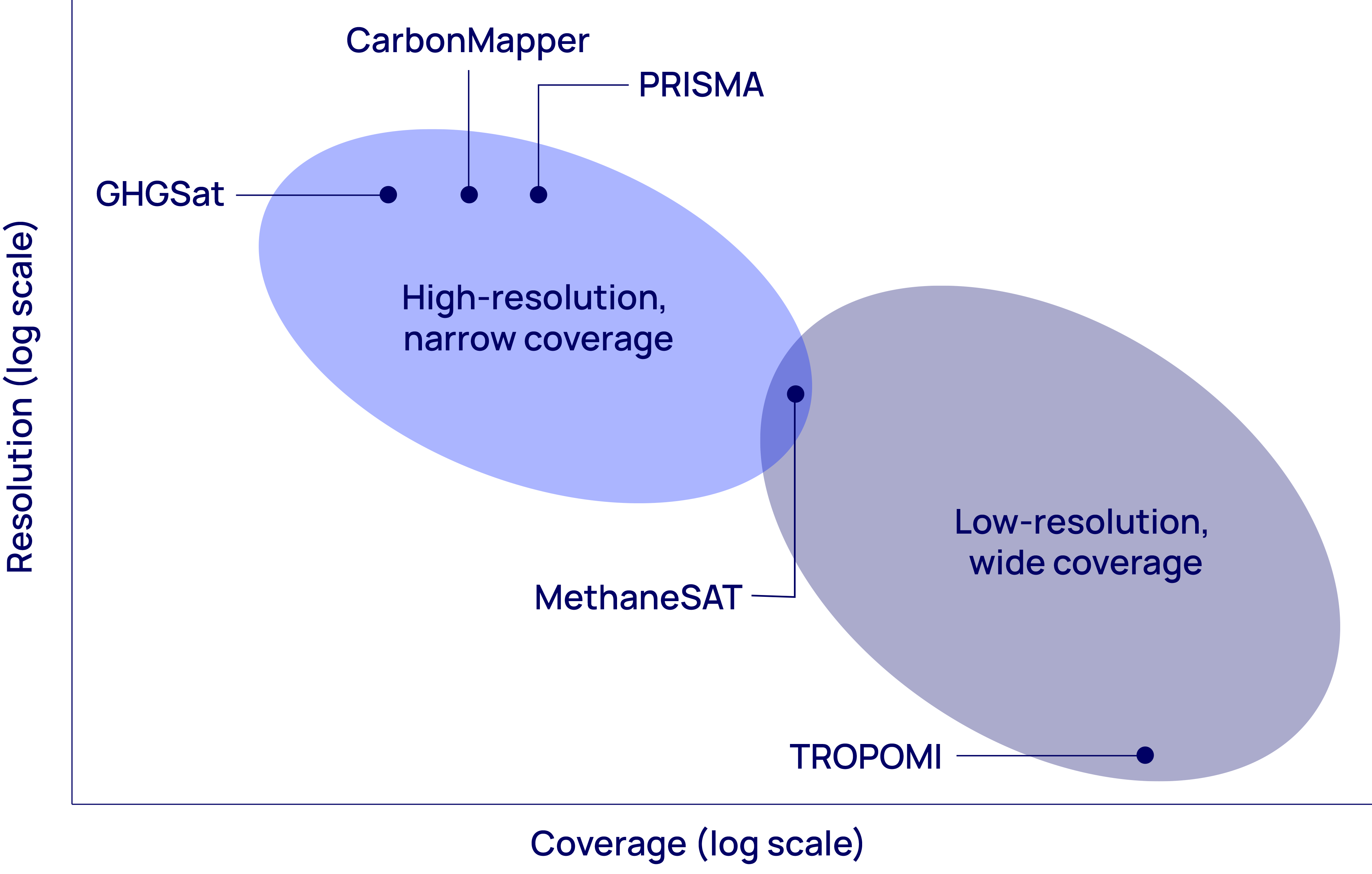

There are currently three main classes of GHG-monitoring satellite. The first, and oldest, provides high-quality data on average GHG concentrations in large geographic regions. The second, not yet operational class, covers regional-scale emissions, and the third focuses on point-source emissions, often at the expense of wider coverage.

