Get Ed Crooks' Energy Pulse in your inbox every week

What the US attack on Iran’s nuclear installations means for energy

Closure of the Strait of Hormuz is seen as unlikely, but uncertainty is high

11 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Are VPPs really a viable solution for easing strain on the grid?

-

Opinion

Data centers are adding an extra 220 gigawatts of electricity demand in the US. How can the grid cope?

-

Opinion

How are energy supply chains changing as electricity demand surges?

-

Opinion

Supply chain constraints limit the growth of gas-fired generation in the US

-

Opinion

A solution to the problem of paying for data centre power?

-

Opinion

The US oil industry is consolidating as growth slows

Just after midnight on Friday night, seven B-2 stealth bombers took off from Whiteman Air Force Base in Missouri, heading for Iran. Supported by about 120 other aircraft, including tankers for in-flight refuelling, they dropped 14 30,000-pound Massive Ordnance Penetrator (MOP) “bunker-buster” bombs on two Iranian nuclear facilities, at Fordow and Natanz, before returning safely to base. Another nuclear site, at Isfahan, was also hit by US submarine-launched cruise missiles.

The US attacks, coming after nine days of conflict between Israel and Iran, represent an escalation of hostilities and could have significant implications for global energy markets. About 15% of the world’s oil supply, in crude and products, and 20% of the world’s LNG supply pass through the Strait of Hormuz, at the mouth of the Gulf. Some Iranian politicians have threatened to block the Strait in retaliation for the US attacks.

The initial reaction in oil prices when markets opened on Monday morning in Asia suggested that the risk of such disruption is seen as quite low. Brent crude was priced at about US$79 a barrel in early trading, up less than US$2 a barrel from Friday’s close. On Monday, tanker traffic still appeared to be moving as normal through the Strait. By Monday evening in the US, Brent crude was down to about US$70.50 a barrel, well below its level last Friday.

However, a number of uncertainties could still affect the ultimate impact on energy markets.

The US has attempted to dissuade Iran from retaliation. President Donald Trump, in a statement on his Truth Social platform soon after the attacks, said “now is the time for peace”. Vice-President JD Vance argued in a TV interview that the US was “not at war with Iran, we're at war with Iran's nuclear programme”.

Administration officials said any strikes from Iran would lead to further US attacks. President Trump declared: “There will be either peace or there will be tragedy for Iran far greater than we have witnessed over the last eight days.”

Iranian officials condemned the attacks and threatened retaliation. Abbas Araghchi, the foreign minister, said: “The war-mongering and lawless administration in Washington is solely and fully responsible for the dangerous consequences and far-reaching implications of its act of aggression.”

He added that Iran “reserves all options to defend its security interests and people".

Iran’s parliament voted to close the Strait of Hormuz, but it is not the key decision-making body. A move to blockade the Strait or attack shipping would have to come from the country’s Supreme National Security Council.

But Israel’s apparently highly effective attacks on Iranian military installations have raised questions over what retaliation might be possible.

It remains unclear exactly how effective the US bombing has been. Fordow, the nuclear site that was the target for 12 of the 14 bombs dropped, is buried in a mountain, with its main halls estimated to be up to 300 feet deep.

General Dan Caine, chairman of the US Joint Chiefs of Staff, said an initial battle damage assessment indicates that “all three sites sustained extremely severe damage and destruction".

The International Atomic Energy Agency (IAEA) said it had been informed by the Iranian authorities that there was no increase in off-site radiation levels around the three sites. But it warned that the presence of enriched uranium meant that bomb and missile strikes “may cause radioactive and chemical contamination”.

Rafael Mariano Grossi, the IAEA’s director general, called an emergency meeting of the agency’s board of governors on Monday. He urged all sides to avoid attacks on nuclear installations and reiterated his call for a diplomatic solution.

The ultimate goals for the US are also unclear. Although administration officials yesterday disavowed any intent to overthrow Iran’s government, President Trump left open the possibility of regime change.

He posted on Truth Social on Sunday: “It’s not politically correct to use the term, “Regime Change,” but if the current Iranian Regime is unable to MAKE IRAN GREAT AGAIN, why wouldn’t there be a Regime change???”

Until very recently, direct US action to attack Iran was not seen as imminent. When Israel began its air, missile and drone strikes on Iranian installations and leaders on 12 June, Secretary of State Marco Rubio put out a statement distancing the US from the attacks.

