Discuss your challenges with our solutions experts

Analysis from Monika O'Shea, Power Market Analyst, ERCOT, with contributions from Riti Goel, Lead Analyst, ERCOT, Rebecca Miller, Research Manager, ERCOT/CAISO

As analysts on Wood Mackenzie’s Market Intelligence team, we have access to monitored generation and transmission data both within ERCOT and across North America. We are in the business of forecasting short-term market conditions and have spent the past several days supporting power producers, electricity providers, and energy traders take action in response to the recent crisis in Texas.

We wish to provide a summary of the events we watched take place earlier this week that resulted in extended blackouts across the state that left millions of people without power and has raised questions around the future of emergency preparedness, market structure, and regulation within the energy sector.

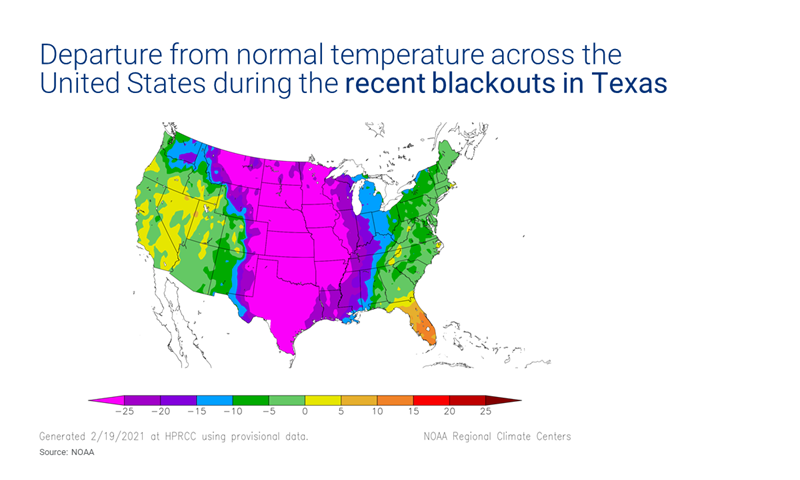

Historically, power demand peaks around 55 GW during the month of February in ERCOT, with overnight temperatures ranging in the low 30s and 40s at the start of the month and rising up to 60s and 70s by end of the month. However, a rare polar vortex dropped overnight temperatures to 50 F degrees below average in Texas this week, resulting in a >74 GW load peak forecast for February 15 and 16 during this 1-in-100 year weather event.

Demand for electricity regularly peaks above 70 GW during warm Texas summers – conditions that are strong, but manageable without a need for rolling blackouts. However, Monday’s winter storm swept in a myriad of complications that would not exist in summer.

Where did things go wrong on Monday?

First and foremost was the failure of thermal generation to perform to ERCOT’s expectations. Summer’s promise of high air conditioning usage drives thermal units to perform necessary maintenance at any other time of year in order to avoid missing out on summer’s optimal price events. Late February marks the ramp into the “shoulder season” when spring temperatures reduce demand for electricity. In the week leading up to the blackouts, approximately 14 GW of coal and gas-fired generation was already reported offline for maintenance, in line with trends from the past six years. During summer heatwaves, outage totals trend closer to ~5 GW of the state’s total >70 GW thermal capacity.

During the week before Feb 15th, ERCOT attempted to regain some of these generators by issuing an Operating Condition Notice (OCN) calling for their return. ERCOT also relaxed emissions restrictions to keep older, more polluting plants from being sidelined by emissions caps during this emergency event.

Some of these units on outage were likely unable to secure gas on such short notice as the weekend’s gas prices rapidly increased from $7 per mmBTU on Thursday to $150 per mmBTU by the weekend due to supply concerns around freeze-offs and heating demand. Unlike in the summer months, during extreme winter peaks gas is diverted for residential heating, decreasing availability for power plants. Additionally, unlike colder markets, ERCOT’s gas fleet has a low percentage of dual-fuel generators that can switch to distillate or fuel oil.

Whether due to gas shortage or unresolvable maintenance issues, despite ERCOT’s best efforts thermal generation on outage totals remained at 14 GW into Monday morning. Plants are not penalized for ignoring ERCOT’s OCN. Instead of returning units into winter’s strongest demand peak, over the span of four hours Monday morning, outage totals more than doubled to 32 GW, far surpassing ERCOT’s highest thermal outage level recorded in the last nine years. Freezing rain and cold temperatures decimated coal, natural gas, and nuclear power plants alike, with emergency equipment failures, broken sensors, frozen coal piles and more issues slashing ERCOT’s thermal generation capacity from 70 to 45 GW in the span of a few hours.

The freezing temperatures also took their toll on gas production. We estimate that on Tuesday, about 18.7 billion cubic feet per day of gas production was lost because of freeze-offs. That is equivalent to about a fifth of total US output.

Without the proper winterization protection or procedures in place, nearly half of ERCOT’s thermal stack went down and was unable to quickly ramp back up. With eyes on more than 74 GW of generation in ERCOT, our power market analysts identified dozens of plant ramp-downs from our electromagnetic field (EMF) and infrared camera (IR) monitors on Texas power plants while our frequency monitor picked up 12 individual trips in the first 48 hours of the emergency - including a large 1,200 MW nuclear unit trip at STP 1 identified hours before unit operators publicly announced the failure. Figure 4 shows a small sample of plants we monitor via EMF and how their output levels changed as the crisis evolved.

