The global power market outlook: can global power generation keep up with the energy transition?

Our 2024 global power market outlooks take a deep dive into how regions are coping with higher expectations for power demand ahead

4 minute read

Matthew Campbell

Senior Research Analyst, European Power Markets

Matthew Campbell

Senior Research Analyst, European Power Markets

Matthew is a senior research analyst with our Energy Transition Practice, focused on power market trends across Europe.

Latest articles by Matthew

-

Opinion

Video | Three FIDs, one day: a turning point for CCUS in the UK and Denmark

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

Looking back at a year of European power: 2023 in review

-

Opinion

European power markets emerge from the energy crisis

-

Opinion

How effective were EU emergency power demand reduction measures?

-

Opinion

Global power markets outlook: the energy transition gathers pace

Alex Whitworth

Vice President, Head of Asia Pacific Power and Renewables Research

Alex Whitworth

Vice President, Head of Asia Pacific Power and Renewables Research

Alex leads our growing long term and short term power research team in Asia Pacific

Latest articles by Alex

-

The Edge

Walking Japan’s energy tightrope

-

Opinion

Asia Pacific power & renewables: 5 things to watch in 2025

-

The Edge

Getting China back on track

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

Asia Pacific power and renewables: what to look for in 2024

-

Opinion

Asia Pacific energy outlook: surging power or lacking charge?

Brian McIntosh

Vice President, Americas Power and Renewables Research

Brian McIntosh

Vice President, Americas Power and Renewables Research

Brian brings more than fifteen years of power industry experience to his role.

Latest articles by Brian

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

How to address congestion risk in US power markets

-

Opinion

How to address risk from extreme weather in power markets

-

Opinion

How to address risk from the intermittency of renewable energy in power markets

-

Opinion

Can Maryland make net zero work?

-

Opinion

Global power markets outlook: the energy transition gathers pace

Ryan Sweezey

Director, North America Power & Renewables

Ryan Sweezey

Director, North America Power & Renewables

Ryan focuses on coverage of North America power markets, producing forecasts of power, capacity and REC prices.

Latest articles by Ryan

-

Opinion

The 2025 US power market outlook

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

North American power markets: navigating a trickier path to decarbonisation

-

Opinion

The Inflation Reduction Act and its impact so far

-

Opinion

The Inflation Reduction Act one year on

-

Opinion

The indefinite Inflation Reduction Act: will tax credits for renewables be around for decades?

Peter Osbaldstone

Research Director, Europe Power

Peter Osbaldstone

Research Director, Europe Power

Peter is a research director with more than a decade’s experience in European power and renewables markets.

Latest articles by Peter

-

Opinion

Iberian blackout: let the finger pointing begin

-

Opinion

European power in 2025: the pace, opportunities and challenges of the transition

-

Opinion

European power and renewables: what to look for in 2025

-

Opinion

The outlook for European power and renewables

-

Opinion

Is European power rising to the challenge of decarbonisation?

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

Dan Eager

Research Director, Europe Power & Renewables

Dan Eager

Research Director, Europe Power & Renewables

Dan is a specialist in power market investment and dispatch modelling.

Latest articles by Dan

-

Opinion

The renewables PPA landscape in Europe

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

European power markets emerge from the energy crisis

-

Opinion

Unveiling the impact of wind and solar variability on European power

Kyeongho (Ken) Lee

Head of Asia Pacific Power Research

Kyeongho (Ken) Lee

Head of Asia Pacific Power Research

Ken is the Head of Asia Pacific Power research in our Power & Renewables group.

Latest articles by Kyeongho (Ken)

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

Asia Pacific corporations hungry for green energy power up for energy transition

-

Opinion

The power of the PPA: corporate renewable procurement sets a new record in Asia Pacific

Global power demand is set to rise significantly as the energy transition progresses, with electric vehicles, decarbonised heating, artificial intelligence processing and green hydrogen all contributing strongly. But can power generation keep up, and what are the implications for supply and prices for different regions?

