Europe’s power market transition and the role of energy storage

Our experts present the opportunities gained from the expanding role of storage assets in a recent webinar

3 minute read

Dan Eager

Research Director, Europe Power & Renewables

Dan Eager

Research Director, Europe Power & Renewables

Dan is a specialist in power market investment and dispatch modelling.

Latest articles by Dan

-

Opinion

Europe’s power market transition and the role of energy storage

-

Opinion

The renewables PPA landscape in Europe

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

European power markets emerge from the energy crisis

-

Opinion

Unveiling the impact of wind and solar variability on European power

Anna Darmani

Principal Analyst, Energy Storage EMEA

Anna Darmani

Principal Analyst, Energy Storage EMEA

Anna is a principal analyst focused on the European, Middle East and African storage markets.

Latest articles by Anna

-

Opinion

Global energy storage market surpasses 100 GW annual installation milestone in 2025

-

Opinion

European Power & Renewables: what to look for in 2026

-

Opinion

Europe’s residential storage market: Plateau market growth and high competition push European brands towards HEMS

-

Opinion

Europe’s power market transition and the role of energy storage

-

Opinion

European power in 2025: the pace, opportunities and challenges of the transition

-

The Edge

Battery energy storage comes of age

European power markets continue to evolve, but the transition is showing signs of imbalance. Global trade tensions are stifling economic growth and investor confidence, while the shift towards a majority renewables and low-carbon system has entered a more challenging and complex phase. Although political support for decarbonisation remains strong, it is being tested by these challenges. Power markets are more downbeat than in recent years, yet there remain pockets of opportunity. Rising price volatility, limited system flexibility, and weakened demand growth are also key factors influencing Europe’s power markets.

In a recent webinar hosted by Wood Mackenzie, our experts explored the challenges and opportunities of Europe’s power market transition. For access to our presentation, including detailed forecasts, country-specific data and technology insights, fill out the form at the top of the page. Read on for a summary of some of our key insights.

An imbalanced transition

Europe has made great progress in deploying renewable capacity, but this success has created new problems. System limitations are challenging the economics of investment in standalone renewables. Capture rates for solar and onshore wind are falling - dramatically in some cases - with figures in April 2025 dropping as low as 20% for solar PV in certain markets.

A key contributor to this dynamic fall in capture rates is demand – or rather the lack of it. Most markets have yet to return to pre-2019 consumption levels and supply is now outstripping demand. Electrification drivers such as electric vehicles, heat pumps and hydrogen are progressing, but not scaling fast enough to offset low levels of demand. Although demand growth is forecast to improve throughout 2028 as some markets increase reliance on gas, a downward trend beyond 2033 will remain.

Price volatility and investment opportunity

The growing share of variable renewable energy sources is creating integration challenges that are driving price volatility across Europe - an effect which is likely to continue as decarbonisation progresses. While this volatility introduces uncertainty, it also creates a standout investment opportunity in batteries and other flexible assets critical to supporting power market balance.

The rising value of storage

European governments have finally recognised the strategic role of energy storage. Fourteen countries have now committed to incorporating storage in their national energy plans as well as releasing funds to support the rollout. The UK and Spain are leading with around 23 gigawatts (GW) of energy storage and overall, with the recent commitment from governments, we will see major growth in energy storage capacity across Europe - exceeding 250 GW by 2034.

This growth is set to come primarily from the large, utility-scale segment which, to date, has lagged behind the distributed market but is now gaining traction. Although Europe’s utility-scale storage reached 12 GW in 2024, only 10% of that is paired with renewables. However, co-locating storage with renewables is becoming more attractive as grid connections are limited and declining capture prices, combined with competitive auctions, improve the business cases for co-location.

Viable routes to market

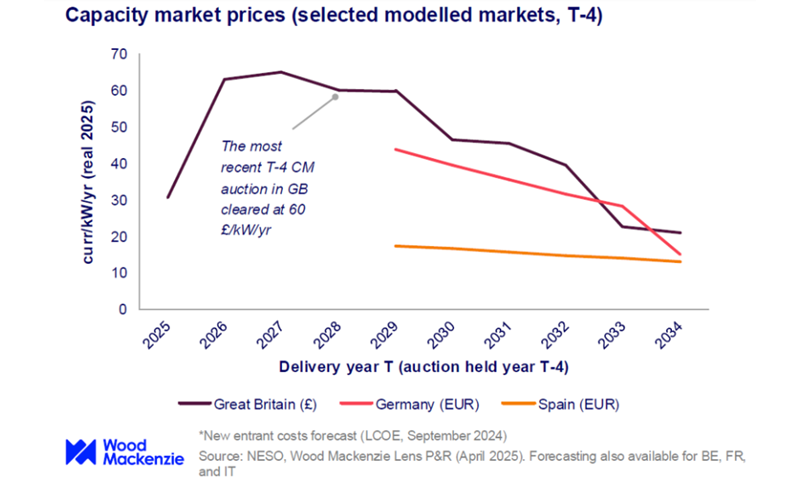

Fair and stable regulation is critical to investment in energy storage, and European governments are increasingly promoting energy storage through a range of support mechanisms designed to increase deployment and reduce investment risk. Since 2020, more than 50 GW of battery projects have secured government support through auctions. Power Purchase Agreements (PPAs) and tolling contracts are growing, but still represent less than 2% of total signed capacity. But it is capacity market contracts that remain the backbone of contracted revenues in Europe. Covering up to 40% of upfront costs in many markets they help de-risk investment and improve confidence.

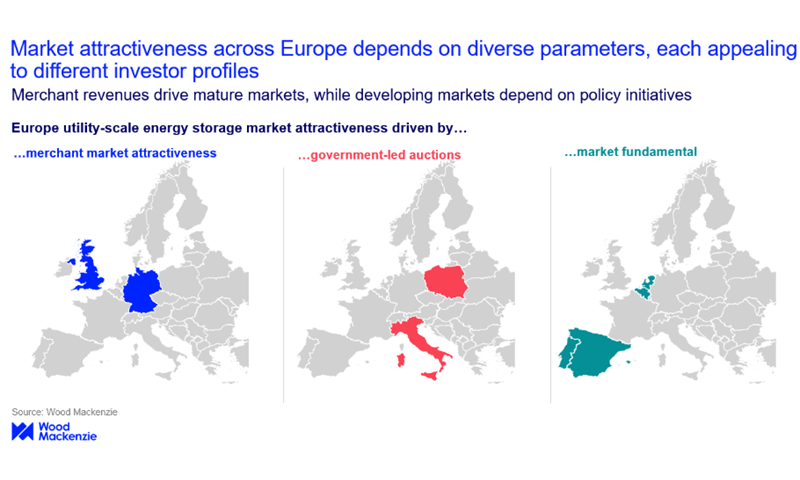

As market volatility remains and system flexibility becomes more valuable, reliable policy frameworks will become increasingly important to the acceleration of energy storage deployment across Europe. Across Europe, successful and bankable storage project development remains reliant on parameters including volatility, policy and fundamentals. These parameters drive different business case opportunities for batteries and with that different business case opportunities. For a deep dive into German storage business case, download the full report.

Learn more

Our webinar covered the challenges and opportunities brought about by Europe’s power market transition as well as the role of standalone and co-located storage.

For full access to our analysis, including the data and trends currently influencing the EU power markets, fill out the form at the top of the page to watch the full webinar recording and download the accompanying presentation slides.