Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980

UK’s AR7 offshore wind auction tees-up a ‘win-win-win’ for policymakers, developers, and suppliers

Strategic recalibration sets the stage for a “more-for-less” victory as ~5.5GW is anticipated to be awarded

1 minute read

With the launch of the UK's Contracts for Difference (CfD) Allocation Round 7 (AR7), strategic recalibrations compared to past auctions could deliver stability to the offshore wind market amid an intense political and economic battleground over net zero targets and public spending, according to a recent insight from Wood Mackenzie.

Following AR5's zero-capacity outcome and AR6's challenges, changes initiated for AR7 are designed to deliver a “more-for-less” political narrative. The Department for Energy Security and Net Zero (DESNZ) will look to procure more offshore wind GW at a lower strike price, according to the insight, "Offshore wind: UK's Allocation Round 7 Smaller pot, better serving".

“AR7 extends CfDs to 20 years and sharpens competition so a smaller pot can buy more MW per pound. It is a deliberate reset that is designed to change the narrative from volatility to stability and create a win-win-win for policymakers, developers and the supply chain” said Sasha Bond-Smith, Research Analyst, Power and Renewables for Wood Mackenzie. “There has been a lot said regarding AR7 signaling a shift away from headline targets, but this should be seen as a positive”

"Chasing 10 GW of installed capacity in one year, only to award no capacity the following year, is not viable given supply-chain limits, modest energy demand growth and grid-constraints."

According to the report, the 41% cut to the annual budget will create intense competition and serve as a pragmatic recalibration that trades size for better £-per-MW efficiency. At AR6 strike prices, the reduced budget would deliver approximately 4.8 GW of capacity, only 20% less than AR6 despite the significant budget reduction. Yet the new 20-year CfD provides the commercial headroom for developers to lower bids by £10/MWh (12%) compared to AR6, potentially unlocking even greater value.

“AR7’s conditional top-up is smart policy: if triggered, it helps ensure full pot utilisation and avoids a repeat of AR6’s effective £895 million underspend. DESNZ have deliberately, and intelligently, put themselves at the helm of the controls that will determine award volume, with scope to lift the post-bid pot if bids offer good value for money, subject to Treasury consent. The mechanism deters bidders from striking unattainably low, hoping for a higher clearing, while preserving the flexibility to maximise capacity”, said Finlay Clark, Principal Analyst, Power and Renewables for Wood Mackenzie.

Strategic bidding parameters will decide who walks away with a CfD

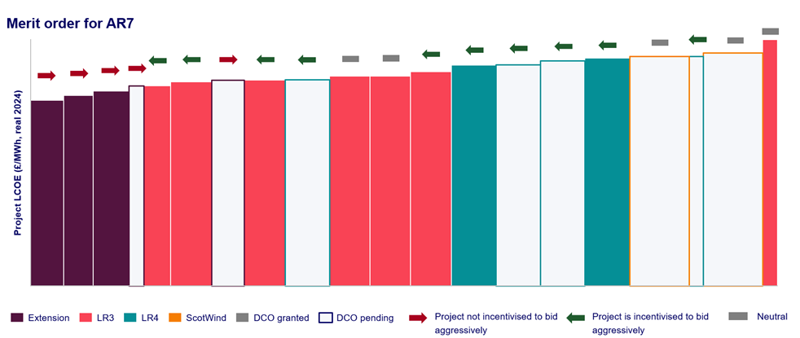

The winners of the round will be decided by intense strategic pressures, not a simple cost-based merit order, according to the report. With 26.5 GW of eligible capacity competing for an estimated 4-6 project slots, the auction's outcome will be defined by a complex battle between developer "must-win" deadlines and portfolio-wide strategy.

“AR7 creates an intense trade-off: stop the option-fee meter, commit to existing mature supply-chain agreements, and judge whether the lowest-cost sites are the strategic priority. Get the sequencing wrong, and you slip out of the merit order and drag down portfolio returns. How developers manage that pressure will decide who walks away with a CfD,” said Clark.

