What happens to gas and LNG if the energy transition accelerates?

Demand will drop off in a 2° C world, but Asia will be a bright spot for growth

1 minute read

Gas still has a role to play in reducing global CO2. But peak gas demand is increasingly becoming a matter of when, rather than if.

Kateryna Filippenko

Research Director, Global Gas Markets

Principal Analyst with a focus on the European gas market and the development of alternative scenarios.

Latest articles by Kateryna

-

Opinion

Gastech 2024: Our top three takeaways

-

The Edge

Future energy: biomethane’s time has come

-

Opinion

From digester to burner tip: navigating the fast-growing RNG industry

-

Opinion

Transforming energy: 5 key questions ahead of Gastech 2024

-

Opinion

Global gas industry in the 2050 net zero world

-

The Edge

WoodMac’s Gas, LNG & Future of Energy conference – five key takeaways

It has been a difficult year for gas and LNG, and the industry is still recovering from the impact of the coronavirus pandemic and the oil price crash. But it has also been a transformational year in the effort to limit global warming to under 2 ˚C.

Europe, China, Japan and South Korea have all committed to achieving net zero emissions by 2050 or 2060. And the US could be looking to regain a leading role in the fight against climate change under a Joe Biden administration. Despite the turmoil of 2020, the key industry players have remained focused on their energy transition targets, and in some cases have set even more ambitious ones.

But what will this mean for the global gas industry?

Demand is resilient, but the risks will grow

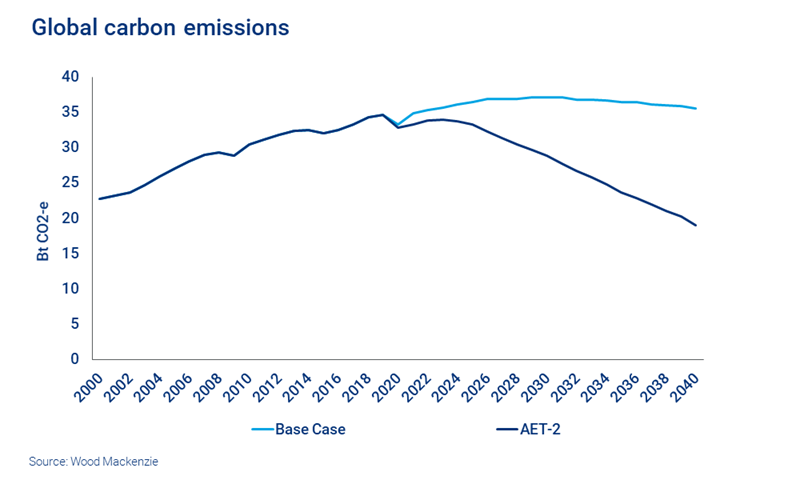

The relatively low carbon footprint of gas means it is among the most resilient of all the fossil fuels under a fast-tracked decarbonisation scenario – Wood Mackenzie's Accelerated Energy Transition Scenario-2 (AET-2) – which considers a possible pathway to limiting global warming to under 2° C by 2050.

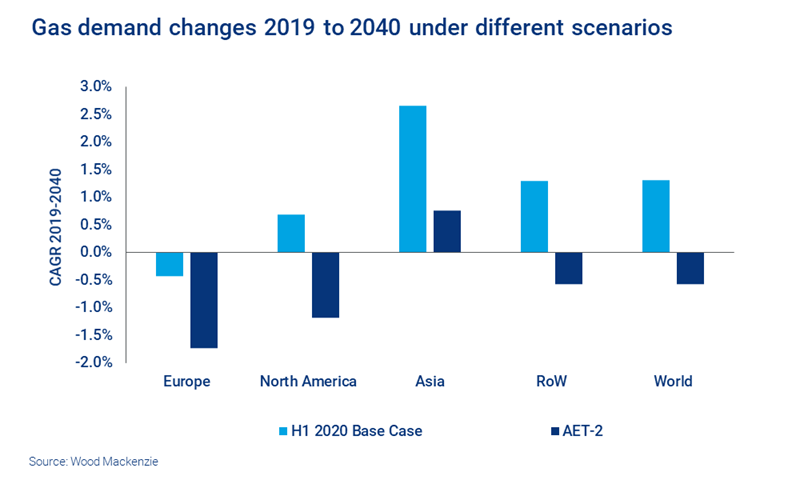

However, peak gas demand is increasingly becoming a matter of when, rather than if. In an AET-2 world, global gas demand will peak in mid-2020 as it comes under pressure from renewables and energy storage, efficiency improvements and new technologies.

