Lens Metals & Mining

Unearth robust data analytics from mine to market. Layers of insight to attract and allocate capital

Request a demo

Lens Metals & Mining

Unearth robust data analytics from mine to market. Layers of insight to attract and allocate capital

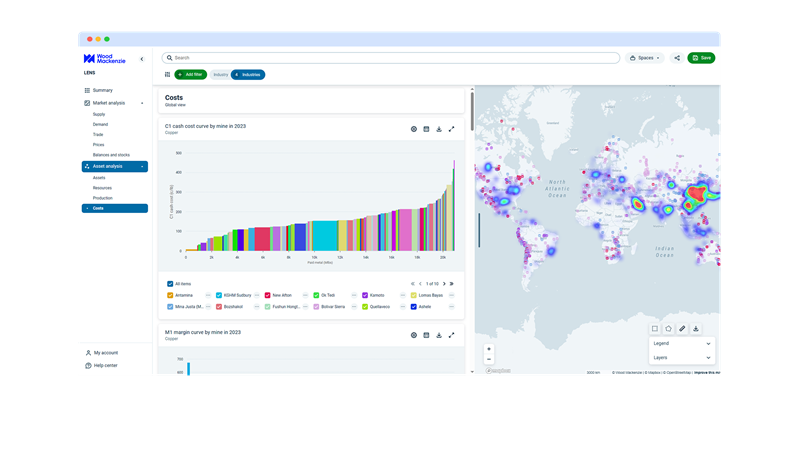

Analytical power of Wood Mackenzie matched by transformative power of a data analytics platform, Wood Mackenzie Lens. An end-to-end data analytics solution to drive efficiency and collaboration across the enterprise. Whether you are screening for new opportunities, conducting asset valuations, or analysing trade flows and market balances. Lens Metals & Mining delivers immediate decision intelligence.

Features and workflows

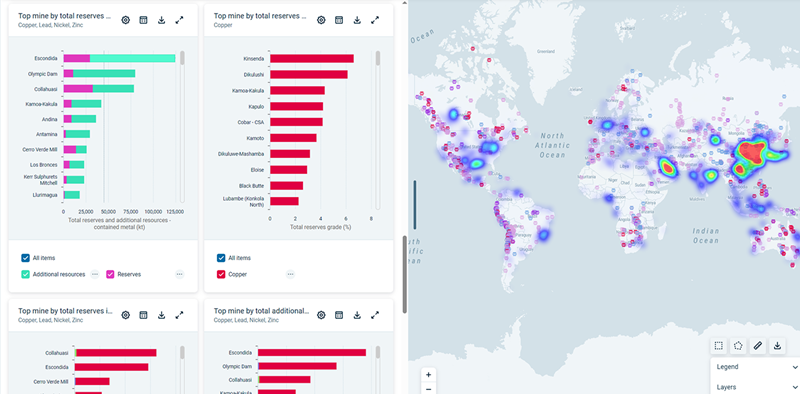

Designed to deliver integrated cross-commodity insights to capture the most bankable opportunities and inform your growth strategy.

Key features of Wood Mackenzie's Lens Metals & Mining:

- Discover planned and existing mines, smelting and refining facilities.

- View how each asset relates to key infrastructure within the value chain, power plants, railways, and ports.

- Analyse resource, reserve, and production costs.

- Assess profitability with crucial cost metrics (cost curves, cash costs, margins, and cash flows).

- Visualise data on key market drivers through charts, graphs, and maps to derive industry trends.

Wood Mackenzie’s Lens Metals & Mining provides data on:

Asset-level data on key mined commodities for your asset screening and analysis in a single platform:

- Copper: 480+ copper mines modelled and 600+ projects

- Gold: 600+ gold mines modelled and 300+ projects

- Lithium: 200+ lithium mines modelled

- Zinc & Lead: 370+ zinc and lead mines modelled and 400+ projects

Comprehensive market coverage with:

- Over 40 years of historical data and forecast extending over 20 years

- Our coverage includes critical minerals such as copper, nickel, lithium, aluminium, graphite as well as other important commodities like coal, steel, iron ore, lead, and zinc.

