Discuss your challenges with our solutions experts

Harvest or grow: what’s the future of upstream oil & gas investment?

Resilience and sustainability will increasingly shape the industry’s investment decisions

1 minute read

With contributions from Gail Anderson, Tom Ellacott, Andrew Latham, Greig Aitken and Amy Bowe

The outlook for the upstream industry has rarely looked so uncertain. After two oil price crashes in five years, market and price risks are at their highest in decades. And upstream spend in 2020 is set to be at its lowest in 15 years. The energy transition and the economic fallout from coronavirus will only make capital allocation decisions that much more difficult.

So, what does the future hold? Will oil companies simply harvest the remaining value of their existing oil and gas assets and invest that money in new activities? Or will they continue to grow, re-investing in new fields to feed petroleum demand for decades to come?

At our recent EMEARC energy summit, we discussed the dynamics that are shaking up the sector, the investment strategies that upstream players might follow, and how Wood Mackenzie Lens® empowers you to respond efficiently, and remain resilient in this ever-changing market. Read on for the highlights.

Subscribers to Wood Mackenzie's upstream services can access the full archive of EMEARC energy summit presentations here.

To continue to attract capital, portfolios have to be built around core advantaged assets – low-cost, long-life, low carbon-intensive barrels.

Andrew Latham

Senior Vice President, Energy Research

With his extensive exploration expertise Andrew shapes portfolio development for international oil and gas companies.

Latest articles by Andrew

-

Opinion

SEC 2025: Why the SEAPEX region still needs high-impact exploration

-

The Edge

How ultra-deepwater is revitalising oil and gas exploration

-

Opinion

Geothermal energy: the hottest low-carbon solution?

-

The Edge

Low-carbon tech: is geothermal close to a breakthrough?

-

Opinion

Can Asia Pacific’s upstream adapt for a more sustainable future?

-

The Edge

Does the bull market in oil rigs signal a slower transition?

Will the upstream oil and gas sector continue to attract capital?

Capital discipline has been the order of the day since the last big oil price crash. And as environmental, social and governance (ESG) issues become mainstream, fund managers and banks are under increasing pressure to justify owning oil and gas shares. Many of the Majors are focused on setting long-term goals for zero emissions and are planning ambitious diversification to align with the energy transition. But in 20 years, oil and gas could still make up as much as 60% of the global energy mix.

Ultimately, the industry is not at risk of being starved of capital – the world will still need oil and gas. But Big Oil will need to think deeply about how to stay investible. Money will flow more easily to those players that have a clear and transparent ESG strategy as sustainability increasingly shapes strategic decisions.

Finding the balance: where are the opportunities for portfolio renewal?

Upstream spending will also need to shift to align with changing investment priorities. Portfolio resilience will be key. Many capital intensive, long life upstream projects yielded low double digit, or even single digit, returns at US$50 a barrel, even before decarbonisation was in the spotlight. These types of projects are at risk as investors chase lower volatility returns and maximum value. But there are plenty of opportunities available for companies to get it right. We assess the main options for portfolio renewal.