In our regional power Strategic Planning Outlooks, Wood Mackenzie’s expert local analysts explore the road ahead for power markets across Asia Pacific, North America and Europe. Read on to get a brief overview for each region, and fill in the form at the top of the page to access your complimentary extracts from the reports.

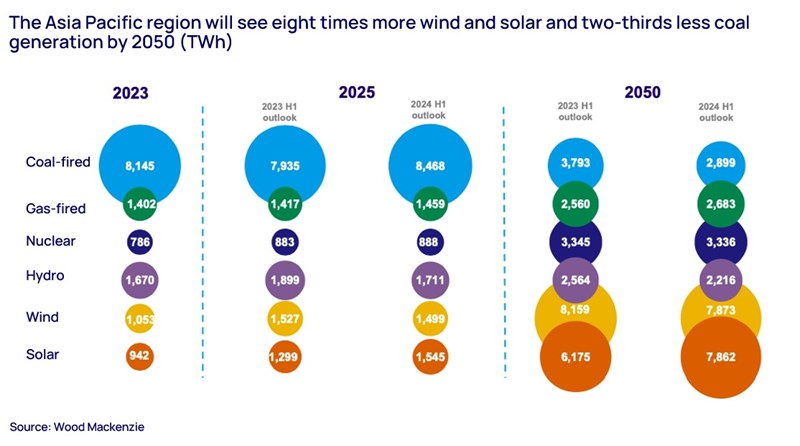

Asia Pacific: Preparing for a US$4 trillion investment boom

Asia accounted for an impressive 81% of power demand growth globally between 2015 and 2023. Demand in the region is still growing 4-5% per year and has now overtaken the rest of the world combined, setting up Asia Pacific to lead trends in electrification in coming decades.

Asia Pacific power investment is booming, with an estimated 10-year outlook at nearly US$4 trillion – that’s 50% higher than over the previous ten years. Renewable technology will be the main beneficiary, although nuclear – seen as a dispatchable, low-cost, low-emission solution – will also benefit, with capacity doubling by 2033. Overall, 84% of new investment is going into low-carbon power sources, while just 16% will be directed towards coal and gas.

The rise in solar capacity in the region is impressive, increasing eightfold to over 6000 Gigawatts (GW) by 2050 – with China accounting for 71% of that total. Wind will also grow significantly contributing almost six times more generating capacity by mid-century. Battery storage will see the fastest growth, increasing 36 times to over 1,500 GW in 2050.

Coal capacity will continue to grow until the turn of the decade, before declining steadily to 2050. However, it won’t all be bad news for fossil fuels; by 2026 Asia Pacific’s gas power fleet will take the lead over North America, becoming the largest in the world. As gas soaks up some of the demand from falling coal, Asia Pacific’s gas fleet is expected to double in size to over 1000 GW by 2050.

Other topics covered in the outlook include tracking of power sector carbon emissions and intensity for over 80 regional markets, prospects for wholesale and end-user power prices, the risk of renewable curtailment and opportunities for liquefied natural gas (LNG).

