Stick or twist:

Should gas resource holders target LNG exports or blue ammonia?

June 2023

Authors

Should gas resource holders target LNG exports or blue ammonia?

As Europe moves away from Russian gas and Asia scrambles to reduce its dependency on coal, there has arguably never been a better time to invest in liquefied natural gas (LNG). As the energy transition accelerates, however, even its most ardent supporters recognise that the party cannot last forever. The allure of a 30-year LNG investment will soon fade.

Consequently, companies and countries looking to develop gas resources for export will increasingly face a choice: follow the established playbook and build LNG facilities, or develop blue ammonia by producing low-emission hydrogen by way of gas reforming with carbon capture and combining it with air-sourced nitrogen. As new projects look to move forwards in the future, a decision to stick with LNG or ‘twist’ on blue ammonia must be made.

Blue ammonia now offers a credible alternative to LNG for gas monetisation. Governments are ramping up subsidies to support development, while rising CO2 costs in key markets make the economics of low-carbon ammonia more attractive than its unabated version. Low-carbon ammonia is also emerging as a credible option for power generation, as well as parts of the economy that are harder to decarbonise, including marine fuels.

Blue ammonia is not without its challenges, though. Rival green ammonia, produced from electrolytic hydrogen powered by renewables, is overwhelmingly considered the future of low-carbon ammonia. Right now, large blue ammonia projects offer earlier scale at lower cost in many parts of the world, but falling costs for renewables and electrolysers will eventually close the gap.

And while Europe is providing certainty on the cost of CO2 to support blue ammonia, across Northeast Asia, limited progress has been made on placing a cost on carbon. This calls into question the potential scale of the low-carbon ammonia market in this important region.

Given such uncertainty, gas resource holders, infrastructure developers and utilities face tough choices ahead. Will the competitive economics, maturity and scale of LNG slow the pace of blue ammonia growth in key sectors? Could falling green ammonia costs eat blue ammonia’s lunch? Will governments in Asia move fast enough to place a higher cost on CO2 to support demand for low-carbon ammonia?

Growth abounds, but with different drivers

Global LNG players are scrambling to develop new supply. Some 180 mmtpa of LNG is already under construction, equivalent to 45% of the current market. We have identified advanced proposals to develop a further 250 mmtpa across Qatar, North America and elsewhere.

Projects to develop the nascent blue ammonia industry are also emerging. QatarEnergy last year announced plans for a 1.2 mmtpa project that could come to market in 2026. OCI, a specialised fertiliser and chemicals producer, is partnering with Linde to develop a 1.1 mmtpa blue ammonia plant in the US. Momentum continues to build with multiple project announcements in the US, backed by a variety of companies. But will blue ammonia ever scale up to position as a material alternative to LNG?

With so much at stake, we consider the cases for and against LNG and blue ammonia, the relative economic advantages of each and the implications for companies invested through the value chain.

Key questions supporting blue ammonia’s global emergence

The case for LNG

For holders of large, low-cost gas reserves, LNG remains the most obvious route to export. Global demand is continuing to rise and, as prices return to some sort of normality, fresh momentum is emerging in Asian markets.

In our base-case Energy Transition Outlook (ETO), consistent with temperatures increasing 2.5 °C from pre-industrial levels, we see LNG demand growing around 300 Mt to reach more than 700 mmtpa by 2050. This requires major investment in new supply. In addition to the more than 180 mmtpa already under construction, the ETO needs a further 50 mmtpa of new pre-FID (final investment decision) supply by 2030 to meet demand.

As the energy transition gathers pace, stakeholders are questioning whether longer-term demand for LNG is so assured.

But neither growth nor revenue is locked in. As the energy transition gathers pace, stakeholders are questioning whether longer-term demand for LNG is so assured. In our Accelerated Energy Transition (AET-1.5) scenario, which aligns with the most ambitious goal of the Paris Agreement to limit temperature increases to 1.5 °C, the world needs far less new LNG supply. This is no doomsday scenario. The market will still need 160 mmtpa of new LNG supply to be developed as demand rises to 600 mmtpa by 2040. But beyond this time, developers face the risk of declining prices and underutilisation as demand reduces to 500 mmtpa by 2050 under our AET-1.5 scenario.

