Get Ed Crooks' Energy Pulse in your inbox every week

What the "big beautiful bill" means for US energy

Wind and solar power will be hit hardest by the loss of tax credits

13 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Supply chain constraints limit the growth of gas-fired generation in the US

-

Opinion

A solution to the problem of paying for data centre power?

-

Opinion

The US oil industry is consolidating as growth slows

-

Opinion

Energy storage steps up

-

Opinion

How the US power system coped with the threat from Winter Storm Fern

-

Opinion

International buyers find value in US gas assets

Securing control of the US Presidency, Senate and House of Representatives in last year’s elections put the Republicans in a strong position to implement their policy agenda, and this year they have taken full advantage of that. The legislation informally known as the “one big beautiful bill”, signed into law by President Donald Trump last week on 4 July, advanced Republican priorities in a wide range of areas, including taxes, Medicaid, food stamps and immigration enforcement.

Energy is one of the industries that will be most affected by the legislation. Tax credits for low-carbon energy are being phased out faster, restricted in availability or simply abolished. The total value of the credits to the industry will be about US$500 billion lower over the next 10 years, according to the Tax Foundation.

Wind and solar power are hit particularly hard by the changes. To claim the full value of the old technology-neutral tax credits, known as 45Y and 48E, wind and solar projects must be placed in service by the end of 2027, or start construction by 4 July 2026 and enter service by the end of 2030.

The White House this week issued an executive order aimed at restricting those credits still further. The Treasury secretary will issue revised guidance on the meaning of “start construction” under the law, with the aim of ruling projects eligible only if “a substantial portion of a subject facility has been built”.

Wind and solar projects also face strict new requirements on the involvement of foreign entities of concern (FEOCs). The rules limit the availability of tax credits based on the involvement of companies and individuals from four countries: China, Russia, Iran and North Korea. The effect is to penalise reliance on equipment from prohibited foreign entities, such as Chinese-backed manufacturers.

The law specifies that the new rules should apply to projects that begin construction after the end of this year. But President Trump’s executive order calls on the Treasury to take prompt action to implement the restrictions within 45 days.

Other low-carbon energy technologies, including battery storage, geothermal and nuclear, fare better under the new law. Those dispatchable clean sources retain full tax credit eligibility for construction beginning up to the end of 2033, 75% in 2034, 50% in 2035 and then 0% thereafter.

However, the FEOC rules also apply here. They will be a significant problem for storage projects, given China’s dominance of the battery supply chain.

Nuclear power was threatened by steep cuts in tax credits during negotiations over the bill, despite bipartisan support for the industry. But in the final legislation, the primary incentives for nuclear power that were established under the 2022 Inflation Reduction Act (IRA) were retained. The one significant change to the 45U tax credit for existing nuclear plants is the addition of FEOC restrictions. The credit for new advanced nuclear technologies, such as small modular reactors, remains in place, phasing out after 2032.

Hydrogen is another technology facing reduced tax credits. Section 45V, the clean hydrogen production tax credit introduced in the IRA, will be available only for projects that begin construction before the end of 2027. It was previously set to be available up to the end of 2032.

Carbon capture, utilisation and storage (CCUS) is one sector that actually benefits under the new law. The 45Q tax credit for CCUS has been retained, and its value increased for capture with utilisation or enhanced oil recovery (EOR). The IRA had set a lower value credit for carbon captured for utilisation or enhanced oil recovery than for geological sequestration, but the new law has raised it to the same level.

The oil and gas industry also benefits from the legislation. The IRA raised royalty rates for production leases on federal lands, and that increase has been reversed, taking the minimum rate back down to 12.5% from 16.67%. The new law also mandates an increased pace of lease sales for federal waters offshore, in Alaska, and in eight other states onshore.

Other measures instituted by the IRA have also been scrapped or delayed, including support for reducing methane emissions. A tax on those emissions, which was scheduled to start being payable this year, has been deferred to 2035. Restrictions in the IRA on tax deductions for intangible drilling costs – often between 60% and 80% of total costs – have been lifted.

Some proposed provisions to streamline permitting procedures were struck out of the bill during its passage through Congress. But there is a new option for oil and gas operators to pay to secure expedited environmental reviews, within 180 days for an initial assessment and one year for a full impact statement.

The US coal industry similarly gains from reduced royalty rates, a commitment to lease sales and a new tax credit for metallurgical coal production.

Measures in the bill that benefit all US businesses will help the renewables industry as well. Bonus depreciation, allowing accelerated write-offs for the cost of business property, was introduced at 100% in 2017, but began stepping down in 2023 on its way to a complete phase-out after 2026. It has now been restored permanently to 100%. That will help support investment in all industries, including wind and solar.