The first class–two satellite is set to launch in 2024: the Environmental Defense Fund’s MethaneSAT. It will track emission rates and locations and changes over time, making it easier to measure performance. It should capture at least 80% of global oil

and gas production and will detect both concentrated point emissions sources and dispersed area sources to quantify total emissions, something not possible with the previous class of satellites.

Figure 3: Current and planned methane-monitoring satellites

With limitations to all three classes, more precise and regular methane measurements are needed to assess routine methane loss from all oil and gas facilities.

A key determinant in those assessments will be the average level of emissions from a typical field. We estimate methane emissions in our Emissions Benchmarking Tool. Typical methane losses per field are small — less than 500 kg/hr (around 0.65 mmcfd), which is below the measurable resolution of most current satellites – but around 96% of all fields have emissions on this scale, making it a large, cumulative problem. More significant emissions from larger fields are often spread across multiple production facilities, making them harder to quantify.

The future of methane detection and monitoring

Consistent methane monitoring through satellites presents several challenges. Geostationary satellites can provide images with high temporal frequency, but a dedicated GHG Geostationary sensor is not yet operational. Orbital satellites provide near-global geographical coverage, but the lower frequency of their measurements over a particular point limits the data’s applicability for user cases such as consistent monitoring and regulatory enforcement.

Methane is also highly dispersible; a methane molecule can travel from North America to South Asia in less than two weeks. Frequency gaps, therefore, make it difficult to track the source of methane Translating any satellite imaging into facility-level emissions data also requires a sizeable, continuous amount of granular weather and atmospheric measurements on the ground.

Additionally, current satellite technology has trouble detecting methane emissions in offshore operations. Satellites use spectrometers to measure different molecules in the atmosphere by observing levels of solar energy absorbed at different electromagnetic wavelengths. However, similarities in the absorption profiles of water, methane and other pollutants make measurements over water, especially in rough seas, particularly difficult. As more finely tuned spectrometers become mainstream, it will be possible to discern between methane and other ambient molecules.

Future innovations to methane tracking instruments promise solutions to all these issues and more.