We are not there yet, but these risks are already impacting developers' ability to secure financing. Several European banks and export credit agencies have withdrawn from directly financing new LNG projects. Given LNG’s relatively high emissions footprint prior to combustion and the risks to project profitability, others are likely to follow suit.

Faced with these challenges, holders of undeveloped gas resources must consider alternative ways to monetise gas exports. Blue ammonia has quickly risen to the top of the pile.

The case for blue ammonia

As hydrogen gains ever more attention, the opportunities and challenges facing developers are crystallising.

Government support is building and definitions as to what denotes low-carbon – or clean – hydrogen are now clearer. While subsidies and rules in most markets focus on enabling the scaling up of electrolytic (green) hydrogen, blue hydrogen remains more competitive and offers scale more quickly. And when it comes to the seaborne hydrogen trade, ammonia is the only option in this investment horizon.

At 180 mmtpa, the existing ammonia market is substantial. But it is also carbon intensive, accounting for 1.5% of global CO2 emissions. In our base case, we expect global ammonia demand from traditional sectors, including fertiliser and other chemicals, to reach 285 mmtpa by 2050. Non-traditional demand, mostly in power and marine fuels, adds 115 mmtpa, taking the total ammonia market to 400 mmtpa by 2050 in our base case. Low-carbon ammonia supply meets 225 mmtpa of this total.

Future non-traditional demand sectors will be met exclusively by low-carbon ammonia. For traditional sectors, US subsidies will enable displacement in existing carbon-intensive facilities. The cost of CO2 in the EU and UK, paired with subsidies, will enable displacement in those markets. But opening markets in Asia will be challenged by the lack of a material cost on CO2 – especially in ammonia’s traditional, price-sensitive sectors, such as fertiliser.

Longer term, green ammonia will prove more attractive

If all forecast low-carbon ammonia in our base case by 2050 were to be blue, it would require 186 bcm of gas to produce. However, we expect the actual opportunity for gas into traded blue ammonia to be a mere fraction of this. Some existing ammonia producers will retrofit plants with carbon capture, use and storage (CCUS) as a cost-effective way of producing blue ammonia in situ. Longer term, green ammonia will prove more attractive, as it can draw on stronger political support and be truly net zero with the right rules in place. Consequently, the scope to develop blue ammonia for export in our base case ETO is limited to 10-20 mmtpa in 2050, requiring only 8-16 bcm of gas.

However, in our base-case forecast, the world fails to achieve net zero emissions by 2050. Demand for low-carbon ammonia reaches 570 mmtpa by 2050 under AET-1.5. And while green ammonia dominates, the opportunity for blue ammonia exports exceeds 50 mmtpa by 2050, requiring more than 40 bcm of gas. Consequently, blue ammonia can emerge as a material opportunity to monetise gas resources in global seaborne trade.

Policy supports the outlook for low-carbon ammonia

Hydrogen projects can capture differing levels of subsidy depending on type and location. The US has attracted significant interest, with up to US$3/kg available to green hydrogen production for 10 years, while blue hydrogen projects can secure US$85/tonne for CO2 captured when pairing hydrogen production with CCUS. Critically, these levels of subsidy allow both green and blue ammonia to compete with the carbon-intensive alternative. Governments elsewhere are under pressure to match these to attract investment.