1. M&A opportunities – are they worth it?

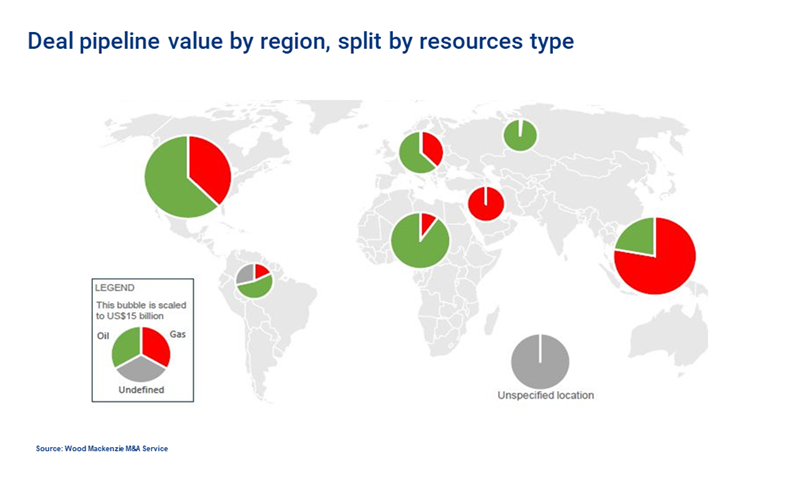

The first half of 2020 was the slowest for deal activity since our records began at the turn of the century. But the market is rapidly changing and upstream is now awash with M&A opportunities. Currently, we’re tracking 200 potential disposals in our deal pipeline, worth at least US$130 billion, and there’s a wide range of assets across resource type and geography.

As Big Oil embarks on major disposal programmes, there will be opportunities for operators planning to stay in oil and gas to acquire assets that can anchor their portfolios and generate cash flow. Recent oil deals have been breaking even with a long-term price of less than US$50 per barrel Brent – so there could be good value to be found for investors that are prepared to dive in.

However, those decisions must be balanced against the risks – particularly ESG factors and the cost of carbon. It will be increasingly important to reduce emissions, both to meet climate targets and to reduce value at risk as more and more countries adopt carbon pricing mechanisms to meet their Paris Agreement targets.

2. Does exploration still have a role?

Over the next 20 years, we forecast that there’ll be demand for at least 1.1 trillion barrels of oil and gas. While that’s a big opportunity, it is far less than the total available resources. Portfolios must be built around only the best oil and gas resources among those plentiful supply options. Assets with the lowest breakeven, lowest carbon and the best chance of commercialisation will fare better. Exploration can play a part in renewing the pipeline of such projects.

Relative advantage tends to fade over asset life: fields often start out as very attractive assets, but that changes as they are depleted. So, companies that want to remain successful must invest – or risk their portfolios becoming increasingly uncompetitive.

3. What’s the recipe for success in greenfield investment?

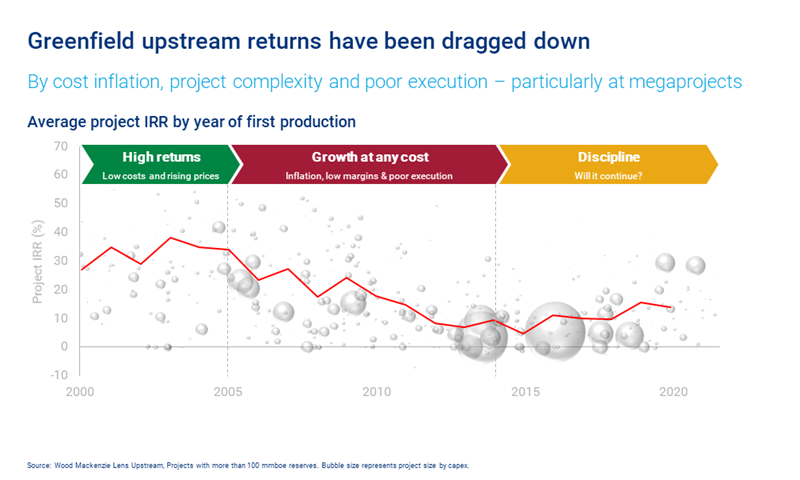

Greenfield upstream project returns have massively underperformed in the past decade. The industry’s focus on capital efficiency, however, has brought costs back under control. Returns are starting to recover, but the future looks uncertain.

There’s plenty of upside, though: the pre-FID pipeline looks healthy. Deepwater oil stands out, both in scale and quality. On the other hand, there are growing complexities in sanctioning spend on large, long-life assets such as LNG and oil sands. While they provide long-term cash flow, the returns from many mega-projects have been disappointing. Faced with an uncertain future, projects with short payback times will have the advantage.