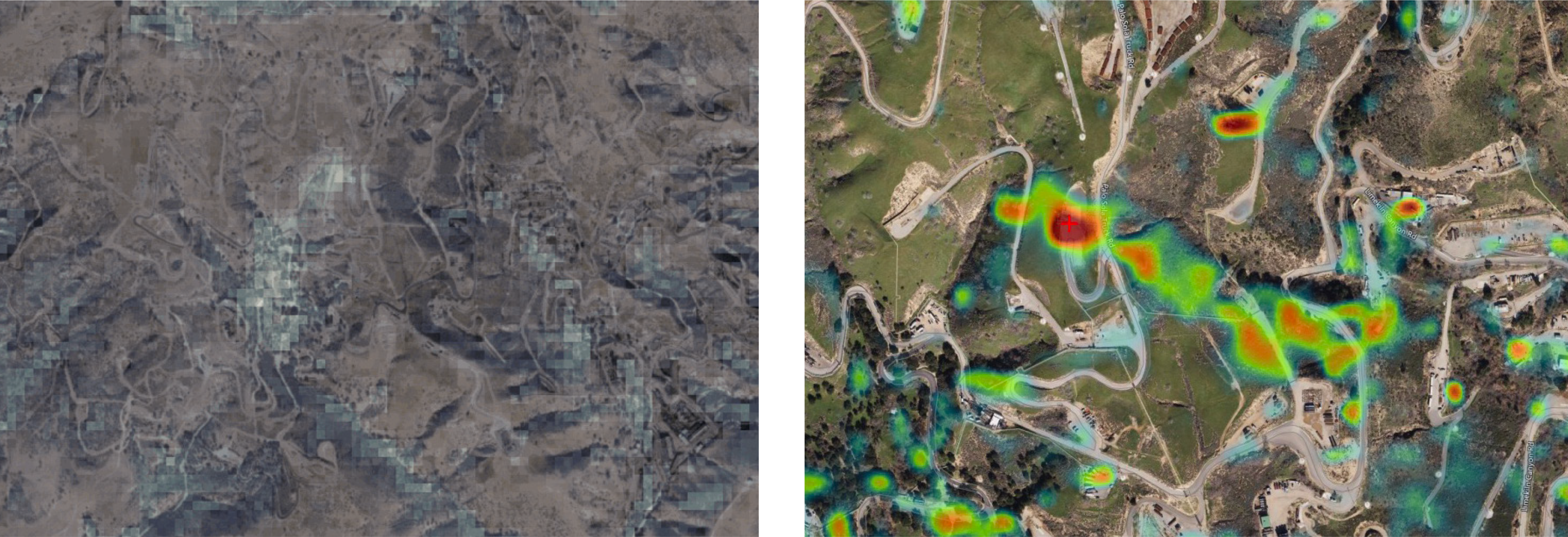

Figure 4: Satellite views of the 2015 methane leak in the Aliso Canyon

These images show a large methane leak in California. The image on the left shows the kind of methane emissions view that is possible with Sentinel 2 data with 20 metre resolution. It does not offer sufficient geographical and temporal resolution to accurately quantify methane. The image on the right shows AVIRIS-NG data overlaid with high-resolution satellite data. This offers better resolution, but the airborne sensor has to be targeted at a specific leak, with a significant trade-off on coverage and comparability. Neither solution can detect smaller leaks

