Discuss your challenges with our solutions experts

Peak season pressures reshape US power markets as capacity constraints drive price volatility

PJM's capacity auction hits price cap whilst MISO experiences record interregional flows, highlighting growing supply-demand imbalances across major electricity markets

3 minute read

Tien Tong

Market Associate, MISO

Tien Tong

Market Associate, MISO

Tien joined Wood Mackenzie in August 2022 as an analyst in the MISO team.

Latest articles by Tien

-

Opinion

US power market outlooks Winter 2025/26: hot topics for MISO, NYISO and PJM

-

Opinion

Peak season pressures reshape US power markets as capacity constraints drive price volatility

-

Opinion

US seasonal outlook webinars: hot topics for MISO and SPP in Spring 2025

-

Opinion

US seasonal outlook webinars: hot topics for ERCOT and MISO in summer 2024

-

Opinion

The key takeaways from our PJM, MISO and ERCOT seasonal outlook webinars

Cole Kroninger

Market Analyst Lead, Power & Renewables

Cole Kroninger

Market Analyst Lead, Power & Renewables

Cole forecasts wholesale energy market prices, congestion patterns and other dynamics in the MISO market.

Latest articles by Cole

-

Opinion

US power market outlooks Winter 2025/26: hot topics for MISO, NYISO and PJM

-

Opinion

Peak season pressures reshape US power markets as capacity constraints drive price volatility

-

Opinion

US seasonal power outlooks Summer 2025: hot topics for ERCOT, MISO and PJM

The summer of 2025 has exposed critical supply-demand imbalances across two of North America's largest power markets. PJM Interconnection's delayed capacity auction for 2026/2027 cleared at the newly implemented price cap, whilst MISO experienced unprecedented interregional power flows that drove price spreads to multi-year highs.

These developments underscore the fundamental challenges facing electricity markets as they grapple with rising demand from data centres and evolving generation resources.

PJM capacity crunch drives prices to ceiling

PJM's Base Residual Auction for the 2026/2027 delivery year cleared at US$329.17/MW-day across the entire footprint on 22 July 2025. This represents the first time capacity prices have hit the newly implemented price cap, marking a significant shift from previous auctions where only select zones cleared at elevated levels.

The auction, originally scheduled for December 2024, was delayed to implement key reforms including price caps and floors, expanded must-offer requirements, and the inclusion of Reliability Must-Run units in the supply stack. These changes came in response to concerns about rising costs from state leaders and consumer advocates.

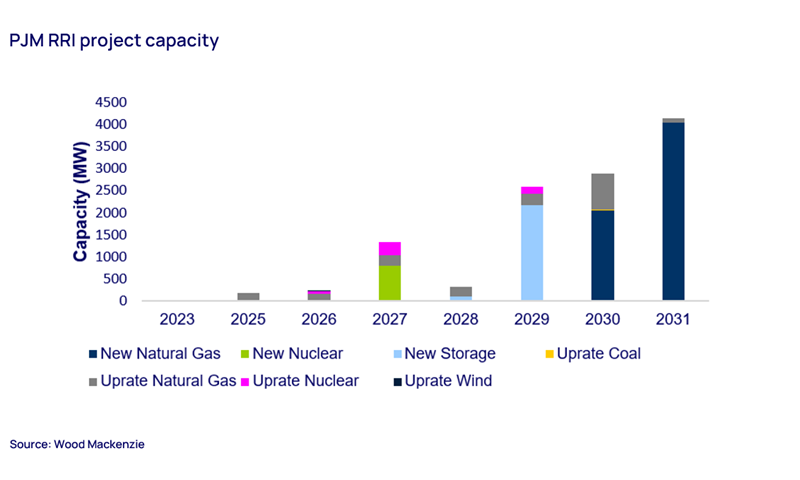

Wood Mackenzie expects PJM's peak load to increase from 154 GW to approximately 159 GW in 2026/2027, driven largely by expanding data centre demand. This load growth has outpaced new generation development, leaving the system with limited reserve capacity whilst most projects awarded through the Reliability Resource Initiative are not expected online in the coming years.

The results highlight the increasing importance of flexible resources, with every demand response resource clearing in the auction. This trend reflects the growing value of fast-responding capacity in maintaining system reliability as traditional generation resources face retirement pressures.

MISO sees record interregional flows amid supply constraints

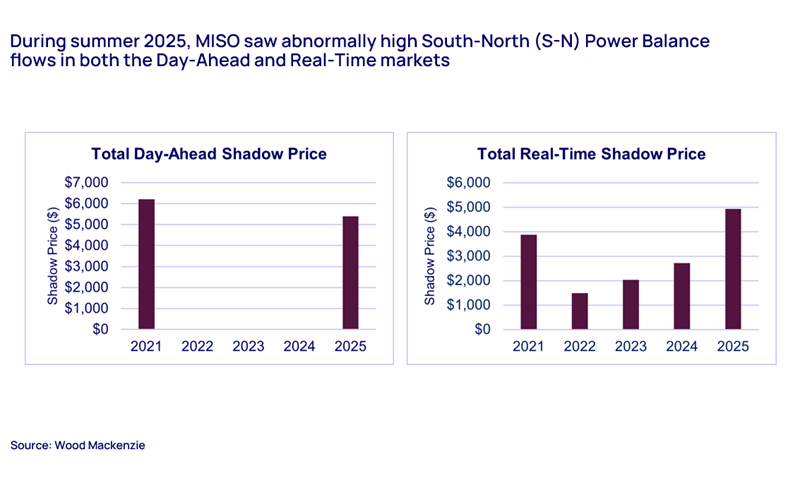

MISO experienced abnormally high South-North power flows during summer 2025, with average price spreads between Classic and South regions exceeding US$15 in both day-ahead and real-time markets. This compares to typical summer spreads of US$2-5 in previous years.

The elevated flows were driven primarily by stronger-than-average demand and significant generation outages in MISO's Classic footprint, rather than the typical factors of gas prices or wind generation patterns. Supply chain issues limiting timely generator maintenance, combined with strain on older conventional generators from hot weather and increasingly variable generation, likely contributed to the unusually high outage levels.

These interregional flows are constrained by the limited 3 GW transmission capacity connecting MISO's Classic and South regions. As resource adequacy challenges persist, South-North flows represent an increasingly systemic risk during peak seasons when wind generation is weak and load is strong in the Classic footprint.

Market outlook points to continued volatility

Both markets face similar underlying challenges that reflect broader transformation across North American power systems. The combination of rising electricity demand, generation resource transitions, and infrastructure constraints is creating new patterns of price volatility and reliability risks.

Market participants should prepare for continued elevated prices during peak seasons as grid operators balance reliability requirements with rapidly evolving energy landscapes. The increasing reliance on flexible resources and growing importance of interregional coordination will be critical factors as these markets adapt to meet modern energy demands.

Wood Mackenzie's analysis suggests these trends will persist as long as load growth continues to outpace new supply additions and resource adequacy challenges remain unresolved across major power markets.

Learn more

Today’s power markets are volatile, requiring traders to be agile and highly responsive to grid constraints, congestion, outages and price movements. Wood Mackenzie’s Power Trading Analytics tools provide unmatched visibility across global power markets.

Our trusted solutions integrate market data, fundamentals and modelling to help traders overcome challenges and react with confidence. Find out more about how our Power Trading Analytics solutions can help you strengthen your trading strategies with timely insights and trusted data.