Quick refresh of charts & analysis via API

- Extend your Lens access by seamlessly integrating Wood Mackenzie data into your workflow with Lens Direct, our powerful API service.

Wood Mackenzie's Lens Metals & Mining enables a number of key workflows including:

- Strategic Planning: Analyse market fundamentals, performance, trade balances, and price drivers.

- Asset screening and analysis: Explore and assess mining assets' performance and potential, nearby infrastructure, and financial viability.

- Merger & Acquisitions: Evaluate potential targets, company profiles, and portfolio diversification opportunities.

- Competitive Intelligence: Benchmark against industry peers to improve competitive positioning.

- Supply Chain Analysis: Manage risks by analysing material flow from mines to refineries.

Why choose WoodMac's Lens Metals & Mining?

Specifically designed for your workflows: A data analytics platform made for all enterprise users to get immediate insights and foster collaboration.

Global data coverage: Meticulously built bottom-up, asset-by-asset and integrated with multi-sector market analysis for a consistent, precise view across mined commodities for robust capital investment decisions.

Integrated: An interconnected global view incorporating assets and market analysis that empower decisions.

Cross-commodity solution: An integrated cross-commodity view of how markets and assets develop across the value chain as per Wood Mackenzie’s energy transition scenarios.

Market expertise: Gain invaluable insights from a global team of industry experts with in-depth knowledge across an increasingly connected energy, chemicals, metals and mining value chain.

Seamless access to data: API service to seamlessly ingest and integrate Wood Mackenzie’s data into your proprietary systems and BI tools.

Lens Metals & Mining

Data meticulously built asset-by-asset and integrated with multi-sector market analysis for a consistent, precise view across mined commodities. Accuracy matters.

4000+

Mines

750+

Smelters

450+

Metal refineries

Commodities coverage

Lens Metals & Mining Assets Discovery

Visualise, screen and benchmark key metal commodities with our asset-level data and intuitive platform. Discover bankable opportunities, benchmark assets to identify target areas for growth and improve competitive position.

Lens Metals & Mining Markets Forecast

Comprehensive analysis of key drivers affecting the metals market. Access detailed long-term outlooks, pricing forecasts and key insights across the metals and mining value chain.

Frequently asked questions

Here you’ll find answers to the most common questions you may have on Wood Mackenzie's Lens Metals & Mining. If you have any other questions, get in touch.

Designed for a diverse range of professionals and organisations in the mining industry, seeking for a reliable platform to support their strategic workflows seamlessly.

This includes mine owners and operators, investment analysts, fund managers, commodity traders, commercial strategists, business development managers, supply chain and procurement managers.

At Wood Mackenzie, we collaborate closely with our partners from leading mining companies and financial institutions to develop Lens Metals & Mining, bringing you the decision intelligence that matters.

Derive insights from the supply-demand forecast with when market developments or industry changes occur. Assess supply and demand projections of total metals consumption, direct-use scrap markets, first- and end-use demand by sector. Compare Wood Mackenzie’s authored outlooks to understand the market drivers behind the differences.

Our intuitive data analytics platform is designed to deliver integrated cross-commodity insights to capture the most bankable opportunities and inform your growth strategy.

Acquire in-depth understanding of how key mined commodities intersect and play a pivotal role in the energy value chain, integrating insights from emissions and other related sectors.

In a single platform, you can:

- Access detailed data on single or multiple assets to analyse investment opportunities globally and see which countries/regions are most active in the commodity supply and demand.

- Understand global supply, demand, trade flows, price forecasts, producers' cost drivers, and their impact from mine to market.

Lens Direct is Wood Mackenzie’s data delivery service that provides a feed connecting users to our extensive datasets, using an API. Here, you can download Wood Mackenzie’s data into your own proprietary systems and BI tools, including Excel, Power BI, Spotfire and Tableau.

Contact an expert

Our team of experts have modelled hundreds of scenarios to provide comprehensive analyses of the metals and mined commodities sectors, while integrating coverage of the entire energy value chain. Contact our experts to book a demo.