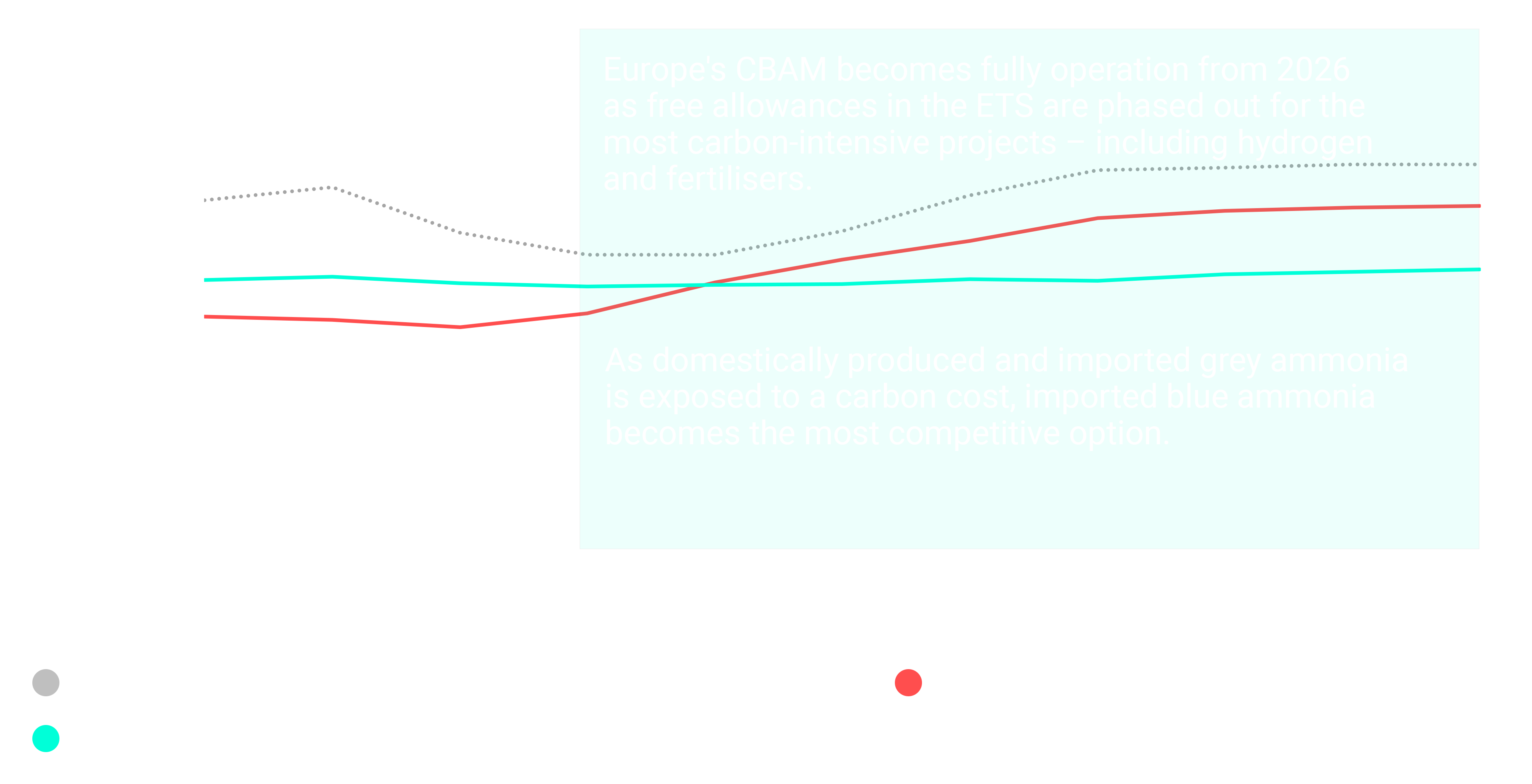

But what makes ammonia exports so compelling is the implementation of Europe’s Carbon Border Adjustment Mechanism (CBAM). This will be phased in as free allowances to European industries are removed, exposing both unabated European ammonia producers and importers to the full cost of the EU’s Emissions Trading System (ETS). This means that ammonia prices will increase by 60%, assuming a carbon price of US$100/t. Consequently, low-carbon ammonia exports to Europe will become the most competitive option.

Delivered cost of ammonia to northwestern Europe

Infrastructure opportunities in ammonia

With the trade in ammonia well established, global infrastructure already exists. Several import terminals are currently expanding ammonia capacity, with others running market tests.

Offering further upside to the seaborne trade of ammonia is the potential for import terminals to incorporate cracking facilities to take ammonia back to hydrogen. The costs and efficiencies of cracking ammonia are challenging, but offer access to a wider range of end-users.

But even in our ETO scenario, infrastructure will need to scale up considerably. As part of its ambitious RePowerEU targets, Europe aims to import almost 21 mmtpa of low-carbon ammonia by 2030. Infrastructure investment opportunities should prove attractive.

What about green ammonia?

Blue ammonia will outcompete most green ammonia projects targeting FID this decade, although this gap closes beyond 2030 as the cost of renewable power and electrolysers continue to fall.

That said, the competitiveness of future green ammonia projects will also be impacted by tightening rules in Europe. These include the Delegated Acts, which sets the rules for electricity used to produce hydrogen and for the carbon intensity of hydrogen and its derivatives.

The economics of LNG versus blue hydrogen

For developers to stick with LNG or twist on blue ammonia, economics matter. Scale, value and profitability are all key to defining how capital will be allocated.

