Get in touch

-

Sonia KerrSonia.kerr@woodmac.com

+44 330 174 7267 -

Kevin Baxterkevin.baxter@woodmac.com

+44 408 809922 -

Vivien LebbonVivien.lebbon@woodmac.com

+44 330 174 7486 -

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Europe's Green Deal and pandemic recovery to take centre stage in 2021

Wood Mackenzie highlights 5 key trends to watch in European power markets

1 minute read

With hopes of vaccines setting a better course for 2021, this year will see policymakers and market participants focus on initial but substantive steps towards net-zero objectives.

What are the biggest trends to watch in European power markets in 2021? Rory McCarthy, Wood Mackenzie Senior Research Manager, sees five key themes:

- Laying the foundations for EU Green Deal delivery

- A record-breaking year for renewables auctions

- The return of power demand

- The supply balance begins to tighten

- Power markets become more integrated

McCarthy said: “From the depths of its worst-ever economic crisis, the EU’s efforts to focus on recovery have been distracted by the resistance of two of its members to rule-of-law clauses attached to the provision of recovery funding, as well as post-Brexit trade negotiations.

“On the former issue, this stand-off was finally resolved on the 10th December, paving the way for recovery funds to be deployed across all 27 Member States from the 1st January 2021 and allowing the EU to avoid beginning the year on an emergency budget.”

While the UK’s enduring trade relationship with its ex-partners remains uncertain, its government has been active in defining national climate objectives. With a revised emissions reduction goal of 68% by 2030 in place, the UK’s energy market is now sorely in need of detail on key policy measures and commercial frameworks.

As the UK charts its own course outside the EU, the remaining 27 Member States will make progress of their own. Having resolved budgetary negotiations, the European Council moved on to endorse a regionally binding 55% by 2030 emissions reduction goal. This was an important step, underlining Green Deal priorities by committing the immediate pathway to net-zero emissions by 2050. EU focus must now shift to delivery.

“Strengthening and expansion will be a key theme across policy and market instruments in 2021, so watch for progress on national energy and climate plans, and the EU Emissions Trading Scheme (ETS) as well. The more controversial carbon border adjustment mechanism may develop more slowly. Meanwhile, more national policymakers will take an interest in carbon taxes and related measures in non-ETS sectors, targeting otherwise hard-to-reach emitters,” added McCarthy.

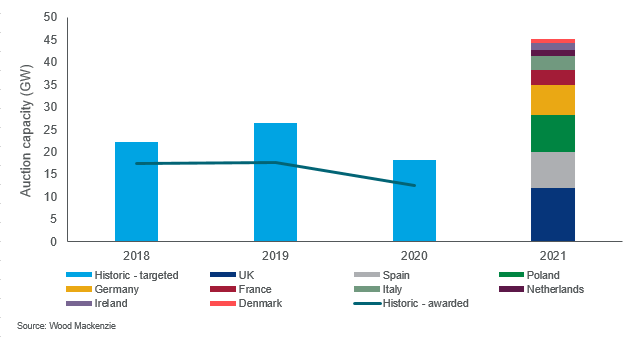

As the race to meet 2030 targets begins, 2021 is set to be a record-breaker for renewable auctions in Europe, says Wood Mackenzie.

“A mammoth 45 GW of capacity is in the auction pipeline for Europe, a significantly higher total than those targeted in recent years. The total consists of 17 GW of wind and 6 GW of solar PV, with the remainder of auctions being either technology-neutral or applying to several sources. Previous auction outcomes highlight that there is no guarantee the targeted volumes will be achieved. Over the past three years, European auctions have seen an average award rate of 70%. If this same level of success is achieved in 2021, we could see upwards of 30 GW of capacity awarded.

“Clearly, wind and solar PV will represent a vast majority of capacity procured in 2021. Whilst delivering low-cost, low-carbon power in abundance, the non-dispatchable nature of these technologies presents a flexibility challenge to power systems. This has already started to manifest in several markets, with negative day-ahead and intra-day power prices occurring during periods of high non-dispatchable renewable generation and low demand. Coronavirus-related demand issues aside, expect the frequency of negative prices to increase.

“This raises the question: are policymakers aware of the flexibility challenge ahead? While negative prices should receive much greater focus over the coming year, we think price signals alone are unlikely to trigger new investment in much-needed flexible resources,” said McCarthy.

The mildest winter on record followed by national lockdowns put a huge strain on energy demand in Europe during 2020. Restricted activity and subsequent economic recession saw reductions in national power demand between 10% and 20% across the region’s major markets. Losing this much system load had a fundamental impact on the cost and source of marginal supply. Renewables were increasingly at the margin, pushing coal and gas out-of-the-money. Coal’s predicament was compounded by cheap gas, making even the most efficient coal plants uncompetitive.

“Once government restrictions are eased and industrial activity recovers in 2021, power demand will return, and we expect this to support higher prices. As the world returns to normal, we think demand recovery will emerge as a stronger theme in the second half of 2021,” said McCarthy.

As power demand recovers, grid operators will be increasingly challenged by the need to source enough dispatchable capacity amid outages and periods of low renewable output, particularly during colder months. This supply balance challenge came to the fore in the fourth quarter of 2020 and will continue to tighten into 2021. Supply concerns have already been particularly noticeable in Great Britain this winter with National Grid’s recent flurry of tight margin notices, the first Capacity Market stress event calls, and additional system balancing products being brought to market. France also heads into the core winter months with a weaker supply balance.

“In the absence of major additions of flexible resources, supply pressure in 2021 will be determined by the availability of existing generators and the scale of thermal plant closures. The ability of Europe’s power systems to cope with the winter’s challenges will be a significant indicator of future flexible supply requirements and overriding policy direction on matters of system security and reliability,” added McCarthy.

Balancing and day-ahead markets will see further harmonisation, while the build-out of HVDC interconnectors in 2021 will continue.

Unlike other energy commodities, power is not heavily traded across borders. Only 3% of the world’s electricity is traded between countries, and the majority of this occurs in Europe. Physical interconnections and market integration have increased ever since the market was liberalised.

“With continuing growth in wind and solar output, and its impact on market balance, there is an increasing need for diversity in national supply. Market integration will be high up the agenda of regulators and policymakers in 2021. Key developments in this area will include: The Trans European Replacement Reserves Exchange (TERRE), day-ahead market coupling, physical interconnector development and, of course, the Brexit elephant in the room,” said McCarthy.