The Wood Mackenzie view

The balance of incentives in the US tax system was tilted strongly in favour of low-carbon energy by the IRA. It has now been levelled out.

Wood Mackenzie analysts have published a detailed assessment of the impact of the new legislation on every energy sector. The big picture is that we expect investment in wind and solar power to fall well short of what it would have been if the IRA incentives had remained in place.

It will not collapse completely. Investment in renewables will be supported by growing electricity demand, state and corporate policies, challenges to the growth of gas-fired generation, and a levelised cost of electricity (LCOE) that is highly competitive in many places.

But over 2025-2035, wind and solar installations will be about 100 gigawatts lower than if the IRA incentives had remained in place, Wood Mackenzie analysts predict. That would lead to total installed wind and solar capacity growing by about 25% over that period, instead of a projected 55% growth under the IRA framework.

The impact will vary widely across technologies and across sectors. For solar, we expect a surge in installations in 2025-2026, as developers rush to remain eligible for tax credits. But on a 10-year view, we expect installations to be 17% lower than in our previous base case forecast.

For wind, we expect onshore wind installation activity to stay robust through 2030, as developers work to put grandfathered projects in service to meet the tax credit deadlines. But in the longer term, we expect onshore wind installations to decline significantly. The most substantial impact will be in offshore wind, where industry economics depend heavily on tax credits. Projects that have not already started construction or taken a final investment decision (FID) are unlikely to go ahead.

Storage is in a relatively strong position compared to wind and solar, because its tax credits will last for eight years longer. But the FEOC rules are a real risk, given the sector’s heavy reliance on Chinese supply chains.

The challenge will be not just in following the rules, but in demonstrating compliance when projects seek financing. The prohibited foreign entities can include the broadly defined “foreign-influenced entity”, in addition to the “specified foreign entities”, creating a significant administrative burden in clarifying sources of investment, technology, components and raw materials.

We still expect US energy storage capacity to grow, but at a slower pace because of the FEOC requirements.

For emerging low-carbon technologies, the picture is mixed. Most CCUS projects currently in development in the US are focused on geological sequestration so will not be affected by the more generous tax credit for carbon capture for EOR and other forms of utilisation. However, some operators may decide to shift to EOR.

Among the biggest beneficiaries of the change will be operators with existing CCUS-EOR infrastructure, such as Occidental and ExxonMobil. The increased EOR credit value could deliver additional revenue from their own CCUS projects, while enhancing the attractiveness of their transport and storage networks for other companies.

In hydrogen, the changes will further tilt the economics away from green (electrolytic) production and towards blue (from natural gas with carbon capture). The curtailed availability of the 45V tax credit means that more than 75% of the total US green hydrogen project pipeline is unlikely to qualify without rapid progress. Blue hydrogen, supported by the 45Q tax credit for CCUS, is significantly more bankable under current policies.

When President Trump took office in January, one of his key themes was “unleashing American energy”, with the goal of increasing investment, creating jobs and cutting prices. It is clear that the bill he has just signed into law will have the effect of curbing investment in some energy technologies, particularly wind and solar.

As US electricity demand grows, it will be critical for investment in other technologies to rise to fill the gap.

New round of US tariffs threatens supply chain cost increases

The other big news for the US energy industry this week was a fresh round of tariff announcements from the Trump administration. The president had set a deadline of 9 July for US trading partners to agree new deals, or face the steep “Liberation Day” tariffs announced in April.

As of this week, only the UK had agreed a comprehensive new trade deal. Two other countries, China and Vietnam, had reached partial agreements, but those still left many key issues open for negotiation. President Trump’s response has been to order another delay in the implementation of the full tariffs, this time until 1 August. He has also proposed new tariff rates for more than a dozen countries, which are generally similar to the rates announced in April, and an increase in the rate charged on copper imports to 50%.

Ben Boucher, a senior analyst in Wood Mackenzie’s Market Intelligence Group who is focused on supply chain research, says the increased copper tariff is the most consequential change. It will have wide-ranging effects across the utility and renewable energy sectors. Wire and cable manufacturing costs are expected to be among the hardest hit. The copper tariff alone is likely to drive US prices up by over 8%. Since the announcement, US copper prices have surged, with COMEX futures jumping 13% on 8 July to reach an all-time high.

At the country level, the new tariffs cover 14% of US imports based on 2024 data. Brazil faces a 50% tariff, while Japan and South Korea face 25%, and Vietnam 20% (or 40% on goods transshipped through the country). Key categories impacted include solar modules, 27% of which were imported from Vietnam in 2024 although the import landscape for modules is rapidly shifting in the wake of the new trade policies. South Korea remains a leading supplier of power and distribution transformers.

On Thursday evening, 10 July, President Trump threatened to impose a new 35% tariff in imports from Canada. Administration officials reportedly clarified that products covered under the US-Mexico-Canada trade agreement would not face the new tariff, and the proposed lower rate of 10% for energy imports would remain.