Green hydrogen will be a game-changer in the long term. It will be increasingly used as an energy source in the transport, heating, industry and power sectors, reaching 10% of total primary energy demand by 2050.

Meanwhile, in our base case, which is consistent with a 3 ° C increase in temperature, gas demand grows at 1.5% in the next 20 years.

Asia will be a bright spot for medium-term gas demand growth

Gas retains a key role in reducing carbon emissions in those regions where coal still dominates, particularly in Asia, where the share of coal exceeds 40%. As a result, the region will be the engine room for growth and will account for a quarter of global gas demand by 2040 under the AET-2.

In the longer term, though, incremental levels of carbon reduction will require less use of natural gas, and Asian demand will decline after 2030.

Asian LNG demand will be resilient

Asian LNG demand will be more resilient than its requirements for gas, supported by a drop in indigenous production and limited piped imports.

In China, the development of challenging tight gas and shale exploration will slow down. Even some of the conventional projects will not materialise as competition intensifies.

Decline in Indian domestic production will accelerate in the early 2030s, driven by a lack of exploration efforts. And in Indonesia, suppressed prices will discourage operators from geologically challenging exploration.

Piped imports into China will also be limited. The investment case for large scale, high-cost assets that offer limited flexibility – such as new international pipelines – will be challenged. Cheap LNG will put pressure on the expansion of costly Central Asian imports.

Lower indigenous supply and pipeline imports will mean that Asian LNG demand will be more resilient than gas demand – decline will start only from 2035.

Europe will still be heavily dependent on imported gas

Domestic European production will continue its decline as legacy fields mature. Some of the higher-cost projects will struggle to deliver value and will not materialise. Europe will largely be dependent on imports – mostly on LNG and Russian piped gas.

As one of the cheapest sources of supply, Russia will be positioned to take a dominant share in the European market. However, the region’s competition policy and diversification efforts will likely limit Russian market share to under 40%.

Lower indigenous production and limited Russian imports will provide headroom for LNG imports in Europe, despite substantially lower gas demand.

In the US, the energy transition will shift the supply cost curve

North American gas demand will peak as early as mid-2020 under the AET-2 scenario. Henry Hub will find some support in the medium term: lower tight oil production due to low oil prices will mean that more expensive dry gas will be required, and the domestic supply curve will shift to the left as a result.

However, the longer-term reduction in gas demand will put pressure on Henry Hub, supporting the competitiveness of US exports into the global market.

New LNG projects will be needed by 2030, but their long-term viability will be questionable.

As demand declines, will there still be a need for new LNG projects?

Yes, but the space for new developments will be limited to only about 145 bcma in 2040, compared to 450 bcma in our base case.

New projects will still be needed by 2030. Low-cost LNG suppliers Russia and Qatar will be front-runners to fill this gap, and low Henry Hub prices will help the competitiveness of US LNG.

But the long-term viability of new investments will be questionable as Qatar and Russia further expand their LNG presence and demand starts declining post-2035. US LNG underutilisation may be required to balance the market in the long run, similarly to 2020.

Prices will remain suppressed, leaving large gas resources stranded

In an AET-2 world, our Global Gas Model shows spot prices in Asia never recover above US$7/mmbtu, while European prices remain below US$5/mmbtu for most of the outlook.

Compared to our base case, that scenario would leave about 12 trillion cubic metres of discovered gas resources stranded: more than three times the amount of gas produced globally in 2020.

Most of this would be in the US, Russia and the Middle East, not only because of the decreasing export opportunities for their vast gas resources, but also because of the lower domestic demand for gas in those regions.

Many pre-FID projects will not materialise. Developers will face tough choices. And industry players will need to do much more to decarbonise natural gas and contribute to achieving carbon-neutral energy systems.

Want to interrogate the AET-2 scenario?

Fill in this form at the top of this page to see our experts explore AET-2 with our Global Gas Model Next Generation.

The success of investments in new technologies to decarbonise natural gas, such as carbon capture, use and storage and blue hydrogen, will dictate the resilience of gas in the future energy mix.

Kateryna Filippenko

Research Director, Global Gas Markets

Principal Analyst with a focus on the European gas market and the development of alternative scenarios.

Latest articles by Kateryna

-

Opinion

Gastech 2024: Our top three takeaways

-

The Edge

Future energy: biomethane’s time has come

-

Opinion

From digester to burner tip: navigating the fast-growing RNG industry

-

Opinion

Transforming energy: 5 key questions ahead of Gastech 2024

-

Opinion

Global gas industry in the 2050 net zero world

-

The Edge

WoodMac’s Gas, LNG & Future of Energy conference – five key takeaways