Methane regulation gets serious

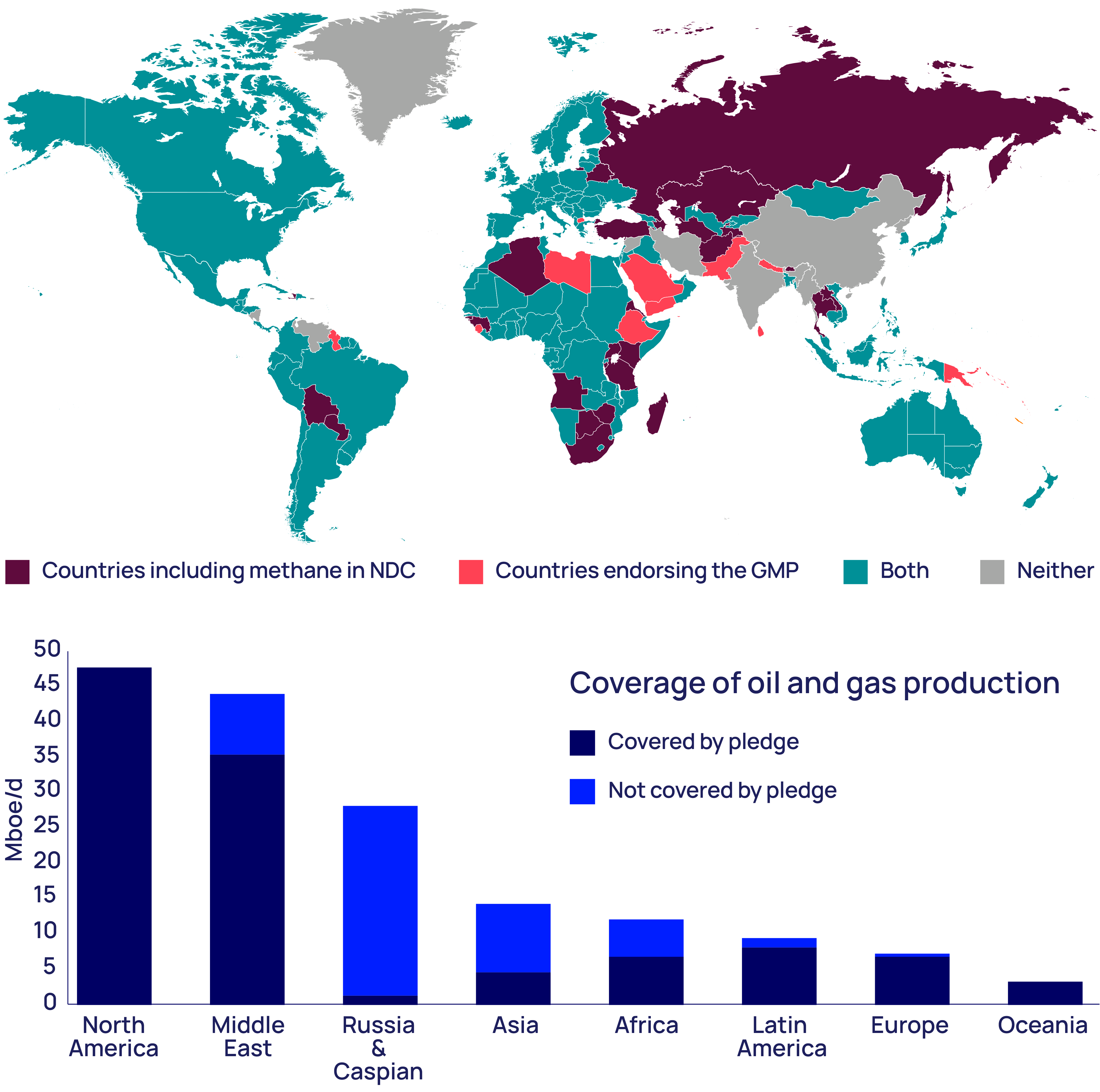

While the larger international oil companies (IOCs) and an increasing number of national oil companies (NOCs) have committed to methane reduction targets, regulatory efforts have lacked teeth. The Global Methane Pledge (GMP), jointly launched by the United States and the European Union (EU) at COP26, covers around 45% of global emissions, but does not include the top three emitters (China, Russia and India). For those that have signed up, pledges and targets remain voluntary.

Figure 5: Global Methane Pledge (GMP) coverage

Several oil and gas players have also joined forces in voluntary methane reduction and reporting commitments. For example, Wood Mackenzie is a supporter of the Oil and Gas Climate Initiative’s (OGCI) Aiming for Zero Methane Emissions, the effort of 12 major oil and gas companies to achieve near-zero operated methane emissions by 2030. The United Nations (UN) also coordinates the Oil and Gas Methane Partnership 2.0, a group of 110 companies committed to following a detailed framework for reporting their methane emissions.

Voluntary action on methane loss is increasingly being replaced by country-specific regulatory demands for emissions reporting and reduction. Financial and reputational costs for non-compliance are set to rise.

- In the US, the Environmental Protection Agency has proposed halting all venting and flaring, while the Inflation Reduction Act (IRA) will introduce a charge of US$900 per tonne of methane emitted in 2024, increasing to US$1,500 per tonne by 2026.

- The EU is working on laws to force oil and gas producers to stop intentional methane losses as part of its methane reduction plan, and to gradually impose methane emission limits on gas imports.

- By 2030, Canada aims to reduce methane emissions from its oil and gas sector by 75% from 2012 levels.

- Nigeria and Colombia are the first African and South American countries, respectively, to regulate methane emissions from their oil and gas sectors.

Of the top two emitters not signed up to the GMP, China is actively working on methane abatement regulations which are likely to be announced before COP28. This could produce a significant regulatory pulse for other countries to follow. India, the second-largest methane emitter globally, declined to sign up to the GMP due to concerns over the impact on its agricultural economy. External pressure could see its resistance reduce over time.

COP28 will be pivotal. Countries will aim for a global stocktake, the first comprehensive assessment of GHG emissions since the Paris Agreement. This will lay bare a significant shortfall in progress, strengthening calls for more widespread targeted regulations, particularly on shorter-term, high-impact issues such as methane abatement.

What can companies and governments do?

As measurement improves and becomes less costly, the ability and willingness of both companies and governments to tackle methane will be highly influenced by the ‘what’ and the ‘where’ of emissions. There is a direct commercial imperative to act in regulated environments where carbon or methane costs apply. The incentives might be less obvious elsewhere, with little or no government push.

Oil and gas producers must turbocharge abatement

Action on methane remains one of the most achievable ways for oil and gas companies to make a sizeable dent in their scope 1 and 2 emissions. OGCI member companies have already reduced upstream methane intensity by nearly 45% in the past five years. However, the whole industry must grasp the nettle to have real impact.