The situation clearly remains changeable. New decisions with potentially significant impacts are coming every day. To keep up with Wood Mackenzie’s assessments of the latest news, follow our power and renewables supply chain and cost hub, and get in touch with us if you need more details.

In brief

OPEC has forecast that world oil demand will be close to 123 million barrels per day in 2050, up from 105 million b/d this year. The projection, published in OPEC’s World Oil Outlook 2025, is significantly higher than estimates from some other forecasters. ExxonMobil, for example, projected in its most recent Global Outlook last year that oil demand in 2050 would be a little over 100 million b/d. Wood Mackenzie’s base case forecast is that it will be about 92 million b/d.

OPEC said that its demand forecast helped underscore the need for major investments in all energy technologies, including oil. It believes the global oil industry will need to invest US$18.2 trillion between now and 2050, to meet growing demand and support global economic growth.

Simon Flowers, Wood Mackenzie’s chief analyst, assesses the outlook for oil supply and demand in the latest edition of The Edge.

The first new US rare earths mine in 70 years is breaking ground in Wyoming this week. Ramaco Resources is developing deposits of rare earth oxides, along with other critical minerals including scandium, gallium and germanium, at a defunct coal mine. The capital cost of the project, including a processing plant, has been estimated at US$579 million. China’s restrictions on rare earths exports earlier this year, used as a tactic in its trade dispute with the US, caused serious problems for global supply chains.

The US government has also agreed a US$400 million investment in MP Minerals, which owns the Mountain Pass rare earths mine in California. The Department of Defense has signed a ten-year price floor commitment for MP Materials’ neodymium-praseodymium products, to ensure a stable and predictable cash flow for the company. Neodymium-praseodymium products are essential for high-strength magnets used in jet aircraft, drones, missiles and radar arrays, as well as wind turbines and electric vehicles.

Other views

Dynamics shaping the European natural gas market – Massimo Di Odoardo, David Lewis and Eric McGuire

Hydrogen: the outlook to 2050 – Murray Douglas, Monica Trilho and Tommaso Pellegrinelli

Europe’s power market transition and the role of energy storage – Dan Eager and Anna Darmani

LNG Canada makes historic first export shipment – Eugene Kim and Daniel Myers

The tariff damage in profile: Energy edition – The Wall Street Journal Editorial Board

The natural gas trap - Bård Harstad

Quote of the week

“I would think, given the scale of the economic opportunity, the resources we have, the expertise we have, that it is highly, highly likely that we will have an oil pipeline that is a proposal for one of these projects of national interest.”

Mark Carney, Canada’s prime minister, told the Calgary Herald that the government’s list of infrastructure projects backed for expedited development would probably include a new oil pipeline to the west coast. The Canadian oil industry and many politicians have backed the idea of increasing pipeline capacity from Alberta to the coast, to reduce dependence on the US as an export market.

Chart of the week

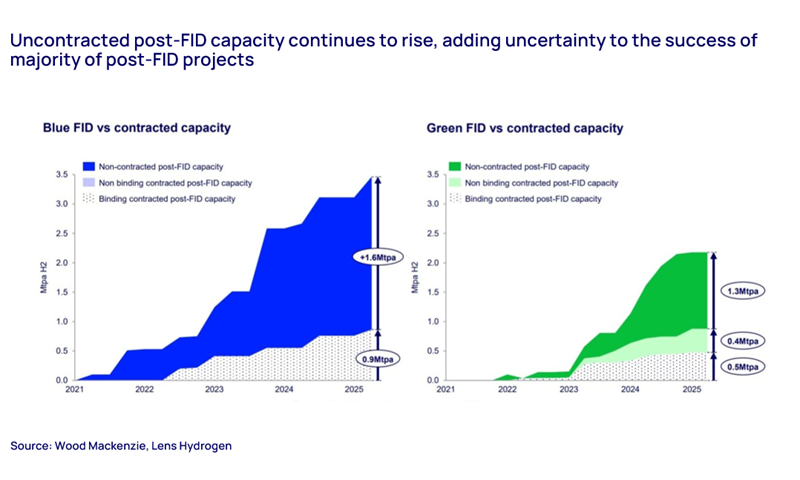

This comes from our new note: ‘Hydrogen: the outlook to 2050’. It highlights one of the most pressing issues for developers in the hydrogen sector: the challenge of finding offtake agreements. Uncontracted capacity from post-FID projects has been growing for both blue and green hydrogen. Post-FID capacity without binding offtake risks cancellation.

However, the long-term outlook for low-carbon hydrogen still points towards strong growth over the next couple of decades, if not as strong as seemed likely two years ago. Download the full report for more details.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.