Less than two weeks later, the US has joined the conflict. In this volatile situation, events could again move rapidly in unexpected directions.

The Wood Mackenzie view

Oil prices have risen this month to reflect an additional risk premium, not because of any impact on physical flows. Oil and LNG are still flowing freely through the Strait of Hormuz. If Iran did move to block or disrupt that traffic, the impact would be much larger than the effects that we have seen so far.

“We know that the global energy system does not work with any long-term closure of the Strait of Hormuz,” says Alan Gelder, Wood Mackenzie’s senior vice president for Refining, Chemicals and Oil Markets. “The supply loss is too large, and consuming countries’ stocks can only last so long while the alternative sources of supply are not large enough.”

If shipping were disrupted or the Strait closed, the impact on oil prices would be severe, with Brent crude moving to US$90 to US$100/bbl, or higher.

US production could eventually help fill part of the shortfall in supply, but it would take time. With WTI crude at around US$60/bbl in May, drilling activity in the US Lower 48 states was declining. Fraser McKay, Wood Mackenzie’s head of Upstream Analysis, says most larger operators won’t decide to ramp up activity substantially until they are confident that prices will stay high for quite some time.

He adds: “Some companies will choose to stick with original plans and maybe tweak activity up slightly instead of cutting back, which was what they were gearing up to do with Brent in the US$60s. The US response could eventually become significant if markets remain tight, but this would do little to offset any near-term disruption.”

The impact on LNG could be even greater, says Massimo Di Odoardo, Wood Mackenzie’s vice president of Gas and LNG Research. “The LNG market is still tight and lacks supply,” he says. “Europe is building stocks and there is no LNG supply upside if prices go higher.”

LNG prices were trading at US$12/mmbtu before the Israeli attacks. That was at parity with oil on an energy-equivalent basis, and quite a high price for the summer months. The previous 10-year annual average was about $7.5/mmbtu.

The summer heat is pushing demand up in North Asia and Europe, and the EU has recently reiterated its intention to get rid of Russian gas imports, including LNG, over the next two years. LNG prices have increased 20% since Israel’s first strike on 12 June, which is more than the increase in oil prices.

(Curtailments of Israeli gas supplies to Egypt have been an additional factor driving prices higher. By contrast, oil supply disruption has not yet materialised.)

Closing the Strait of Hormuz would hurt Iran’s economy by shutting off most of its oil exports, and would be expected to provoke a strong response from the US. For those reasons, we see such a move as unlikely. But just because a course of action is irrational does not mean that it is impossible.

The threat of attacks on shipping or other disruption to traffic in the Strait should be taken seriously, even if it is not the most likely outcome.

Backing in the US Senate for plans to cut tax credits for wind and solar

While the eyes of the world have been focused on Iran, legislation with significant implications for the US economy has been making steady progress through Congress. The One Big Beautiful Bill Act, a wide-ranging tax and spending package, passed in the House of Representatives in May, and is now being considered by the Senate.

The House version included steep cuts in support for low-carbon energy, and especially for renewables. The draft of the Senate version that emerged from the finance committee last week changes several details, some of them significant. But the general intent of the proposed law is still to withdraw support for low-carbon energy in general, and for wind and solar power in particular.

In the latest proposals, positives for energy companies include extensions of the tax credits for dispatchable technologies, including storage, geothermal, hydro and nuclear power.

Eligibility for the credits for wind and solar has also been extended slightly. Those projects will be able to claim the credits at the full current rate if they start construction by the end of 2025, instead of within 60 days of the bill passing, which was the deadline set in the House version.

But the wind and solar credits still disappear quickly. Projects could claim the credits at 60% of the current rate if they start construction in 2026, at 20% in 2027, and not at all after 2027.

The new rules for foreign entities of concern (FEOCs), which are intended to stop companies from China, Russia, North Korea and Iran benefiting from tax credits, could prove a negative for the industry.

The House provisions were widely criticised as complex and difficult to implement. The Senate version of the rules is intended to offer greater clarity. But industry executives have warned that they still leave significant uncertainty and will add to the administrative burden on the industry.

Wood Mackenzie analysts have not yet assessed the potential impact of the Senate proposals. The legislation can still change from the committee version to the final vote in the full Senate.

But for wind and solar, the current proposals are not very different from the House version. We estimated that if the Big Beautiful Bill becomes law in the form passed by the House, it would cut 16% from solar installations and 20% from wind installations over the next five years, compared to our previous base case forecasts.

