The outlook for European power and renewables

Navigating revenues for grid-scale storage, deploying the onshore renewables pipeline and avoiding another false dawn for hydrogen

4 minute read

Peter Osbaldstone

Research Director, Europe Power

Peter Osbaldstone

Research Director, Europe Power

Peter is a research director with more than a decade’s experience in European power and renewables markets.

Latest articles by Peter

-

Opinion

2025 global power market outlook: divergent paths in a transforming energy landscape

-

Opinion

Iberian blackout: let the finger pointing begin

-

Opinion

European power in 2025: the pace, opportunities and challenges of the transition

-

Opinion

European power and renewables: what to look for in 2025

-

Opinion

The outlook for European power and renewables

-

Opinion

Is European power rising to the challenge of decarbonisation?

Zoe Grainge

Principal Analyst, Northern and Western European Wind

Zoe Grainge

Principal Analyst, Northern and Western European Wind

Latest articles by Zoe

-

Opinion

The outlook for European power and renewables

-

Opinion

Is European power rising to the challenge of decarbonisation?

-

Opinion

EU wind pledges: a little overblown?

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray is responsible for Wood Mackenzie’s global coverage across the hydrogen value chain.

Latest articles by Murray

-

Opinion

Hydrogen: the outlook to 2050

-

Opinion

Our top takeaways from the World Hydrogen Summit

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what utilities and developers need to know

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what industrial players need to know

-

Opinion

eBook | Investing in hydrogen from now to 2050: what you need to know

-

Opinion

What lies ahead for hydrogen and low-carbon ammonia?

Anna Darmani

Principal Analyst, Energy Storage EMEA

Anna Darmani

Principal Analyst, Energy Storage EMEA

Anna is a principal analyst focused on the European, Middle East and African storage markets.

Latest articles by Anna

-

Opinion

Europe’s power market transition and the role of energy storage

-

Opinion

European power in 2025: the pace, opportunities and challenges of the transition

-

The Edge

Battery energy storage comes of age

-

Opinion

The changing shape of European energy storage

-

Opinion

The outlook for European power and renewables

-

Opinion

Is European power rising to the challenge of decarbonisation?

To ensure European power markets decarbonise smoothly, sustained investment in infrastructure and flexible resources is needed. The ambitions of European Union energy policy dictate a faster pace of change than is currently in evidence. So, what are the potential commercial and technical enablers of an accelerated transition, and what are the risks to success?

Subject matter experts from Wood Mackenzie’s renewables, hydrogen and energy storage teams recently presented their views on the evolving dynamics in post-crisis power markets at our Paris Power & Renewables Briefing 2024. Fill out the form at the top of the page to download our presentation from the event, or read on for a summary of the key takeaways.

Energy storage: Navigating revenues for grid-scale batteries

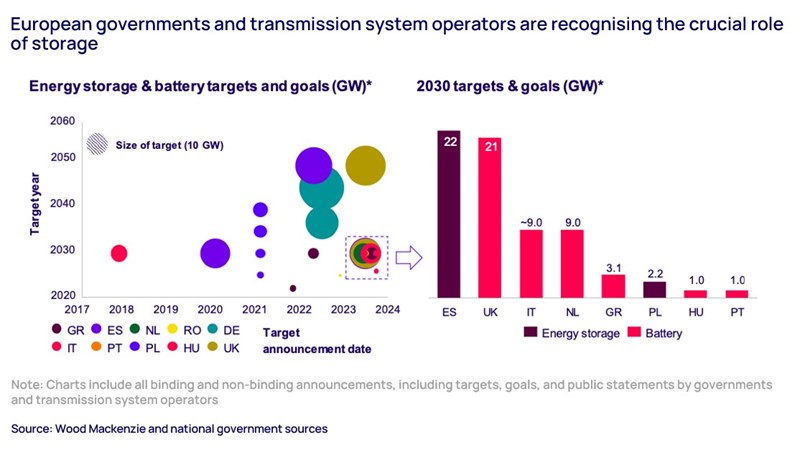

Governments and transmission system operators (TSOs) are finally recognising the crucial role energy storage has to play in facilitating the energy transition. Batteries and storage are beginning to be incorporated into national targets and 10-year national energy and climate plans (NECPs), the means by which the policies and measures to meet these targets will be identified. Spain and the UK lead the charge with over 20 gigawatts (GW) each of capacity targeted by 2030 (see chart below).