Let’s start with the size of the prize. Approximately US$250 billion of additional investment in pre-FID LNG liquefaction projects is required to meet our base-case forecasts by 2050. In contrast, US$24 billion of investment is required for blue ammonia for exports. In our AET-1.5 case, things improve for blue ammonia, with US$80 billion required compared with US$160 billion for LNG. So, for those seeking scale over the next 15 years, the prize is still LNG rather than blue ammonia.

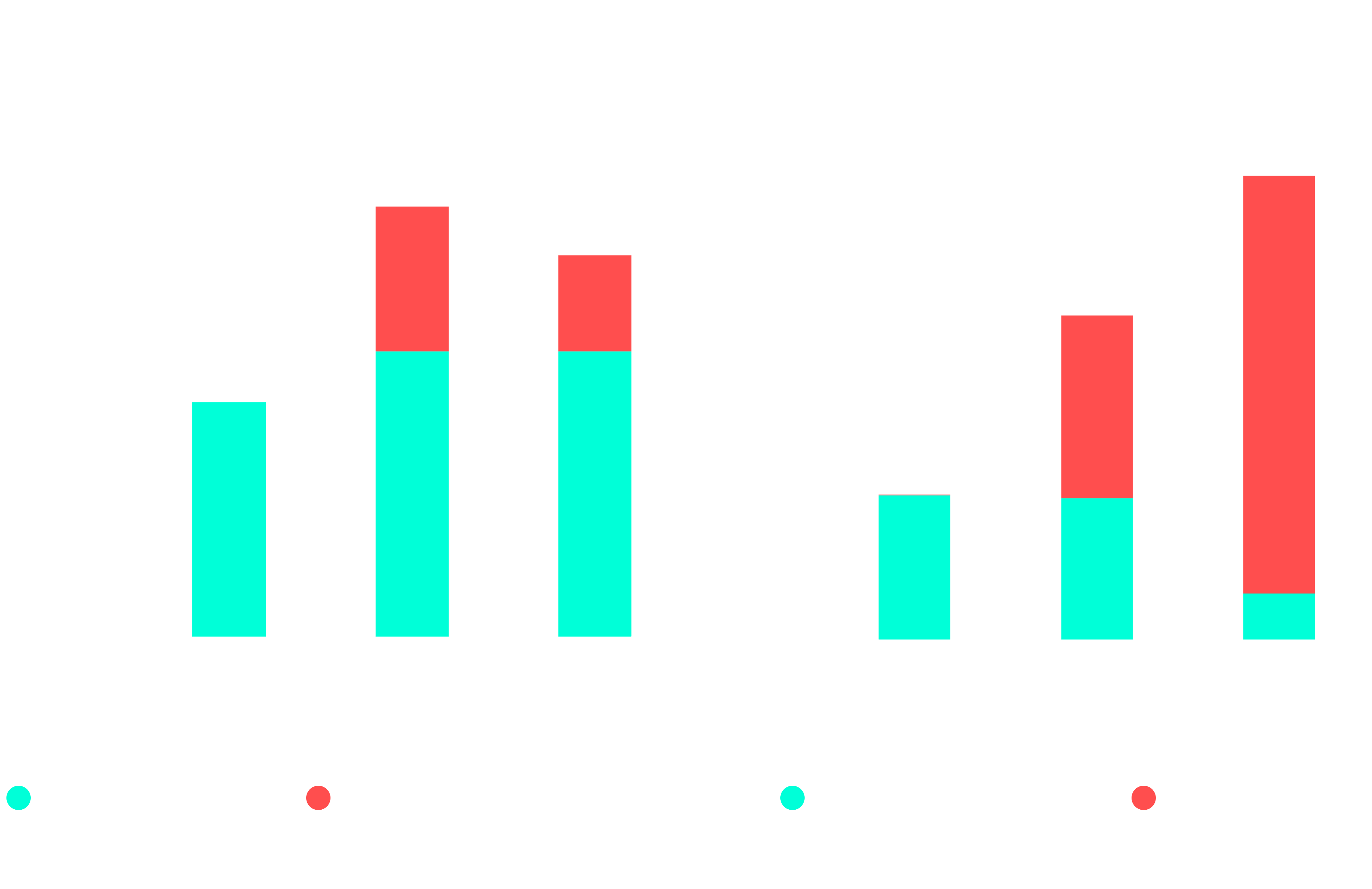

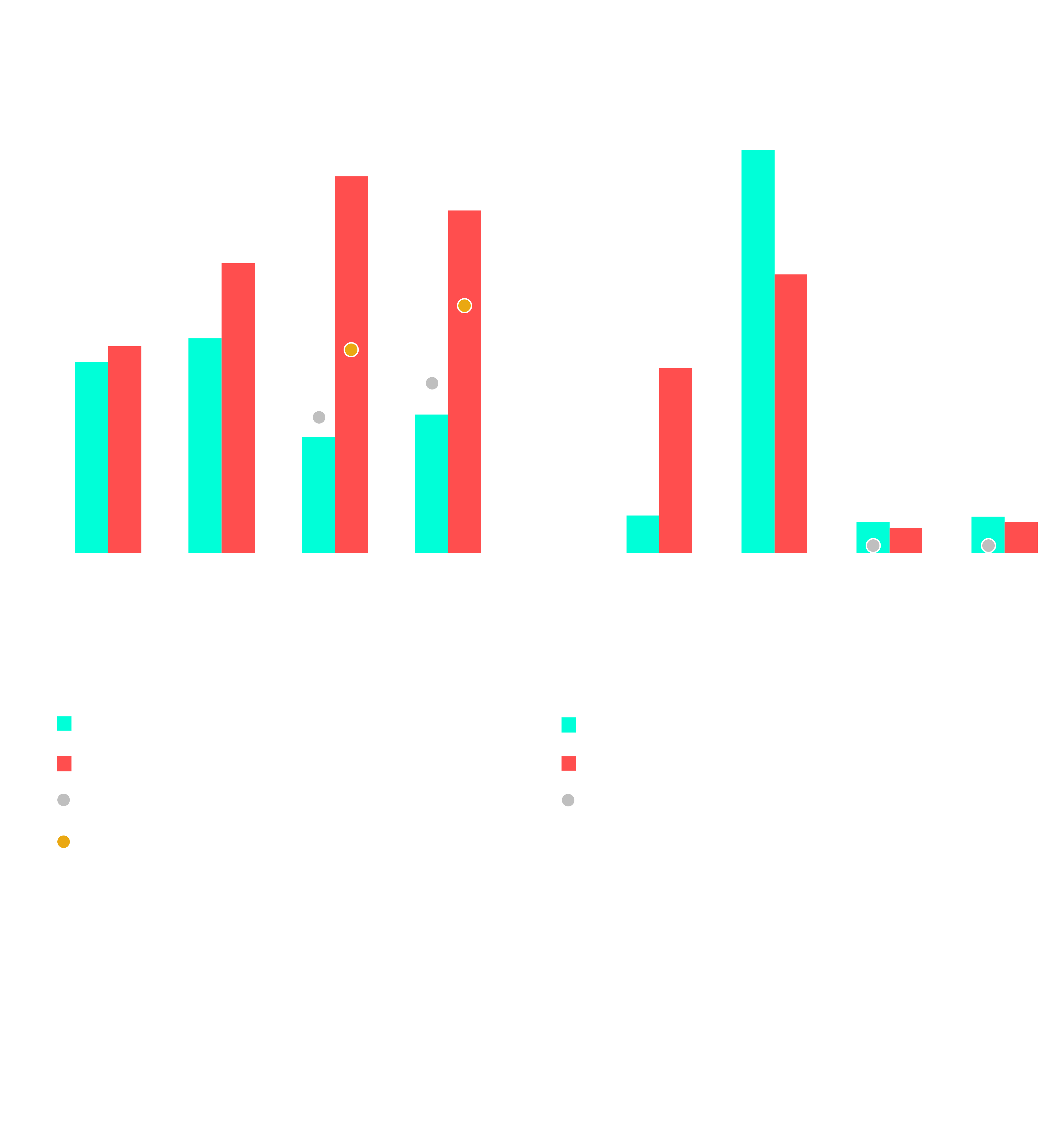

Comparison of LNG and blue ammonia projects in Qatar and the US Gulf

For profitability and value, though, blue ammonia could prove more attractive, depending on prices, costs and tax. We have used our economic models to compare key metrics under our base case price assumptions, looking at projects in Qatar and the US Gulf Coast for LNG and blue ammonia delivered to the EU.

