Big themes and risks for energy in 2021

Five to watch – economic boom, action on climate change, oil demand, industry finances and upstream investment

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

How and why big oil is strengthening its oil and gas exposure

-

The Edge

Is net zero by 2050 at risk?

-

The Edge

Can emissions taxes decarbonise the LNG industry?

-

The Edge

Why the transition needs smart upstream taxes

-

The Edge

Can carbon offsets deliver for oil and gas companies?

-

Featured

Wood Mackenzie 2023 Research Excellence Awards

After a tumultuous twelve months, what will shape the energy world in 2021? Here are five themes to watch – and the associated risks.

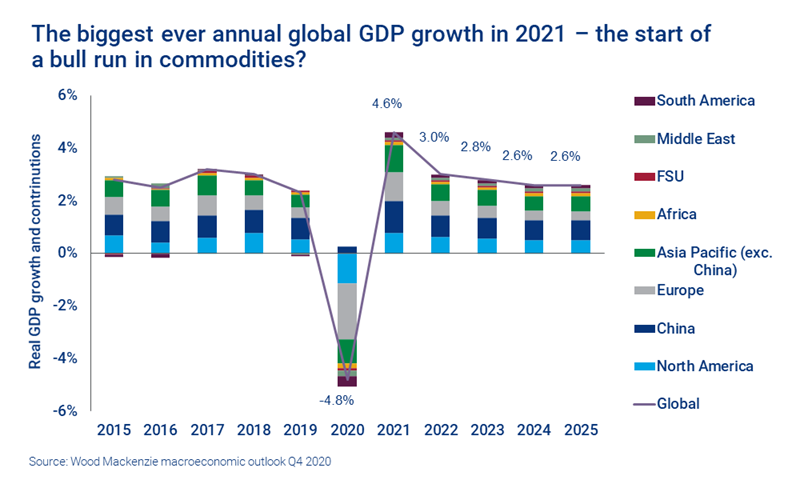

1. From economic bust to boom

The start of Covid-19 vaccination programmes means the upside of a quicker economic recovery becomes a real possibility. If global GDP surpasses the 2019 peak, in 2021 we will experience the biggest ever annual increase in economic output. That would add around US$4 trillion to GDP – equivalent to another Germany, the world’s fourth largest economy. Although a bounce is hardly unexpected after the recession, the magnitude of recovery can still make an impression.

Certainly, it’s a better backdrop for commodities – copper’s soaring price in recent months is an indicator of cyclical upturn. Might 2021 even be the start of sustained higher commodity demand through the decade, another super-cycle?

Our economic view is more sober – with GDP growth averaging 2.1% annually, lower than the 2.9% since 2000. Yet investment in the energy transition is a new driver for commodities, at least US$40 trillion over the next twenty years on our estimates. It’s central to the post-pandemic stimulus packages and will carry on well beyond. That augurs well for – among them copper, aluminium, nickel, lithium, cobalt, perhaps gas and LNG too.

The risks? Many. Delays to the vaccine roll-out could choke off recovery. Scars from the pandemic could also hold back growth. Highly indebted governments might rein in spending. Rising income inequality promotes populism and protectionist policies. And deglobalisation – countries ‘going it alone’ might undermine the global economic expansion.

2. Action on climate change steps up

Hopes are rising that COP 26 in November 2021 can deliver a successful new round of five-year commitments to get the world onto a 2 °C or lower trajectory by 2050.

The key pieces of the jigsaw are coming into place: carbon neutrality commitments from China (2060); net-zero from South Korea, Japan and Canada (2050); ratification of the EU Green Deal due in the early months of the year; the UK setting higher emissions targets; and a Biden presidency expected to sign an Executive Order to bring the US back into the Paris Agreement.

Ambitions for companies are snowballing too. Equinor is the latest oil Major to set a net zero 2050 target, as have steel and mining giant ArcelorMittal and the biggest thermal coal trader in the world, Glencore.

The risks? The Senate and/or the Supreme Court could tie Biden's hands on US decarbonisation. We could see no progress on carbon pricing in hard-to-decarbonise sectors. Governments’ resolve to cooperate on tackling climate change could be distracted by the need to rebuild economies in the wake of Covid-19. These could delay the investment needed to commercialise new zero carbon technologies like green hydrogen and CCUS.

3. Balancing the oil market and Iran

Hope is in the air – we continue to expect an exceptional year for oil demand growth, up 6.6 million b/d as the global economy rebounds. OPEC+ enters 2021 constraining supply and nursing the market back into balance. The 0.5 million b/d increase of supply from January, cobbled together as a compromise by the group, will go toward meeting resurgent demand. We think Brent will move above US$55/bbl by end 2021.

The risks? More delays in controlling the pandemic would stall demand recovery. Iran looms large on the horizon. Iran may be tempted in coming months to increase exports from today’s minimal levels to test the geopolitics, adding to the challenges of OPEC+. Were sanctions to be lifted – unlikely until 2022 at the earliest – up to 1 million b/d of crude could return to market within months.

The Biden administration could decide to return the US into the international deal. Any negotiations are not likely to begin until after Iran’s own presidential election in June 2021, and Iran must first comply with the significant hurdle of the Joint Comprehensive Plan of Action (the Iran deal).

4. Rebuilding the sector’s financial strength

The oil industry’s balance sheet has been shot to pieces in 2020 by earnings losses and negative cash flow, topped off with asset write-downs. Financial leverage for the Majors averaged 30% end Q3 (including operating leases), the highest this century and double that of a decade ago. Much of the rest of the industry is in an even weaker position.

The cost cuts, write-downs, budget and dividend cuts of 2020 have primed the Majors for a powerful V-shaped bounce.

All that could start to flip strongly the other way in 2021. The cost cuts, write-downs, budget and dividend cuts of 2020 have primed the Majors for a powerful V-shaped bounce. The industry needs Brent above US$41/bbl in 2021 to generate positive free cash flow on our calculation; at our 2021 forecast of US$51/bbl deleveraging will be underway in earnest. The Majors’ leverage falls to a ‘comfort zone’ of 10% to 20% in just two years if Brent averages US$60/bbl.

Asset sales are another option and many companies plan to shed non-core assets. The Majors would have to sell up to US$50 billion of assets to get leverage down to the same range; the wider industry perhaps US$200 billion. Both would take years to work through.

The risks? Modest oil prices could force the more financially stretched to sell assets below value into an illiquid M&A market and to make deeper investment cuts.

5. Oil and gas investment at fifteen year low

Financial pressure is one reason upstream investment continues its structural decline. Budgets in upstream oil and gas were slashed again in 2020, and we expect spend in 2021 of just US$300 billion, 30% down on 2019, 60% on the 2014 peak. Drilling in the US L48 is at multi-year lows, conventional FIDs in 2021 likely to be half pre-crisis levels at best.

The risks? The world may be sleepwalking into a supply crunch, albeit beyond 2021. A recovery in oil demand back to over 100 million b/d by late 2022 increases risk of a material supply gap later this decade, triggering an upward spike in price. Much the same is in prospect for LNG where demand is set to grow rapidly in Asia, new projects have dried up and can take 5-7 years to come onstream.

Thanks to: Peter Martin (Economics), Julian Kettle (Metals and Mining), Jonny Sultoon (Energy Transition Practice), Ann-Louise Hittle (Macro Oils), Tom Ellacott (Corporate Analysis) and Fraser McKay (Upstream).