Sign up today to get the best of our expert insight in your inbox.

Big Oil’s opportunity for M&A in the petrochemicals downturn

Access to key growth markets in Asia is the prize

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Kelly Cui

Principal Analyst, Petrochemicals

Kelly Cui

Principal Analyst, Petrochemicals

Kelly is an expert in the coal-to-olefins (CTO) and methanol-to-olefins (MTO) sector.

Latest articles by Kelly

-

Opinion

Which global steam crackers are at most risk of closure?

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Why crude-to-chemicals is the obvious way forward

-

Opinion

Coronavirus to disrupt China’s chemicals sector more than SARS

-

Opinion

Can China’s CTO and MTO industries survive the threat of massive steam cracker investment?

-

Editorial

Why is China the early adopter of CTO/MTO

Darryl Xu

Principal Analyst, APAC Chemicals

Darryl Xu

Principal Analyst, APAC Chemicals

Darryl specialises in aromatics, and manages our global paraxylene and benzene/styrene research in Asia.

Latest articles by Darryl

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Will Shell exit Pulau Bukom?

-

Opinion

Plastic circularity: how much will recycled plastics displace oil-based feedstock?

-

Opinion

Petrochemical feedstocks: three global trends to watch

Yuqi Hu

Managing Consultant, Corporate Research

Yuqi Hu

Managing Consultant, Corporate Research

Yuqi is a Senior Consultant on the Corporate Research team. She has worked at Sinopec, Aramco and Clariant.

Latest articles by Yuqi

-

Opinion

How do integrated companies position themselves in the changing downstream landscape?

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Are NOCs prepared for the energy transition?

Alan Gelder

VP Refining, Chemicals & Oil Markets

Alan Gelder

VP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

Opinion

Forecasting the future of oil demand: five key questions answered

-

Opinion

How do integrated companies position themselves in the changing downstream landscape?

-

Opinion

Which global steam crackers are at most risk of closure?

-

Opinion

Assessing the refineries at risk of closure

-

Featured

Oils & chemicals 2024 outlook

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

Petrochemicals may be experiencing a severe cyclical downturn, triggered by excessive capacity build-out, but it’s one of the oil and gas sector’s best long-term bets. Its sustained growth prospects reflect the incredible utility of plastics. But another key attraction is petchems’ lower greenhouse gas emissions through the value chain relative to the combustible fuels that account for most of the dollars in a typical barrel of oil.

I asked our Research experts – Kelly Cui, Darryl Xu, Yuqi Hu and Alan Gelder – about the timing of petrochemicals’ recovery and whether the downturn might spark change in the corporate landscape.

First, the bullish long-term outlook for petrochemicals demand is undimmed by the current downturn. One measure is feedstock – we expect demand for naphtha and LPG to increase by 7 million b/d, or 50%, through 2050. In contrast, demand for combustible fuels for each of the road transport, shipping, RCA, industry and power generation sectors peaks and enters terminal decline in the next 10 years. Jet fuel for aviation, which is harder to decarbonise than other transport fuels, is an exception.

Most petrochemical demand growth is about plastic in its multifarious forms, driven by rising GDP, population and prosperity in developing economies, and Asia in particular.

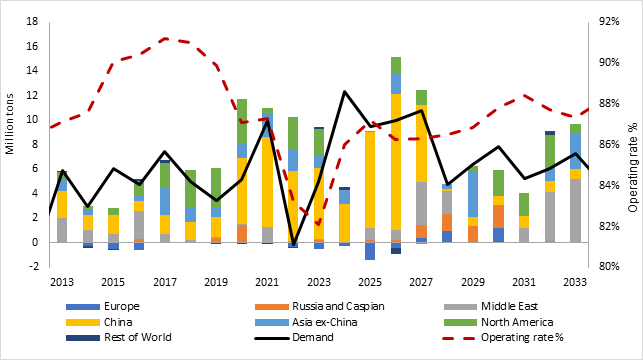

Second, the downturn is of the industry’s own making. Eyeing future growth, companies have over-invested for several years. Annual capacity additions in ethylene, the building block of the plastics product suite, have increased five-fold from 2.3 million tons at the 2015 low point to over 10 million tons from 2020 to 2023.

China is responsible for two-thirds of the new ethylene capacity and will also triple domestic paraxylene (PX) capacity, a key raw material for producing polyester. China’s investment surge results in part from private polyester producers – previously heavily reliant on imports – back-integrating into refining to lock in PX feedstock. The other factor is strategic: the giant Chinese NOCs, Sinopec and PetroChina, in adapting for the transition, are investing to skew downstream portfolios away from fuels towards petrochemicals products.

With global ethylene capacity build outstripping demand growth by two to one over the last four years, the industry’s operating rate has fallen from over 90% in the four years to 2019 to 82% in 2023. Other petrochemical products are also suffering from falling utilisation rates. Profit margins have been squeezed and much of the petrochemicals industry is under severe financial pressure.

The immediate outlook remains challenging. Investment outside China has come to an abrupt halt, but in China itself, capacity additions don’t peak until 2026. Global demand will jump from 2024 on our forecasts as the global economy recovers but it will take time to absorb the surplus capacity. We don’t expect operating rates to get back to 90% until the end of the decade.

Best placed to weather the storm are gas-based crackers in the Middle East and the US, with low feedstock costs and integrated refiners/petrochemical facilities that have optionality in both fuels and petchems.

Third, the downturn will accelerate industry consolidation. Higher-cost, standalone units are most at risk. China has already announced the closure of five small steam crackers, taking 1.2 Mtpa of ethylene capacity out of the market by 2026. We expect more Asian crackers to close in Taiwan, Japan and South Korea. In Europe, six crackers totalling 2.5 Mtpa of ethylene capacity could close in the next few years. Paraxylene capacity rationalisation will be a trickier proposition, given its close integration with refinery gasoline production.

The downcycle also presents an opportunity for strategic buyers – and big integrated players in particular – to strengthen their portfolios for the transition. We expect IOCs will continue to be net sellers, high grading portfolios around advantaged assets in the US, Middle East and Europe.

Middle Eastern NOCs will look to extend their reach into growth markets. ADNOC is particularly active – it’s bidding for a minority stake in Braskem, the Brazilian petrochemical business with global exposure across plastics markets; and has also made an offer for Covestro, a producer of high-performance engineering polymers, which is listed in Frankfurt but has global reach.

The big question: how can Middle Eastern NOCs gain a bigger foothold in the key Asian growth markets? The primary goal of Saudi Aramco and others in building significant downstream assets in Asia over the last decade has been to secure offtake for crude oil production. These facilities now offer opportunities for organic growth in petrochemicals; to serve as a platform for further acquisitions; or to forge new partnerships in the sector.