Until now, unattractive business cases have been the biggest barrier to grid-scale development. However, as electricity prices become more volatile and capacity markets more extensive, new opportunities are opening up. As a result, we expect a ten-fold increase in grid-scale storage over the next decade, from 9 GW in 2023 to 100 GW in 2033.

With the ancillary market largely saturated, developers are seeking alternative routes to market. In more mature markets, the merchant tail will continue to form a significant part of the final business cases, making future projects heavily reliant on arbitrage values and upcoming capacity market prices. In the less mature European energy storage market, project pipelines are strong but currently on hold as developers await upcoming tenders and auctions to secure a share of their project revenue through contracted revenue. You can access example breakdowns of cost and revenue for a standalone battery in Germany in 2025 and 2030 in the presentation.

Wind and solar: Deploying the onshore renewables pipeline

The European Commission strongly supports the deployment of renewables in the interest of both decarbonisation and energy independence. The bloc has a legally binding target of 42.5% renewable energy generation by 2030. However, the impact of regulatory best practice guidelines has yet to filter down fully to the national level.

A range of challenges stand between the European renewables sector and the EU’s ambitious targets. At a technology-specific level, the solar photovoltaic (PV) segment relies heavily on equipment imports (mostly from China), while onshore wind is dominated by EU-based manufacturers but is supported by an external supply chain. What’s more, current policies fail to provide protection from manufacturing cost fluctuations due to protectionism from non-European governments.

Europe (the EU27 countries) have a combined national 2030 capacity targets under their NECPs (National Energy Climate Plans) of 333 GW for onshore wind and 633 GW for solar PV generation. As things stand, most individual capacity targets for onshore technologies will not be met. Meanwhile, overall REPowerEU targets will be missed – by 35% in the case of wind and 15% in the case of solar PV.

It’s worth noting that despite having on average the lowest LCOE across Europe, onshore wind faces relatively poor growth prospects compared to solar PV. We expect grid-connected onshore wind to add 132 GW of capacity in key European markets between 2024 and 2033; in the same period, grid-connected solar PV will deploy 313 GW.

*Note: Key European markets include Spain, Germany, France, UK, Italy, Netherlands and Poland.

Hydrogen: Avoiding another false dawn

Hydrogen has been mooted as an alternative to an all-electric economy since the original energy crisis of the early 1970s, yet so far, this lighter-than-air energy resource has failed to take off as a serious commercial concern. While announced production capacity continues to grow, progress to final investment decision remains limited and the pace of project developments keeps 2030 targets out of reach.

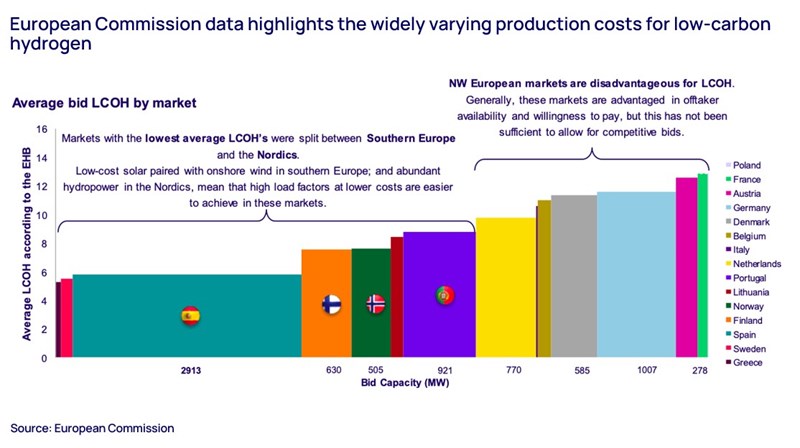

In the short term, production cost challenges for clean hydrogen are a major barrier to uptake, and economies of scale are not yet being realised. Aside from surging renewable electricity costs, higher contingency costs, additional supervision requirements and engineering, procurement and construction capacity constraints are all hampering progress.

Despite these obstacles, in the long-term the European Union requirement for renewable fuels of non-biological origin (RFNBOs) will boost demand for green hydrogen in the bloc. However, the pace and scale of build out in different countries is likely to vary significantly by country. In Southern Europe, low-cost solar and onshore wind generation mean that high load factors at lower costs are easier to achieve, while in the Nordics, abundant hydropower offers a similar advantage. In contrast, while markets in Northwest Europe are advantaged in offtake availability and willingness to pay, this has not been sufficient to allow for competitive bids (see chart below).

Learn more

Don’t forget to fill out the form at the top of the page to download the full presentation, which includes a wide range of charts and supporting data covering these topics in greater detail.