All this while, wind turbine icing impacts still lingered in West Texas from a different ice storm the previous Tuesday, compounding with generally weak wind speeds to keep wind production sub-6 GW all day on Monday. IRR (Intermittent Renewable Resource) outages had jumped to 16 GW earlier in the week and climbed even further toward 22 GW as many South and Coastal turbines were iced during the same storm that decimated power plants Sunday night.

Texas’s >28 GW of wind capacity historically provides around 7 GW of power during winter peak periods. On Monday, systemwide wind production overperformed ERCOT’s next-day forecast by around 1.5 GW for most of the day as turbine icing did not impact Coastal wind farms as heavily as the ISO had anticipated. Using raw model data from Monday which does not incorporate IRR outages, wind saw potential to produce an average of 5.4 GW during the on-peak period instead of 2.5 GW. However, the disparity was narrowest during the evening due to naturally weak wind speeds, as seen in Figure 5.

Incentivizing cold-weather equipment for Texas turbines after the last massive ice storm in October 2020 could have ensured a faster rebound from the wind fleet after the previous week’s icing and supplied a couple of extra GW for Monday’s evening peak, though still a fraction of the total peak. It is important to note renewable power is expected to vary – ERCOT never included more than 2 GW of intermittent generation in its “extreme” resource adequacy scenario for this winter, less than 3% of previous winter record demand peaks.

Where did ERCOT’s planning cases fail?

The Winter 2020/2021 Seasonal Assessment of Resource Adequacy (SARA) projected winter peak demand at 57.7 GW based on ‘normal conditions.’ The normal planning case for peak winter demand assumed around 8.5 GW of thermal generation on outage and around 7 GW of wind capacity. Two extreme scenarios are outlined in the SARA as required by the Public Utility Commission of Texas after the February 2011 winter event. One extreme case depicts normal demand and sub-2 GW wind, and the other depicts “extreme season peak load” at 67.2 GW (based on 2011’s winter peak) paired with “extreme generation outages” at 14 GW.

In actuality, Wood Mackenzie’s next-day load forecast for Monday evening hour ending (HE) 20 peaked over 74 GW, 10% higher than the extreme planning case load peak. During the day thermal generation on outage totals soared to nearly 32 GW by evening, leaving the thermal stack 22% weaker than in the “extreme outage” scenario. Meanwhile, wind production weakened to 600 MW in this exact hour, slightly weaker than the 1.7 GW low wind planning case. Other assumptions from the SARA such as 838 MW imports fell flat as well as surrounding regions suffered their own icy weather, leaving ERCOT with only one variable left to edit: demand. As capacity began to plummet overnight, ERCOT issued an Energy Emergency Alert (EEA) Level 3 at 1:25 CST and began the rotating blackouts. By midday, the grid had shed an estimated 25-30 GW of load, more than one-third of Wood Mackenzie’s forecasted evening load peak. This amounted to more than 3 million households without power in sub-freezing temperatures.

Though the SARA’s most extreme planning case with high load/high outages saw reserves drop to 1.4 GW, already EEA 2 territory, the two extreme scenarios were not combined in the SARA into a high load/ high outage/ low wind scenario where a 4 GW deficit would have been apparent. The fact that the “worst-case” scenario of these three variables was not considered yet would have involved load shed suggests Texas’s stack has always been skating on thin ice in the face of these rare extreme winter events.

As stated earlier, 14 GW of generation on outage is not an outlandish figure for late winter based on the past six years of data, despite it being used as an “extreme outage” case in resource adequacy planning. In the hypothetical case that the additional 18 GW of thermal generation had not been knocked out by the weather this week, icing had not limited the capacity of wind farms to produce additional power, and a gas shortage had not further constrained available generation, a load forecast of 74 GW would still have required approximately 3.9 GW of load shed and emergency conditions, risks that Wood Mackenzie suggested to our customers the Friday before this event.

The blackouts did not ease into the following days as temperatures remained sub-freezing. Protocol changes from the PUCT have been abundant over the last week, overriding the peaker net margin threshold, and maintaining Value of Lost Load (VOLL) pricing during load over-shed periods. In these periods the grid appears sufficiently supplied as thermal generation rebounds while utilities struggle to reconnect load, leading to weak Locational Marginal Prices (LMPs) and >$8900 reliability adder. Relief from the blackouts has only come as temperatures warm, power plants regain footing, and wind speeds rise into the weekend, with the EEA 3 notice having ended this morning 105 hours after it was announced.

Key issues that will be raised by this event

The last time ERCOT saw EEA 3 was February 2011 during unprecedented wintery weather that resulted in widespread thermal generation failure. After this event, FERC encouraged utility commissions across the states to mandate winterization of their plants, though the PUCT did not and it appears generators did not make efforts to winterize their Texas plants.

More time and information will be required to fully understand all the factors that contributed to this week’s failure in ERCOT. But at its core, the key question is how planning processes, market rules, and regulations need to change to ensure that the energy complex is able to cope with rare, extreme weather events particularly as climate change introduces the potential for increased risk for these events. Getting this right will only increase in importance as the degree of variable renewable generation increases and reliance on gas as a bridge fuel to decarbonize the energy sector increases.

Be the first to know.

Throughout unprecedented events, our team provides clients with real-time updates to help navigate participants on the front lines and beyond. To learn more about what can do for your business, or to speak with an expert, please fill out the form at the top of this page.