The analysis highlights a critical tension reshaping the traditional LCOE-based merit order. Leasing Round 4 projects carry “option-fee drag” of between £91-185m per GW per year, which incentivises developers to bid aggressively to secure a route-to-market. Morgan and Mona (JERA Nex bp/EnBW), despite paying at the top end of these fees, are among the most advanced and have greater certainty on programme timelines. By contrast, non-consented LR4 schemes must balance that urgency against the real risks of permitting delays and capex re-pricing, and those risks need to be reflected in bids.

On the other side, some Leasing Round 3 (LR3) projects face pressures rigid supply chain commitments. Developers like RWE at the Norfolk Vanguard projects (~2.8 GW) have issued firm Notices to Proceed (NtP) for major HVDC transmission components and hold non-firm turbine agreements. These projects are incentivised to win in AR7 or risk losing their production slots and facing costly re-pricing in an uncertain future market.

This dynamic is further complicated by the low-cost "Extension" projects, which face a "fish-or-bid" dilemma. Sponsors must weigh 'fishing' for a higher price against the risk of less-favourable terms in AR8, potentially incentivising single-asset players like Equinor to capitalise now while diversified players wait.

"The strategic wildcard is RWE," said Bond-Smith. "Commanding 40% of the eligible capacity, they are the only bidder with assets in all three strategic buckets: high option-fee LR4, contract-pressured LR3, and low-risk Extensions. Their portfolio strategy will be a decisive factor in the auction's final outcome."

While this intense competition will drive down strike prices, the analysis notes that a 2021-style price crash is unlikely. The market has matured, with capital discipline a central theme combined by the need to secure farm-down partners, creating a more sustainable bidding floor. This is supported by a temporary fabrication 'oversupply' for 2027-29 has eased fears of a major capex surge seen in prior rounds.

Despite intense competition, changes to AR7’s framework combine to yield a ‘win-win-win’ across participating parties

According to the report, this intense competitive dynamic, driven by strategic necessity rather than just LCOE, is precisely what makes AR7 a recalibration.

“The bidding process is complex and high-stakes, compounded by a smaller pot with the unknown likelihood of top-ups. The results deliver more than just a single clearing price; it's an opportunity to deliver distinct, positive outcomes for developers, the supply chain, and the UK's energy transition,” said Clark.

Developers win - longer contracts turn volatility into route-to-market certainty:

AR7 seeks to offer a clear route-to-market with improved contract economics. The 20-year tenor lowers revenue risk which will also help attract co-investors/farm-down capital at the time that it is needed most. This creates competing forces on strike prices: farm-down pressures and elevated capital costs push bids higher, while the extended revenue certainty pulls them lower by reducing the risk premium investors demand, supporting disciplined, financeable bids. Whether developers can bid competitively hinges on institutional appetite for guaranteed 20-year cashflows. Strong demand enables lower strikes, but capital scarcity keeps the floor firm.

Supply chain win - stable rounds convert intention into firm backlog, keeping factories utilised

"The industry doesn't benefit from boom-bust; it needs a steady cadence and a credible roadmap," said Clark. "AR7 can deliver both.”

The 2027-2029 fabrication window for 2029-2032 CODs lands just as supply-demand tightness eases, with neighbouring tenders slipping past 2031, so suppliers are keen to fill order books, and the UK can step in. The new ~£544m Clean Industry Bonus (CIB) co-funds UK plant and port upgrades and rewards accredited net-zero suppliers, so orders translate into real investment and jobs. Paired with a consistent 3 to 4 GW each year, AR7 arrives at a crucial time to help keep factories utilised, sharpens pricing, and attracts new entrants while sustaining the facilities the industry already has.

Energy Transition win

"After two years encompassing failed tenders, cancellations, and cost spikes, AR7 can reset confidence in the energy transition as well as offshore wind," said Bond-Smith. "A steadier, more predictable buildout with longer-tenor contracts can lower delivery risk and demonstrate that large-scale offshore wind remains financeable. If AR7 clears near expectations with full pot utilisation, it puts wind back in the sector’s sails and supports the wider energy transition."

Crucially, a visible UK success provides a template for policymakers globally who are wrestling with similar political and cost headwinds: stable volumes, budget discipline and targeted industrial incentives can deliver results.