Apples-with-apples comparisons are difficult due to different commercial structures and relative taxation. However, even once these differences are factored in, some clear high-level conclusions emerge.

First, the scale and value to be derived from LNG investments is much larger. As the industry has evolved, operators have increased project size to bring down unit costs and deliver value at scale. This has inevitably come with high upfront costs and financing requirements, but it also means high barriers to entry – LNG remains a business limited to big energy companies and well-backed US infrastructure players. We expect many will continue to push LNG developments given the scale of projects and depth of the market.

New investments in blue ammonia are currently smaller, and competition from legacy players in unabated ammonia poses risk. However, as the market becomes more material, LNG developers with low-cost gas resources and ready local markets could leverage their deeper pockets and scale up supply, thus establishing themselves as key players. Export-led projects will look first to markets like Europe offering incentives such as CBAM.

Second, the profitability and payback periods of blue ammonia investments could be much more attractive than LNG. This will in part depend on location and relevant tax regime, with the US 45Q tax credit providing a hedge compared with Qatar, despite higher nominal feedgas costs. But the biggest potential boost to blue hydrogen economics hinges on how carbon is priced at consumption. Locking in European demand through long-term contracts could deliver internal rates of return for blue ammonia that are higher than those of LNG, halving payback periods. In contrast, the tax burden on LNG investments is much larger, which is presumably not lost on governments that derive major revenue from LNG exports and so benefit from higher government take.

Price, as always, is the great unknown. With volatility increasing in the gas markets, returns are less assured. But for investors interested in taking full-value-chain exposure, the potential upside could also be an attraction. Shorter payback periods for blue ammonia could be particularly attractive for those with first-mover advantage in accessing Europe. And if the world was going to edge closer to our AET-1.5 scenario, lower LNG prices and higher carbon prices would further strengthen the attractiveness of blue ammonia vs LNG.

The implications for resource holders, governments and developers

Holders of undeveloped gas reserves fully recognise that an accelerated energy transition risks leaving their resource stranded. We have not reached that point yet and, for many, LNG remains the primary option. However, resource holders, governments and developers planning 30-year investments must now start to make decisions on the allocation of engineering and technological capital to determine the outcome of future projects. What is clear is the following:

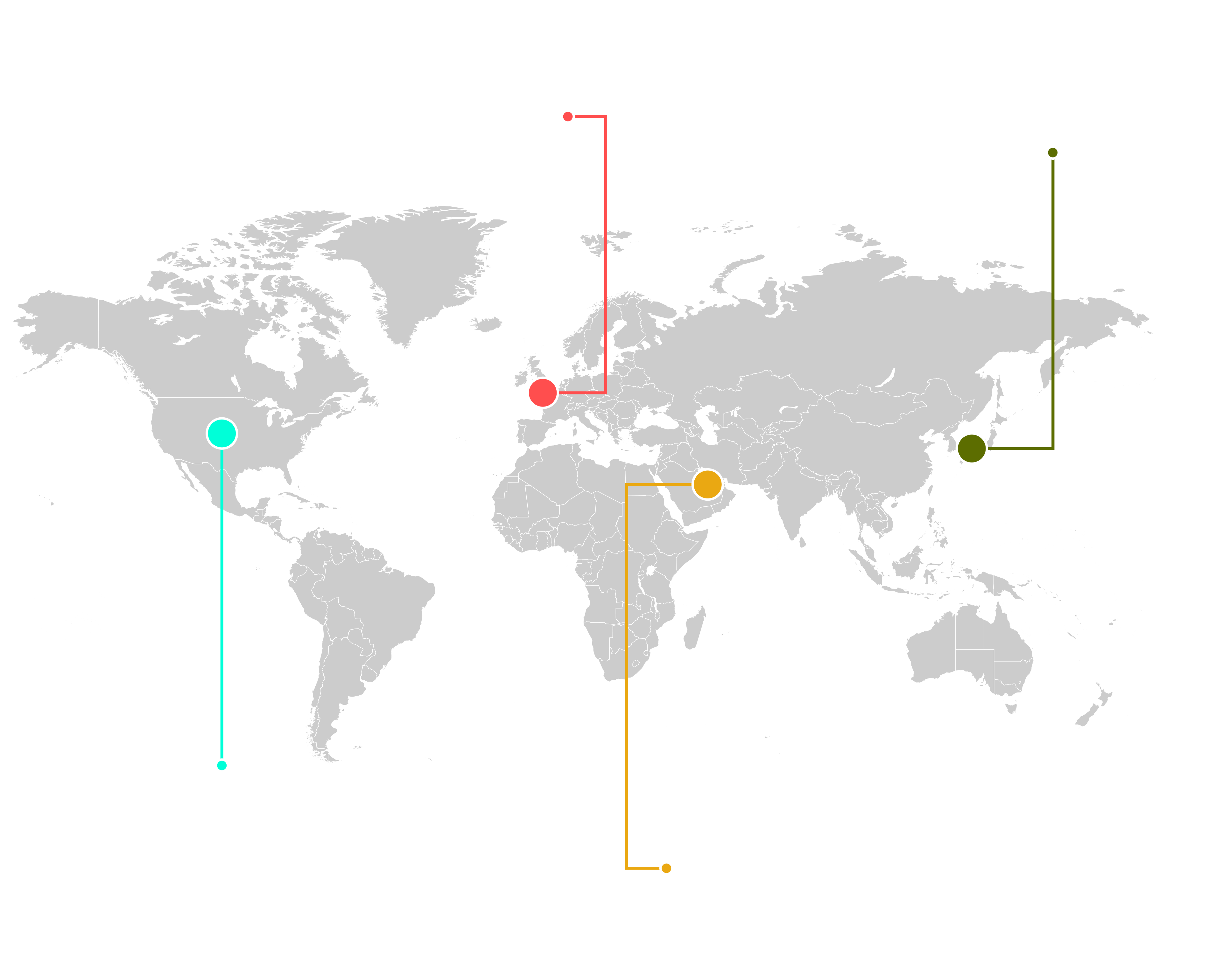

- Supply location will impact development choices.

- The decision to pursue LNG or blue ammonia will depend on taxation, proximity to market, upstream development costs and energy transition ambitions.

- The US looks attractive for blue ammonia, given its 45Q tax credits for carbon capture and support from the Inflation Reduction Act.

- Blue ammonia developers elsewhere must consider their competitiveness with the US, either by leveraging lower feedgas costs, such as the Middle East, or accommodating comparable tax incentives.

- Diversification into blue ammonia is a natural evolution for LNG developers and resource holders.

- LNG developers have already delivered projects and supported gas-intensive industries (grey ammonia, gas-to-liquid, methanol, aluminium, fertiliser exports, local power and so on). Blue ammonia can be viewed as further industrial diversification, with potentially better returns.

- There are only a limited number of ammonia off-takers right now, but this list will grow fast. A key uncertainty remains whether markets will grow at the same rate.

- Blue ammonia presents a recognisable value-chain industry with many of the same counterparties for trading, infrastructure and end-users, for example:

- JERA has executed an MoU with Yara for offtake of up to 0.5 mmtpa of clean ammonia for co-firing into power

- Vopak, Gasunie and HES are jointly developing the ACE Terminal for ammonia imports into the Netherlands

- RWE, Uniper, and many others are engaged in US blue ammonia developments

- Mitsui, Mitsubishi and other large traders operating across the value chain.

- Building blue ammonia could enable the scaling of the nascent CCUS industry, which is necessary to support the decarbonisation of existing upstream and energy investments.

- Developing new demand for low-carbon ammonia is key.

- Some of the traditional markets are all good candidates to develop demand for low-carbon ammonia, with Europe the biggest target given policy support.

- Marine fuels offer huge potential. Capturing combustion emissions on ships remains challenging, and while LNG is surging to support this, it is also fast going out of fashion.

- The use of ammonia as a marine fuel has its challenges but is one of the few options that offers full decarbonisation for shipping at present.

- Power could be the ultimate prize but will be dependent upon successful adoption in north Asian markets.

- The competitiveness of blue ammonia versus LNG and green ammonia will decide its fate.

- Much will depend on the cost of developing upstream gas combined with CCUS and future policy in Asia to tax carbon at a higher rate.

- But progress in both areas would also increase LNG’s competitiveness versus coal and bolster the LNG demand outlook in Asia.

- Blue ammonia economics are more attractive than green today, but for how long?

- If developers pile into blue ammonia en masse, could we even see a glut, cratering prices?

Explore our latest thinking in Horizons

Loading...