Sign up today to get the best of our expert insight in your inbox.

Re-thinking energy transition supply chains

Can the rest of the world compete with China?

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Rory Mccarthy

Director, Power & Renewables Consulting EMEA

Rory Mccarthy

Director, Power & Renewables Consulting EMEA

Rory is a Director in the Power & Renewables Consulting division for Europe, the Middle East and African markets.

Latest articles by Rory

-

The Edge

Re-thinking energy transition supply chains

-

Opinion

Not made in China: the US$6 trillion cost of shifting the world’s clean-tech manufacturing hub

-

Opinion

2023: the year the European renewables bubble burst

-

Opinion

Will renewable auctions underpin Europe’s net zero ambitions?

-

Featured

Will 2021 be a record-breaking year for renewables auctions in Europe?

-

Opinion

Three reasons why Europe is set to lose the energy storage race

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

What will define LNG’s three phases of market growth?

-

The Edge

The coming low carbon energy system disruptors

-

The Edge

Could US data centres and AI shake up the global LNG market?

Policymakers worldwide were already stunned by China’s dominance of energy transition supply chains, but war in Ukraine took this to the next level. As soaring commodity prices, supply chain disruption and cost inflation rattled the global economy, China doubled down on its low-cost manufacturing supremacy. In response, governments around the world have staked serious financial and political capital on efforts to re-shore clean tech and reduce their dependency on China.

How realistic is this? How much will it cost? And does China’s dominance really matter? Rory Mccarthy, Director, Power & Renewables Consulting, spoke to Gavin Thompson, Vice Chair, EMEA.

How has China dominated clean tech?

Through a ‘move early, move fast’ approach. Chinese government support has boosted domestic clean tech manufacturing by playing to its strengths: competitively priced manufacturing at a scale no other country can match.

Recognising both the threat and the opportunity of decarbonisation, China has pushed its mining companies to scour the globe for transition metals and in recent years has offered generous subsidies to its clean tech industries. As a result, China’s renewables, battery and electric vehicle (EV) manufacturing has gone into overdrive.

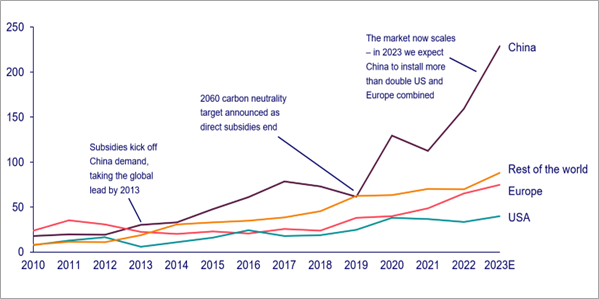

Today, around 80% of battery supply chains sit in China, while the country has a 97% share of solar wafer production. And even after installing 230 GW of wind and solar in 2023 - more than double the US and Europe combined – China's production surplus and lower costs mean its manufacturers continue to open new markets overseas.

Can the rest of the world compete with China?

There’s no shortage of ambition. The US Inflation Reduction Act (IRA) is incentivising the re-shoring of manufacturing capacity with generous tax credits and tariffs on Chinese imports. Europe’s 2023 Net Zero Industry Act introduced local content requirements and pushed back on single market imports. Brazil, India and Japan have also ushered in local content policies.

But even with incentives, clean tech manufacturers outside of China have struggled to compete. Chinese solar photovoltaic (PV) module production costs are almost 70% lower than in some other major markets, while Chinese-made batteries and EVs continue to undercut their rivals.

But China is not just winning on costs. The country has thrown off a reputation for mass-produced low-quality output and is producing best-in-class turbines, PV modules and battery cells.

What would be the cost of re-shoring supply chains?

Wood Mackenzie’s Net Zero Scenario requires US$29 trillion of capital expenditure across power and renewables by 2050. Given the higher cost of manufacturing outside of China, we estimate a 20% increase in overall capital expenditure on this key equipment - US$6 trillion more for a ‘not made in China’ transition for power alone.

Is the world prepared to pay more?

The necessary investment to reduce reliance on China must all be paid for. And while energy security and job creation play well to the electorate, higher costs do not.

Elections in 2024 will be crucial, with some politicians dangling slower transition pathways to voters. In the US, a future Republican administration would likely pick apart key tenets of the IRA, with renewables and EVs perennial Trump bugbears. Opposition to the European Commission's recommended 2024 climate targets is a rallying cry for populist parties ahead of June’s European Parliament elections. In the UK, the opposition Labour Party, widely tipped to form the next government, recently slashed its plans to spend an additional £28 billion per year to achieve net zero.

This doesn’t mean net zero targets will be dropped, but neither does it mean countries will throw open their doors to low-cost Chinese hardware. Worldwide, governments have reason to be cautious. Beijing has shown its willingness to flex its supply chain muscles and, on several occasions, has limited or banned the export of rare earth metals and processing technologies essential to clean tech manufacturing. Last year, Beijing considered banning the export of technology used to produce advanced solar wafers.

Where do we go from here?

Despite the rhetoric, an energy transition without Chinese supply chains is unthinkable. The country’s clean-tech manufacturers have driven the aggressive cost reductions that are benefitting the rest of the world, bringing down solar and battery costs by almost 90% and wind by over 40%. And catching up to China’s production scale risks further delaying a transition already running behind schedule.

Efforts to cut dependence on China are likely to settle on a compromise. With the right levels of investment, incentives and innovation, costs can be reduced further, and a growing proportion of supply chains re-shored profitably. The ongoing expansion of solar PV module manufacturing in the US and Europe is testament to this.

Learn more about how our consulting team can support your business across solar, wind and energy storage supply chains.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.

Sign up today using the form at the top of the page to get The Edge delivered to your inbox.

2024 APAC Energy & Natural Resources Summit

9 May 2024 | Marina Bay Sands, Singapore

Book your tickets now