- Monetisation

Companies' immediate focus should be on getting captured emissions into the sales stream. Additional revenues can help offset abatement costs. However, the cost of addressing methane leaks is often greater than the revenue loss and leaves companies with insufficient incentive for action.

Proactive upstream players can work with third-party midstream providers to avoid flaring and venting. Tougher regulation, including carbon prices and specific charges for methane leaks, will encourage operators to access markets by investing in domestic or export infrastructure.

Methane reduction as a service may also have a future. This is currently monetised in the relatively uncertain offset market amid growing interest. The American Carbon Registry recently published a methodology to generate offsets from plugging methane leaks resulting from orphan and abandoned oil and gas wells. While prices for these offsets remain low, as more stringent regulations come into play those offsets should become more valuable.

Advocating for additional financial incentives can be effective. Gas buyers are becoming increasingly focused on the methane emissions associated with their energy supplies, and the UN Environment Programme has proposed a methane supply index to allow gas buyers to understand associated methane emissions. Operators in the US and Europe are already successfully negotiating premium pricing for certified low-methane-emitting production.

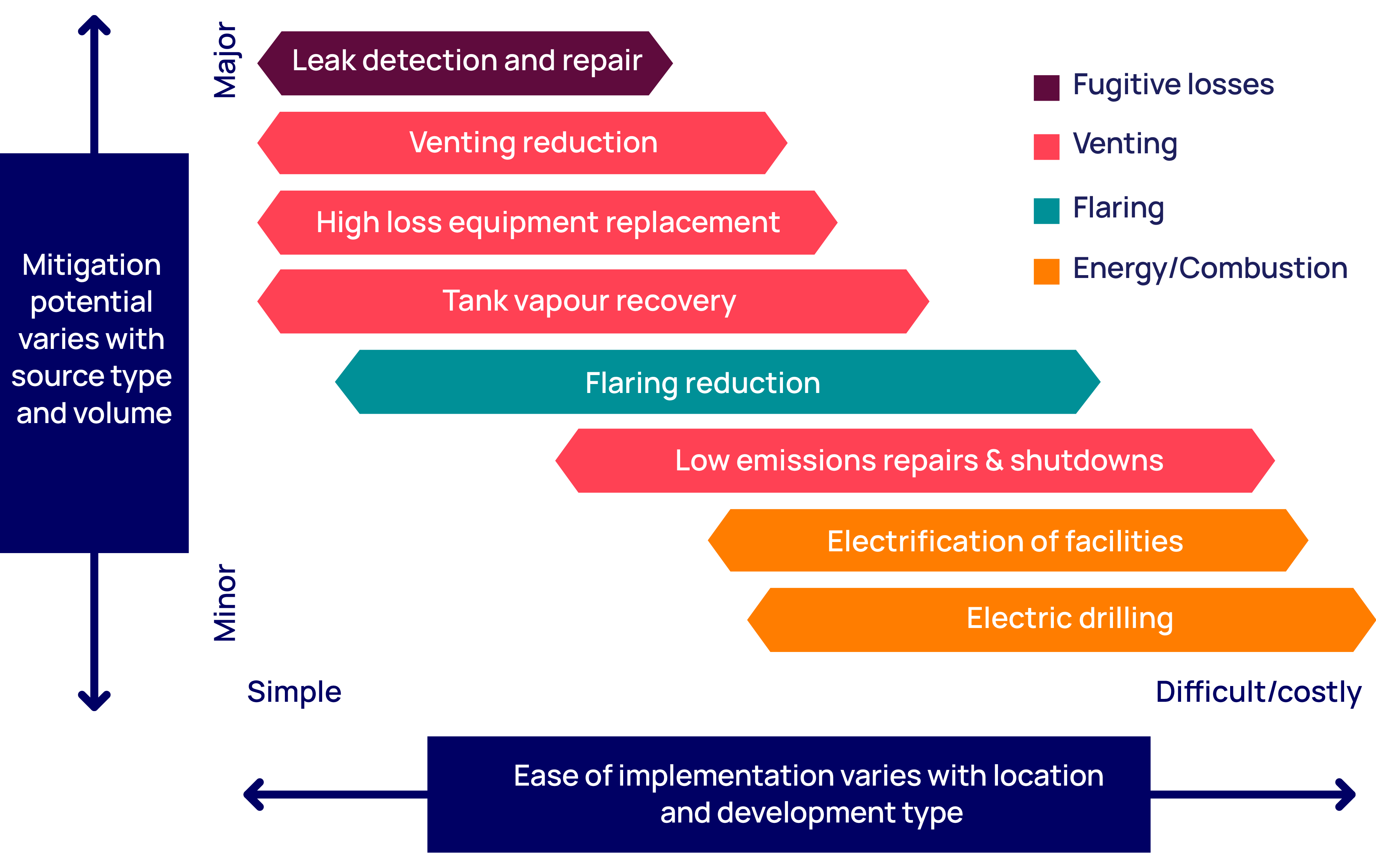

- Deployment of known solutions

Doubling down on existing mitigation efforts brings immediate benefits. Most methane reduction methods using existing technology and equipment are relatively simple and cost-effective. Reducing venting and flaring is an urgent task that does not require technological improvements and is fairly straightforward if operators have access to infrastructure, gas markets and incentives.

More regulatory support will be required in hotspots such as Africa, Russia and Asia. For routine operational emissions, progress can easily be made by better monitoring for leaks, tightening valves and swapping out high-bleed devices.

- Partnerships and collaboration

Groups advocating for rapid methane reductions, such as the UN, the OGCI and the Methane Guiding Principles, are leading the way on best practices, but need broader participation. OGCI members include most of the world’s largest upstream companies but represent only a fraction of global emissions.

The industry must work with joint-venture partners and others to expand efforts. For example, the Majors’ operated methane targets exclude the 41% of their portfolios operated by others. Widening this to include non-operated assets would improve monitoring and spread resources and costs.

