Get Ed Crooks' Energy Pulse in your inbox every week

Rising power prices create problems for US policymakers and the industry

Discontent over electricity bills is growing, putting pressure on politicians to intervene

9 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Supply chain constraints limit the growth of gas-fired generation in the US

-

Opinion

A solution to the problem of paying for data centre power?

-

Opinion

The US oil industry is consolidating as growth slows

-

Opinion

Energy storage steps up

-

Opinion

How the US power system coped with the threat from Winter Storm Fern

-

Opinion

International buyers find value in US gas assets

A pledge to cut US energy prices was at the heart of President Donald Trump’s election campaign last year. “My goal will be to cut your energy costs in half within 12 months of taking office,” he said in September 2024.

Although a 50% price cut always seemed unrealistic, the president’s message sent a clear signal that lower energy costs were one of his top priorities. But in one key energy sector his administration is not showing much evidence that it is having any impact. US electricity prices, which began to rise steadily during the Biden administration, have continued to increase under President Trump.

Over the 12 years from the start of 2009 to the end of 2020, average US retail power prices, as measured by the electricity component in the CPI, rose by 12%. Over the four and a half years since the start of 2021, they have risen by 36%. The average annual rate of electricity price inflation has jumped from 1% to 7%.

Public concern over electricity bills is growing. A poll in April commissioned by the non-profit group PowerLines found that 63% of respondents said their electric and gas utility bills were adding to their financial stress. Social media are full of angry comments from consumers shocked by their rising bills.

Politicians have taken notice. Mikie Sherrill, the Democratic candidate for the governorship of New Jersey, has said that on her first day in office she would declare an emergency over utility costs.

Mike Braun, the Republican governor of Indiana, this week created a new role for a Utility Consumer Counselor, with a mission to save money for ratepayers. Governor Braun said: "We can't take it anymore… [I would] like to see the utilities' investors bear more of the cost of doing business."

Governor Ned Lamont of Connecticut, a Democrat, said in June: “I think electric bills are too damn high”, and signed legislation intended to cut them.

The American public has had a range of opinions on who bears the most responsibility for rising bills. A poll in New Jersey last month found that utility companies were the most widely blamed, chosen by 26% of respondents, followed by the state’s governor (19%), the federal government (15%), the state legislature (14%) and energy producers (10%).

Energy secretary Chris Wright said this week on Fox News that stopping the rise in electricity prices and reshoring jobs and opportunity was what he worried about most, seven days a week. And he argued that changing the direction of the industry would take time.

“Electricity prices rose a lot – almost 30% – under the Biden administration, and it angered Americans. It’s part of the reason President Trump was elected,” he said. “That is a key challenge for us, though: things move slowly in the electricity grid. All sorts of crazy projects were under construction and being built on your electricity grids over the last four years. We can’t stop all of them. They’re going to get finished. That extra expenditure goes into the rate base for the utility, and it pushes up your prices.”

Over the next few years, he added, he expected the administration to “make enormous progress” in stopping the rise in electricity prices, while making sure there was sufficient power available for the US to remain ahead of China in developing AI.

But progress over the next few years may not assuage mounting discontent among the American public.

The Wood Mackenzie view

The bad news for politicians and industry leaders who are being blamed for rising electricity bills is that the upward pressure on prices is set to continue. In fact, some of the drivers expected to push prices higher over the coming decades are only just starting to take effect.

Over the past five years, electricity bills have been rising in part because of the need to replace ageing infrastructure and strengthen resilience to events such as wildfires and storms.

Over the past four years, investment by US investor-owned electric utilities has risen by about 50%, from US$134 billion in 2021 to US$203 billion in 2025, according to the Edison Electric Institute, the industry group. That capital spending goes into the utilities’ rate bases, allowing them to recover their costs through higher bills.

Robert Whaley, Wood Mackenzie’s director for North America power, says there are two other key factors that will put upward pressure on US retail electricity prices over the years and decades to come.

One is demand growth, driven in particular by data centres for AI, but also by new manufacturing facilities and the electrification of transport in some states.

There are many uncertainties here, including how much of the proposed new demand will actually materialise, and how far rate structures are adopted to shield residential customers from some of the impact. But as a general principle, if higher demand means increased investment in new generation, distribution and transmission infrastructure, that investment will have to be paid for somehow.

The other factor is higher natural gas prices, driven by increased consumption for power generation and higher LNG exports. US benchmark Henry Hub gas has generally remained subdued in recent years, with prices falling back after a spike in 2022. But over time we think US gas prices will be on a rising trend.

Wood Mackenzie is forecasting that Henry Hub will average about US$4.60 per million British thermal units (mmBTU) in real terms in 2030, up from about US$3 / mmBTU today.

Because gas plants are generally the marginal suppliers, that will put wholesale power prices in most markets on a rising trend.

All this suggests that without some dramatic policy interventions, the consumers who are unhappy about their electricity bills are going to get even less happy in the years to come. The prospect of more such interventions is becoming a material issue for the industry.

In brief

President Trump has filed a formal request to the US Supreme Court for it to decide rapidly on the legality of the wide-ranging tariffs he has announced since taking office in January. Two lower courts have ruled that the president exceeded his legal powers when imposing two sets of tariffs: the “fentanyl tariffs” on imports from Mexico, Canada and China, and the “reciprocal tariffs” imposed on almost all countries.