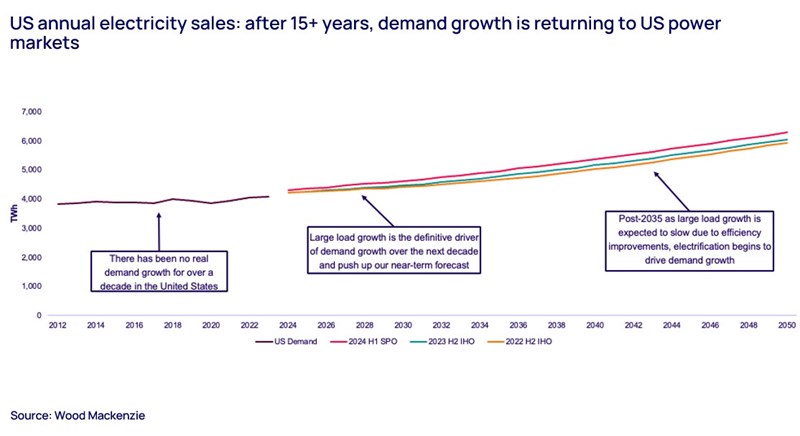

North America: Demand growth returns to the conversation

After over 15 years of virtually flat demand, large load growth from data centres and manufacturing has given the US power sector a jolt. This increased demand is concentrated regionally in hotspots including PJM, Texas, the Southeast and the Southwest. In the short term, we therefore expect some uncertainty due to constraints in supply, but over the mid-to-long term we foresee stronger demand through 2030.

From the turn of the new decade, efficiency improvements may start to slow down large-load demand growth. The growth potential of AI and the continuance and effectiveness of incentives for domestic manufacturing will be key factors in this respect. Post-2035, electrification will become the key driver of demand growth, particularly from transport.

The sudden upturn in demand creates a historic investment opportunity, while at the same time presenting a significant challenge. We expect bottlenecks such as transmission development to limit how quickly new supply can be brought online. In the short term, this is likely to lead to operators deferring planned retirements of coal and gas power stations and increased use of the thermal fleet. In fact, we now expect gas demand to stay resilient through to the mid-2040s, although by 2040 the US coal fleet will be largely retired.

The full report includes an in-depth exploration of the implications of higher demand for the investment landscape by region, sector and technology, as well as analysis of what it means for prices.

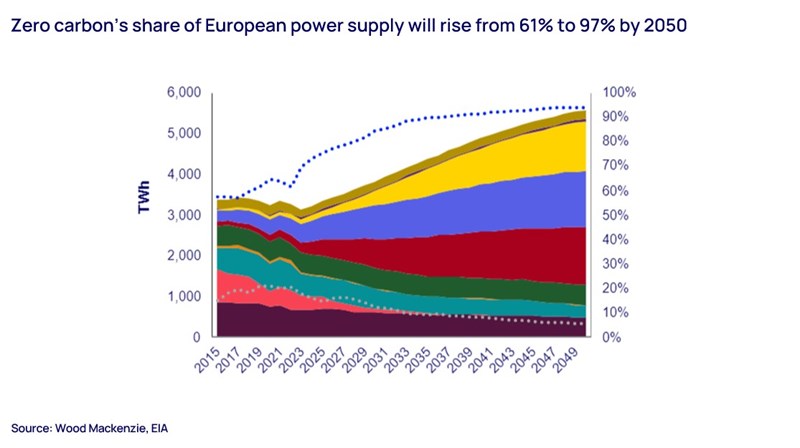

Europe: Rethinking the pace of transition in pursuit of net zero

The European Union’s REPowerEU plan aims to significantly reduce the bloc’s dependence on fossil-fuel by 2030, accelerating the transition to low-carbon energy. In pursuing its bolstered net-zero ambitions, the EU’s policymakers have focused on three key elements: boosting the delivery of renewable capacity, coordinating grid investments and incentivising electrification.

As a result of the power sector’s crucial role in Europe’s energy transition, we forecast zero-carbon generation’s share of European supply will soar from 61% in 2022 to 97% in 2050 with an investment opportunity for 301 GW of wind and 651 GW of solar in the 2024-2033 timeframe alone.

Updated 2030 National Energy and Climate Plans reveal increased renewable supply ambitions across the board for member states yet electrification isn’t happening quickly enough, with electric vehicle and heat pump deployment facing challenges.

Nevertheless, Europe’s supply from renewables will climb steeply in the 2030s as project economics and policy goals align. Solar will dominate capacity, but higher utilisation rates will mean wind accounts for 46% of supply by 2050 (compared to solar’s 27%).

Learn more

Don’t forget to fill out the form at the top of the page to access your complimentary extracts from the full reports, which include a range of charts and data exploring these themes in more detail.