Powering through uncertainty: securing critical electrical materials in a difficult United States market

Uncovering strategies for ensuring critical electrical equipment supply surety

3 minute read

Last year, Wood Mackenzie examined the future of US power and distribution transformer markets and noted that while there was some short-term softening of the markets, many of the challenges are here to stay (for more details, read our recent article: 4 years into a difficult transformers market in the US, is there a potential end in sight?).

Looking ahead, challenges in sourcing electrical equipment are likely to escalate due to clean energy investments, manufacturing investments, data centre builds, aging equipment, equipment and material tariffs, weather events and the push to electrification.

Utility executives are proactively fostering cross-departmental collaboration to enhance supply chain strategies, ensuring the procurement of essential equipment to mitigate supply challenges and guarantee project success. But what specific strategies are proving most effective? Our comprehensive analysis reveals the tactical approaches utilities are implementing to secure critical equipment supply. Fill out the form at the top of the page to download our comprehensive strategy guide.

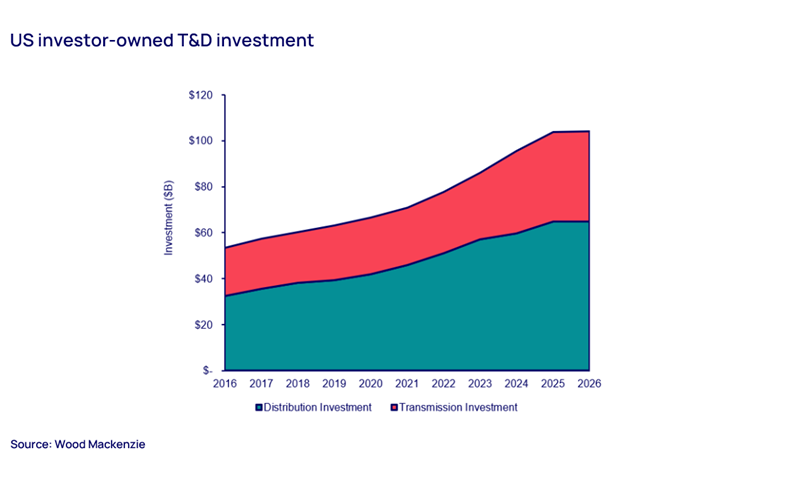

The increasing demand for electricity in addition to aging systems necessitates new and upgraded Transmission and Distribution (“T&D”) infrastructure, leading to a higher need for electric materials. This surge in demand stresses a sector already characterised by long lead times, potentially jeopardizing project timelines and profitability. See the graph below, which shows growth in US T&D investments over the past 10 years.

The challenge ahead

The demand for key T&D equipment has accelerated in recent years, and this trend is expected to continue. Looking forward, there are several key drivers indicating a surge in future demand:

- Increased emphasis on clean energy: Deployments of clean energy sources are expected to more than double by 2034 despite new administration cuts to PTC, ITC, and Manufacturing tax credits.

- Growing investment in US manufacturing: Recent policies such as the IRA, IIJA, and CHIPs Act have spurred investment in US manufacturing facilities.

- Electricity demand growth: After a two-decade period of stagnation, electricity demand growth has returned; Blackstone estimates that the US will see over $1 trillion invested in data centers over the next five years to support AI expansioni

- Aging equipment: An estimated 70% of transformers are at least 25 years old, necessitating replacements.

- Imposed tariffs from the new US Federal Administration: These tariffs are directly impacting electrical equipment imported into the US, as well as indirect impacts on critical materials such as grain oriented electrical steel and copper.

- Higher frequency of damaging weather events: More frequent severe weather events are driving the need for resilient infrastructure.

- Ongoing push towards electrification: The shift towards electrification continues to increase demand for electrical equipment with adoption of EVs, and heat pump deployments, which are important demand drivers for equipment such as switchgears/breakers and wire/cable.

With increasing demand, utility companies have lengthening lists of grid maintenance, hardening, and development projects, many requiring key electrical equipment such as transformers, switchgear equipment, and complimentary components.

How are leading utilities prioritising these competing demands and securing the equipment they need most? Our detailed strategy framework breaks down the decision-making processes that are delivering results - fill out the form at the top of the page to download it now.

Additional supply is coming but not at the pace needed to support the increasing demand. Major suppliers of electrical equipment used for power grids announced manufacturing expansion investments globally in 2023-24 to meet the growing demand of critical T&D equipment.

Most facilities and expansions announced during this period are expected to be completed between 2025-2027, or 2-4 years from initial announcement dates and are expected to be fully operational by 2029-2030. Understanding this supply-demand mismatch is crucial, but knowing how to navigate it strategically is what separates successful utilities from those facing project delays.

As a result of the anticipated increase in demand and lag in capacity expansion, electrical equipment prices are expected to continue to increase. These equipment prices are also at risk of being impacted by new US trading policies as the materials and component parts are frequently imported from China, Mexico and Canada (for more details, read our recent article about the impact of President Trump's tariffs on utility supply chains).

All in all, utilities are thinking ahead and identifying tangible actions for their organisations before supply challenges exacerbate.

Learn the proven strategies

Ready to discover the specific procurement strategies, supplier relationship tactics and cross-departmental collaboration frameworks that are helping utilities secure critical electrical equipment in this challenging market? Our comprehensive strategy guide includes actionable checklists, timing recommendations and real-world implementation approaches that you can apply immediately.

To access our complete strategies for ensuring critical electrical equipment supply surety, simply fill out the form at the top of the page.