Article I of the US Constitution specifies that it is Congress that has the power to “lay and collect Taxes, Duties, Imposts and Excises… [and to] regulate Commerce with foreign Nations.” The Trump administration argues that the president is allowed to set tariffs under the 1977 International Emergency Economic Powers Act, which gives him the authority to take action “to deal with any unusual and extraordinary threat” to the national security or economy of the US. John Sauer, the Trump administration’s solicitor-general, recommended that the Supreme Court should hear oral arguments in the case in the first week of November.

Two Japanese engineering companies have talked about confirmed or possible investments in power equipment manufacturing that should help ease tightness in the supply chain and allow a faster build-out of new infrastructure. Hitachi announced planned investments of more than US$1 billion in the US, including US$457 million for a new large power transformer factory in Virginia.

Separately, Mitsubishi Heavy Industries was reported to be prepared to double its production capacity for gas turbines. Chief executive Eisaku Ito said the company was already increasing capacity by 30%, but that would not be enough to meet growing demand.

The insurance marketplace Lloyd’s of London has said it will no longer seek to discourage insurers from providing coverage for coal, oil sands and Arctic oil projects. New chief executive Patrick Tiernan, who took over in June, told the Financial Times: “It’s important we don’t wade into issues we don’t need to.” Under his predecessor, John Neal, Lloyd’s had said in 2022 that it would ask insurers at the marketplace to no longer provide new insurance coverage for or invest in coal-fired power plants, thermal coal mines, oil sands projects and Arctic oil development. That position has now been dropped

Tiernan said in a statement discussing the financial performance of the Lloyd’s market in the first half of 2025: “We must remain apolitical. Our neutrality is part of our value. In a world of strained trade relations, Lloyd’s licence network can be a safe harbour.”

Other views

Could US LNG become a victim of its own success? – Simon Flowers and others

China shifts electric vehicle strategy from price wars to innovation race

US grid interconnection agreements increase 33% in 2024

US EV charging infrastructure shows resilience amid policy headwinds – Emil Koenig

A new Russia-China gas pact could reshape global energy markets – Tatiana Mitrova

Meet the rave-throwing think tank shaping the tech Right – Nancy Scola

Breaking the cost barrier in residential energy – Tesla Energy

Quote of the week

“Even if you wrapped the entire planet in a solar panel, you would only be producing 20% of global energy. One of the biggest mistakes politicians can make is equating the ELECTRICITY with ENERGY!”

Chris Wright, the US energy secretary, posted on X in support of his argument that the Biden administration put too much emphasis on “unreliable, intermittent electricity” from wind and solar.

His point was that electricity accounts for only about 20% of the world’s final energy consumption. So even if all of that power was provided by solar, there would still be enormous demand for oil, gas and coal. Supporters of renewable energy countered that in that impossible hypothetical scenario – or even in a possible case of massively increased solar generation – electricity’s share of global energy consumption could increase significantly, through the electrification of transport and heating. It would also be possible to use electricity to create gas and liquid fuels.

Chart of the week

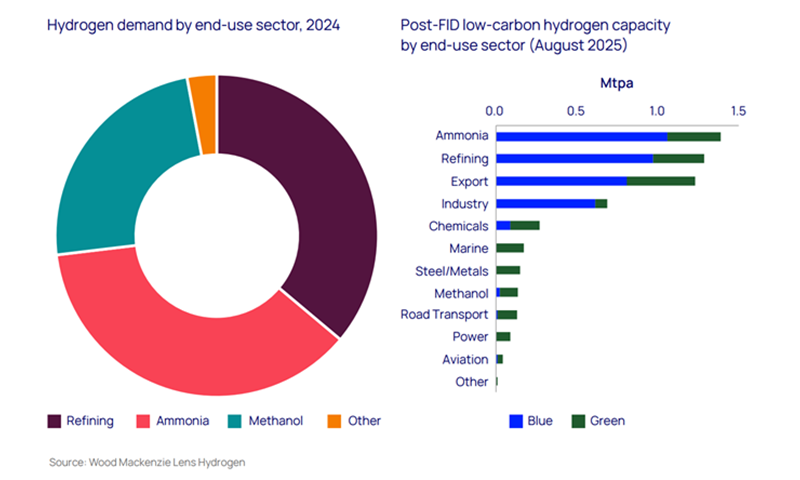

This comes from our latest Horizons report: ‘Isn’t it ironic? How Europe’s oil refiners could offer a route to scale up green hydrogen’. The irony in the title refers to the fact that the key to developing new low-carbon hydrogen fuel could come from a much older energy sector: oil refining. As the chart shows, refining is one of the key sectors for hydrogen demand today. And in Europe, regulations will push refiners towards using lower-carbon inputs. The result could be to create a market that will allow low-carbon green hydrogen to scale up significantly. Check out the full report for more details.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.

Business as usual is over

Introducing the latest insight from our thought leaders, the book Connected: Bringing predictability to the increasingly uncertain world of energy.

As climate change accelerates and geopolitical tensions reshape global markets, the energy landscape has become increasingly interconnected. Connected explores why those interconnections have developed, and how they bring clarity to the most important decisions we make about the future of energy.