Spain’s government assesses the lessons from the April blackout

The Spanish government has published the initial conclusions and recommendations from the inquiry into the blackout that hit the Iberian peninsula in April. The report concluded that there were two key reasons for the failure of voltage control that led to loss of power on the grid.

First, there were not enough synchronous plants capable of regulating voltage – such as gas-fired power plants – connected to the grid. The day before the incident, the grid operator had asked for 10 such plants to be connected, but the actual number was only nine.

Secondly, several plants that were capable of regulating voltage did not respond effectively to help stabilise the grid as the crisis developed.

The inquiry committee has issued a series of recommendations, including stronger supervision of stakeholders in the electrical system to ensure they comply with their regulatory obligations, as well as technical measures to strengthen voltage control and protect against fluctuations in the system.

The committee also supported an increase in energy storage capacity and stronger power transmission interconnections with Spain’s neighbours.

In brief

An intense heatwave across much of the US, known as “heat dome” conditions, is expected to drive electricity demand on the country’s grid to a 12-year high this week. PJM Interconnection issued a Maximum Generation Emergency alert for Monday 23 June.

Mitsubishi Corporation is planning to invest US$3.9 billion to increase its solar generation capacity in the US, Nikkei reported. The company plans a 160% increase in its US solar generation capacity by 2028, to support progress towards its goal of doubling its renewable generation capacity between 2019 and 2030. Mitsubishi will source the panels for its projects from US suppliers, Nikkei reported.

A provision in the One Big Beautiful Bill legislation now being negotiated in Congress would compel the US Postal Service (USPS) to sell the electric vehicles acquired under a controversial plan announced in 2022. The USPS would also have to remove any EV charging infrastructure it has installed. Production of the electric trucks has been plagued by difficulties and delays.

Other views

Iraqi gas production increasing as flaring levels fall – Alexandre Araman

Chinese industrial maximalism: Lu Feng – Kyle Chan, Thomas de Garets Geddes, and Ailsa Brown

The PJM crisis: it’s time to end the deregulation experiment – Power for Tomorrow

Quote of the week

"As datacenter production gets automated, the cost of intelligence should eventually converge to near the cost of electricity.”

Sam Altman, cofounder and chief executive of OpenAI, wrote about the future of artificial intelligence in a note titled ‘The Gentle Singularity’. One of his key points puts a spotlight on the importance of energy for the future of the technology.

Chart of the week

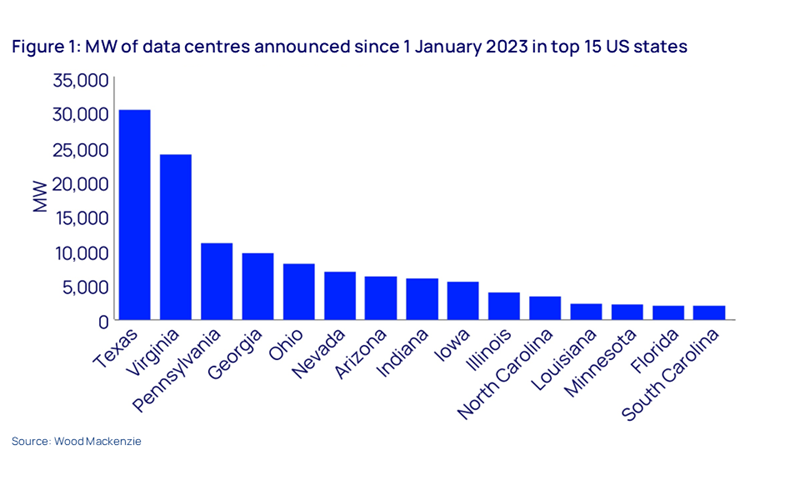

This comes from our latest Horizons report: ‘US power struggle: How data centre demand is challenging the electricity market model’. The report, by my colleagues Chris Seiple and Ben Hertz-Shargel, looks at the implications of the “gargantuan demand growth” for electricity in the US, created by power-hungry new data centres and manufacturing facilities.

The chart shows the top 15 US states for planned new data centres, by expected electricity consumption. Wood Mackenzie is now tracking 134 gigawatts of proposed data centres across the US, up from 50 GW a year ago. The fact that Texas is in first place reflects, among other factors, the importance of energy for data centre location decisions.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.