Electric vehicle sales are in the fast lane

EV sales have shifted up a gear – what does the road ahead look like?

1 minute read

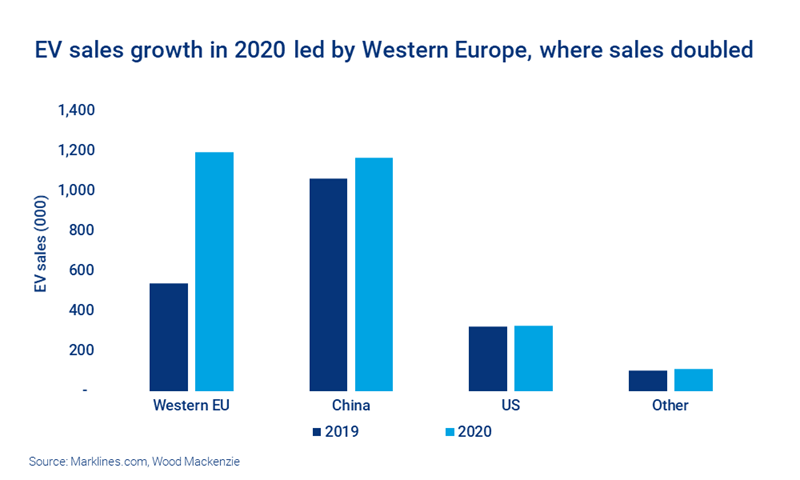

The transport sector all but ground to a halt in 2020. But while lockdown restrictions around the world put the brakes on internal combustion engine (ICE) passenger vehicle sales, electric vehicle (EV) sales shifted up a gear, surging 38%.

Will EV sales growth continue to outpace that of ICE vehicles? As we buy more and more EVs, how and where will we charge them? And what will drive the rise in commercial EV sales? In our latest electric vehicles long-term outlook, we examine the drivers of growth in detail.

Fill in the form for a complimentary extract. Or read on for an overview of a few of the key themes.

EV stock to reach 700 million by 2050

We expect EV sales to reach 62 million units a year by 2050, for a total global stock of 700 million. EVs will account for the lion’s share of sales in several regions by 2050, including Europe, China and North America.

ICE vehicle sales are in terminal decline. We believe we already saw peak sales in 2017, while the global stock of ICE vehicles could peak as soon as 2029.

In the short to medium term, regulation will do the heavy lifting in encouraging EV adoption. Both the carrot and the stick will play a role. China, for example, has extended its generous EV subsidies to 2022, while fleet emission targets became 20% more stringent in Europe last year. In the US, we expect passenger EV sales to reach 83% by 2050, accelerating after California’s 2035 ICE ban.

We closely track individual countries’ plans to phase out ICE vehicles. Norway is currently taking the most aggressive approach, with a 2025 target in its sights. Fill in the form for an extract of the report, which includes a breakdown by country.

Residential charging will be the preferring charging method by 2050

While early adopters of EVs primarily reside in homes with access to off-street parking, the deployment of chargers in multi-unit dwellings is on the rise. This reduces the need to install more public chargers.

North America, Europe and China accounted for more than 90% of residential, public and charging outlets in 2020. Their market share will drop significantly, to 69%, by 2050 as public charger installations slow due to an increasing number of fast-charging outlets.

At a whopping 88% of an estimated 416 million charging outlets globally, residential chargers are projected to be the primary mode of charging for EVs. Fill in the form for a complementary extract, which includes a forecast breakdown of residential charging outlet installations globally. Or visit our store to buy the full report, which analyses charging infrastructure for all vehicle types by region.

Commercial vehicle sales fuelled by electric buses and light trucks

There are fewer barriers to the electrification of commercial vehicles, where take-up is likely to be driven more by simple cost considerations than emission regulations. The projected costs of battery packs (and, hence, EVs) and their far lower operating expenses suggest that commercial EVs will have a cost advantage over commercial ICE vehicles.

Led by electric buses and light trucks, commercial EV sales are likely to top 3 million by 2025 and triple to nearly 9 million by 2030. That’s about 60% of the number of passenger EVs by 2030. Commercial EVs are likely account for 24% of the global stock by 2050. Growing commercial ICE vehicle sales in less advanced economies keep the combined EV sales share at a modest 29%.

Our latest EV long-term outlook explores the outlook for passenger and commercial EVs and charging infrastructure on a global and regional basis.

Fill in the form at the top of the page for a complimentary extract, which includes:

- ICE/EV stock by region

- ICE phase out plans by country

- Automakers' carbon neutral goals

- Global residential charging outlet installations by country

-

20%

decline in overall car sales in 2020

-

38%

surge in EV sales in 2020

-

80%

of vehicle sales in Norway were EVs in 2020

-

55%

of new car sales will be EVs or fuel cell vehicles by 2050