US shale gas is back: new demand signals underpin upstream opportunity

Which companies and areas are best positioned to capitalise on a structural shift in US gas demand?

2 minute read

Ryan Duman

Director, Americas Upstream

Ryan Duman

Director, Americas Upstream

Ryan specialises in supply forecasting, basin characterisation, upstream decarbonisation and economic modeling.

View Ryan Duman's full profileLydia Walker

Senior Research Analyst, Upstream

Lydia Walker

Senior Research Analyst, Upstream

Lydia is an upstream analyst on Wood Mackenzie's Lower 48 research team

View Lydia Walker's full profileGrowth-focused opportunities have quickly returned to the US Lower 48 gas basins. Demand across the region is expected to grow more than 35% by 2040, requiring a near doubling of gas-focused capex to deliver almost 40 bcfd of new supply. The Permian and Haynesville alone won’t be enough. Additional sources of supply will be critical.

The good news is that prices must rise for the market to balance. A US$4.50/mmbtu floor by 2030 opens a wide range of opportunities for gas-focused upstream investment.

This analysis has been months in the making. As part of our process, we spent time in Asia, Houston, and Oklahoma City to assess the role M&A will play in bringing new gas capex into the US Lower 48 upstream ecosystem. Through our partnership with Novi Labs, we also enhanced our well-level analysis to benchmark E&P performance and identify new opportunities.

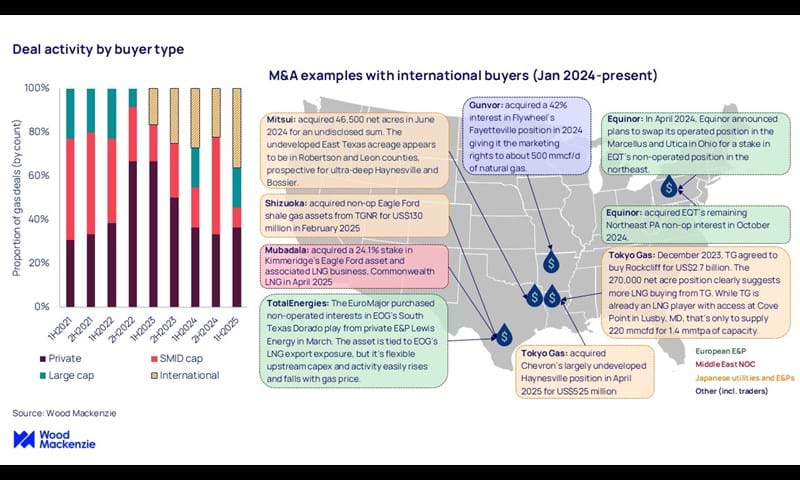

Early movers like TGNR, TotalEnergies, and several PE-backed teams are already acquiring gas assets ahead of further price increases. But the window is now. Those who act early can form the right partnerships, secure premium inventory, and structure marketing agreements with key demand centers, including LNG players and AI-linked hyperscalers.

Fill out the form to access a free extract from the report, including select charts and data, or read on for a brief overview.

The perfect storm for higher gas prices

Multiple factors are coming together to support sustained price growth: reduced associated gas supply due to lower oil prices, ongoing pipeline bottlenecks in the Northeast, strong growth in power demand, and increasing LNG export capacity. At the same time, leading publicly listed gas operators are deliberately holding back on spending, prioritising financial strength over production growth and aiming to manage the market. The result is a significant supply gap.

Who's winning the race ?

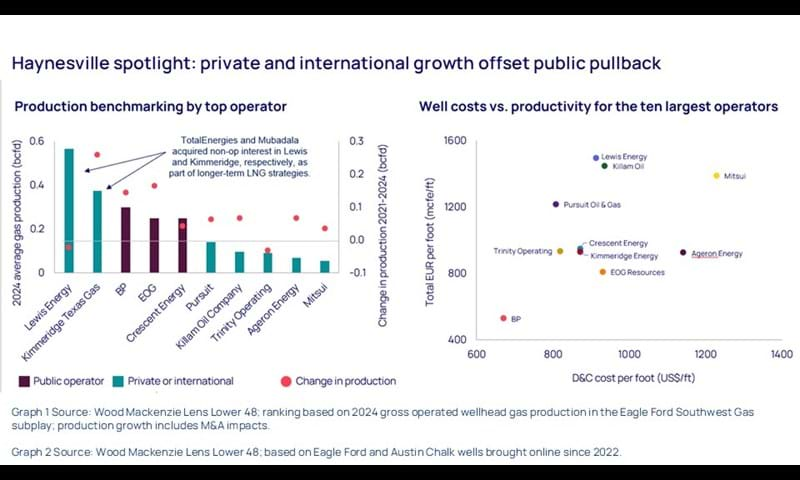

Private operators and international players are seizing this moment, already capturing 80% of recent US gas growth. These operators have improved capital efficiency and now boast some of the most competitive cost structures in major gas producing regions.

Where the action is

The Haynesville and South Texas regions are the hotspots for gas deal activity, offering proximity to high-demand markets, abundant low-cost resources, and a corporate landscape primed for consolidation. However, as Gulf Coast valuations inevitably climb, opportunities will expand into other regions.

Multiple paths to profit

Whether companies are seeking physical hedges for LNG offtake, simple resource capture at attractive valuations, or portfolio diversification, the strategies are as varied as they are compelling.

Fill out the form to access a free extract from the report, 'US shale gas is back: new demand signals underpin upstream opportunity’.