More transparency on best practices and the participation of non-industry partners would lead to more efficient research and development. This could help shift the emphasis from ‘naming and shaming’ to collaborative innovation on cutting harder-to-abate emissions.

Industry methane targets should also be overhauled. Currently self-set and self-monitored, there are multiple methodologies, timeframes and goals. The upstream sector would benefit by working together on target setting; so far only the Majors have signed up to standardisation.

Figure 6: Identifying sources and quantifying volumes will guide mitigation strategies

Governments must step up to the plate

Similarly, government action will be vital to reducing methane losses. We see three high-level actions that could stimulate more progress globally.

- Greater ambition

Voluntary pledges can only take the world so far. Ambition must translate into implementable and enforceable policy. An obvious starting point is global collaboration on stopping all large-scale flaring and venting of methane. Efforts in the US and Europe to address small-scale methane leaks are touted as positive steps but must go further.

- Consistent enforcement

Lofty targets and financial penalties for non-compliance are meaningless unless effectively enforced. Sidesteps must be avoided and loopholes closed. Policymakers and regulators must also collaborate with industry to set realistic targets and timelines for emission reductions while ensuring that fees and fines are levied appropriately.

- Financial support for technology

Governments should support funding to improve both measurement technology and abatement solutions. As part of the US IRA, US$350 million in funding is available to help monitor and reduce methane emissions, while in Canada, the CleanBC Industry Fund has granted Cdn$113 million for decarbonisation initiatives.

A flexible approach to technology makes sense. While the IRA allows the use of any applicable technology, it also requires blanket OGI surveys. Where this results in cost duplication, producers will be discouraged from adopting potentially more accurate leak detection technologies.

Similarly, over-dependence on a single technology can stymie progress. Satellites are not a silver bullet; but they are part of the solution. Excitement over the role of satellites must not overshadow opportunities to use existing monitoring methods as data accuracy improves.

Liked this article? Join the debate

Hear our authors live in conversation and pose your questions in our Q&A.

Join us for a live stream event on LinkedIn on 22 November

Explore our latest thinking in Horizons

Loading...